The widely circulated video of Richard Werner with Tucker reminded me of the Japanese market in the late 80s early 90s.

This is an incredibly important story and one that most Bitcoiners are not well aware of. It has all kinds of lessons for interest rates, "property bubbles" and leverage 1/N

It's one I lived very closely.

The next 5 years, the Yen went on a tear, peaking at 120 yen to the dollar in 1990. /p trading firm on Wall Street, chronicled in Michael Lewis's "Liar Poker"

That year, it seemed, Japan was set to conquer the world. I was heavily involved in the Japanese Bond market, traveling to Tokyo often for work.

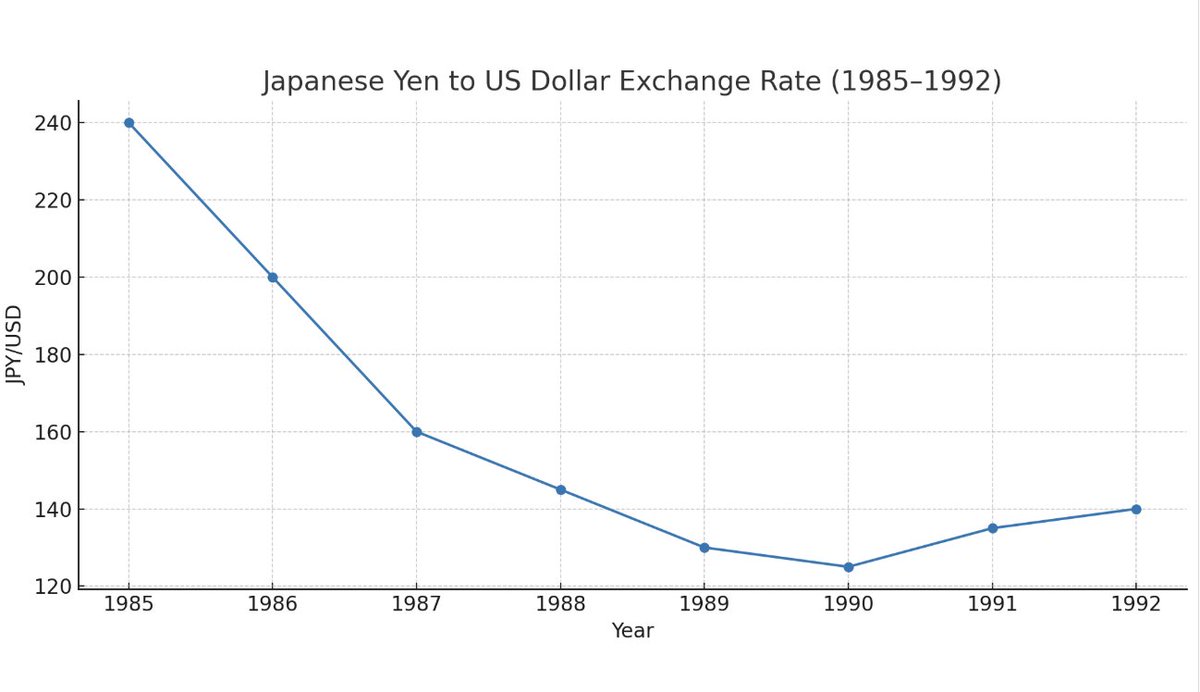

To set the context, between 1979 and 1981, Paul Volker had raised interest rates to a peak of near 20% to break inflation. That had caused a massive strengthening of the dollar which was killing US exports.

Just like today, where Trump is accusing the world of "taking advantage of us", the US government was outraged that the Japanese export economy was doing so well and the USA wasn't. The response was the "Plaza accord" where US decided to formerly depreciate its currency. Especially versus the Yen.The next 5 years, the Yen went on a tear, peaking at 120 yen to the dollar in 1990. 2/N

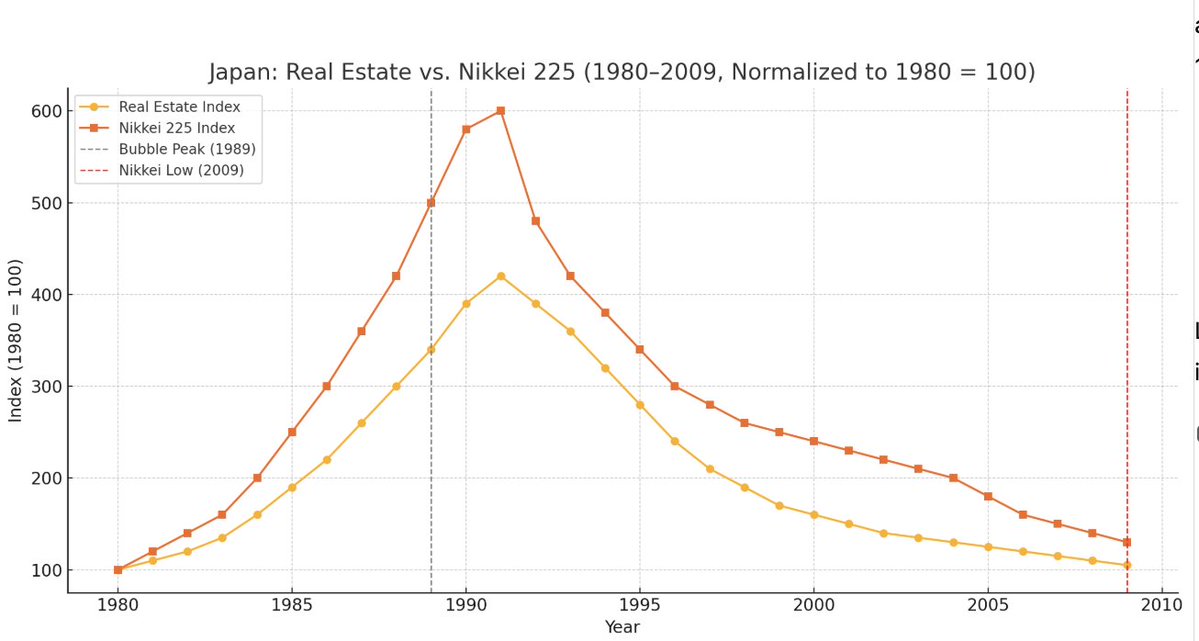

As the Yen soared, the Japanese stock market and real estate market skyrocketed.

Richard Werner correctly points out that this was in large part due to the credit money creation by the Japanese Banks.

In 1989, I got to see that story from the inside. I moved from Salomon Brothers to Greenwich Capital, a top Arb shop with the lure of having access to LTCB's balance sheet: the second largest bank in Japan.

LTCB was larger than any American or European bank by total assets in 1990.

And I had access to its balance sheet for swaps and arbitrage. Let that sink in. 3/N

Now lets look at what happened. Simple.

The asset bubble popped.

As Richard Werner mentioned, the banks had fueled this bubble. Although LTCB was huge, it only had a 10% equity buffer, like banks today in the USA.

When the Japanese Central Bank raised rates, there was no more fuel to fund the "flywheel". Property companies went bust. LTCB, larger than any US or Japanese Bank, went bust.

There was no reflating the broken bubble. Japan tried endlessly. They invented QE. The Central bank now owns more than 50% of the Bond Market and 7% of the Stock Market. 6/N

A few conclusions for Bitcoiners

1. Propping up asset prices works until it doesnt

2. When the Humpty Dumpty breaks, you can't put him together again

3. Bitcoin is what Saylor calls "Digital Property". What killed the actual Property Market in Japan was leverage. Thjs could have devastating impacts for Bitcoin as well, eventually

4. But we're not there yet. Enjoy the massive ride of Bitcoin over the next decade. But watch out for leverage.

25.47K

214

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.