Michael Egorov (@newmichwill), founder of @CurveFinance, gave a talk titled “Yield Basis”.

Let’s walk through his case for why impermanent loss (IL) can be neutralized 👇

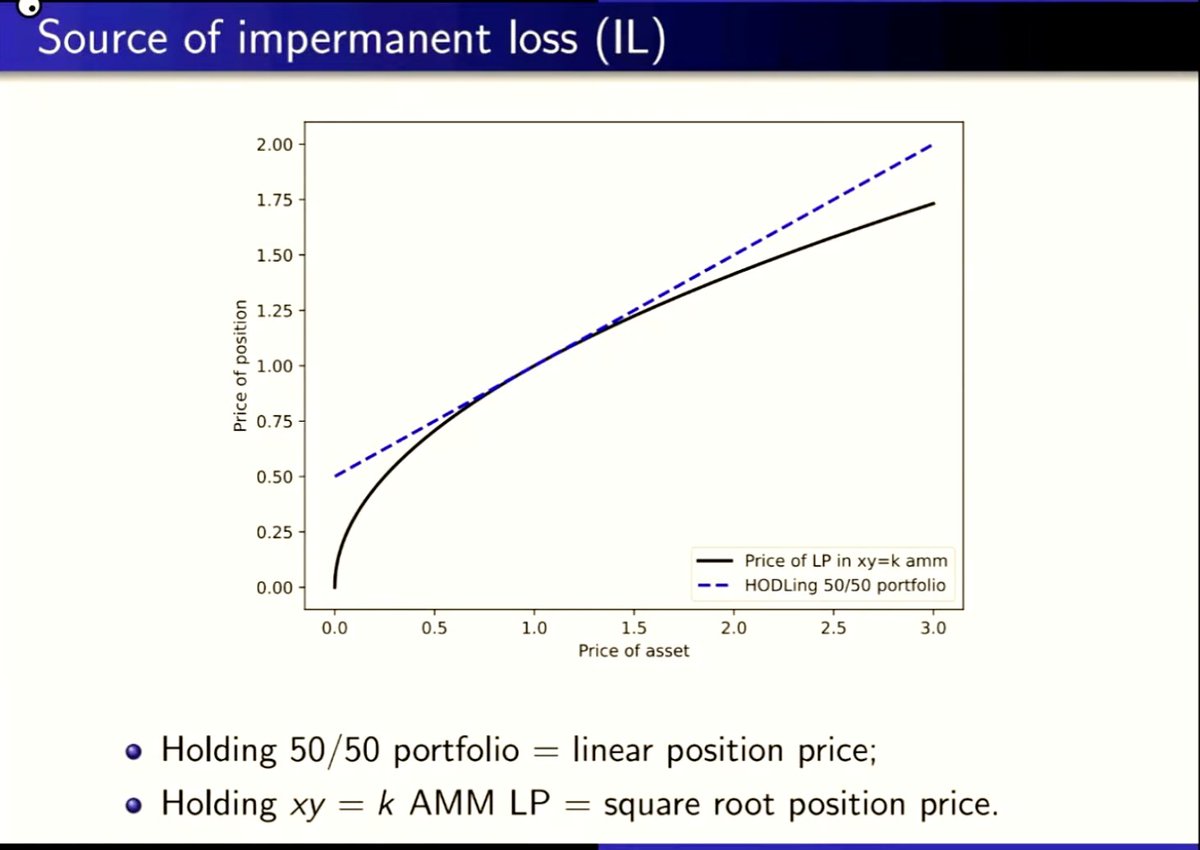

What is impermanent loss, exactly?

Impermanent loss (IL) happens when you provide liquidity to a pool of volatile assets, say $ETH and $USDC, and the price of ETH moves, in either direction.

1. Let’s say ETH goes up.

→ Traders start buying ETH from the pool

→ Your position gets rebalanced toward USDC

→ You now hold less ETH than you started with

→ Even though ETH is worth more, your portfolio is worth less than if you had just held ETH and USDC separately

2. Now let’s say ETH goes down.

→ Traders start selling ETH into the pool

→ Your position gets rebalanced toward ETH

→ You now hold more ETH (but it's cheaper)

→ Again, your portfolio is worth less than just holding outside the pool

In both cases, your exposure shifts toward the losing asset.

This happens automatically and it’s not free.

The AMM’s rebalancing math pulls you away from market-neutral value.

That’s impermanent loss.

Over time, you might earn fees to compensate for it.

But in most real-world pools, especially with volatile assets, the math doesn’t add up.

That's IL. It’s the reason passive LPs don’t touch volatile pools.

So… can we remove IL?

Turns out, yes. But it takes a weird kind of leverage.

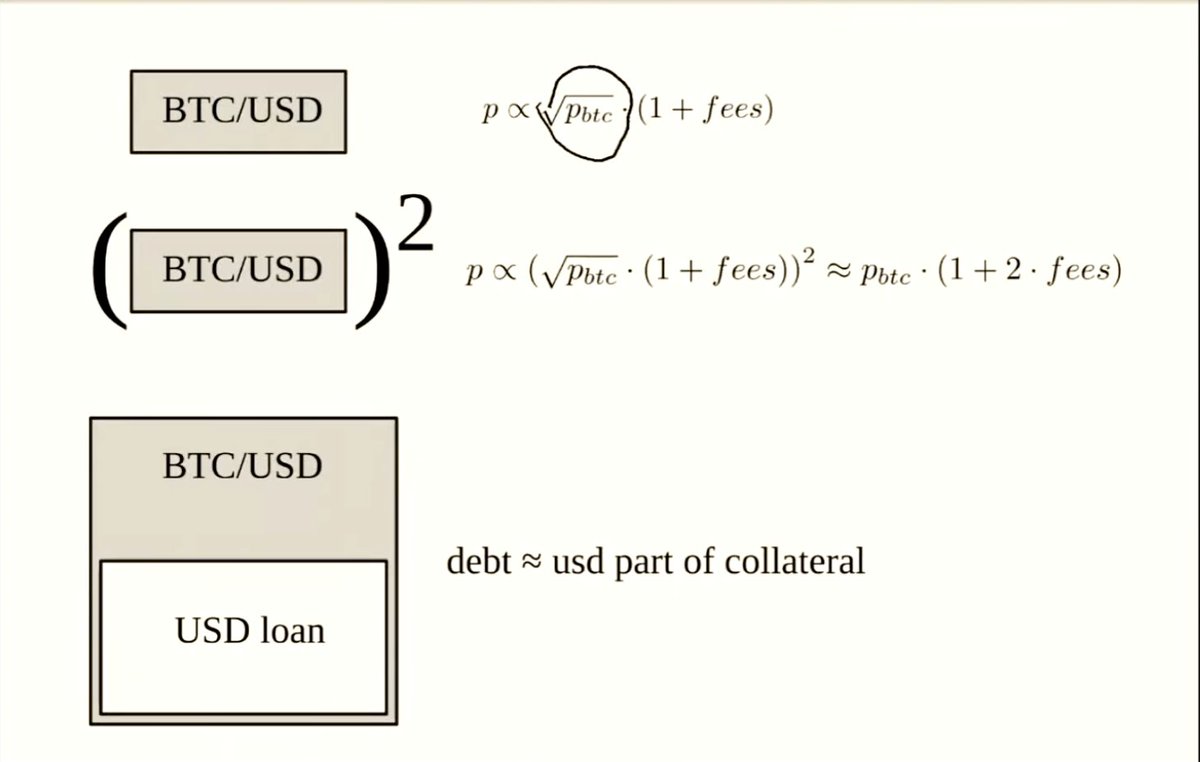

“IL happens because LP value ∝ √(price).

But if you square it via 2x leverage, you get price-linear exposure.”

Michael’s trick:

→ LP in BTC/USDC

→ Borrow USD against LP (equal to stable side)

→ Compound the loop

Now:

(√p ⋅ (1 + fees))² ≈ p ⋅ (1 + 2⋅fees)

BTC exposure + fee yield.

No IL.

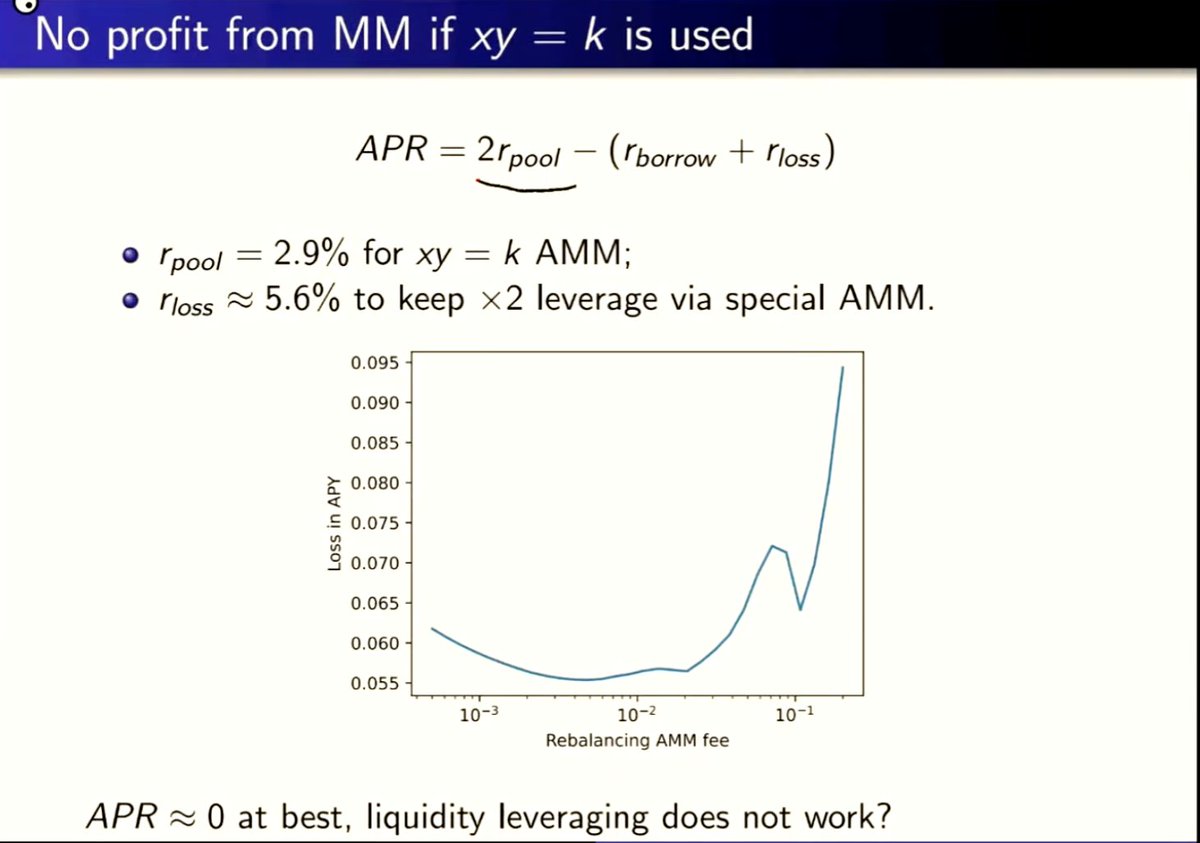

But there’s a catch.

You have to constantly rebalance the loan against your position.

That incurs losses from rebalancing (aka "volatility decay").

Michael simulated this on Uniswap v2.

Result? Your gains = your losses.

You break even. Not useful.

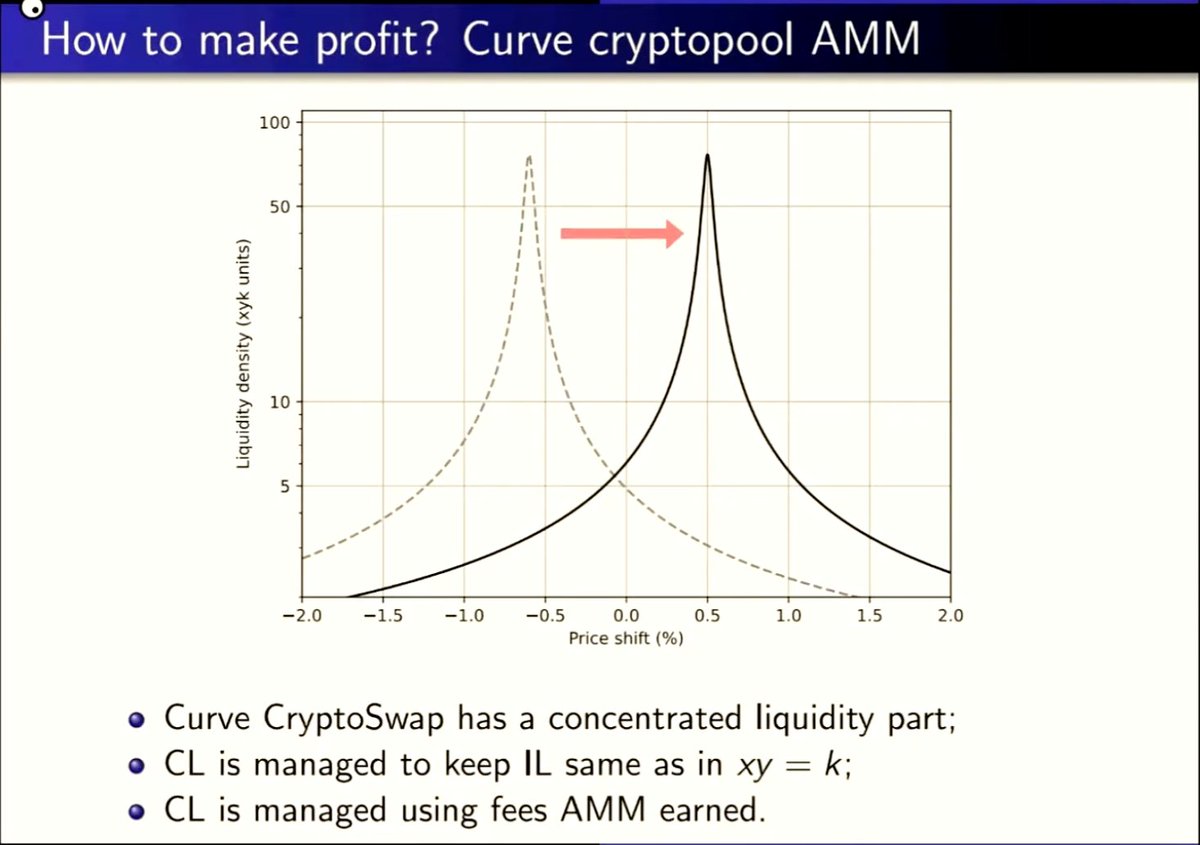

Enter Curve crypto pools

Unlike Uni v2, Curve crypto pools use adaptive concentrated liquidity.

They automatically shift liquidity to optimal zones, but only if they have the budget to do it.

How is this budget filled?

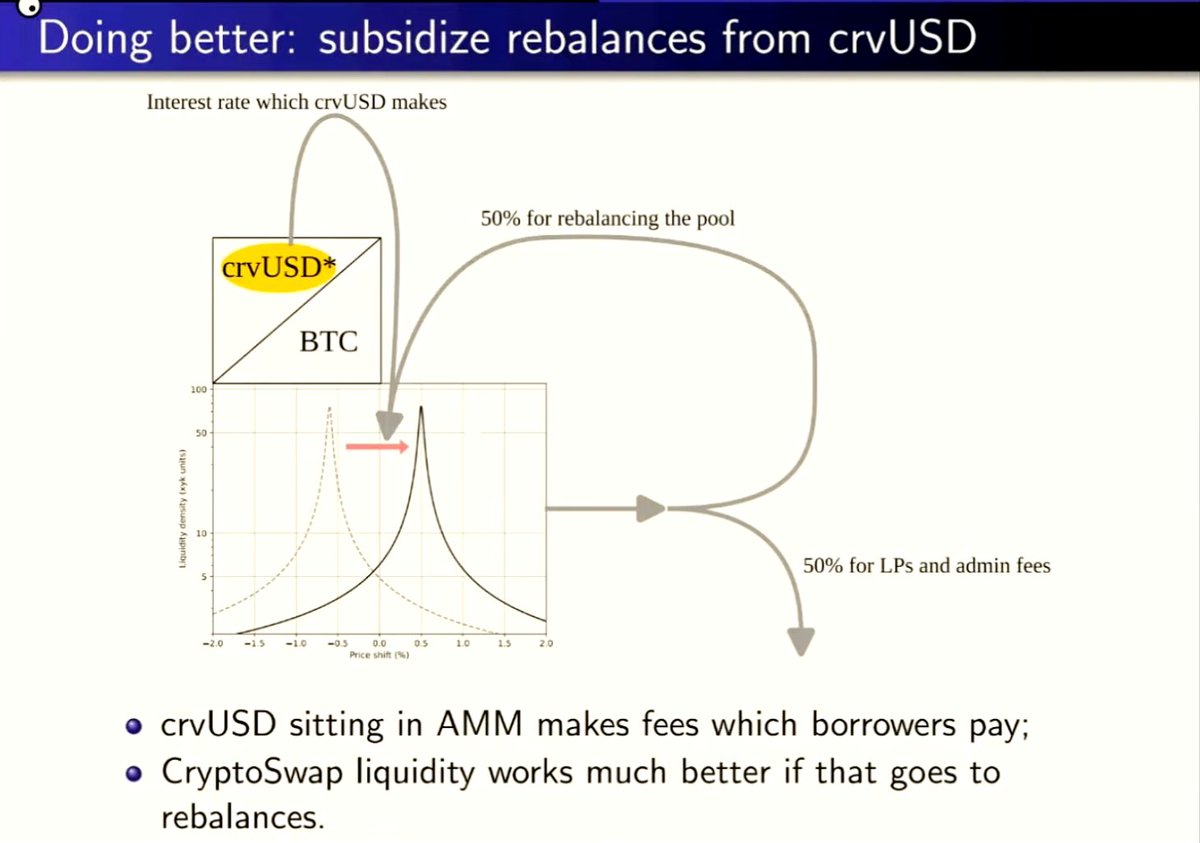

→ 50% of swap fees go to LPs

→ 50% fund the rebalancing budget

But what if the price drifts far from the center?

If there's no budget, liquidity can’t move. You get stuck in a low-fee zone.

So Curve keeps the concentration moderate (3–5x), balancing fee earnings with rebalancing cost.

Still not perfect. So here’s the next step.

Subsidize rebalances from $crvUSD.

The idea: pair your asset with crvUSD.

Borrow against your position at a floating rate.

Use the interest paid by LPs to fund denser, better-positioned liquidity.

Now the pool earns more. Maybe more than you pay.

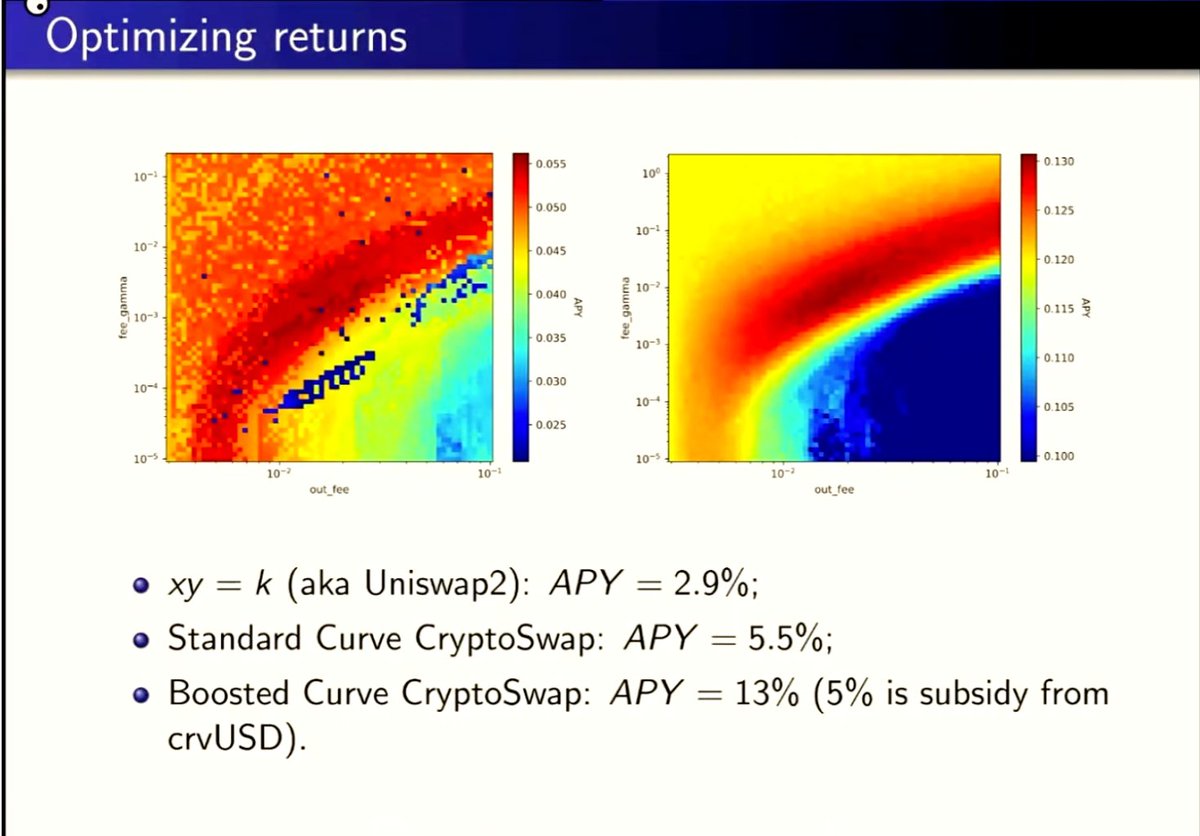

Does it work? Michael ran the numbers.

Backtested with:

• Arbitrage between Curve + Binance

• Real BTC price feeds (2023–2024)

• Real Curve pool parameters

Result:

→ Uniswap v2: ~3% APR

→ Curve pool alone: ~5.5%

→ Curve + leverage + rebalance budget: ~13%

You pay 5% borrow cost → earn 13% & make net yield ≈ 7% with no impermanent loss.

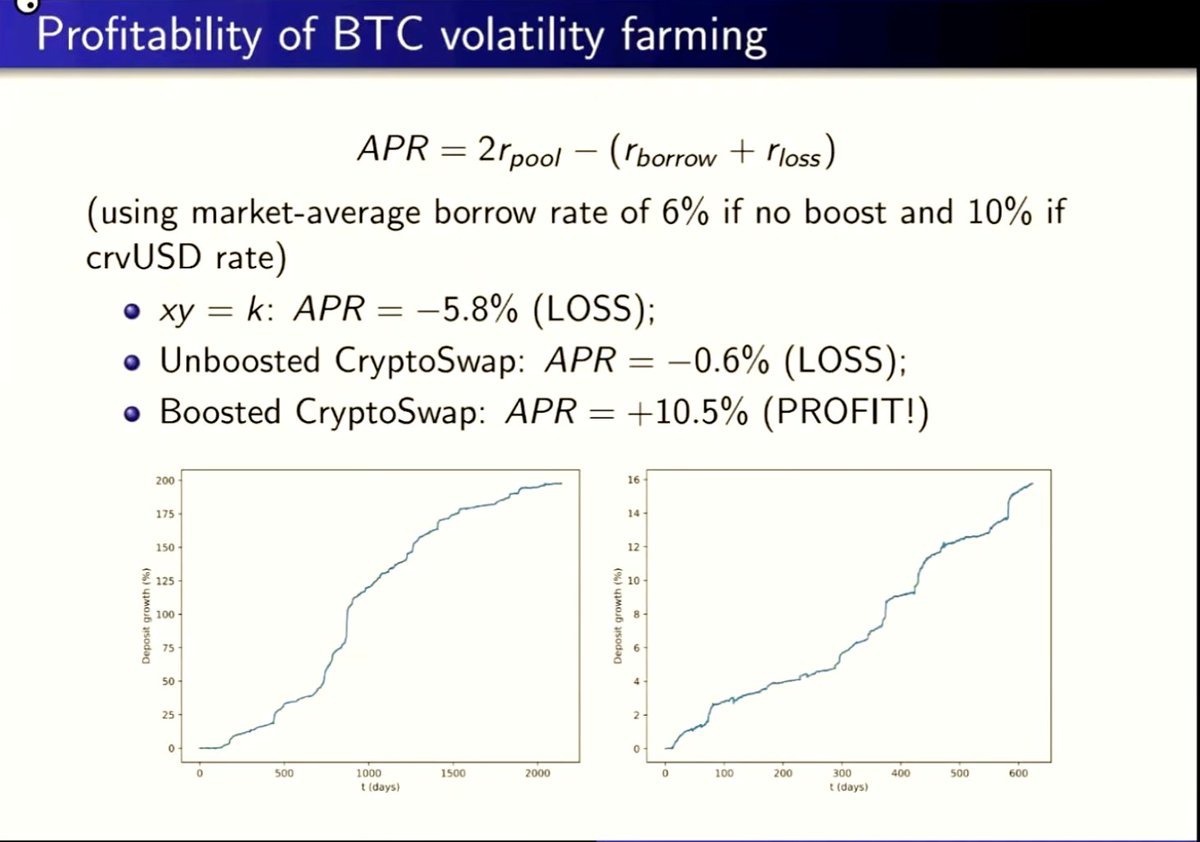

Okay, but what about no IL?

He built a custom AMM that applies compounding leverage over Curve pools.

→ Keeps constant leverage

→ No impermanent loss

→ Realistic rebalancing

Simulated APRs:

→ 2023–24: ~9%

→ 2019–2024: ~20% (mostly due to 2021 volatility of BTC)

31.16K

254

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.