Ever wondered why your lending APY is so low... even when someone else is borrowing at 10%?

Yeah, same here.

Most of us use pool-based lending protocols.

I still do too.

But I recently found something smarter, built on top of @VenusProtocol

Let me show you how it works 🧵👇

1/

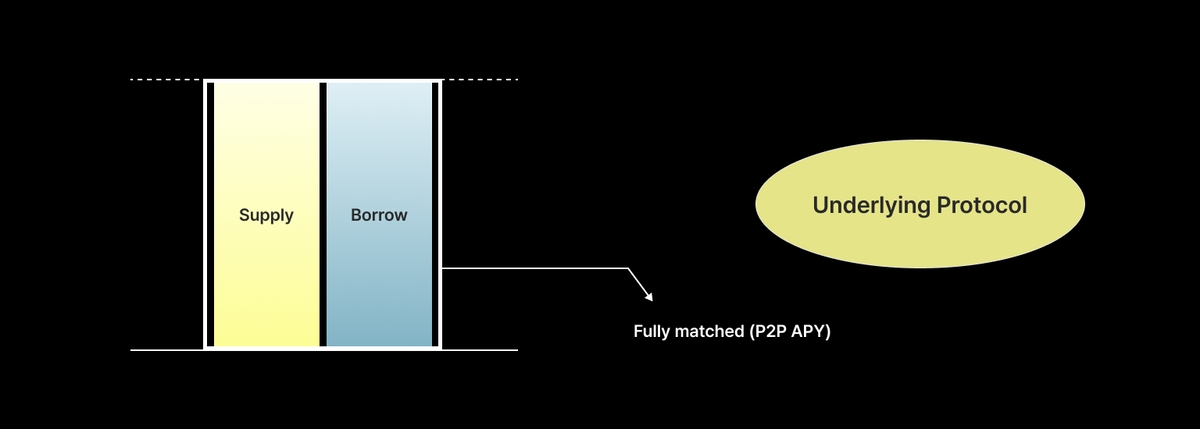

Let’s start with the real issue.

Protocols like Venus and Aave work by pooling funds.

You supply USDT. Someone borrows from the pool.

The rest of the funds just sit there... waiting.

That idle capital? It’s why your APY sucks.

2/

Here’s the math no one talks about:

Say 20% of the pool is borrowed at 10%.

Only that 20% is generating yield.

Your APY drops to around 2%.

The other 80% of the capital is just... chilling.

Feels broken, right?

3.

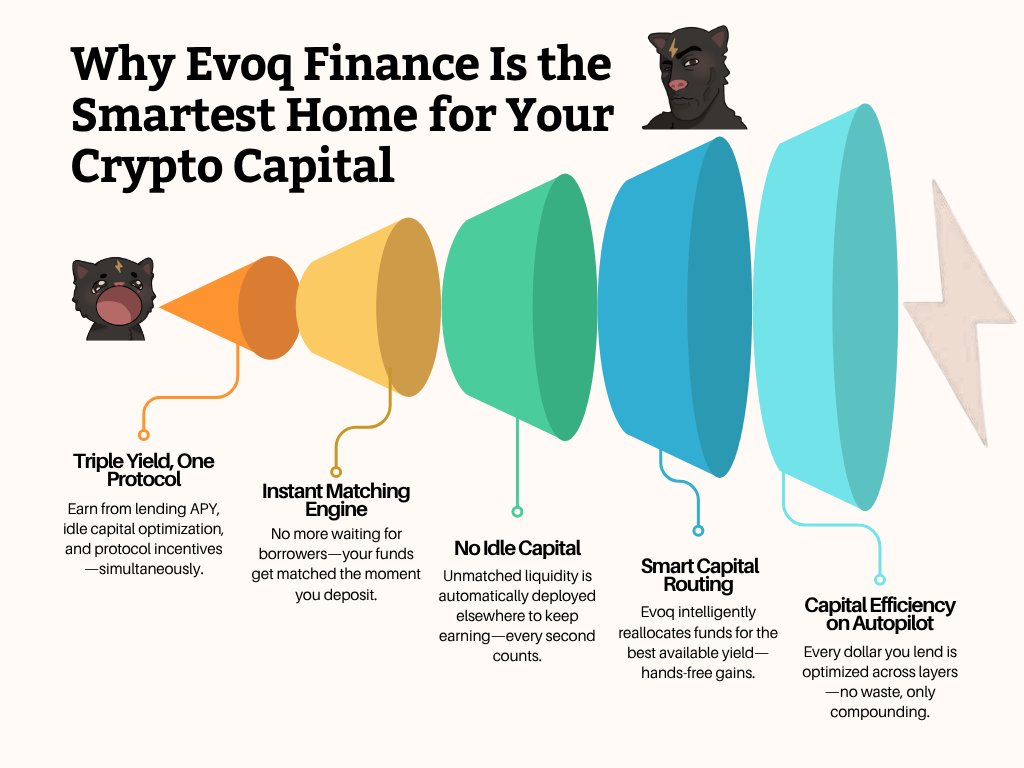

Now imagine something different.

What if:

• Every lender was matched 1:1 with a borrower

• Every dollar was working

• There was no idle capital

• And both sides got better rates

That’s what peer-to-peer lending aims to fix.

4/

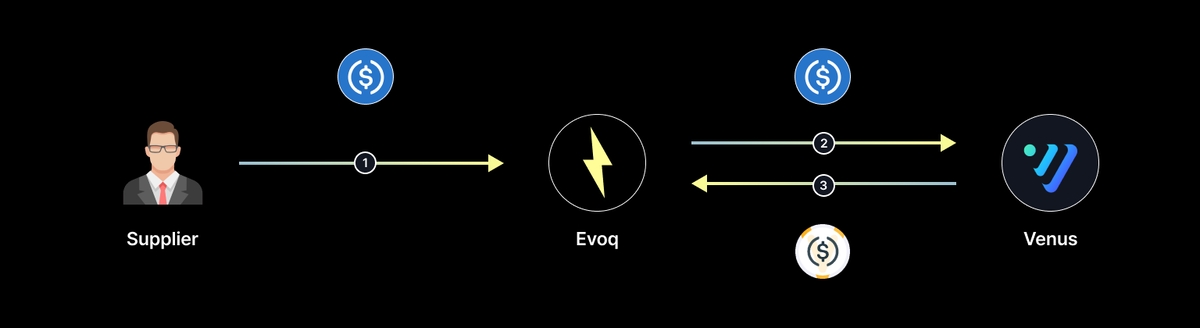

This is where Evoq comes in.

It’s a P2P lending optimizer that plugs into Venus.

You deposit into Evoq like you would Venus.

But behind the scenes, it’s matching you directly with borrowers.

You both get better deals, without changing your experience.

5/

Here’s how it works, step by step:

• You supply USDT into Evoq

• Evoq puts it into Venus and gets the interest-bearing token (vUSDT)

• When a borrower shows up, Evoq pulls your USDT back out

• It gives it directly to the borrower

You’re now matched.

6/

Because of that match:

• Your assets are 100% utilized

• Your APY is better than Venus

• The borrower pays less too

• Nobody’s funds are sitting idle

You don’t do anything extra. Evoq just does the smart routing for you.

7/

But what if you want your funds back and they’re matched?

Evoq uses the borrower's collateral to pull liquidity from Venus, gives you your funds, and then re-matches the borrower with Venus.

You withdraw instantly. The borrower stays covered.

Smooth stuff.

8/

So the whole point is simple:

You get the same experience as Venus

You take on the same risks

You use the same assets

But you just earn more.

Because capital is being used more efficiently.

No new system to learn.

11/

There’s also talk of Evoq expanding to HyperEVM soon.

If you’re farming on BNB Chain now, you might get early access or extra multipliers if the rumors are true.

Positioning early makes sense here.

Moreover, they just jumped to #8 on DappBay’s user-growth rankings which is a good signal

13.54K

128

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.