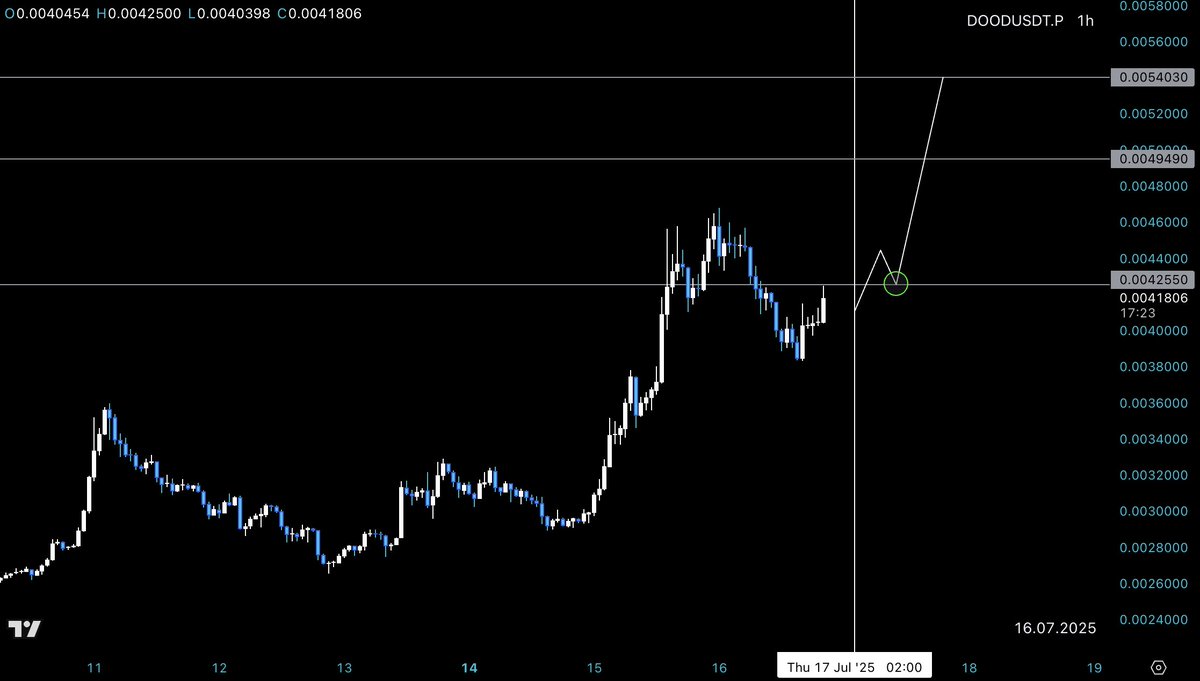

$DOOD LTF 📈

• S/R Flip & trend change is what we need 👀

S/R Masterclass:

🧵 The Ultimate Masterclass: RESISTANCE in Trading |

🔹 Market Structure, S/R Flips, Liquidity & Smart Money Tactics

Most traders think resistance is “where price stops going up.”

But real traders know it’s where narratives unwind, liquidity is engineered & traps are set.

❤️ & RT 🔁 if you study structure, not noise.

In this thread, we break it down with precision 👇

1/ What We’re Covering:

📌 Resistance defined (beyond the basics)

📌 Market structure & context

📌 Why resistance works (supply, memory, liquidity)

📌 S/R flips & their deeper logic

📌 Real examples + institutional view

📌 Advanced confirmation tools

📌 Practical frameworks for trading resistance zones

Save this. Revisit it.

2/ Resistance: Not a Wall - A Narrative Threshold

Resistance is not just “a line on the chart.”

It’s the point where:

• Buyers hesitate

• Sellers accelerate

• Smart money offloads

• Liquidity concentrates

⥮ It’s where the story shifts.

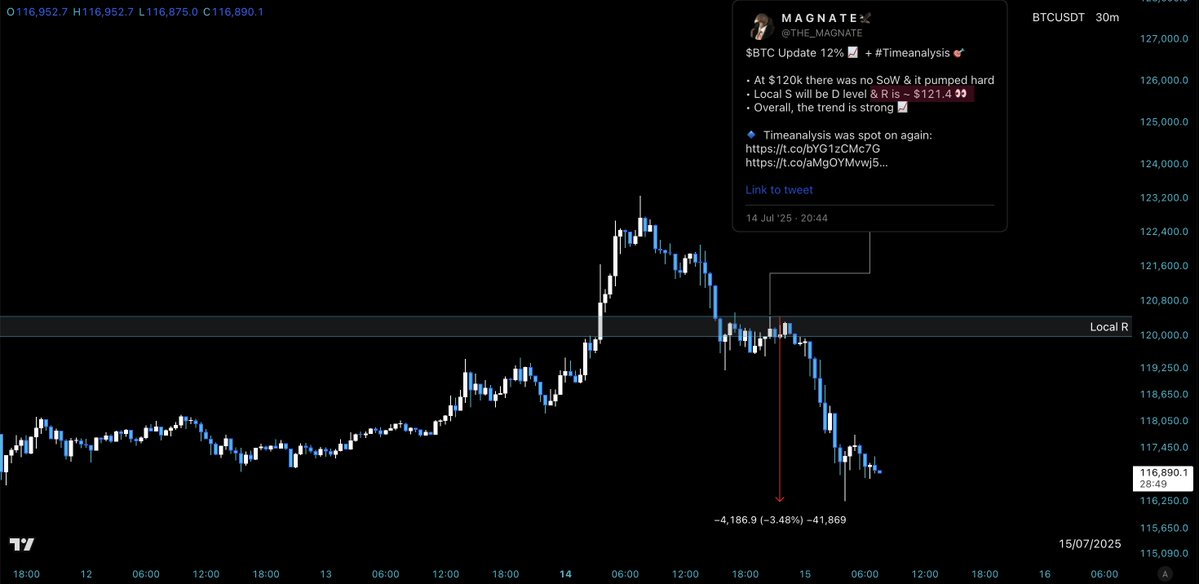

A few hours ago, I shared these levels for $BTC & quick 3.5% 📉

3/ Market Structure: Why It Comes First

You can’t understand resistance without market structure.

Structure answers:

– Are we in expansion or correction?

– Are lower highs forming?

– Are we in a bullish trend with pullbacks or distribution?

⚠️ Context transforms a level from noise → signal.

4/ Resistance in Uptrends vs Downtrends

🔹 In an uptrend, resistance often leads to healthy consolidation (bull flag, wedge, etc.)

🔻 In a downtrend, resistance is a continuation trigger the next lower high.

Same word. Different outcomes. Structure defines function.

5/ The Core Drivers of Resistance

Why resistance form:

🧠 Memory: Past rejection = emotional anchor

💧 Liquidity: Clusters of stop orders = fuel for reversals

📊 Volume: Distribution = heavy selling into strength

🔁 Technicals: Trendlines, Fibs, Pitchforks, HVNs, etc.

6/ S/R Flips: Structure Confirmed

One of the most powerful setups in trading.

🔁 Resistance → broken → turns into support

🔁 Support → broken → turns into resistance

This isn’t magic. It’s the market re-pricing intent.

⥮ Buyers defend where they previously broke through. Sellers lean in when bulls fail.

7/ Identifying Key Resistance Zones

Strong resistance zones often include:

✅ Previous swing highs

✅ Confluence with MTF S/R /Fib/(A)VWAP...

✅ Daily/Weekly/Monthly levels

✅ Confluence with round numbers

✅ Exhaustion candles (long wicks)

✅ Spike in volume without continuation

⥮ Bonus: Look for HTF levels tested only once.

8/ Real Market Example: $ETH at $3,500 (April 2022)

ETH rallied to $3,500, a clean multi-month resistance.

• Breakout wicks above the level

• Volume faded on the push

• Daily close back below = failed breakout

• Structure broke → 75% drop followed

⥮ This wasn’t noise. It was an engineered distribution, liquidity trapped, then exited.

9/ Resistance + Liquidity: The Hidden Layer

Tools like Bookmap or TensorCharts reveal:

🟥 Sell walls stacked just below key highs

🎯 Market makers absorbing longs

🫧 Spoofing behaviour

⥮ Understand: price is attracted to liquidity, not just levels. Resistance zones are engineered magnets.

10/ Resistance Entry Triggers: What to Wait For

Smart money doesn’t guess.

They wait for:

🕯️ Exhaustion candles

📉 Failed breakouts / liquidity grabs

🧭 Market structure shift (HH → LH)

💥 Volume divergence

♻️ S/R flip with reclaim + hold

⥮ Framework > emotion.

11/ Resistance as a Strategic Tool

Use resistance to:

🔺 Exit longs

🔻 Enter strategic shorts

🧠 Gauge market strength/weakness

⏱️ Time rotation between assets

🔁 Confirm bias in multi-timeframe confluence

⥮ One level. Multiple edges, when seen with clarity.

12/ Resistance + Market Structure Recap

✅ Resistance is a product of structure

✅ Not all resistance is equal (volume + intent matter)

✅ S/R flips confirm shifts in market psychology

✅ HTF resistance dominates LTF noise

✅ Always trade in context of structure

13/ Final Thought: Resistance is the Battlefield of Belief

• At resistance, bulls and bears collide.

• Those who see structure win.

• Those who chase narratives lose.

• Know the terrain. Anticipate the traps. Respect the level, but verify the reaction.

⥮ Let the market come to you. Don’t force a bounce.

If you found this valuable:

• ❤️ & Follow @THE_MAGNATE for more advanced trading frameworks.

• Bookmark 🔖 this for your trading journal.

• DM open for collabs, insights, or 1-1 Masterclass ✉️

1.85K

3

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.