July was a massive quarter for regulatory wins, RWAs, and the broader crypto industry.

Hong Kong passed its Stablecoin Bill, the U.S. signed the GENIUS Act, and countries like El Salvador, Argentina, the UAE, and the Central African Republic opened sandboxes dedicated to tokenization.

At the same time, Fortune 500 companies (Amazon, Walmart, Shopify, PayPal) announced or tested stablecoin infra, while TradFi giants such as VanEck (vBILL), WisdomTree (USDW), and Figure (tokenized HELOCs) entered the market, targeting different asset categories each.

Yet crypto, at $3.7 trillion, is still a fraction of global finance. BlackRock alone manages more than three times the size of our industry.

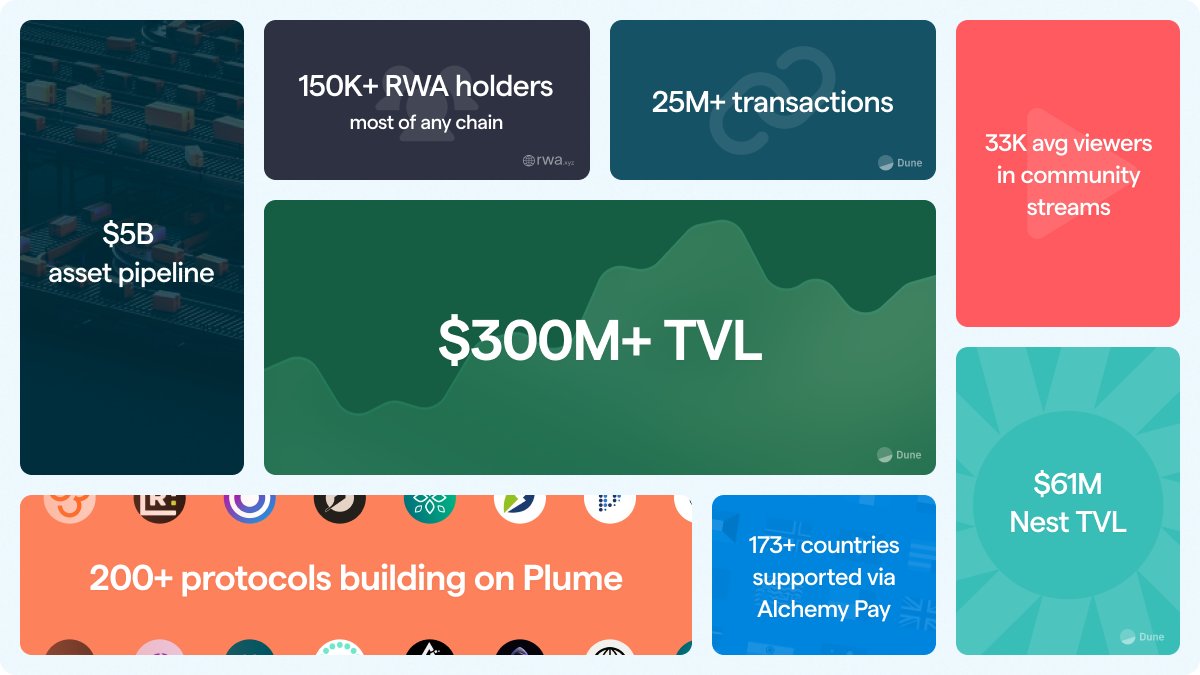

With this perspective, the upside for Plume is immense. Although I consider the mainnet launch a success, with $367 million of TVL after two months, the margin for growth is orders of magnitude bigger.

Breakdown of the TVL among the top 10 protocols:

1. @NestCredit (Yield Vaults) - $66m

2. @MorphoLabs (Lending) - $60m

3. @superstatefunds (Institutional funds) - $56m

4. Nucleus (Stablecoin) - $53m

5. USDC.e (Stablecoin) - $38m

6. Plume pUSD (Stablecoin) - $37m

7. @SoleraLabs (All-in-one app) - $16m

8. @MineralVault_ (Commodities) - $10m

9. @MidasRWA (Yield strategies) - $10m

10. @roosterprotocol (DEX) - $7m

One cool (and funny) thing is seeing more exotic assets being tokenized, such as Durian farms, Thai tuk-tuks, and African-focused remittances.

Cash-flow generating assets or businesses are being brought onchain to leverage DeFi's strengths and open up tons of new use cases.

To wrap up, the sector is finally getting what it needed: clearer regulations.

There is still a long way to go, but the favorable macro situation, paired with new entrants of companies, institutions, and governments, is making things quite bullish for everyone involved in the tokenization space, particularly Plume.

1.68K

9

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.