Memeland Weekly Recap 119

Potatoz birthday, MemeStrategy, MEME, and much more!

Catch up on everything that happened last week in Memeland

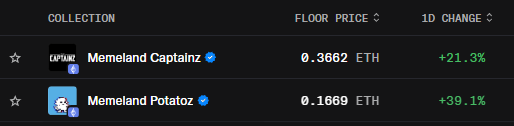

Results are wild

Big news out of MemeStrategy: their highly-watched Rights Issue just wrapped up and the results are wild.

---------

1/ Oversubscribed by 964%

The company offered ~122.6M new shares to existing holders on a 1-for-2 basis.

They received over 1.3 billion share applications.

That’s 1,064% demand for what was on offer oversubscribed by nearly 10x.

Raised Capital: ~HK$153M ($19.6M)

According to prior filings, this capital is earmarked for business expansion.

It’s now up to MemeStrategy to show what exactly that means.

---------

2/ Shareholding Structure Remains Intact

Ray Chan, via Home Office Development Ltd, maintains 64.31% control, unchanged from before.

Public holders now own the remaining 35.69% of shares.

That means:

No dilution of founder control.

But also, no shift in power dynamic or new strategic investors entering through this round.

---------

3/ Share Price Reaction: +5.28%

Post-announcement, MemeStrategy’s stock rose to HKD 3.19, gaining over 5% on the day.

That shows positive short-term sentiment.

Investors seem to be betting on two things:

The capital raise strengthens the balance sheet.

The demand signals institutional or strategic confidence.

---------

4/ So What’s Next?

i/ What’s Working:

- The raise was successful, and demand was overwhelming.

- Market reaction is positive at least for now.

- The upcoming issuance of shares (trading begins Aug 11) may bring renewed attention.

ii/ What Needs Watching:

- Execution risk: The company has not yet disclosed concrete plans for deploying the funds.

- Communication: MemeStrategy and Memeland still haven’t clearly explained how this public-side raise ties back to product-side developments.

---------

5/ Connection to Memeland?

This won’t directly pump NFT floors or MEME token price.

But indirectly:

- It strengthens the corporate side of the ecosystem (MemeStrategy is the HKEX-listed vehicle).

- It gives them more resources to push whatever their next move is whether it's in commerce, entertainment, or finance.

In short, this was a win.

Now the pressure is on the team to turn it into momentum not just money in the bank.

Because if nothing material comes from this raise. People won’t forget how much they just over-subscribed.

Let’s see what they do next 🏴☠️

MemeStrategy updates

Some updates of @MemeStrategy

📄 Auditor Change Announcement

🔺 Resignation of EY

Ernst & Young (EY) has resigned as auditor effective July 22, 2025 due to disagreement over the audit fee for the fiscal year ending December 31, 2025

EY confirmed there are no other issues—just fee negotiations. No audit work had begun for FY2025, so the impact on the upcoming annual audit is expected to be minimal

✅ Appointment of Deloitte

Deloitte Touche Tohmatsu has been appointed auditor from July 22, 2025 until the next AGM

Audit Committee chose Deloitte based on:

Competitive audit fees and proposal

Relevant audit experience and expertise

Independence and integrity

Strong reputation

Adequate resources and personnel

Compliance with regulatory guidelines

Board believes the change enhances cost efficiency without compromising audit quality

🧭 Summary & Implications

The auditor change is procedural, not due to audit risk or financial disputes.

No red flags—both the Board and EY confirmed there are no outstanding issues.

Aims to improve cost structure while ensuring audit integrity and compliance.

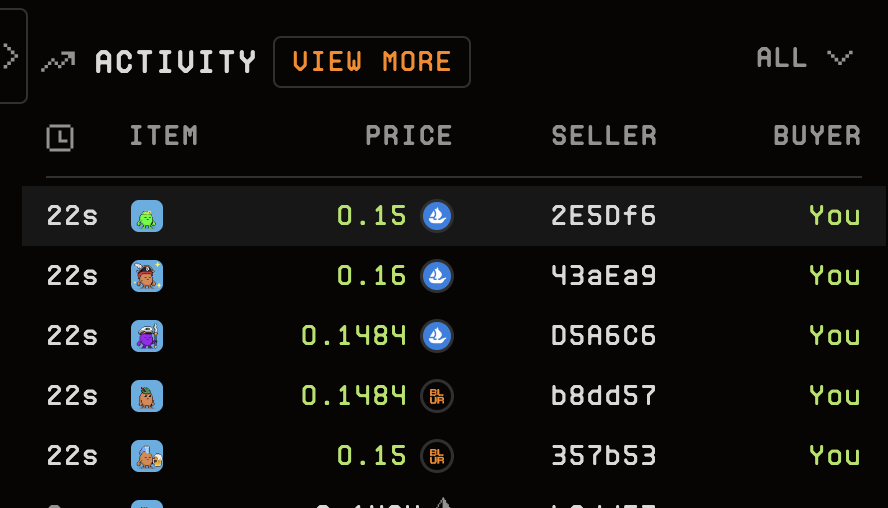

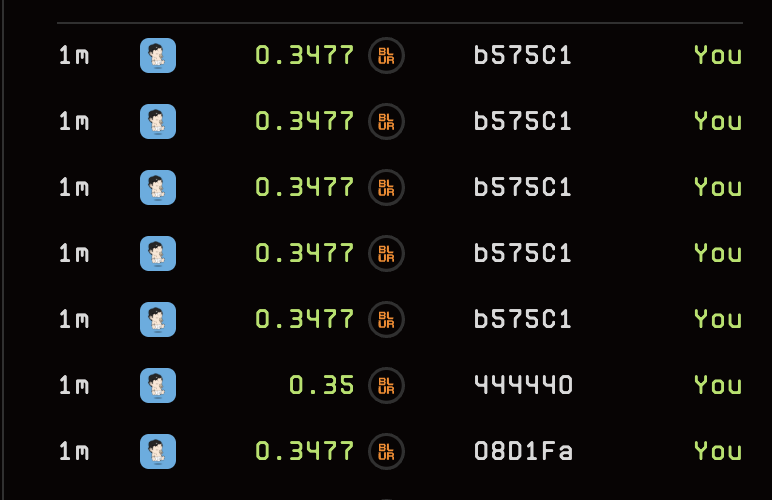

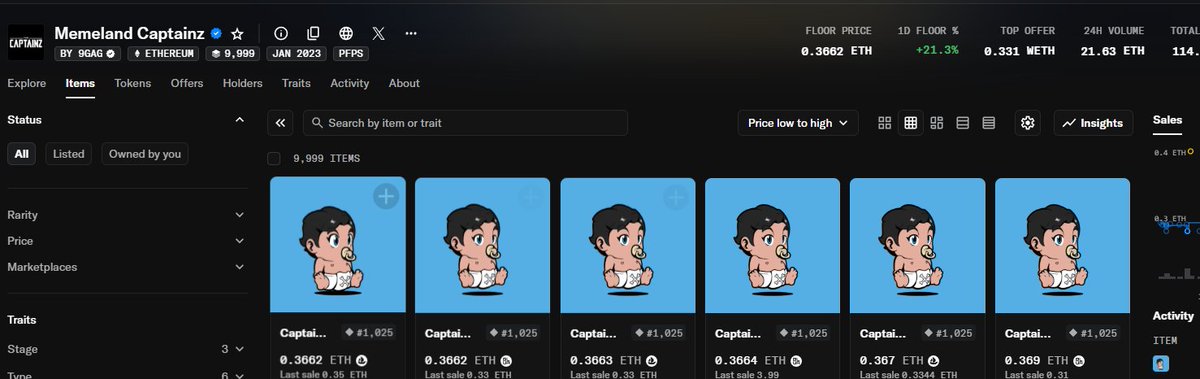

Few more captainz in the collection

Probably one of the most hated projects at the moment. I picked up a few more at 0.3 ETH, so I'm now holding 26 Captainz. My break even is embarrassingly high at around 0.9 ETH. This has easily been my worst conviction play so far.

My thesis is simple. The project is hated by everyone, communication has been nonexistent, and most holders feel betrayed. At the same time, there are still huge whales involved, and the connections are there.

To me it screams bottom signal at 0.3 e, especially with the reveal catalyst in 2 months if there are no delays

The fact that @Memeland still has no art has become a meme in itself, and I think that alone will get them attention.

Captainz are worth 6 Karafurus can't go worse then that

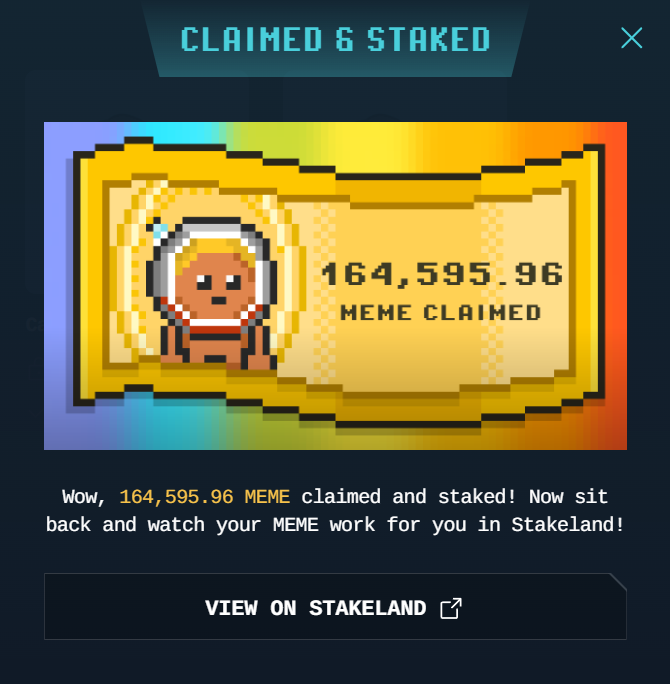

Few more $MEME in the collection

I’m not a Captain, Potato, or MVP.

I just bought $MEME — with conviction.

Happy Birthday @Memeland.

I’m here because the team is capable of pulling this off.

$MEME isn’t a gamble — it’s 3 years and history in the making. A fuse waiting to be lit.

Let’s see what happens when the world finally pays attention.

Stick to the plan

𝗦𝗧𝗜𝗖𝗞 𝗧𝗢 𝗧𝗛𝗘 𝗣𝗟𝗔𝗡 📝🚀

In Web3 things move fast.

Emotions run high.

But if you want to actually make it you need more than vibes.

You need a plan!

And you need to follow it.

𝗛𝗲𝗿𝗲’𝘀 𝘄𝗵𝘆 𝘁𝗵𝗮𝘁 𝗺𝗮𝘁𝘁𝗲𝗿𝘀 🧵👇

1️⃣ 𝗗𝗶𝘀𝗰𝗶𝗽𝗹𝗶𝗻𝗲 𝗯𝗲𝗮𝘁𝘀 𝗲𝗺𝗼𝘁𝗶𝗼𝗻

A Vanguard study showed that investors who stuck to a plan outperformed those who chased hype.

Emotional decisions = underperformance

2️⃣ 𝗧𝗵𝗲 𝗭𝗲𝗶𝗴𝗮𝗿𝗻𝗶𝗸 𝗘𝗳𝗳𝗲𝗰𝘁

Psychology tells us that unfinished plans increase stress and mental load.

A clear strategy brings clarity and focus.

3️⃣ 𝗜𝗺𝗽𝗹𝗲𝗺𝗲𝗻𝘁𝗮𝘁𝗶𝗼𝗻 𝗜𝗻𝘁𝗲𝗻𝘁𝗶𝗼𝗻𝘀

People who decide in advance what to do when are 2–3x more likely to follow through (source: Gollwitzer, NYU).

Know your triggers before you need them.

4️⃣ 𝗪𝗲𝗯𝟯 𝗶𝘀 𝗳𝘂𝗹𝗹 𝗼𝗳 𝗱𝗶𝘀𝘁𝗿𝗮𝗰𝘁𝗶𝗼𝗻𝘀

New coins. New narratives. New memes.

Without a plan, you’ll constantly chase noise and miss the big wins.

5️⃣ 𝗧𝗵𝗲 𝘀𝗺𝗮𝗿𝘁𝗲𝘀𝘁 𝗶𝗻𝘃𝗲𝘀𝘁𝗼𝗿𝘀 𝗮𝗿𝗲𝗻’𝘁 𝘁𝗵𝗲 𝗳𝗮𝘀𝘁𝗲𝘀𝘁

They zoom out, stay calm, and execute based on logic, not hype.

📌 𝗧𝗟𝗗𝗥:

Planning in advance isn’t boring.

It’s your edge.

Stick to it when it’s hardest.

That’s where conviction lives.

That’s where results happen.

#Crypto #Web3 #StickToThePlan #CryptoMindset #DYOR

Invest in founders

Being an investor I invest in founders. What does that mean? Channeling down it means I invest in the platform that founders are building, because I believe in the vision overall. And that has got tricky over years. Why?

There are ways and tools for founders to build out platforms. NFTs, tokens, memes, traditional capital markets, etc. a founder can have setbacks at one of these, for example, NFTs get fucked in FP, but it doesn’t mean the overall platform gets fucked as he focuses on other tools to grow the platform. Obviously ideally he excels at everyone of them to amplify the growth on a high level.

It would mean being an investor, you need to have the right alignment AT THE TOP LEVEL, or at EVERY LEVEL.

1) you either own % of the parent company. Like I invested in @Igloo so whatever built underlying, I get exposure to them.

2) for something like @Memeland, I need to get exposed not just to the token and NFT, but once @MemeStrategy was launched, I bought shares as well.

As investors, you have to think deep, we can’t complain why one tool is down and just another tool is up, when all the founders care is to grow the platform.

Just think deep on how you can get best exposed to what the founders are building, I.e the platform.

Discord VC

Butler Conan and Butler Captainz at your service… 🫡

The castle gates are open and the vibe is strong. Yes, Discord VC is on as usual tonight!

📍 Memeland Discord VC

🗓️ July 24 | 23:00 GMT+8

Is this the cycle top? Or the last boarding call before liftoff? 👀 Is alt season finally making a comeback?

Come hang with the crew and let's talk it out.

Thank you for reading down here!

If you found this post helpful:

- like/retweet the first tweet

- follow me for more guides, recaps, summaries, and highlights

4.43K

64

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.