Use $LBTC as collateral to get a perp loan on teller 👀

No margin calls.

How Lombard Plans to Increase Yield for LBTC

Lombard was originally launched as a LST built on Babylon, a Bitcoin staking and restaking protocol. Babylon’s core idea is that projects using BSN technology pay a portion of their fees—as gas and native tokens—to BTC stakers.

It’s a strong concept that could fundamentally change how idle BTC is perceived, transforming it into a productive yield-generating asset. However, implementing this model is technically and economically challenging:

- Technical complexity: Integrating with the Bitcoin network is difficult and slow.

- Economic maturity: A substantial amount of BSN activity is needed to generate stable, meaningful yield.

Currently, @babylonlabs_io offers a yield of only 0.43%, entirely driven by inflation of the $BABY. I expect meaningful change around late 2026 to mid-2027, when more BSN-powered services are live on mainnet.

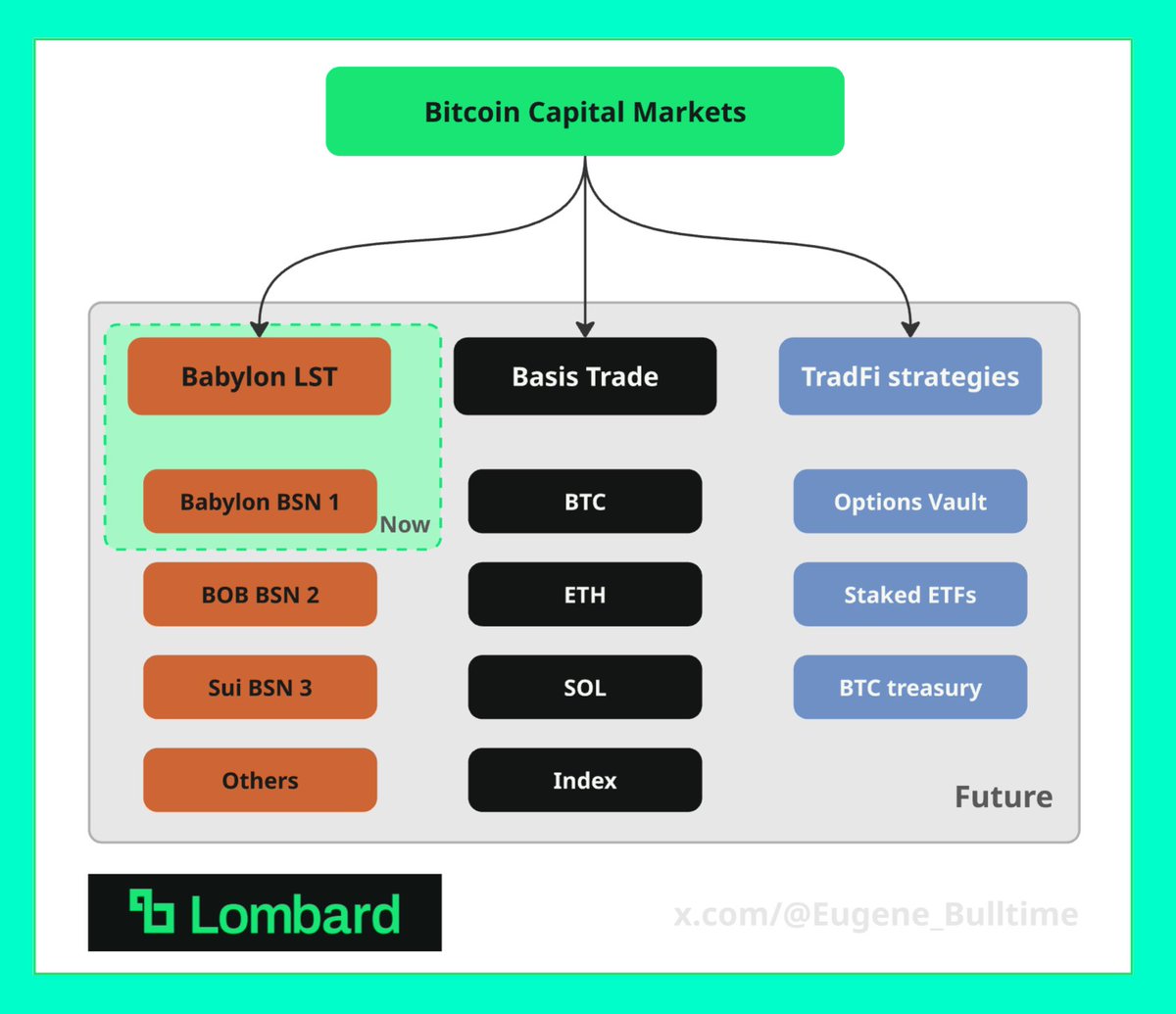

Until then, LST protocols offer a weak value proposition. In short, Lombard has hit the ceiling of what’s possible with Babylon alone — so the team is pivoting toward the Bitcoin Capital Markets (BCM).

Enter: Bitcoin Capital Markets (BCM)

Lombard now aims to generate yield for BTC holders from alternative sources, beyond Babylon. Here are several strategies the team could be create:

Basis Trade Vaults

1. Web3 (spot + futures)

A classic delta-neutral strategy using a long BTC spot + short BTC futures position, with yield generated from funding rate.

Since Lombard accepts BTC, but this strategy typically requires stablecoin collateral, they would need to borrow stablecoins against BTC. Or use COIN(M) Perp on Binance.

Yield potential: 6%–10%

2. Web3 Advanced (futures curve)

A classic TradFi strategy of deliverable futures using long near-dated futures + short long-dated futures, profiting as prices converge over time.

Yield potential: 4%–8%

3. Web3 Collateral (non-BTC pairs)

Same delta-neutral structure like as #1, but deployed on other assets like ETH or SOL, again using borrowed stables backed by BTC.

Yield potential: 10%+

4. Web3 Index

A diversified version of strategy #3 across multiple assets with high funding rates, with automated rebalancing for optimal yield.

Yield potential: 15%+

Basis trading is one of the most reliable yield strategies, but it demands automation, active monitoring, and solid risk management. With leverage, yields can be even higher.

The best part? All these strategies can be fully deployed in DeFi (e.g., via @aave + @HyperliquidX ), although some off-chain infrastructure may be required for position management.

TradeFi Strategies: The Next Frontier

While basis trading already expands BTC's yield potential, the next step is tapping into TradFi strategies, such as:

1. Options – a popular instrument in traditional finance, rarely available in DeFi

2. Staked ETFs – BTC held in ETFs could potentially be staked in BTC-staking protocols (not only Babylon)

3. Corporate BTC Treasury – corporate holdings of BTC could be used in yield-generating strategies (details still emerging)

These strategies won’t be built by Lombard alone. Instead, @Lombard_Finance will partner with TradFi institutions, providing infrastructure and tokenization of real-world yield for BTC holders.

Why This Matters

Web2 strategies operate in a market that’s 1000x larger than Web3. That means:

- The yield accessible from Web2 is significantly higher and could massively impact BTC holders yield.

- Lombard acts as the bridge, tokenizing this offchain yield and making it accessible through onchain infrastructure.

TL;DR

1. Lombard is evolving beyond Babylon

2. It’s opening access to a yield market exponentially larger than Web3

3. Lombard becomes the connection point between TradFi and DeFi for BTC yield

======================================

If you liked the research, plz like/retweet and follow to @Eugene_Bulltime

And follow to strong visioners and analysts:

@0xBreadguy

@poopmandefi

@TheDeFISaint

@DoggfatherCrew

@0xSalazar

@DefiIgnas

@Defi_Warhol

@Moomsxxx

@hmalviya9

@Mars_DeFi

@rektdiomedes

@eli5_defi

@JayLovesPotato

@Steve_4P

@TheDeFinvestor

@0xCheeezzyyyy

@0xKaveh

@arndxt_xo

@Picolas_Caged

@dudu_bitcoin

@marvellousdefi_

3.05K

2

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.