The Best Low-Risk Yield For ETH On @katana 🌾

I'm a busy person, so I don't want to actively manage my farming positions. Set & forget is the goal + harvesting once a month. Thus, I'll be looking for low-risk farms for my ETH.

🍣 On @SushiSwap, weETH/vbETH LP gets 22% APR

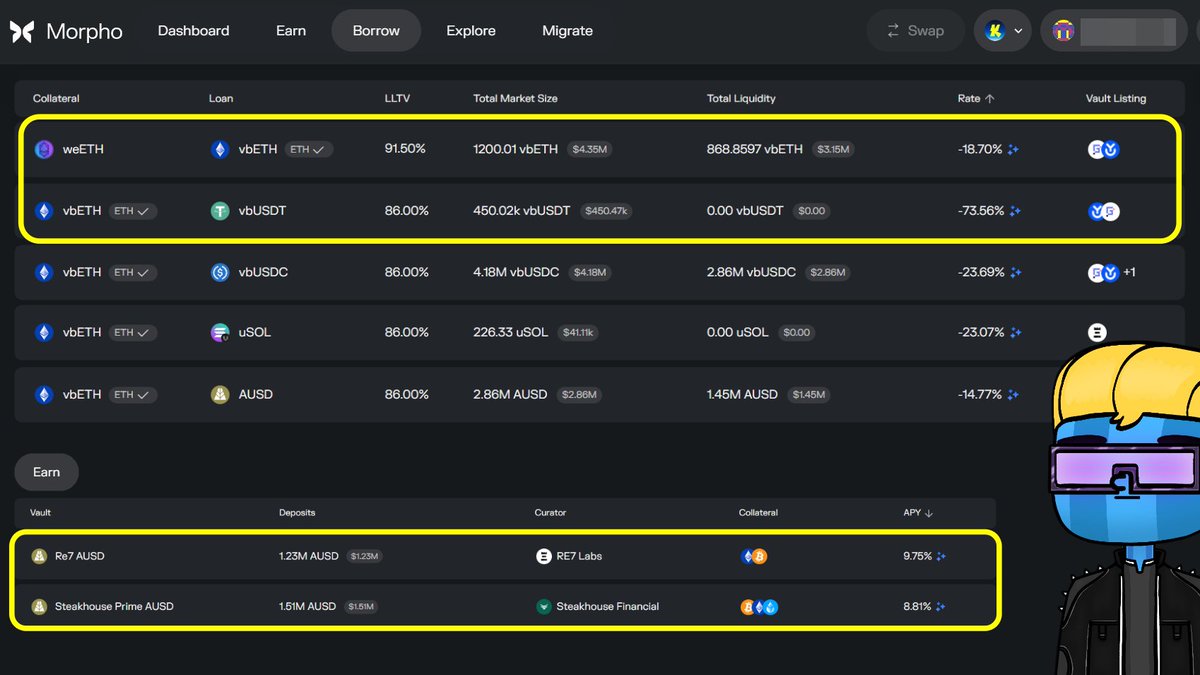

🦋 Meanwhile, @MorphoLabs has 57% APY on ETH. This is how:

1️⃣ Bridge ETH to Katana with @JumperExchange

- E.g. $1000 in vbETH

2️⃣ Swap vbETH for weETH with @wolfswapdotapp

- weETH is EigenLayer restaked ETH from @ether_fi with 3.4% APR

- Yield: $34

3️⃣ Go to Morpho. Borrow from weETH/vbETH (LLTV: 91.5%) for 19% APY (KAT 14% + MORPHO 6% - Interest 1%)

- Since it's a stable pair, use a higher LTC of 81.5%

- With $1000 weETH, get a $815 vbETH loan

- Yield: $155 (KAT $114 + MORPHO $49 - Interest $8)

4️⃣ Borrow from vbETH/vbUSDT (LLTV: 86%) for 74% APY (KAT 58% + MORPHO 18% - Interest 2%)

- This is a volatile pair, be conservative with an LTC of 56%

- With $815 vbETH, get a $456 vbUSDT loan

- Yield: $337 (KAT $264 + MORPHO $82 - Interest $9)

5️⃣ Swap vbUSDT for AUSD with @wolfswapdotapp

6️⃣ Back on Morpho, Earn with AUSD for 10% APY (Native 1% KAT 9%)

- Yield: $46 (Native $5 + KAT $41)

TOTAL YIELD: $572 ($34 + $155 + $337 + $46) | APY: 57%

🧑🌾 My ETH is now working hard to make me rich! Only on Katana!

⚠️ The numbers above are rough estimates assuming APY & token prices remain stable + zero slippage/gas/protocol fees

2.45K

34

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.