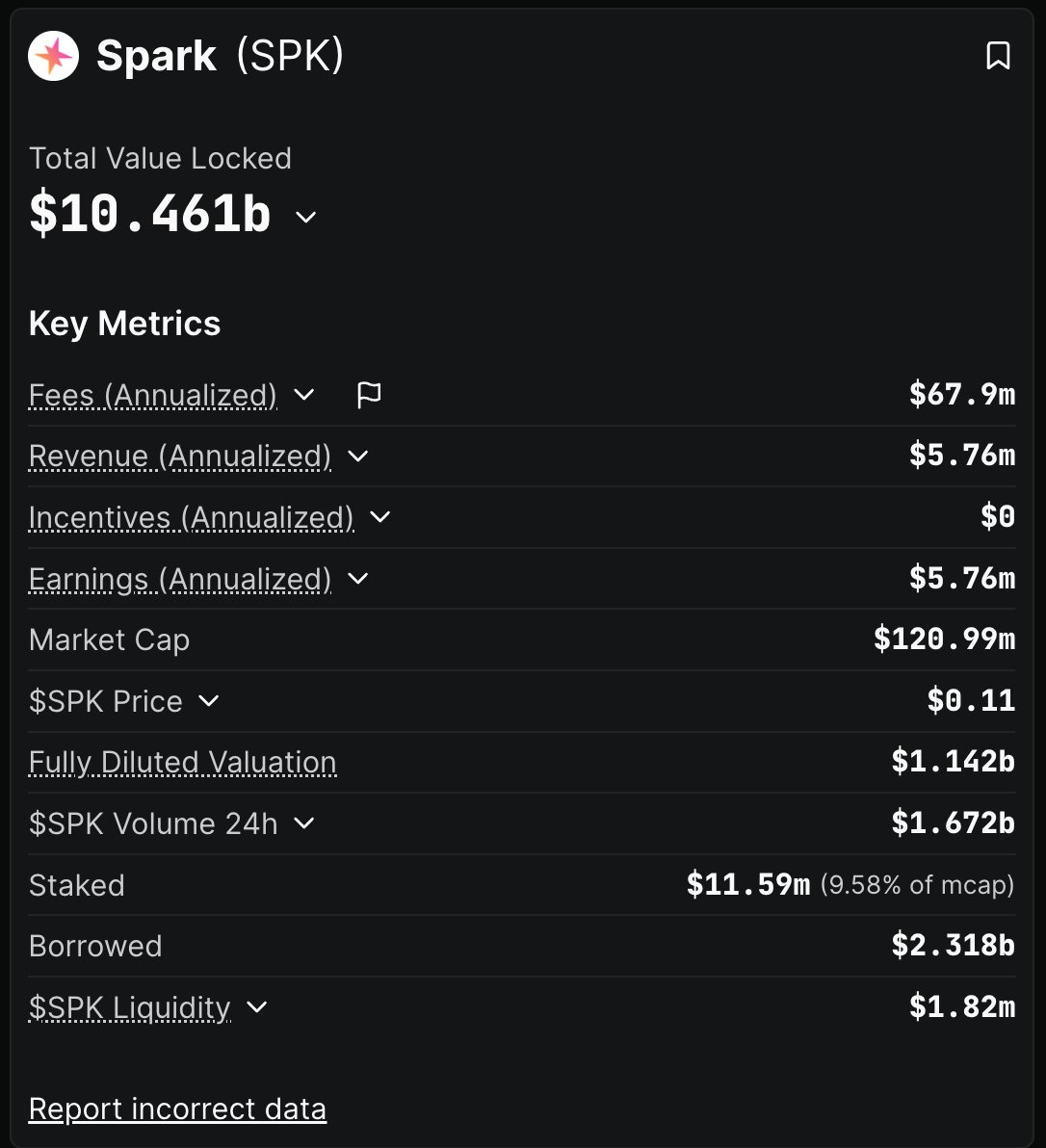

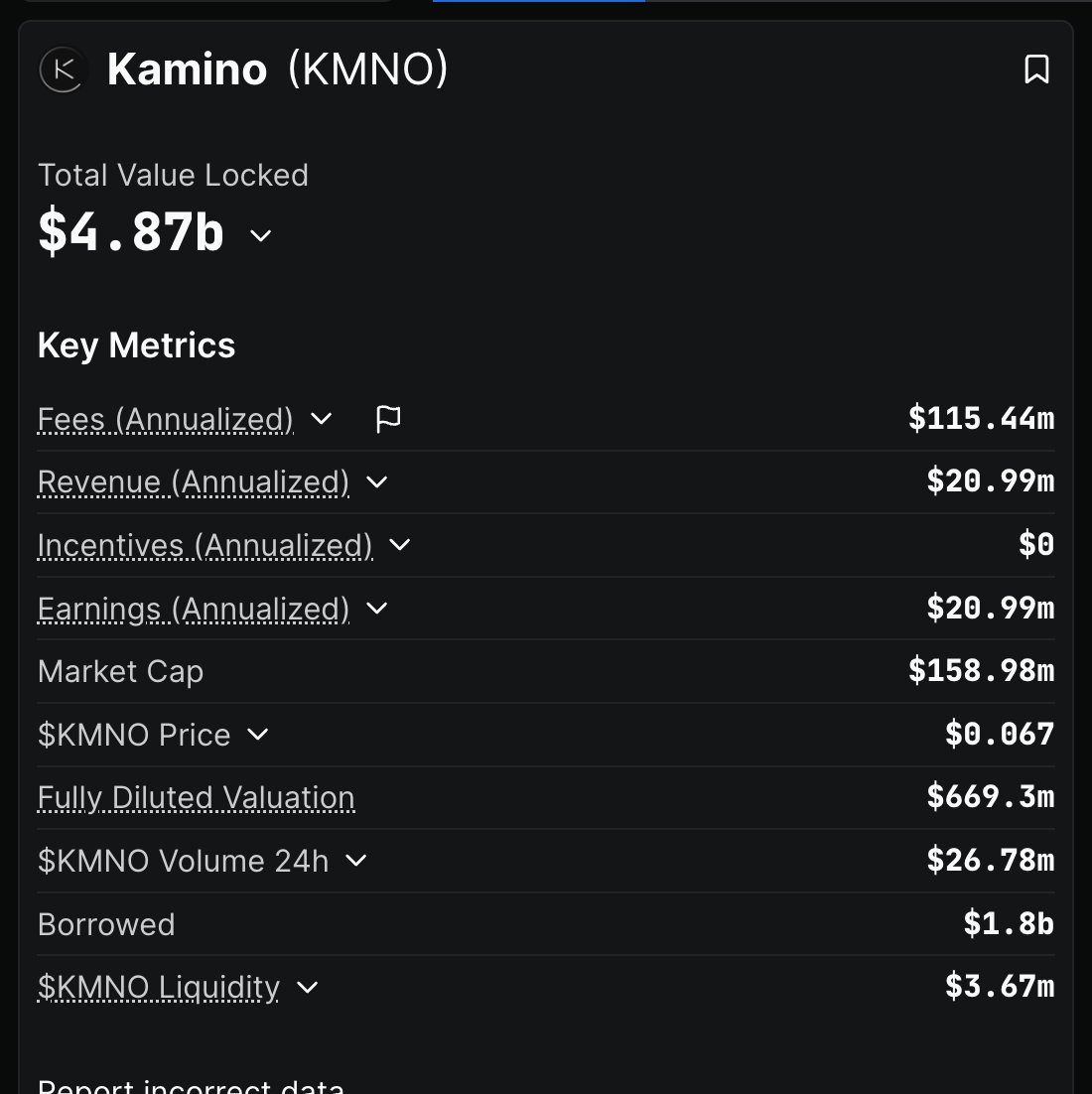

Looking at the commonalities and potential opportunities between $SPK and $KMNO:

* Both are among the top projects in DeFi TVL rankings, each with tens of billions of dollars in TVL.

* The token empowerment is relatively weak, with no buybacks, no burns, and no staking dividends.

* Both projects have real earnings, and even $KMNO has better earnings data.

* Both are lending-based protocols.

* $SPK's parent is $MKR, the leader in Ethereum lending, while $KMNO is a top lender on Solana.

* Both are listed on Binance & OKX spot markets.

* Both have a market cap of just over 100 million.

The biggest difference is that — $KMNO went from 30M to 300M last year and then dropped back to 70M, accumulating some trapped positions; $SPK has been hovering around 30M-40M with no trapped positions, but given the current situation, it's still not easy to pull this off.

Show original

19.98K

4

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.