BMNR issuing shares and buying ETH at around 5% daily trading volume.

Aggregate trading volume and % issued against that daily are the two key numbers to monitor.

$ATNF $BMNR $BTBT $BTCS $DYNX $ETHZ $FGF $FGNX $GAME $SBET

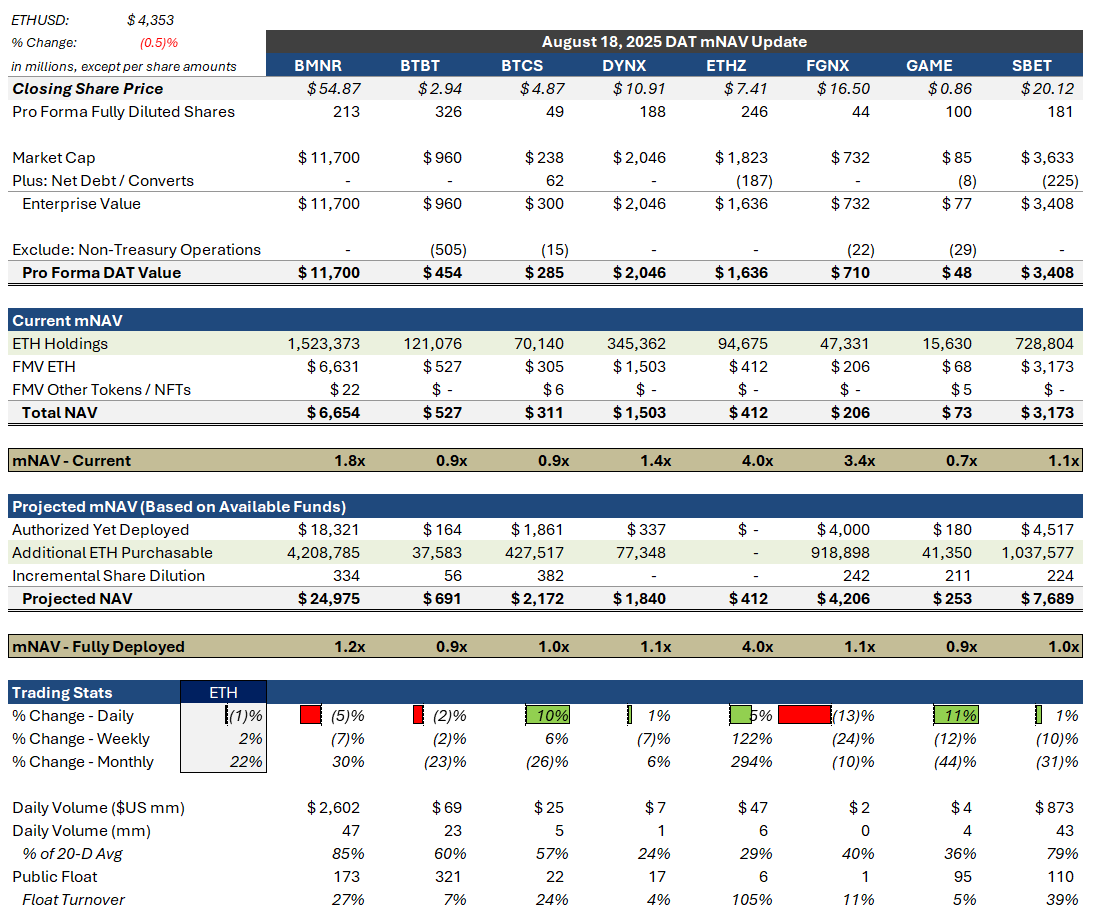

Daily DAT Update (Mon 8/18/25):

$ATNF changes ticker to $ETHZ and adds 12,489 ETH WoW for $4,531 per ETH, increasing average cost basis to $3,902.

$BMNR boosts ETH stack by 373,110 tokens to 1,523,373 ETH. No disclosure on how many shares were issued, but my guess is ~27mm via ATM (5% of ADTV). Net impact to mNAV after today’s move is down from 2.1x to 1.8x.

$BTCS approves 5c dividend for Common and Series V Preferred shareholders. Shareholders can receive either cash or ETH (“Bividend”). First time I’ve seen an ETH dividend, but apparently they did something similar in 2022, but with BTC. Additionally plans to issue a one-time loyalty payment of 35c/share (7%) to shareholders that HODL shares from 9/26/25 through 1/26/26. Works out to ~$20mm for both dividends.

Volumes down for 4th consecutive session to $3.6bn with ETH flattish. Most notable decline is ETHZ, which peaked last week at $2.3bn and does $47mm today. Lots of debate over the weekend on what’s better, low mNAV (value) or high mNAV (growth). I think of mNAV as a proxy for risk/beta. Higher mNAV works great on the way up but hurts more on the way down (e.g. BMNR -5% vs SBET +1% today). If I had to choose, I’d want low mNAV, with high trading volumes and access to non-dilutive funding. Risk/reward feels pretty good owning 1.0x-ish mNAVs with potential for re-rating upwards when sentiment improves. Won’t mention names but you can probably figure it out.

1.94K

7

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.