This is a masterclass in the boomer stretch-for-yield products and probably the best argument against being a bond bear.

When you can't get the yield from bonds, you extract it from the volatility markets by shorting equity volatility to extract more yield.

If they lower rates to bail out the housing market, that will cause the boomer money market $ to consume more and more yield lowering the cost of capital into a self-reinforcing WEIMAR mania in risk assets until of course the levy (leverage) breaks....

Am I understanding this correctly @BenBrey ??

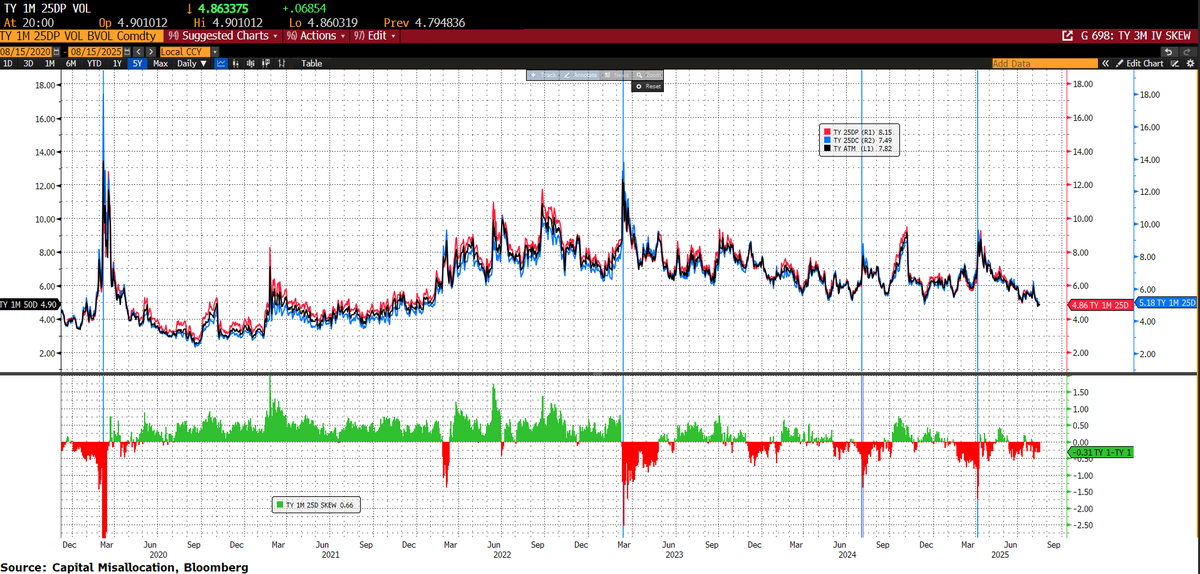

Very clear illustration to show you how the bond market underwent a regime shift post covid when the govt rug pulled the bond market. Then when that trickery was fully digested, ending in the SVB/CS evaporations, that we switched back to the old regime. The market still has a lot of people living in the 2022 mindset.

Call skew been consistently trading at a premium since SVB with a few exceptions here and there. But note the duration of those exceptions keeps shrinking (ie the green in panel 2 below).

Don't let this silly PPI report or the "ISM Prices Paid" or any of this nonsense sway you. The old regime is back in control. The MOVE index just hit sub 77 today.... rates vol imploding, curve dropping (albeit slowly), and yet almost no one understands the implications of this - sort of amazing honestly. Think about it dynamically not from the BS falsified equilibrium framework hardcoded into your brain.

1) Growth slowing clearly + 2) New Taxes in District 1 (Tariffs, Student Loans, FHA) + 3) Unafforable Housing Market (ie lower rates needed to recussitate the highest multplier economic sector in the USA)

This leads to 1) front of the curve dropping, 2) back of the curve following & occasionally leading due to JP stubborness, 3) call skew beginning to dominate across the curve, 4) rates volatility fallling, 5) mortgage spreads falling due to #4 and % of new mortgages taking on floaters as front drops up a ton.

Then we get money supply destruction as mortgage life declines, big bid in treasuries, less $ income for Buffett/Boomers/S&P100 all rolling w/ T-bill and chill strategy. Less cusion for carry traders and pressure on foreigners to devalue / drop rates to avoid their FX from getting too strong since almost all of them are exporters.

Then, we get to the point where volatility yield is meh, risk premiums are meh, and so the only source of carry is rates and that gets eaten as well. The carry bubble (Marx would refer to this as capitalism) will ultimately eat every source of yield to feed the $800 trillion beast its $40 trillion a year ($1t/week) from a global economy that has $105 trillion GDP. Where do you think 35-40% is coming from to satifsfy "The Beast"? The only way to do it is to extract all the income and then shock the system and then extract again. BUT eventually there isn't more income to extract. Remember an 80 vol equity market equates to roughly a 32% implied yield - do you not like taking on 32% implied yield on an a global asset that just dropped 20%+?

If you are a bond bear, my advice is to use today to get out of the way b/c you don't want to be one of those poor souls searching for their faces in Dante's 8th circle of hell alongside those condemned for Fraud who Dante envisioned were forced to run back and forth in a ditch whipped by demons for eternity for their misconveyence.

6.99K

18

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.