It's Friday night so of course I am playing around with HyperEVM. Here's 8 things I did:

1. Supply kHYPE to @hyperlendx

2. Borrow uBTC for 1,56% APY

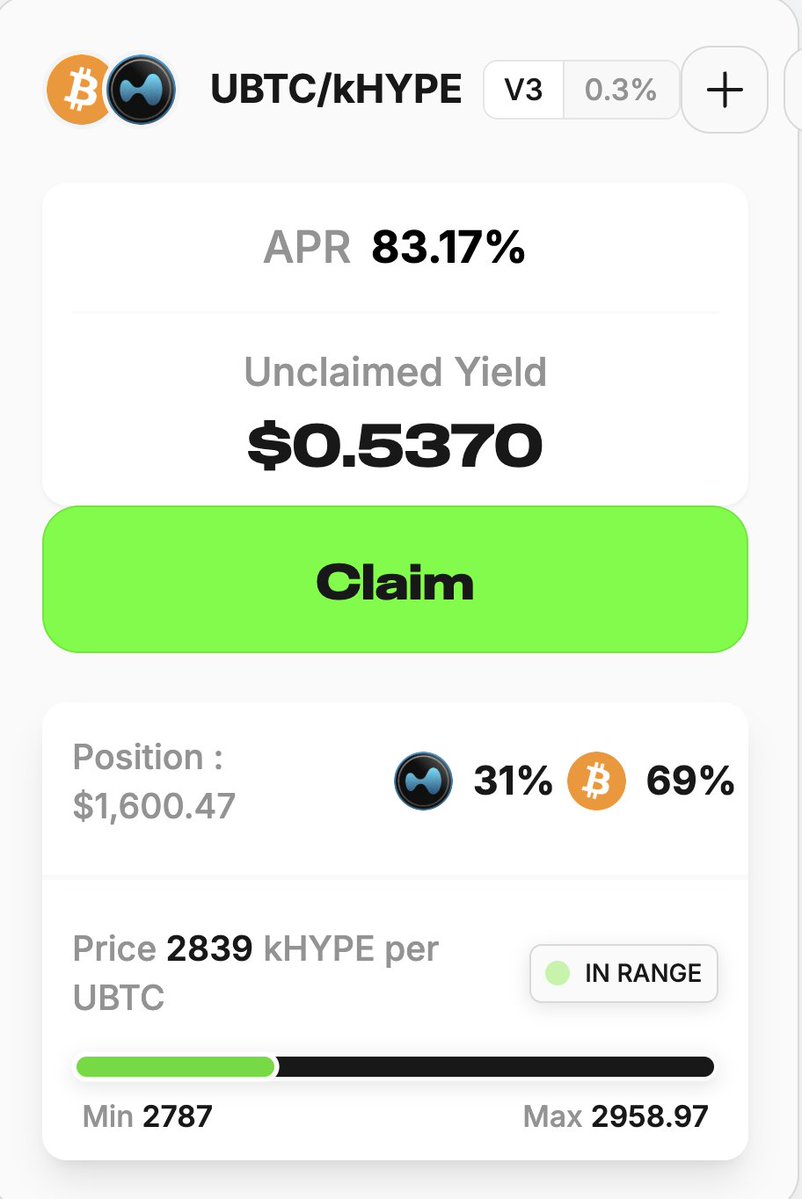

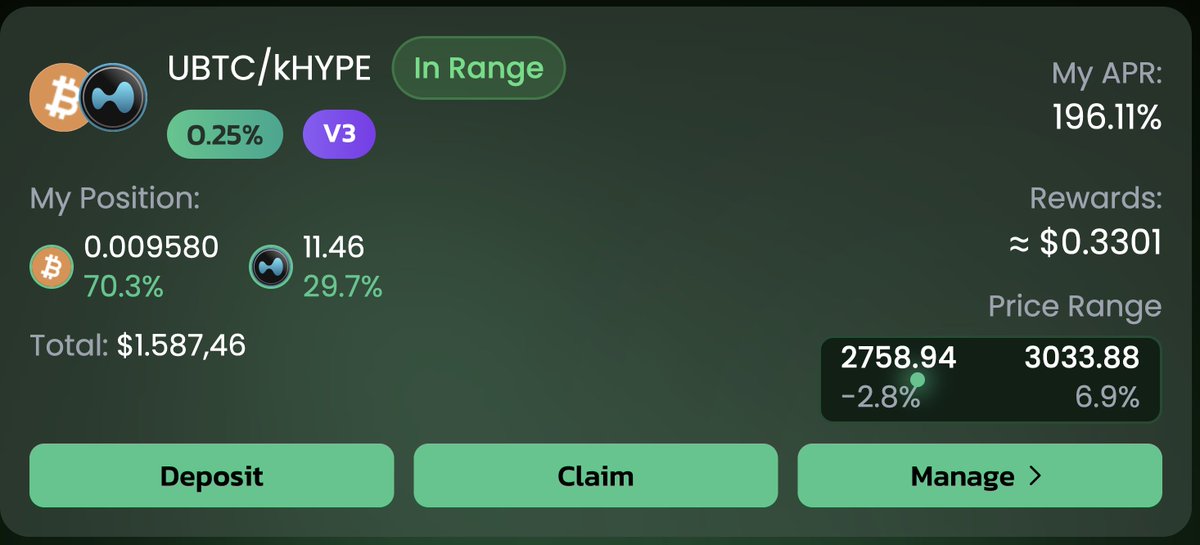

3. Supply in kHYPE/uBTC Pool on @prjx_hl

4. Supply in kHYPE/uBTC Pool on @HybraFinance

5. Supply kHYPE on @sentimentxyz and borrow USDT for 1,44% APY

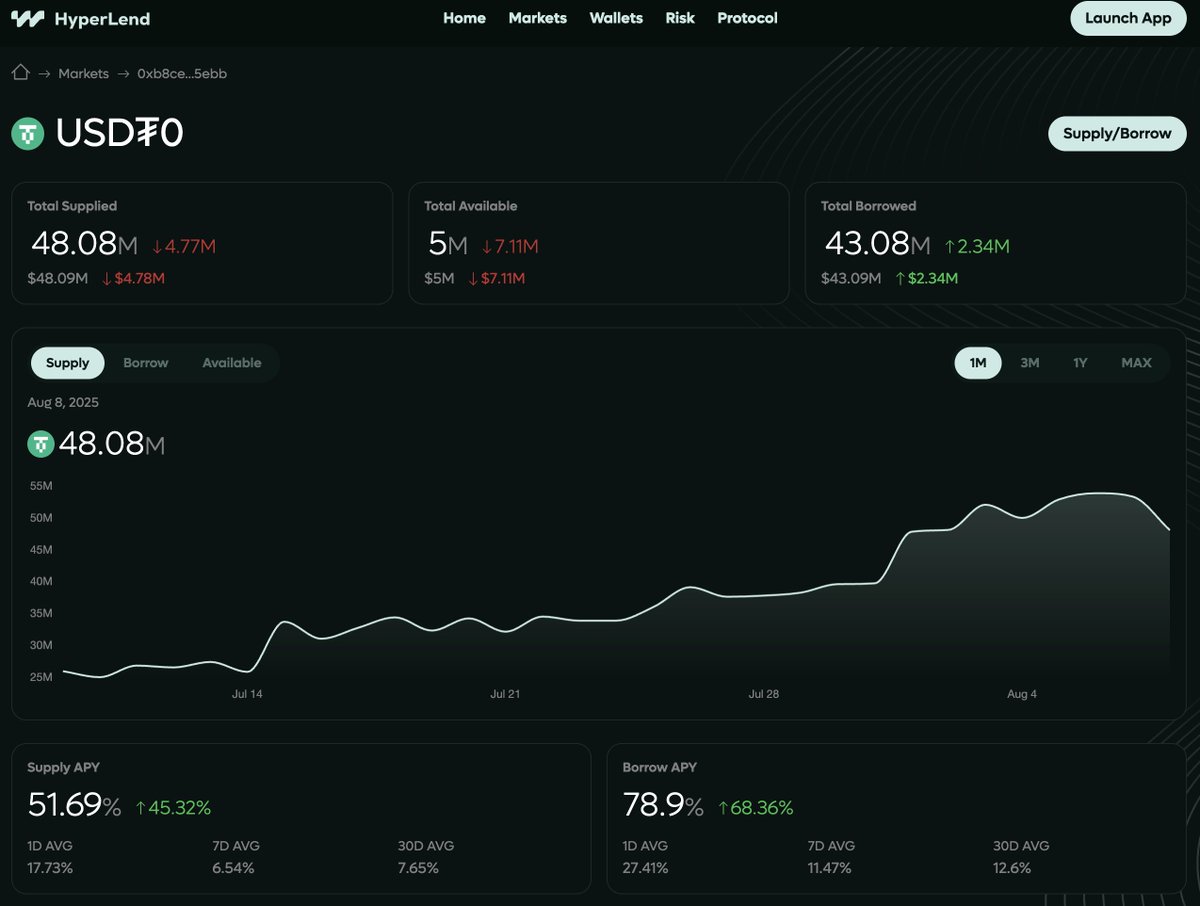

6. Supply that USDT on @hyperlendx for >50% APY

7. Borrow uETH for 1.27% APY

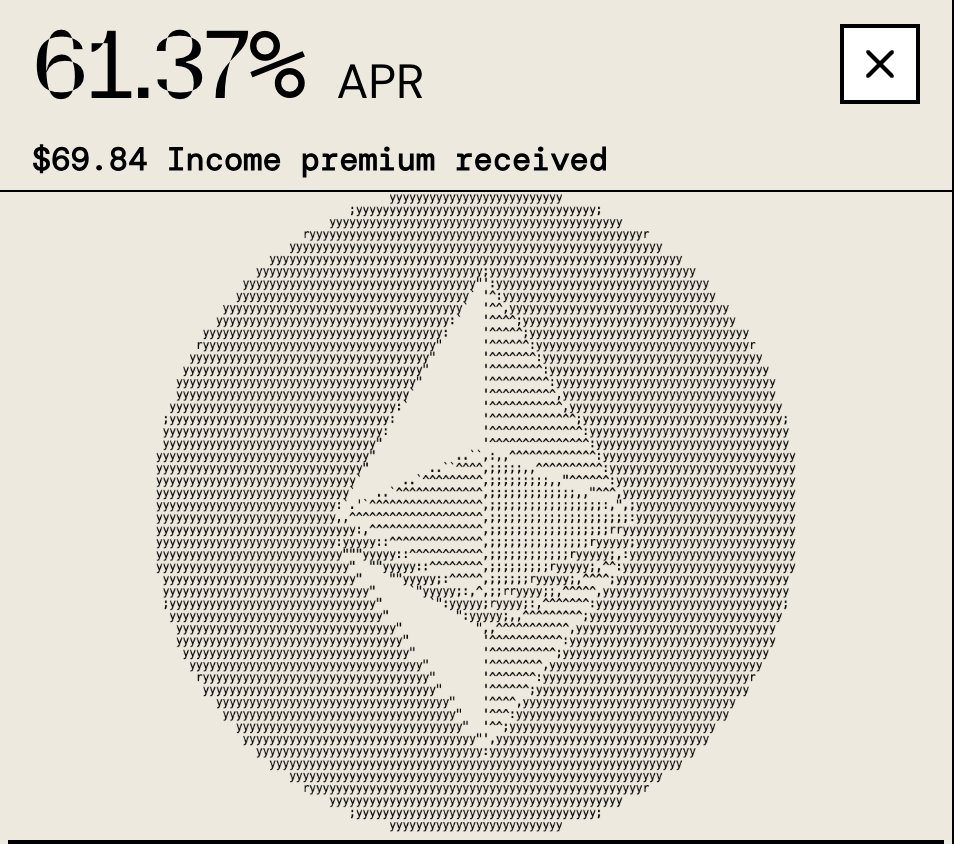

8. Sell covered Call Option on ETH on @ryskfinance and get $69.84 upfront. (Plus Rysk Points)

Learnings

@hyperlendx is great to borrrow BTC and ETH for cheap but very expensive to borrow stables. That's where @sentimentxyz shines.

@prjx_hl makes a lot of fees and gives points but @HybraFinance gives higher APR, since TVL is smaller.

@ryskfinance has a very nice UI/UX and raised caps for once.

There are tons of other projects - will keep exploring!

Let me know your favorite strategies and what I should explain more? Maybe in a video?

Ref Links if you want to support

Hyperlend:

Sentiment:

Project X:

Hybra:

Rysk:

4.97K

15

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.