Stablecoin yield farming is something everyone is doing. Currently, a relatively stable approach is to buy U.S. Treasury bonds to back stablecoins, and another is to engage in basis trading for stablecoins, then leverage DeFi lending to act as a yield booster.

In May, I marked the stablecoin yield protocol invested by Pantera, @multiplifi, and have been wanting to gather data on it, but I ended up dragging it out until today...

Multipli mainly relies on arbitraging funding fees on CEX to generate yield for stablecoins, supporting users to deposit USDT, USDC, and WBTC on Ethereum and BSC. It's important to note that withdrawals take 7-10 days.

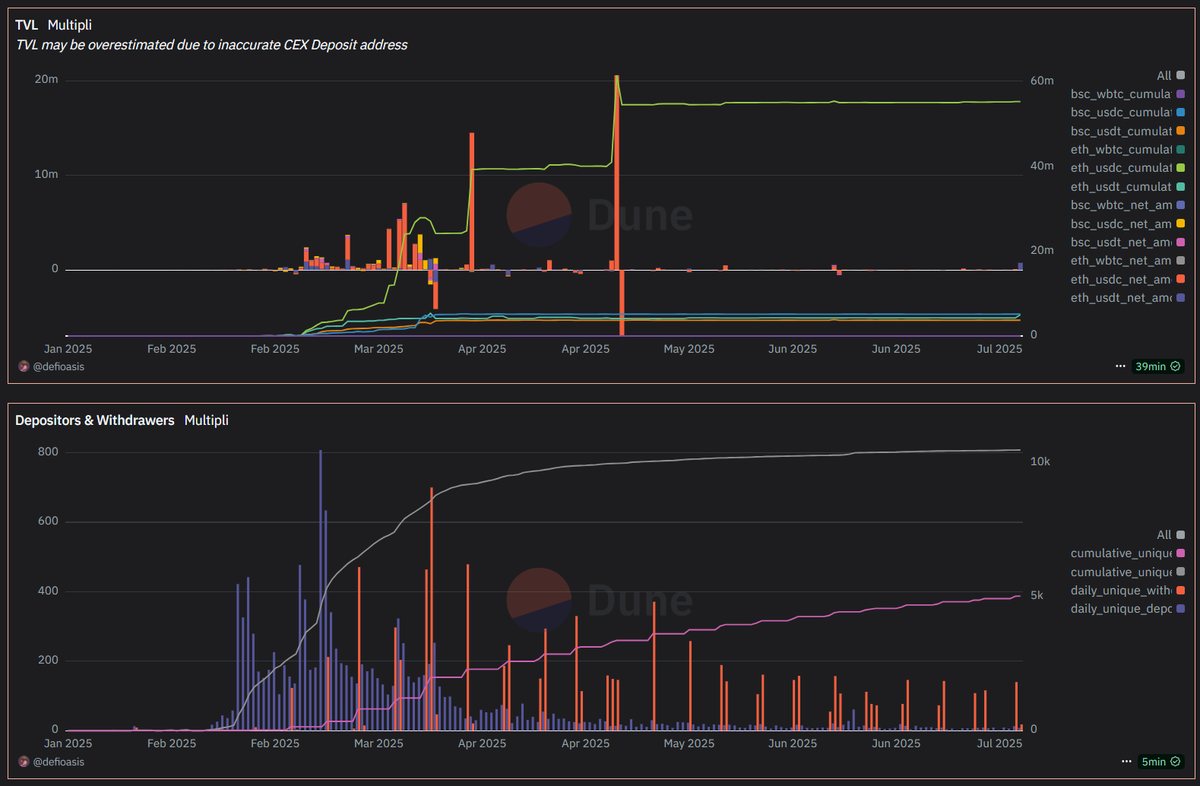

- TVL is over $60 million, with the majority of deposits being Ethereum USDC, primarily deposited between February and May. After May, TVL growth has been quite slow, likely due to lower yields, currently around 5%.

- WBTC has a hard cap of $5 million, with 44 WBTC already deposited; USDC and USDT still have available limits.

- There are about 10,500 cumulative depositors, but in the last two to three months, there have been more withdrawers daily.

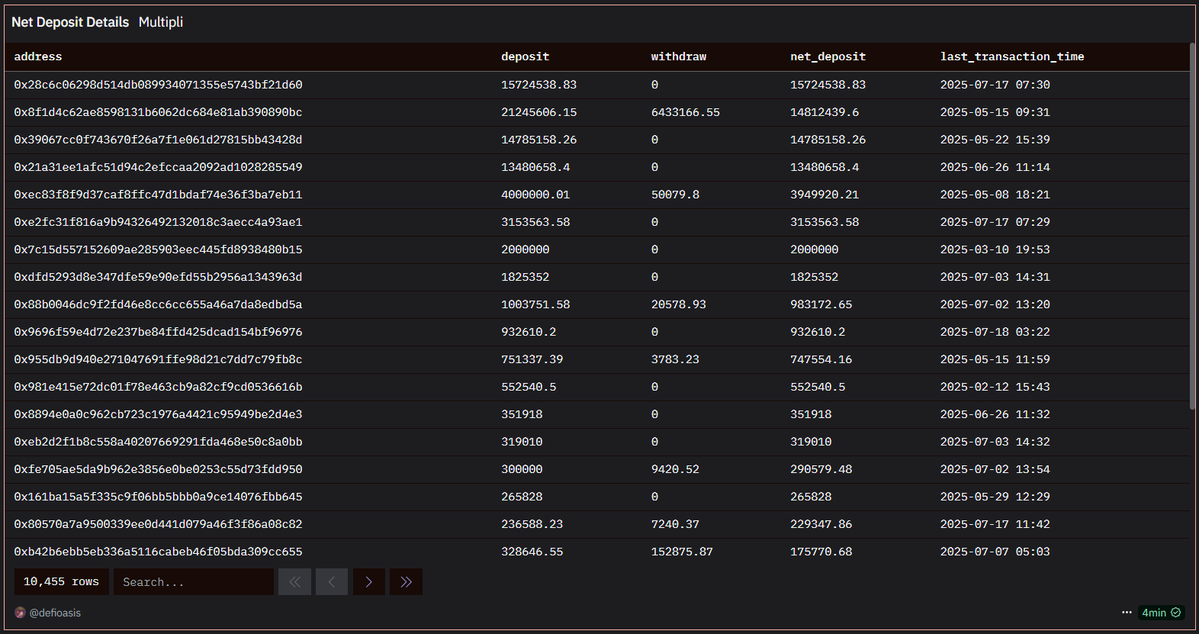

- Why are there more withdrawers, yet TVL remains relatively unchanged? Because the top four depositors have net deposits exceeding $13 million each, with a total net deposit of $58.8 million, accounting for nearly 90% of the total TVL. It's a bit exaggerated; perhaps the project team doesn't know where to gather funds to support the scene...

Data:

Show original

9.87K

3

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.