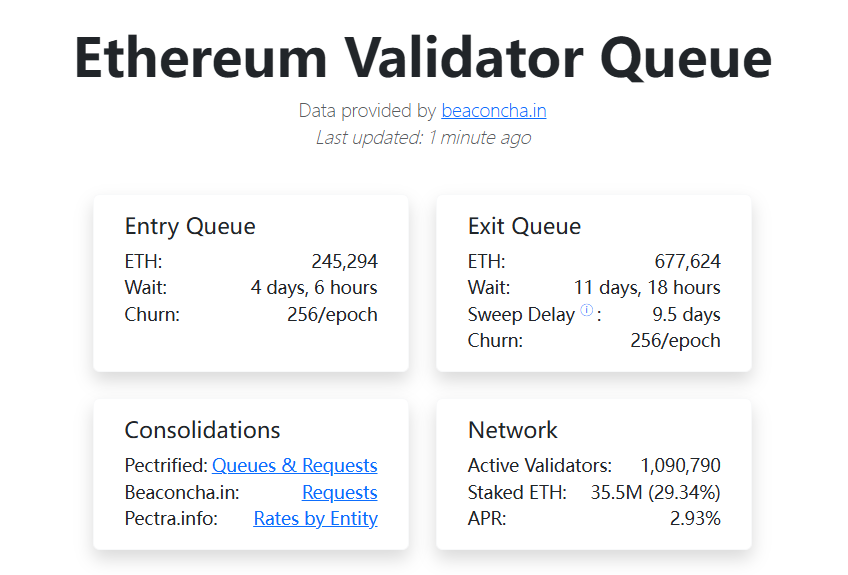

⚡️ Someone sent me this, validatorqueue data shows that 677,000 ETH queued up to exit the staking queue, does it mean that Ethereum is not stable?

After analysis, the surge in queues is due to many reasons -

1️⃣ Profit-taking: ETH rebounded more than 160% from its April low, rising from about $1,500 to over $3,800

Many early stakers choose to be safe.

2️⃣ Strategy failure: From July 16th to 21st, Aave's lending rate soared from 3% to 18%, resulting in an inversion of the LST/LRT circular strategy yield and forced large-scale redemptions.

3️⃣ Brother Sun made a move: A single person withdrew 6w ETH from Lido and Aave, and the whale demonstration effect amplified market sentiment.

These backlogs of ETH take about 15 days to digest, which does have a short-term impact on liquidity. However, you can't just see the exit data, the inflow data is also worth paying attention to -

There are now 245,000 ETH waiting in line for stake, and strong demand + institutions are slowly sweeping the goods, which shows that the market is not a complete exodus, but there are funds that are seizing the window to change positions.

And from a larger perspective, Ethereum's staking structure is entering a new stage of "active rebalancing and higher liquidity":

In the past, it was lock-up staking, but now it is a dynamic flow, chasing yields and strategies.

This is not a bad thing, this is what a mature asset should look like.

So I don't think the fundamentals have actually deteriorated, and once the technical backlog is cleared, net staked ETH will resume its growth trend.

If you are really afraid, hurry up and sell the three melons and two dates in your hand, the market will definitely be able to catch it, I am willing to recycle 2888 at a low price!

Show original

27.91K

14

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.