Fortunately, yesterday's timely reminder.

This SOL micro-strategy fell 77% in the second half of the night

After reading it, after the official announcement of the $200 million credit agreement

The company also plans to issue an additional $43.7 million in shares and call warrants at $3.5 per share, and although the transaction has not yet been completed, as soon as the news came out, everyone collectively panicked and ran away.

If you don't pretend, you have to issue additional shares to sell to your family.

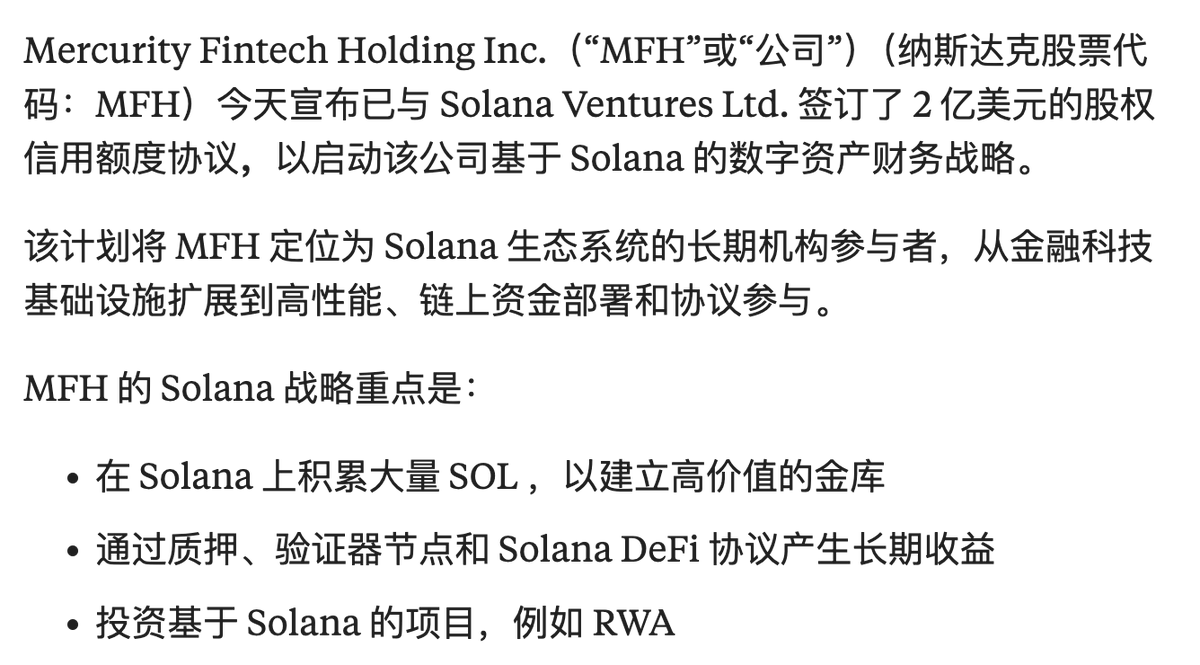

Mercurity, which previously transformed into a SOL microstrategy, officially announced that it has signed a $200 million equity credit agreement with Solana Ventures.

Companies can get funds to allocate SOL; Ventures can get new shares at a discounted market price.

However, Solana Ventures itself is SOL's official fund, and it invests in its own company to buy its own coins.

This set of dolls has begun to set themselves.

60.13K

93

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.