CDP: The Classical Aesthetics of Stablecoins

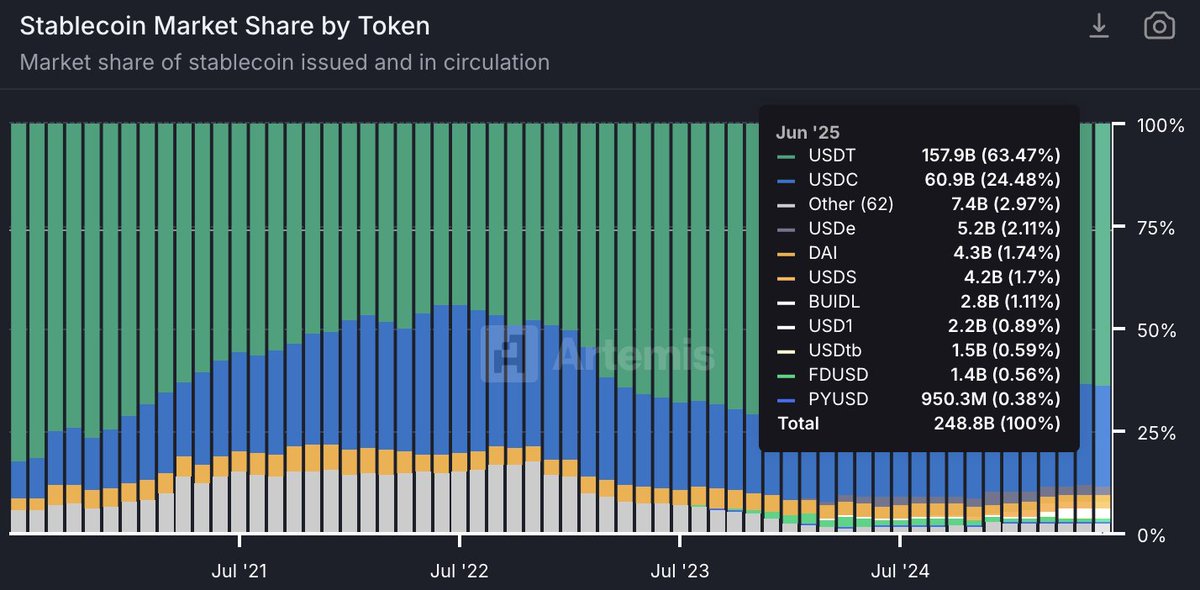

As of 2025, stablecoins remain the most promising opportunity in crypto. Their massive scale has turned them into a strategic battleground — even among nations. According to data from Artemis, out of the $250 billion total stablecoin supply, $USDT and $USDC together still command a staggering 88% market share, while hundreds of new stablecoins have yet to make a meaningful dent in their dominance.

Among the remaining contenders in the decentralized stablecoin space, two prominent names— $DAI and $USDS — stand alongside the rising star $USDe, collectively representing over $8.5 billion in circulation. Both $DAI and $USDS originate from the same protocol: MakerDAO (now rebranded as Sky).

Despite increasing competition from both legacy and emerging players, MakerDAO has managed to maintain its dominance—largely thanks to a structural mechanism it pioneered early on: CDP (Collateralized Debt Position). In the previous bull market, stablecoins built on CDP architecture accounted for nearly 20% of the total market, a remarkable figure given the high concentration of stablecoin dominance at the time.

Today, this seemingly old-school mechanism continues to be adopted by multiple stablecoin protocols, spawning various derivatives and adaptations.

Why does it still work? What problem does it solve so elegantly that others still rely on it?

This article unpacks the foundational logic of CDP — both from a design perspective and through the lens of real user behavior.

What Is a CDP?

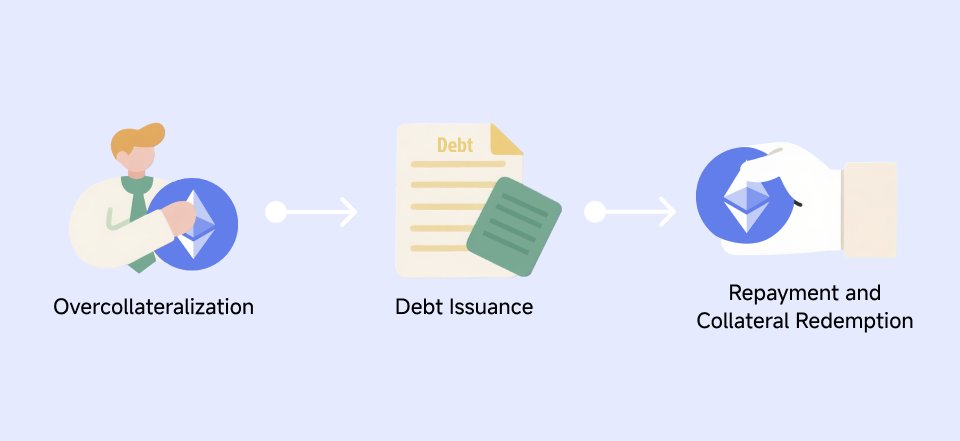

CDP stands for Collateralized Debt Position, a mechanism that allows users to mint stablecoins by locking up their existing assets as collateral. Fundamentally, it’s a structure that enables users to issue stablecoin debt against their crypto assets. The process involves several key steps:

Overcollateralization: Users deposit crypto assets—such as $ETH, $WBTC, or $USDC — into a CDP protocol. Taking MakerDAO as an example, the collateral ratio must stay above 150% to keep the position safe and avoid liquidation. This overcollateralization serves as a buffer against market volatility, ensuring the system remains solvent even when collateral prices drop sharply.

Debt Issuance: Once the collateral is locked, the protocol allows users to borrow—typically in the form of decentralized stablecoins (e.g., $DAI from MakerDAO, now branded as $USDS). This process effectively mints new stablecoins and brings them into circulation.

Repayment and Collateral Redemption: To unlock the collateral, the user must repay the borrowed stablecoins along with a stability fee. This fee represents the cost of maintaining the peg and is displayed as an annualized percentage yield (APY) on the debt position. Once repaid, the borrowed stablecoins are burned, and the collateral is unlocked and claimable.

Why Use a CDP Protocol?

The core appeal of CDPs lies in their ability to transform the price appreciation potential of an asset into immediately usable on-chain liquidity—without requiring the user to sell or unwind their position. For DeFi users, this unlocks greater strategic flexibility while maintaining long exposure. The most common use cases include:

Leveraged Positions: This is one of the primary use cases for CDPs. Users deposit a volatile asset as collateral and borrow stablecoins against it. They then use those stablecoins to purchase more of the same volatile asset, effectively creating a leveraged long position. For example, you could lock $ETH into a CDP, borrow $DAI, and use it to buy more $ETH—amplifying your exposure to $ETH price movements.

Yield Strategies: Stablecoin issuance is the core component of CDP systems. At the same time, the most competitive stablecoin protocols today are locked in a race of relentless innovation—and in this environment, any stablecoin without embedded yield will struggle to gain adoption or build serious traction.

At the same time, CDPs are capital-inefficient—users must overcollateralize heavily and not all users are willing to take on directional risk merely to improve capital efficiency. That’s why protocols often try to “make their stablecoins work harder” by integrating them into broader DeFi yield ecosystems.

Take MakerDAO, the original CDP pioneer, for example. As part of its recent brand transition to Sky (@SkyEcosystem), it introduced a redesigned stablecoin: $USDS, which replaces $DAI as the core debt asset. Around $USDS, a number of yield-focused strategies are emerging, such as:

· Simple Saving

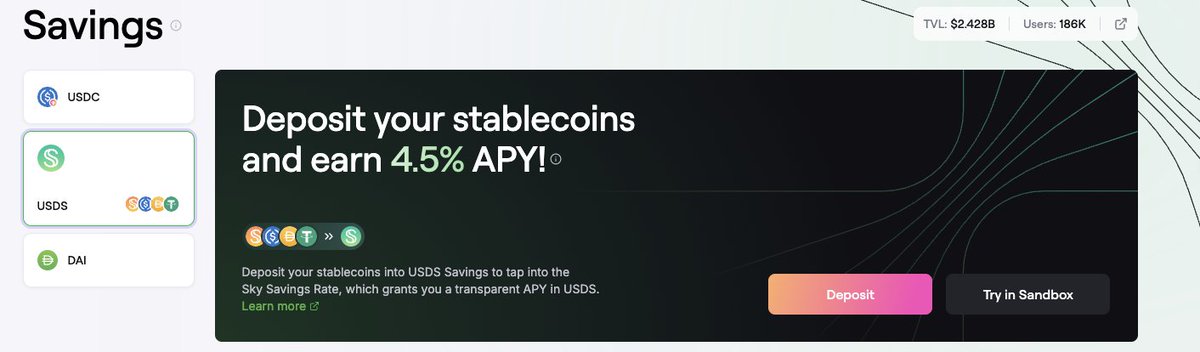

Although CDP protocols form the foundation of stablecoin issuance, participating in their yield opportunities doesn’t necessarily require opening a collateralized debt position. To expand liquidity and accessibility, many protocols offer alternative, more user-friendly ways to gain exposure.

In the case of MakerDAO, users can earn yield directly through the “Savings” module on sub-DAO lending protocol, Spark (@sparkdotfi). This yield is sourced from stability fees generated by CDP borrowing, returns from U.S. Treasury bills, and interest payments within Spark itself. According to official documentation, the current APY stands at 4.5%, and it remains fixed regardless of utilization on the lending side.

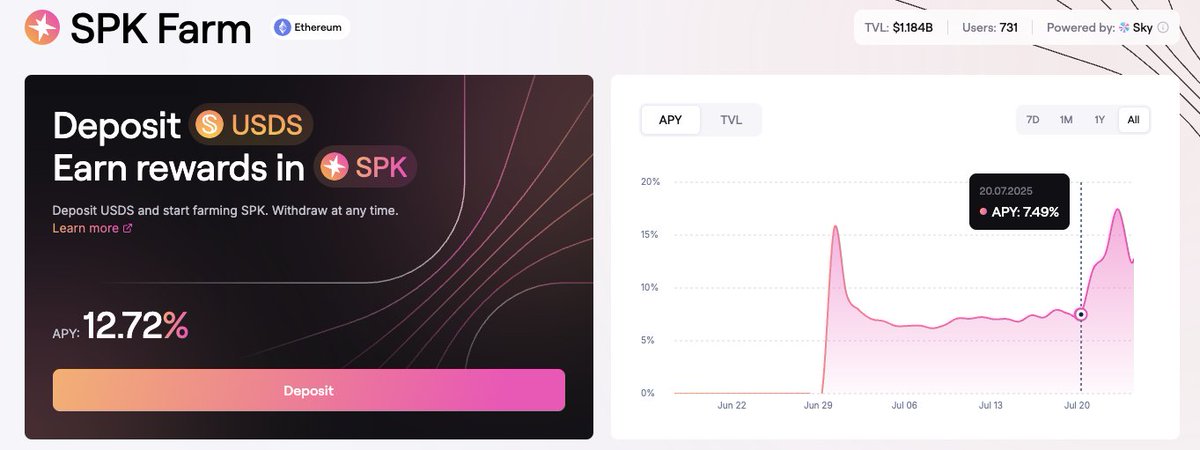

· Token Farming

Incentivized farming has long been a staple of stablecoin bootstrapping. In most cases, the process follows a familiar pattern: acquire the stablecoin → stake it → earn governance or reward tokens.

Naturally, the performance of farming is highly dependent on the price performance of the farm token itself. Volatility tends to be significant. For example, in Spark’s recent farming program, the APY fluctuated dramatically from 7% → 17% → 12% within just a week. Temporary spikes in yield don’t necessarily reflect sustainable returns. Always confirm whether positions can be exited freely, and scrutinize the fine print before committing capital.

· Improper Usage Risks

Many CDP-based stablecoins are fully decentralized. Compared to centrally issued stablecoins like $USDT and $USDC, $DAI has always held a distinct position in the crypto landscape. However, this regulatory resistance also makes it particularly attractive to malicious actors.

As a result, $DAI often appears following major exploits or protocol hacks—serving as the stablecoin of choice for attackers looking to quickly move or launder stolen funds.

The Difference between CDP and Lending Protocol?

Many users tend to confuse CDPs with lending protocols like Aave or Compound when they first encounter them. After all, both allow you to collateralize assets in exchange for liquidity, and both can generate returns through interest rate.

However, a CDP isn’t about “borrowing” — it’s about “minting debt against yourself.” In contrast, lending protocols let you borrow funds provided by others. This fundamental difference shapes the economic behavior behind each model.

For loan sources, when you borrow from Aave or Compound, you’re drawing from a liquidity pool funded by other users — the assets come from other lenders. The protocol charges interest from these pools and redistributes it to the lenders. In contrast, the stablecoins borrowed through a CDP protocol aren’t pre-deposited by others. Instead, they are freshly minted by the smart contract when you collateralize assets like $ETH. In other words, you’re creating new debt, not consuming someone else’s deposits.

For interest rate mechanisms, lending protocols rely on supply-demand dynamics and interest rate curves, which can lead to sharp short-term fluctuations. CDPs, however, have interest rates determined by protocol governance, making them relatively stable over time. This means your cost of capital is more predictable when using a CDP.

For risk bearing, if a borrower on Aave fails to repay, their collateral is seized to offset the loss — but any shortfall is ultimately absorbed by the protocol and its suppliers. In a CDP system, however, the risk is fully borne by the individual who minted the stablecoins. If the collateral ratio falls below the liquidation threshold, the smart contract will automatically liquidate the position.

Even CDPs Can Collapse Under Extreme Market Conditions

As one of the foundational structures of DeFi lending systems, CDPs appear robust on the surface — but in complex market environments, they harbor significant hidden risks. The most common threat users face is liquidation risk triggered by a sudden drop in collateral ratio, leaving them no time to top up. Other dangers include oracle delays leading to “false liquidations,” yield mismatches causing failed arbitrage strategies, or network congestion rendering all actions ineffective. In extreme scenarios, these risks often erupt simultaneously.

The most iconic disaster occurred on Black Thursday in 2020, when MakerDAO experienced a systemic liquidation failure.

That day, $ETH’s price plunged 43%, triggering widespread panic. A flood of transactions caused gas fees to skyrocket and the network to become severely congested. Worse still, MakerDAO’s oracle updates lagged behind. When the new price finally fed through, a large number of vaults instantly fell below their liquidation thresholds. Liquidation bots — known as Keepers — were supposed to step in, but they became paralyzed due to soaring gas costs. Their scripts lacked the flexibility to adapt to such extreme conditions.

This created a critical vulnerability in the system. Malicious actors exploited the situation, seizing $8.32 million worth of $ETH for zero cost, effectively looting MakerDAO’s vaults. The protocol was left with $5.67 million in bad debt.

This incident not only exposed the fragility of CDP systems under extreme stress but also served as a wake-up call for the entire industry. It highlighted the importance of robust risk management, resilient oracle infrastructure, and fault-tolerant liquidation mechanisms — providing hard-earned lessons that continue to shape the evolution of DeFi today.

End

CDPs were one of the earliest lending primitives in DeFi and still serve as the foundational blueprint for many newer protocols. While they may no longer be the brightest star in the stablecoin space, for DeFi newcomers, they remain a valuable sandbox for understanding risk, efficiency, and trust.

Disclaimer: This content is for educational purposes only and does not constitute financial advice. DeFi protocols carry significant market and technical risks. Token prices and yields are highly volatile, and participating in DeFi may result in the loss of all invested capital. Always do your own research, understand the legal requirements in your jurisdiction, and evaluate risks carefully before getting involved.

Author: OneKey Team ( @jonasCyang )

26.68K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.