Here's a hardcore analysis.

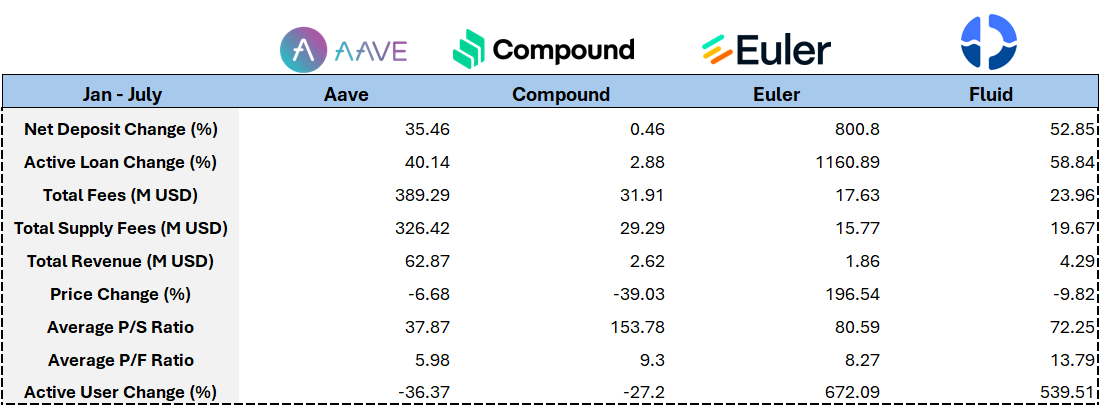

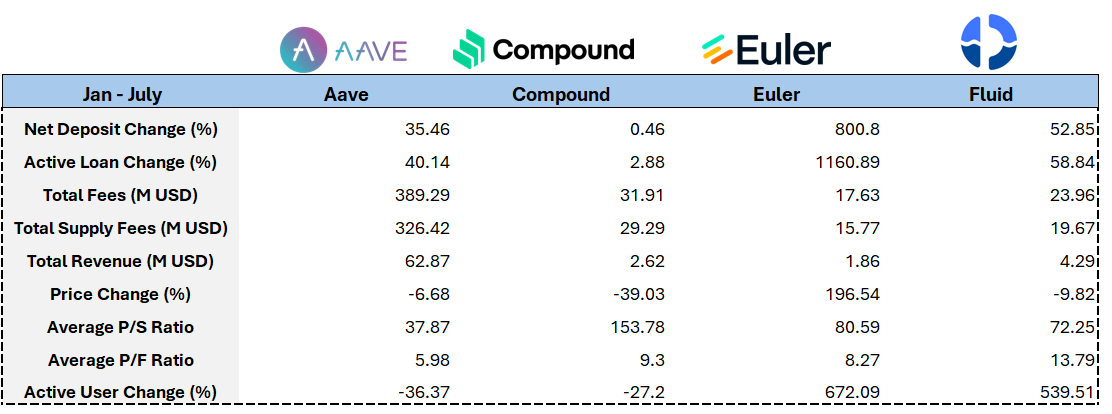

I used to just have a gut feeling that AAVE was the biggest, but I didn't realize that AAVE's income and interest expenses are 10x-20x those of several other competitors.

Is Compound really falling behind this obviously?

"An In-Depth Analysis of the Financial Statements of Leading Lending Protocols"

TL;DR

- Circular lending has become a mainstream play in DeFi, driving the fundamentals of underlying lending infrastructure platforms and eliminating lending protocols that cannot keep up with the trends.

- @eulerfinance has surged ahead with its EVK framework that allows anyone to deploy lending Vaults, leading to a significant rise in fundamentals/token prices, and the future deployment of RWA asset lending will serve as another catalyst.

- @aave has benefited from the launch of USDe + PT-USDe, the Umbrella mechanism, and the cross-chain issuance of GHO, with various metrics showing steady growth in the first half of the year.

Where do the fees for lending protocols come from?

Generally, they stem from the total interest paid on all borrowing positions, whether they are open, closed, or liquidated. This interest income will be distributed proportionally between liquidity providers and the DAO treasury.

Additionally, when a borrowing position exceeds its set LTV limit, the lending protocol will allow liquidators to execute liquidation on that position. Each type of asset corresponds to specific liquidation penalties, and the protocol will obtain the collateral and conduct auctions/fluid "liquidity liquidation" mechanisms.

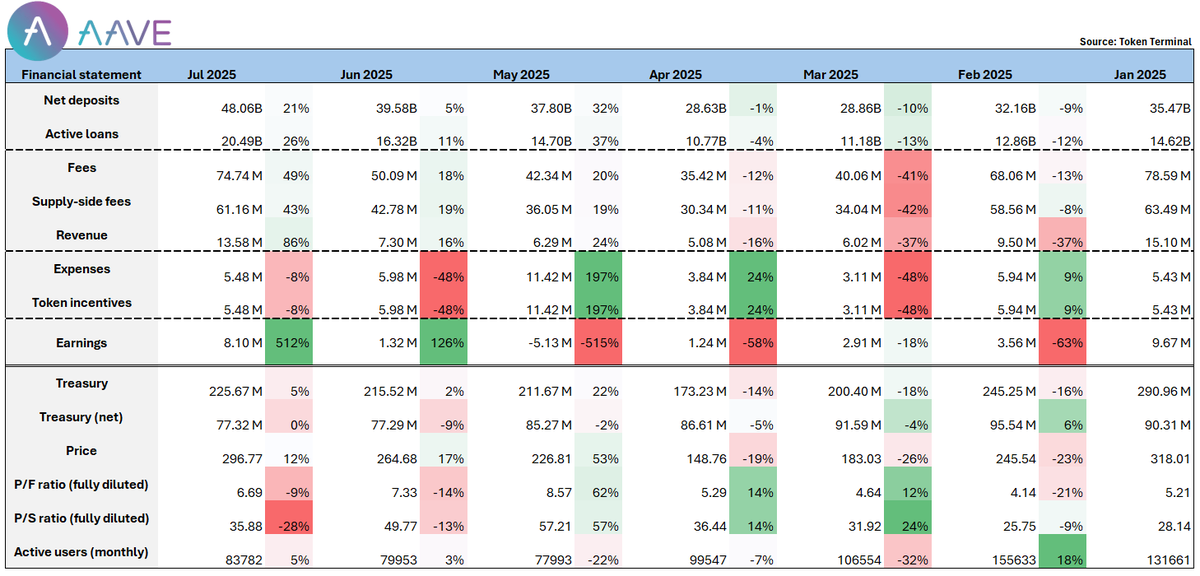

What can we see from Aave's financial statements?

Aave's protocol fees and income peaked at the beginning of the year, then gradually declined alongside the market correction. I believe that the rebound in data after May is mainly due to the launch of USDe + PT-USDe, as the most significant demand for circular lending in this round is driven by Pendle's PT-type assets and the stablecoin launched by Ethena.

Data shows that in the early stages of PT-sUSDe's launch, nearly $100 million in supply was quickly deposited into the Aave market.

Moreover, the Umbrella mechanism was officially launched in June, and as of now, it has attracted approximately $300M in funds for deposit protection. At the same time, the cross-chain issuance scale of Aave's native stablecoin GHO continues to grow (current circulation ~$200M), and its multi-chain application scenarios are also expanding.

With multiple favorable factors driving it, Aave experienced a comprehensive breakthrough in July:

Net deposits surpassed $4.8 billion, ranking first in the entire network;

The protocol's net profit surged nearly 5 times month-over-month in June, reaching ~$8M;

Based on price-to-sales and price-to-earnings ratios, Aave remains an undervalued project in the sector.

Given the current growth trend and product maturity, it is expected that more traditional institutions will choose Aave as their DeFi platform. In terms of fee income, TVL, and protocol profitability, Aave is likely to continue setting new records, solidifying its position as a leader in DeFi.

81.4K

116

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.