The Real Stablecoin Capital Engine of Hyperliquid Isn’t USDC

Most people see $USDC as king. But on @HyperliquidX, things work bit differently.

Stablecoins play a huge role in the Hyperliquid ecosystem. With over $5B, that’s nearly one-third of the total $14.4B $HYPE mcap.

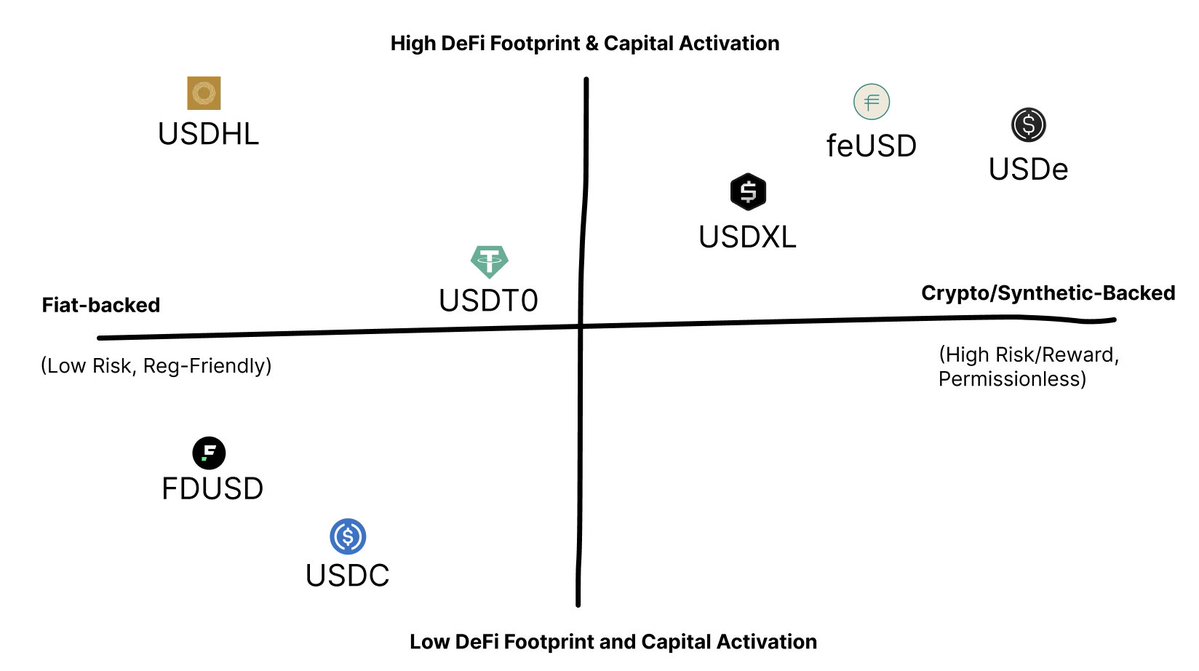

This quadrant maps out the which assets backing these players (fiat vs synthetic/crypto) and how deeply integrated and capital-active they are across Hyperliquid’s DeFi stack.

@HyperliquidX is rewriting #Stablecoin dynamics.

Let’s break it down 👇

1/ First thing first, we need to decode the axes:

Horizontal:

Left = Fiat-backed (low risk, reg-friendly like US treasuries).

Right = Crypto/Synthetic-backed (high risk/reward, permissionless).

Vertical:

Bottom = Low DeFi footprint (basic holding/trading). Top = High activation (lending, yields, ecosystem loops).

2/ Top-right quadrant = Alpha zone 🔥

These 3 are the true capital engines of HyperEVM.

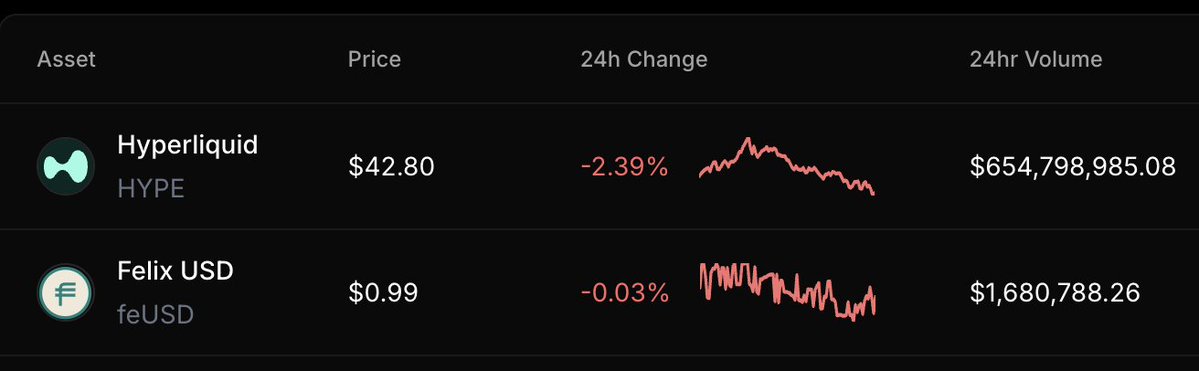

$feUSD from @felixprotocol uses an over-collateralized CDP model, minted from $HYPE, $1.6B+ 24hr volume!

$USDe by @ethena_labs Bridged, borrowed and yield-farmed. The supply on Hyperliquid is a fraction of total $6B+

$USDXL: Overcollateralized synthetic from @HypurrFi. Earns interest while being collateral.

3/ Top-left = Building blocks 📦

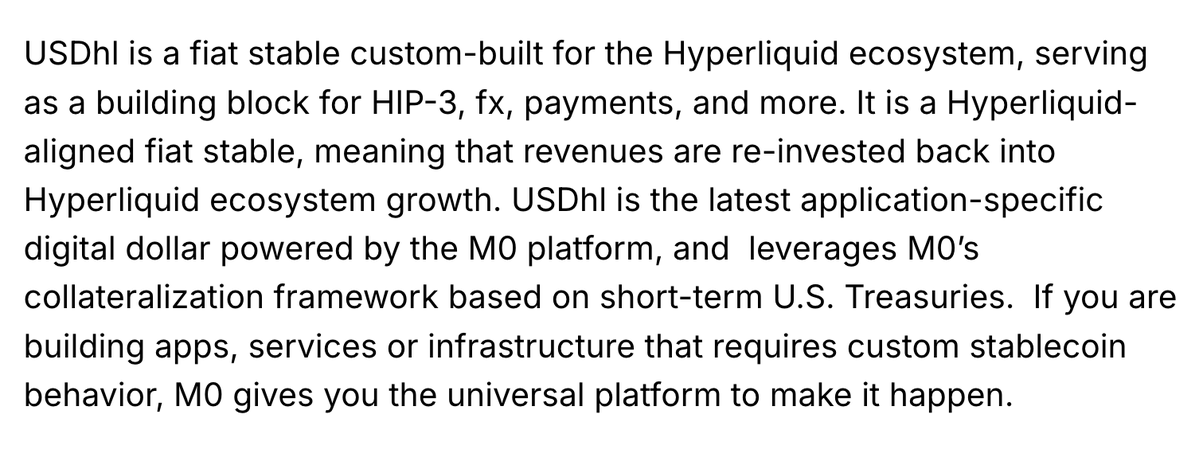

Hyper USD $USDHL is custom-built for Hyperliquid by @m0foundation @felixprotocol. It is fiat-backed by short-term US treasuries + revenue buys back $HYPE. Deep liquidity, low risk and pretty high activation.

Read $USDHL:

Closer to the center is $USDT0 which is variant of $USDT by @Tether_to bridged 1:1 from Ethereum via @LayerZero_Core. Liquid, but not revolutionary. Volume king, capped by regs.

4/ Bottom-left = The "Safe but Sleepy" zone

Low risk, but minimal DeFi energy. These are your classic fiat-backed stables.

$USDC by @circle hit $4.9B supply on Hyperliquid in under a year using as margin.

$FDUSD from @FirstDigitalHQ were regulated, then bridged but rarely used in #DeFi.

Fiat-backed ≠ productive.

Whitepaper from $FDUSD

5/ TL;DR💥

Unlock Hyperliquid's stablecoin quadrant to 2x your yields in 2025. Imo Stablecoin UX is basic; alpha lives in capital activation.

Stablecoin UX ≠ Stablecoin Alpha.

3.33K

16

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.