The biggest risk at Jackson Hole is that the current market expectations for interest rate cuts are overly optimistic. It's hard to imagine Powell delivering a speech that meets the market's high expectations...

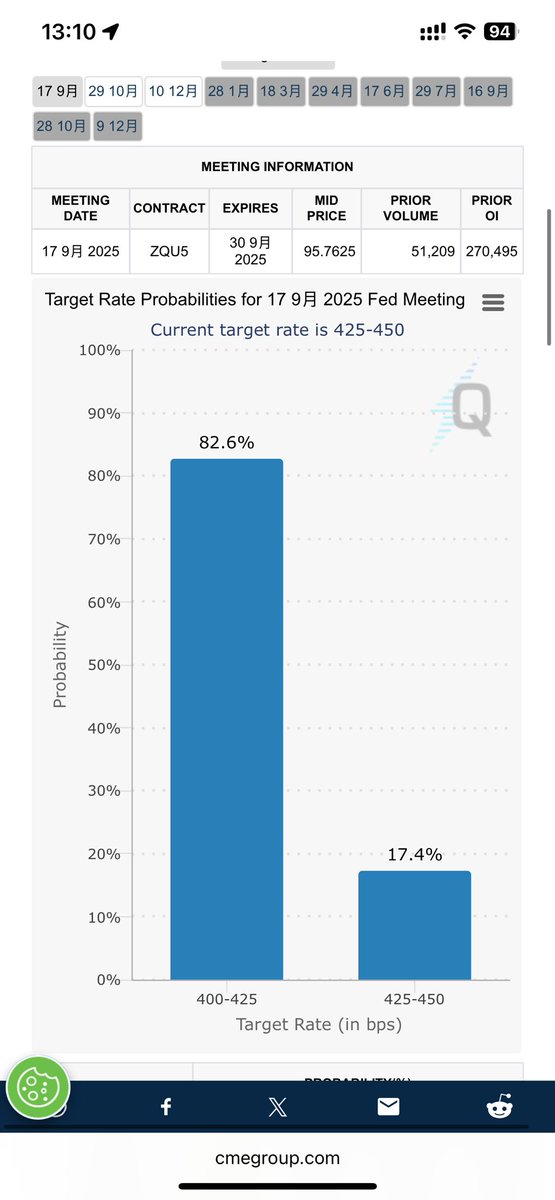

Fortunately, the market has begun to adjust its expectations rather than continue with the frenzy. According to FedWatch, the probability of no rate cut in September has now risen to 17.4%.

Before the PPI, this number was 0, and at that time, the market only had expectations for a 25 or 50 basis point cut.

After the PPI, the probability of a 50 basis point cut dropped to zero, and expectations for no rate cut re-emerged.

Today, the expectation for no rate cut has returned to 17%.

Essential for investment, key events to watch this week (8/18-8/24)

This week has many macro events, but their impact on the crypto market is not very direct. Notably, on Tuesday, Deribit will launch USDC options. The early liquidity may be poor, but the new product could bring good arbitrage opportunities.

🌟 Key events this week:

8/19 Tuesday

💼 Trump meets Zelensky (01:15)

💼 Trump holds a multilateral meeting with European leaders (03:00)

💼 Deribit will launch Bitcoin and Ethereum linear options settled in USDC

8/20 Wednesday

💼 New Zealand Reserve Bank announces interest rate decision (10:00)

💼 Several economy-related speeches

8/21 Thursday

💼 Federal Reserve releases minutes from the monetary policy meeting (02:00)

💼 Jackson Hole Global Central Bank Conference

💼 Several economy-related speeches

💼 Initial jobless claims in the U.S. for the week (20:30)

Outlook for this week:

The implied volatility for major BTC contracts has generally risen above 35%, while ETH has returned to 70% across major contracts, with short-term contracts even breaking 75%, still more than double that of BTC. The pullback that started last week shows no signs of ending, and short-term options are relatively cost-effective for bottom-fishing. Recent options are suitable for directional judgment, with limited losses and unlimited profits being very practical in the current market.

13.25K

8

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.