Quick Explain & Personal Though on Pendle's @boros_fi

1. Funding rates are periodic payments between long and short prep traders. If the market is bullish (perp price > spot), longs pay shorts (positive funding rate)

2. Boros "tokenizes" these funding rates into assets called Yield Units (YU). Example: 1 YU-ETH = the funding yield from 1 ETH notional in Binance's ETH/USDT perp

3. If you think funding will go up ▶︎ Long YU. If you think funding will go down ▶︎ Short YU.

4. Use Case Example: Ethena, which relies on positive funding for stablecoin yields, can short YUs to lock in rates and protect against drops

---- thoughts:

1. This product is targeting the funding rate arbs and protocol, but not normal retail user. I don't think much retails really care about how much they are paying to the funding rate. For funding rate stablecoin protocol like Ethena, they may have huge demand on "Short YU", not sure about the liquidity for them to hedge if buy side is not enough.

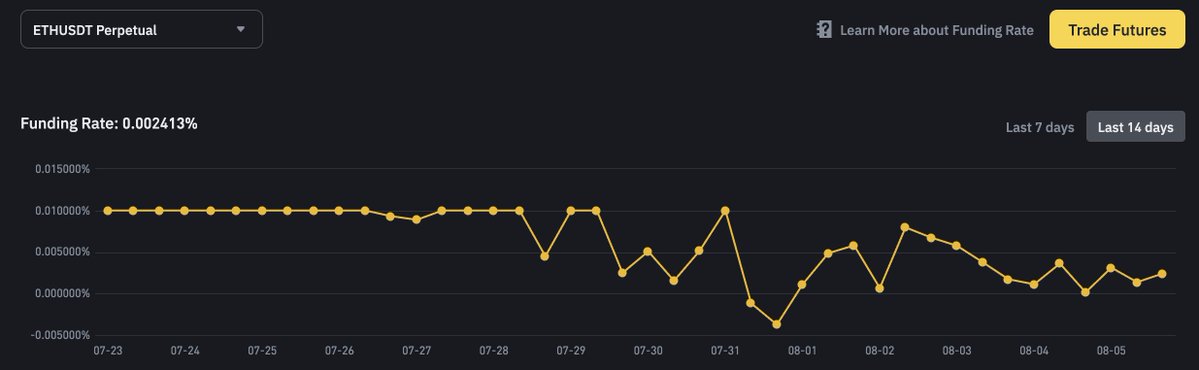

2. Funding rate formula can be adjusted by CEX. From below chart, you can actually observe the recent funding rate for $ETH is pretty consistent to stay on/below 0.01%, even during a bull market. Exchange generally now encourage more AUM so they tend to not make their funding rate too high.

The result is more smart users (who actually who play with trading funding rate) will also likely to sell YU as well. So I'm not too sure who will be the buy sides of YU.

3. Pendle Team always deliver a great product, I'm a pendle user and I'm willing to trust them have a proper mechan on this product, including risk control.

Show original

14.03K

78

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.