99% of tokens rug. Think about that. Almost every token dies, yet platforms made billions. The game is weird. We all know that. Don't hate the player, hate the game.

I've been thinking about this wrong. Everyone tries to prevent rugs with better launches, vesting, audits, dIsTriBUtIoN (kek). All cope. The answer is making rugs impossible. Mathematically impossible.

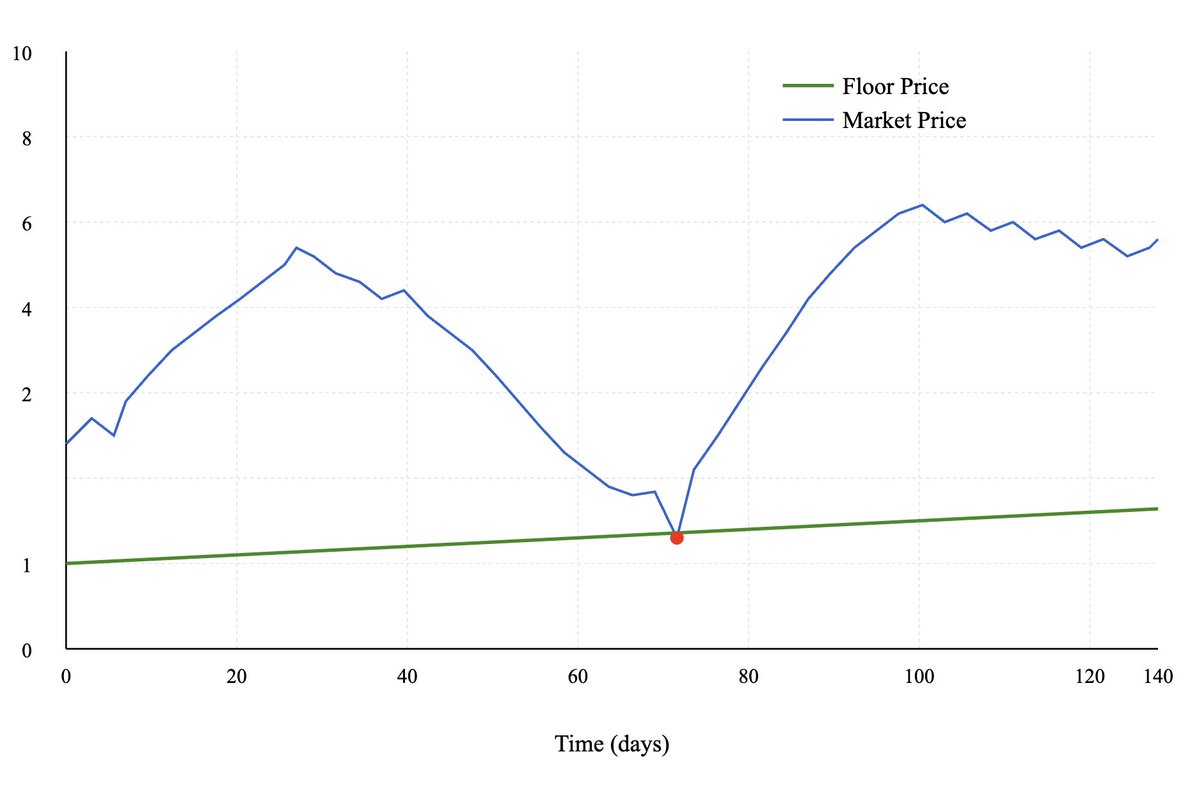

Think LP fees + JitoSOL yields + MEV. If that backs your floor, the floor only goes up. Not a treasury. Not a multisig. Just math.

So, how about this: you never sell (Murad mode). You borrow against your position. Zero interest. No liquidations. Price crashes? Doesn't matter. Your loan is still good.

Ok but how? When you borrow against your position, you're not borrowing against volatile token price—you're borrowing against the guaranteed floor. Since floors only go up (LP fees + JitoSOL yield + fees), your collateral value never drops below your loan. No liquidations possible. Traditional lending needs interest because they take price risk. I don't. One-time origination fee covers protocol costs. After that, borrow forever. Your position keeps earning yield while borrowed against. It's not a loan really—it's unlocking liquidity from future floor appreciation.

Latest design uses volatility-based dynamic fees—market action becomes permanent liquidity. Protocol-owned floors enable safe liquidity sharing between pools, creating network effects as the capital base grows.

Why Solana? Because I need ms blocks to rebalance pools in real-time. I need low fees so the protocol can eat bad trades. I need parallel execution for the lending logic. Ethereum and L2s still too slow. Also Solana is where all the action is. This is a Solana Cycle (real).

Most DEXs optimize for volume. Questionable metric. Volume could also mean churn. Churn means someone's exit liquidity. This will optimize for positions that never need to exit. Trust me I've round-tripped 8 figures because I couldn't sell, I need this more than anyone.

Everything still in design phase, honing the mechanics. Development starts soon. The UI accepts any token and converts to JitoSOL automatically. One click. Most won't even know what's happening under the hood. They'll just see their floor going up.

Yes, obviously not reinventing the wheel here and well aware of Baseline. Most design is borrowed from them, but on Solana.

DMs open.

Feedback, opinions and shitposts are welcome.

ILY.

Selling is a problem → thin liquidity.

Sell shaming too → markets need exits.

Many don't know this but I've been in crypto for over 10 years. Designed protocols, built distributed systems, operated infrastructure at scale. Proper building, not just shitposting.

Working on something new. A DEX with built-in lending market. Guaranteed price floors, interest-free loans against positions, leverage without liquidation. Will be on Solana.

Tokens you never need to sell—just borrow against them when you need cash. There are tradeoffs of course, still designing everything.

Think: The unruggable DEX. Up only tech.

Trying to ship this year. Will take a few months minimum. Writing this for accountability to push myself.

Yours truly.

Was channeling some McAfee energy there ("bubbles are mathematically impossible in this new paradigm" lol).

IL: The floor liquidity is single-sided (only buys, never sells at floor), so no IL at that level. It's more reserve vault than traditional AMM at the floor range you're right.

JitoSOL risk: Fair point on validator risk. Though with 93% of Solana validators running Jito, it's about as close to protocol-level as we get without being native staking.

Fixed supply: Absolutely must be enforced on-chain with no governance. That's table stakes.

External shocks: True, yields can compress in bear markets.

Nothing risk free obviously but we're dramatically shifting the risk profile in holders' favor.

Regarding token qualification: Still designing the criteria. Might be permissionless not sure. Open to thoughts on what you'd want to see!

4.98K

59

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.