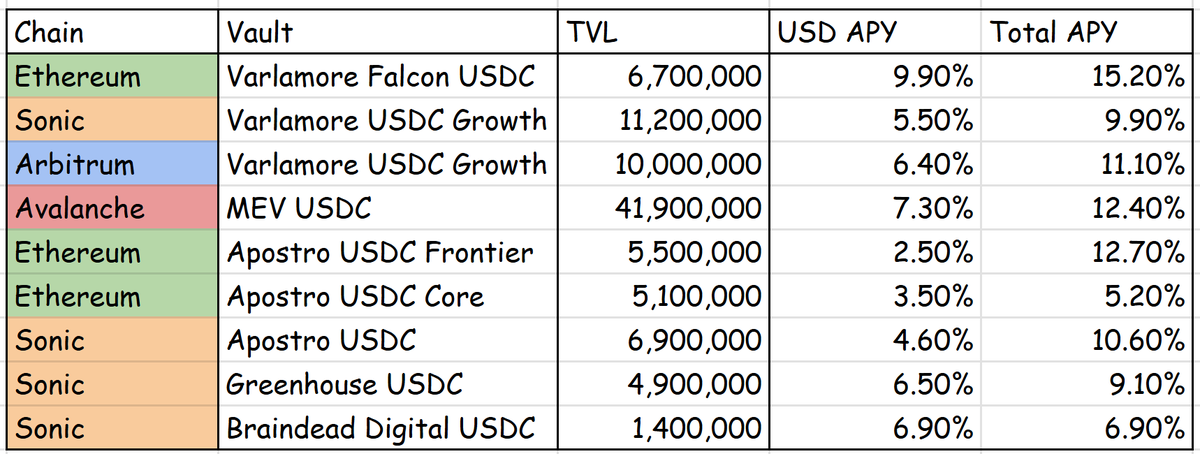

Lil' snapshot on Silo's USDC vault performance across all chains and managers.

1⃣ Highest Total APY - vfUSDC w/ 15.2% Total APY

Been a widdle bit of FUD recently but we come back.

Consistently one of the strongest performers as a DUAL-INCENTIVIZED vault with high yield-bearing collaterals.

2⃣ Highest USD APY - vfUSDC w/ 9.9% USD APY

High borrow demand with PT-sUSDf's fixed APY spike.

Also veeeeeery generous USDf incentives thanks to our good KAW KAW lads.

3⃣ Fattest Liquidity - mevUSDC w/ $41.9m TVL

2nd highest raw USD APY and now eclipses EVERY other vault by a mile.

Definitely the backbone of Silo Avalanche's success story.

As an intellectual, I simply browse the Silo Earn page by max supply APR (DYOR though aha)

GET IN HERE:

2.45K

17

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.