A new class of public companies is emerging.

These firms are building Ethereum treasuries to earn yield, support the protocol, and reshape how corporate capital interacts with decentralized networks.

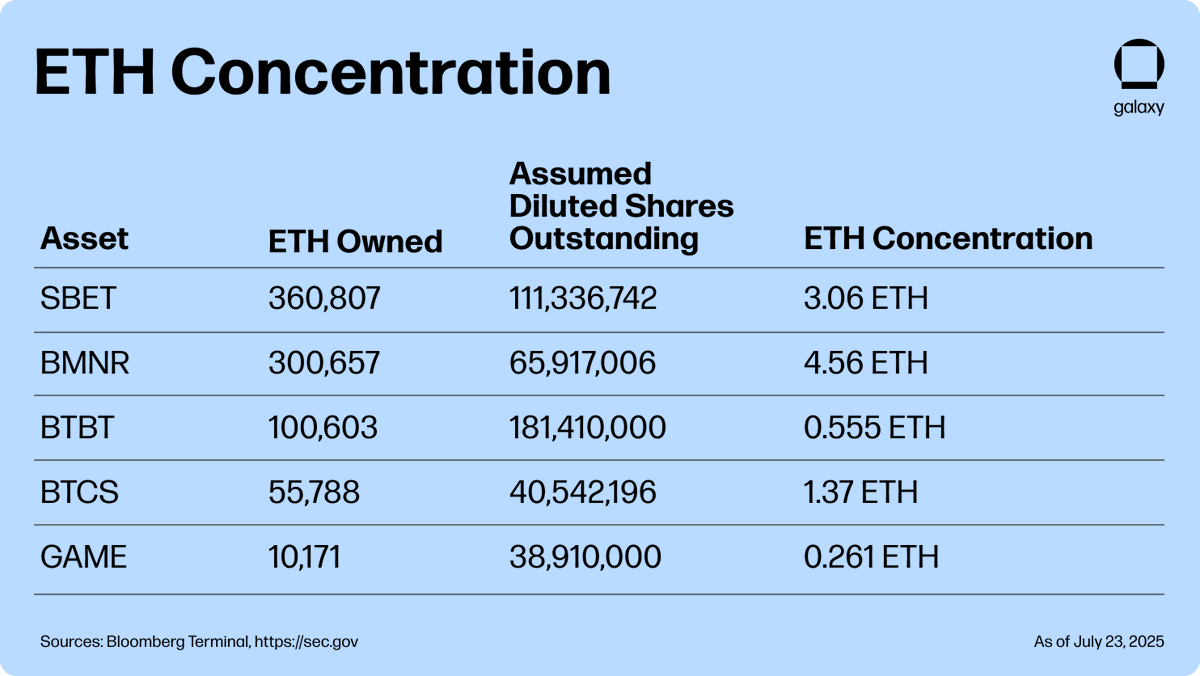

📊 ETH concentration across leading firms:

@glxyresearch's new report, Beyond Bitcoin: Ethereum as a Corporate Treasury Asset, explores this in depth.

@mustbetherosas profiles four public companies - @SharpLinkGaming @BitMNR @BitDigital_BTBT @GSQHoldings – that have collectively raised hundreds of millions to acquire and stake $ETH.

Unlike bitcoin treasuries, which tend to be passive, ETH treasuries are capital productive.

These firms are staking ETH or deploying it into DeFi to earn yield while contributing to Ethereum’s validator set and protocol stability.

Each company featured in the report built its ETH treasury through equity issuance.

This means they carry no debt maturity overhang, no coupon obligations, and no default risk if crypto markets turn against them.

The absence of leverage materially reduces systemic fragility and avoids the refinancing and dilution risk tied to deeply in-the-money convertibles.

Inside the report:

✔️ETH per share (ETH concentration)

✔️Market premium to ETH book value

✔️Staking and DeFi deployment strategies

✔️Dilution risk and capital structure

Read the report:

22.35K

198

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.