Just got back to Suzhou and immediately tried out the web version of @Surf_Copilot, generating a deep research report on the backpack @Backpack. Here are some product insights:

1. The product is quite generous with costs in its inference; one question actually crawled 215 sources. If the inference uses o3, the cost is about $2, while if it uses 4.1 mini, the cost is around $0.5. Looking at the current subscription fee, it feels like charity. However, the current cost imbalance isn't a big issue because, in the long run, the inference costs of AI will definitely keep decreasing, and the break-even point should come soon.

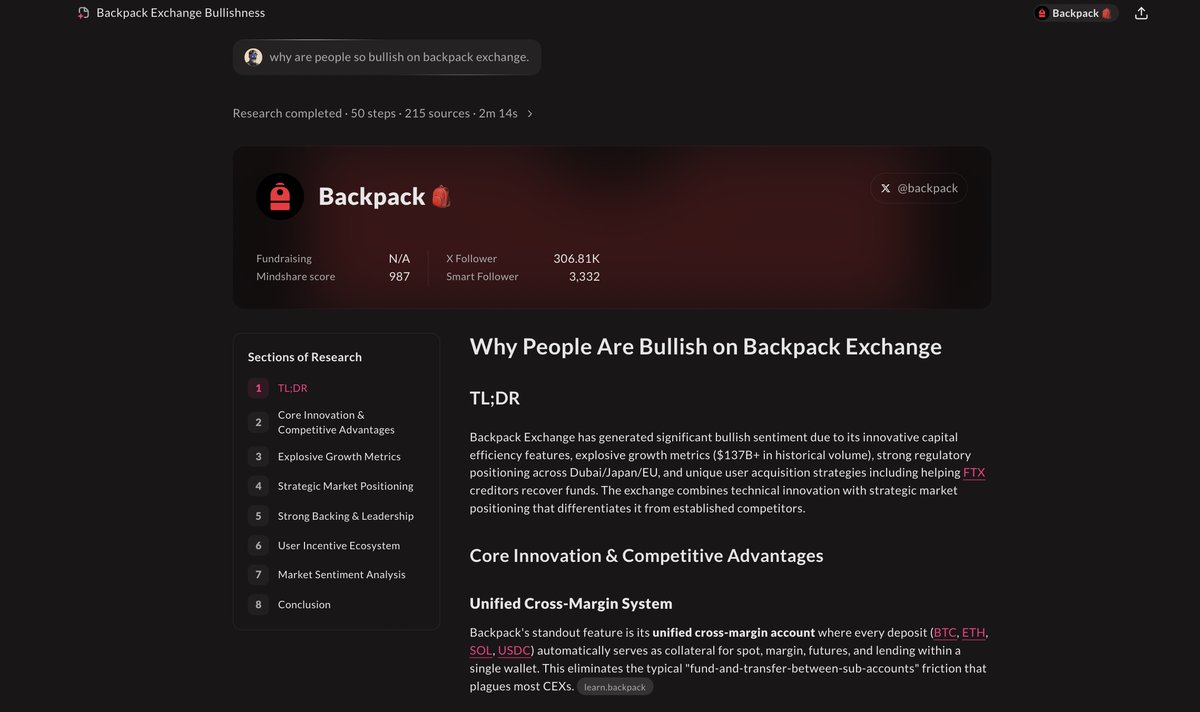

2. The overall UI and interaction design of the product are very impressive. For example, during the wait for report results, the product segments the inference progress and has a marquee flashing, giving users strong positive feedback that "AI is working hard, don't worry."

3. The positioning feature on the left side of the report results page is well designed, enhancing reading efficiency and giving users a greater sense of control over the generated content. The results page can be expanded to view the inference process, and sourcing sources are provided, making it easier for users to fact-check, which helps mitigate the destructive impact of AI hallucinations on conclusions.

4. In the discovery page, the product provides more detailed research reports on currently popular projects. This content looks like it was completed through a collaboration between humans and AI. Personally, I think it is very helpful for saving costs, and there aren't many valuable projects in the crypto space. This content serves as a PGC knowledge base, and as more projects are covered, the user value created will increase, making it a content project with increasing marginal returns. I suggest maintaining a frequent update schedule.

5. For this type of investment research product in the crypto space, it seems to me that the target customer profile is more like friends who want to become KOLs, as it can greatly enhance the efficiency of searching and organizing information.

However, these types of products all share a common problem: the data crawled by each product is quite similar, mostly from news sites and socials, and at most, they look at on-chain data. Ultimately, these are all public domain data; what you have, others have too.

Of course, some products may do prompt engineering a bit better, but this slight advantage will eventually be erased with the evolution of the base models.

In the end, the way everyone seeks differentiation basically relies on improving product visuals and interactions, which isn't very significant.

6. Reflecting on this statement from Brother Pi: in niche agents, the one who ultimately wins is the one with unique private data, and whoever has a powerful external database for RAG can master the pricing power on the C-end.

Here’s the link to the report results; you can feel for yourself that the overall completion of the product is still very high:

Show original

3.41K

32

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.