How to earn 16–25%+ APY, farm a potential $HYPE, $kHYPE, and other airdrop, and stake $HYPE, all in one place?

Meet @0xHyperBeat, the DeFi power-protocol on @HyperliquidX that's quietly building a yield empire, & the best part?

You’re still early

Let’s break it all down 🧵👇

To begin with, what exactly is @0xHyperBeat?

A community-first protocol built on @HyperliquidX to:

◆ Secure the chain via staking

◆ Power real yield products (vaults, lending)

◆ Boost DeFi composability

◆ Distribute ownership via Hearts points

It’s permissionless, liquid, & deeply integrated with @pendle_fi, @MorphoLabs, @ether_fi & more!

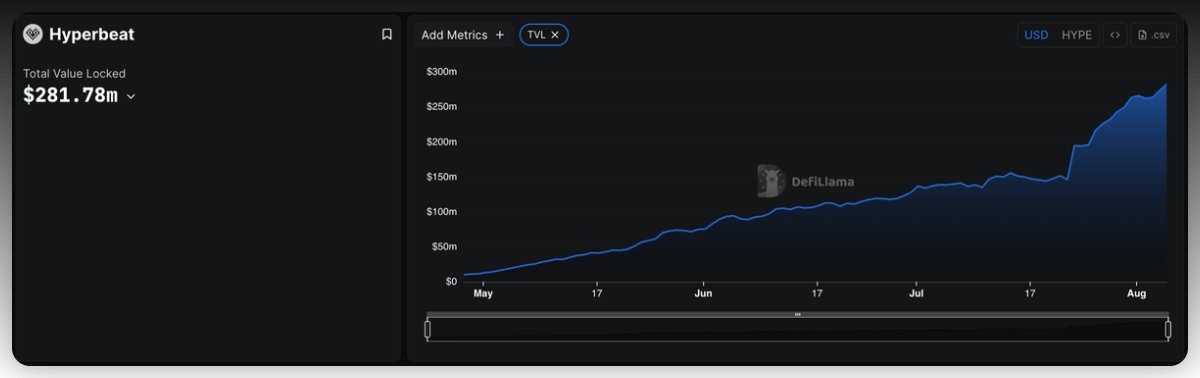

By the Numbers (Aug ‘25):

◆ $288M+ all-time high TVL

◆ $110M+ worth of $HYPE staked

◆ 45K+ wallets farming “Hearts”

◆ 2.97M $HYPE securing the chain

This is no small beta. It’s a core protocol on HyperEVM, and growing fast.

What happened this week at Hyperbeat?

• Earn and Morphobeat TVL: $240M (ATH).

• Validator stake: 2.45M HYPE ($111M).

• Hyperfolio Swap volume: $22M.

• Week 17 Hearts: 35.1M/51M distributed to 41.8k addresses.

• Hyperbeat Builder Codes live, integrate vaults to earn fee-share:

• beHYPE LST vault 50% filled:

• @HyperSwapX points integrated.

• New Morphobeat vaults curated by @MEVCapital and @hyperithm:

• hbUSDT and hbHYPE whitelisted as collateral on Morphobeat:

• @spectra_finance live on HyperEVM with 2 Hyperbeat pools:

What's next?

• wHYPE deployment on Ethereum mainnet.

• $hbUSDT and $hbHYPE pools on @pendle_fi.

• Dynamic vault allocation views.

• Dynamic vault oracle updates.

• Hyperbeat Pay, a vertically integrated Hyperliquid-native alternative to banking.

• Further vault ecosystem point integrations (@HypurrFi, @ResolvLabs and @ethena_labs).

• Native on-ramp for deposits from CEX and other off-chain sources.

• V2 (with Dark mode, yes it is coming very soon).

Key Components:

◆ beHYPE: LST for staking $HYPE

◆ Morphobeat: Lending + Vaults on top of @MorphoLabs

◆ Hearts: Loyalty points

◆ Pendle Integration: Trade fixed/floating yields (20%+ on PT-hbUSDT)

Let’s unpack each of them👇

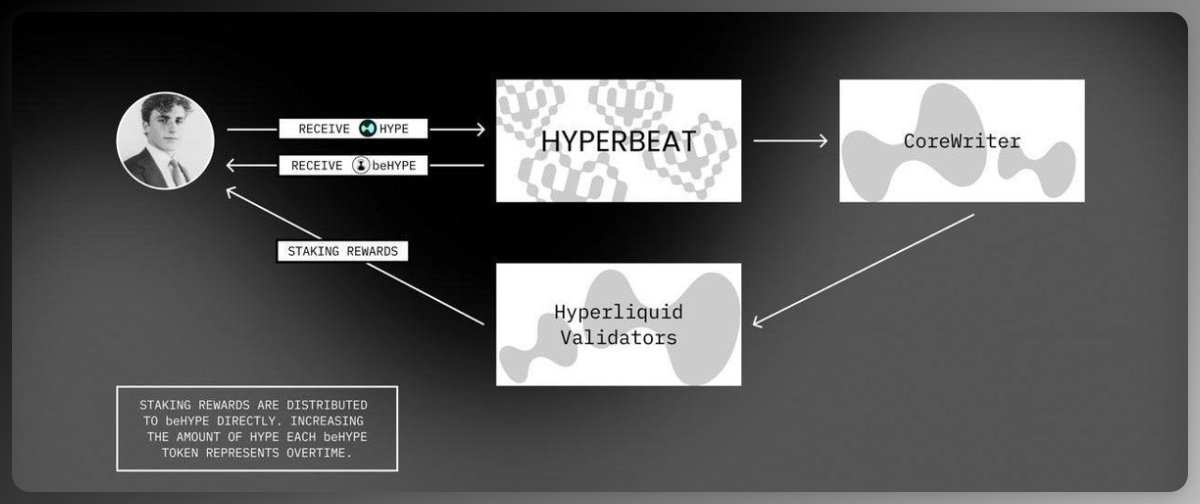

◆ beHYPE (Liquid Staked HYPE)

Stake $HYPE → Get $beHYPE

→ Earn ~2–3% APY

→ Stay liquid to borrow/lend/farm

→ Boost Hearts for higher tiers

→ Points from different partners

Also backed by @EtherFi, and vaults like Hyperbeat USDT offer 16% APY.

This is your base layer.

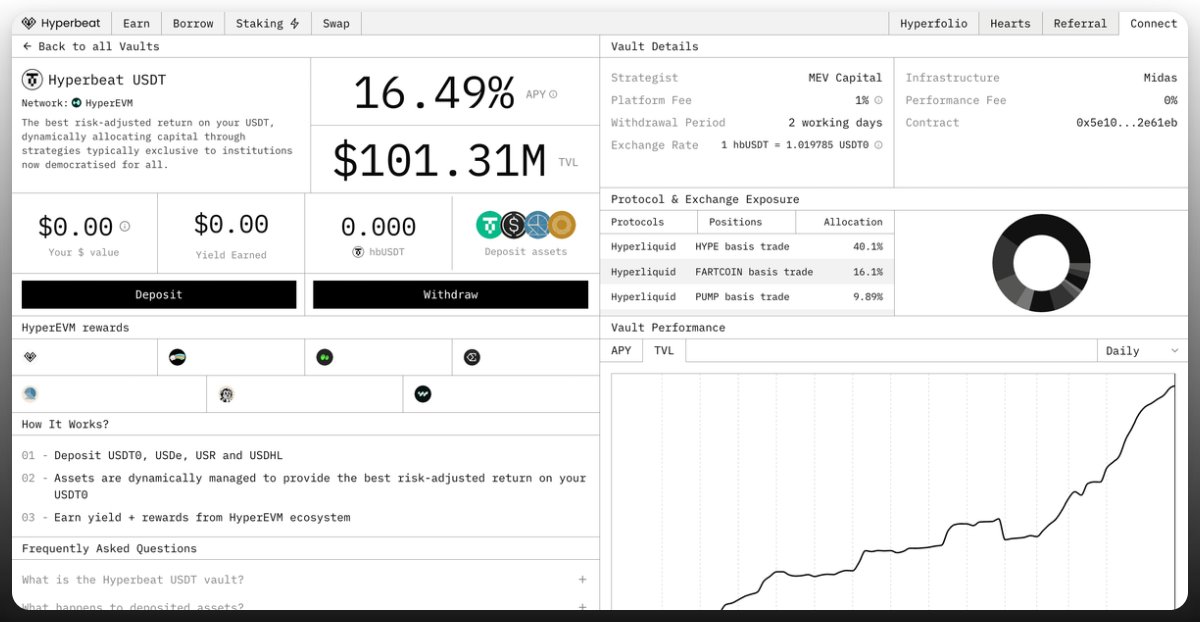

◆ Morphobeat: Vaults & Lending

Built with @MorphoLabs, @hyperunit, @ethena_labs & $USDT0

You can:

→ Supply assets (HYPE, ETH, USDT, USDe)

→ Earn 15%+ APY passively

→ Loop strategies for 25%+ APY (<80% LTV)

→ Earn points from partnered projects

Top vault: USDT at ~16%+ APY (auto-rebalanced, risk-managed), earning Hyperbeat, HypurrFi, HyperSwap, Hyperlend, and Felix points among others.

Morphobeat, our strategic collaboration with @hyperunit, @ethena_labs and @USDT0_to is live.

Powered by @MorphoLabs, Morphobeat offers 2 key primitives:

1. Lending Markets: A fully onchain lending alternative to centralized finance via @hyperunit, on @HyperliquidX. Enabling stablecoin borrows for $HYPE, $BTC, $ETH, $sUSDe and $stHYPE with further blue-chip, real-world and long-tail collateral assets to follow.

2. Vaults: Non-custodial, risk-optimized vaults for $HYPE, $ETH, $USDe, and $USDT(0). Earn real yield via curated strategies from @gauntlet_xyz and @MEVCapital with additional incentives.

Audits and security:

- Audited by @OpenZeppelin and @SpearbitDAO.

- Built on Morpho's permissionless lending infrastructure.

- Formally verified using @CertoraInc.

Deposit on:

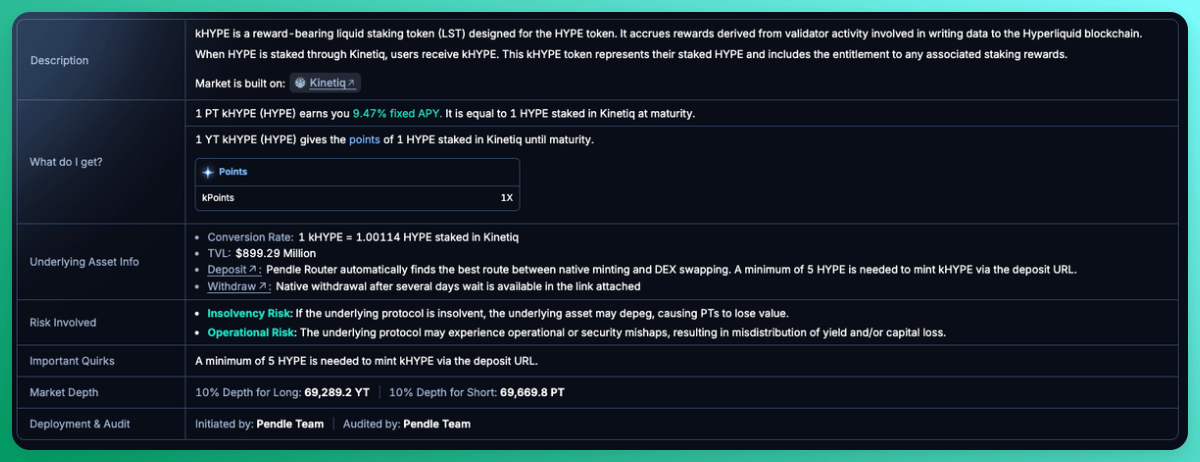

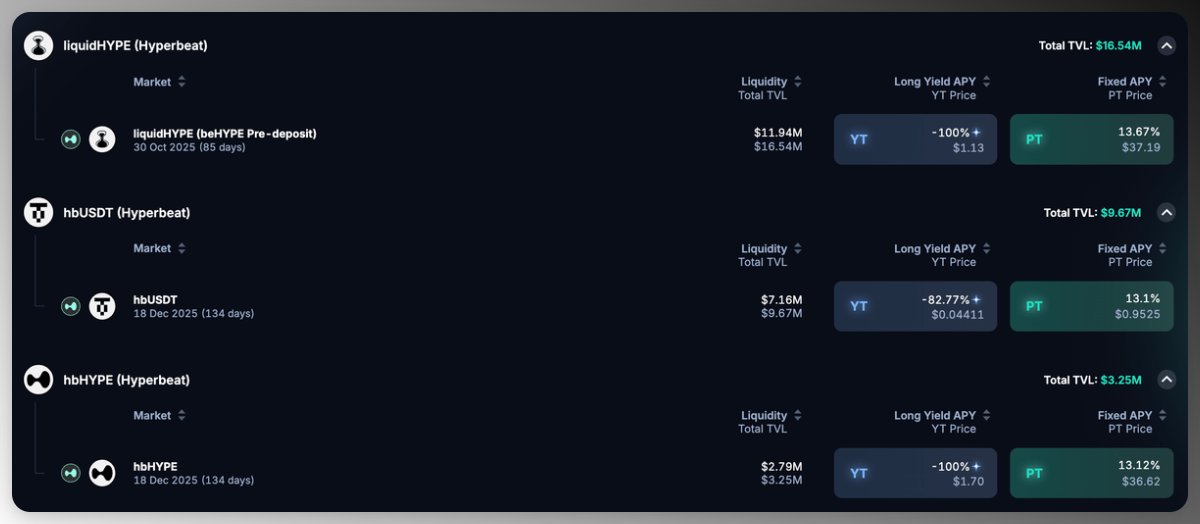

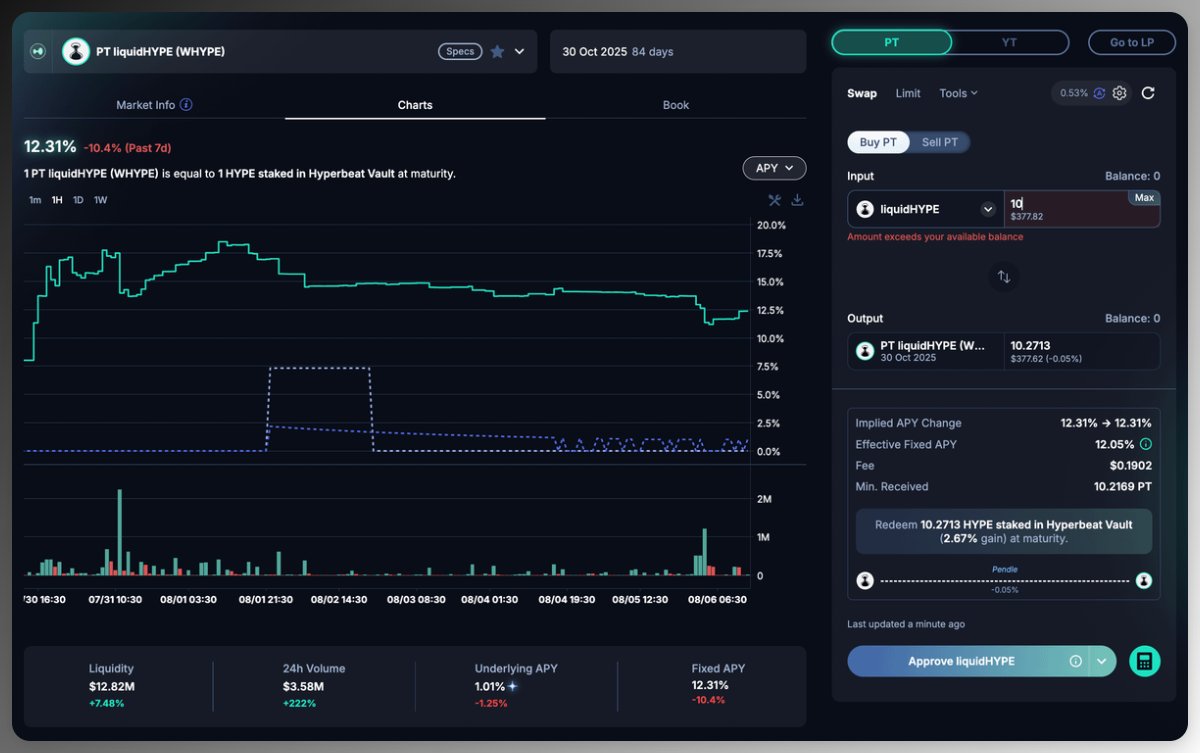

◆ @pendle_fi Yield Strategies

$hbHYPE tokens are tradable on @pendle_fi

→ Buy PT-hbUSDT for 13%+ fixed APY

→ LP on Pendle for variable yield + Hearts

→ Use Pendle tools to long/short interest rates

This adds composability + unlocks new risk/reward profiles.

To understand YT & PT, check out this 🧵👇

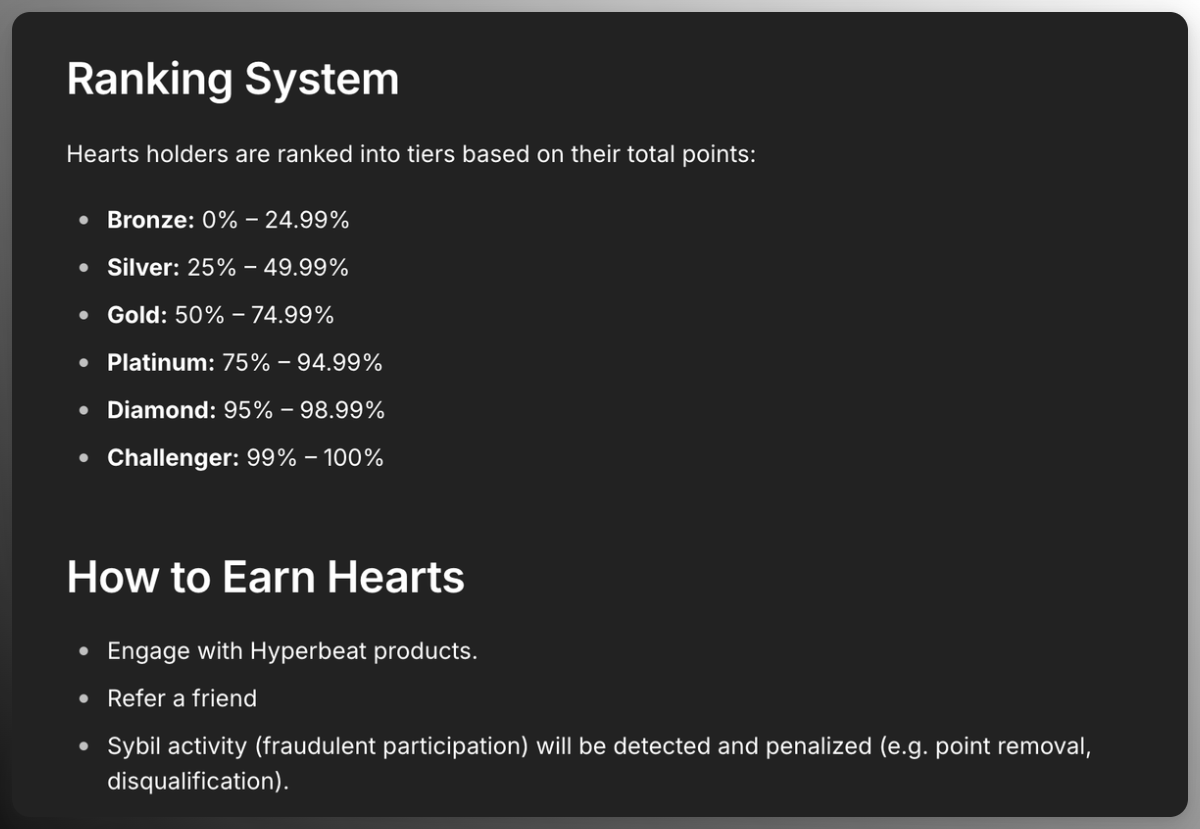

◆ Hearts: Points with Purpose

→ Total Supply: 51M

→ Distributed Supply: ~37.2M

→ Remaining Supply: ~13.8M

→ Time remaining: ~7 Weeks

Earned by:

→ Depositing into vaults

→ Staking $HYPE

→ Referrals

→ Swapping

→ Looping/borrowing activity

→ Interacting with partnered projects

Tiers go from Bronze → Challenger

Weekly snapshots every Thursday.

🖤 Hyperbeat Hearts are live 🤍

Hearts reward users actively contributing to Hyperbeat.

- To date 1300 have earnt Hearts.

- Over $14m deposited into Hyperbeat Partner Vaults.

Program Details:

- Fixed supply of 51M Hearts, distributed weekly.

- Week to week different multipliers and boosts will apply.

- Points formula, multipliers and boosts will not be public.

- There are 5 tiers, sorting users by the number of points earned.

- Users minting stHYPE through Hyperbeat or staking on testnet will be credited Hearts upon mainnet validator launch.

Check your balance on:

Now, moving onto the Farming Strategy (Low Risk):

• Bridge USDT to HyperEVM

• Deposit in Morphobeat Stable Vault (~16% APY)

• Stake HYPE → get beHYPE (~2–3% APY + points)

• Swap for PT hbHYPE on Pendle (12%+ APY on maturity)

Projected return:

→ 16–25% APY

→ Hearts boost

→ Points from partnered projects

That wraps this 🧵 for now!

If you'd like to try out @0xHyperBeat, make sure to head here:

& while I come up with guides and info on more HL eco projects, make sure ot L+RT this post & let me know what dApps you are interacting with in the comments 👇

22.08K

90

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.