1/ Before you ape into the next dog-coin, anchor your VWAP. It shows exactly where the crowd bought. Let's dive in 🧵👇

2/ Quick refresher: aVWAP = the volume-weighted average price from any point you choose. Price above it ➡️ most buyers are green. Price below it ➡️ most are red.

3/ New coin? Anchor from the first candle. Example: $USDUC bounced hard on its first aVWAP test, but a later breakdown warned bulls to bail—before a 700 % rocket once price reclaimed the line.

4/ Up-trending coin? Anchor from the swing low. $FARTCOIN respected its March-low aVWAP twice; as long as price holds above, the average buyer stays in the money and momentum can build.

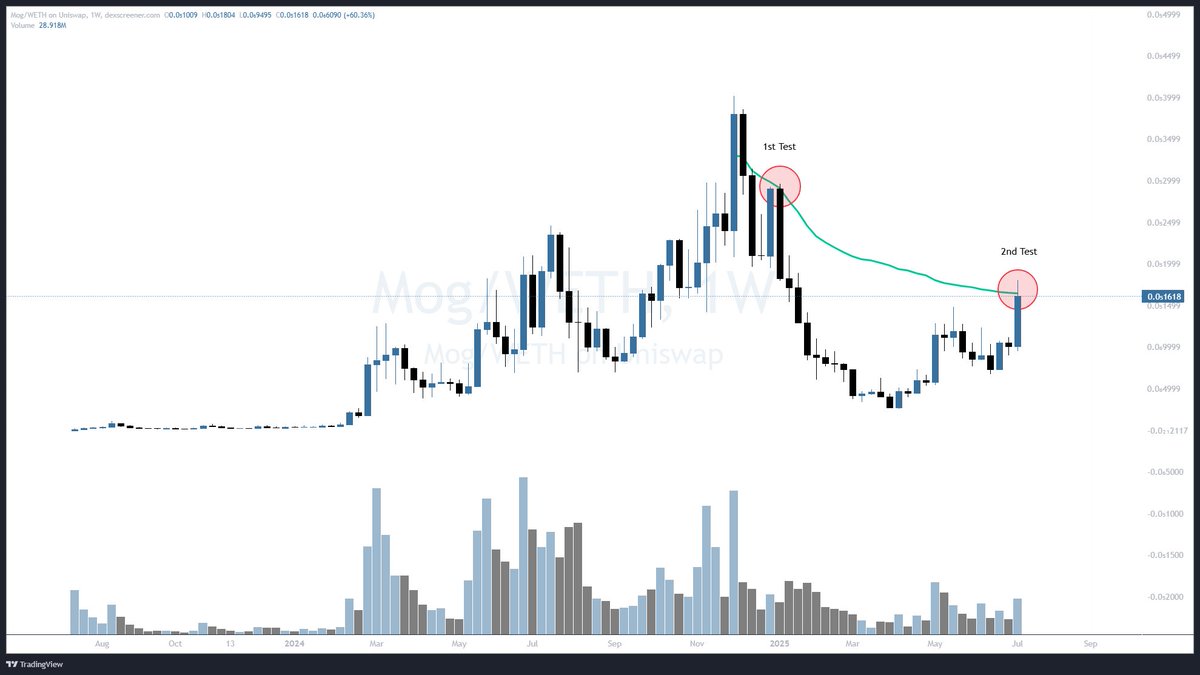

5/ Comeback coin? Anchor from the swing high/ATH. $MOG just revisited its ATH aVWAP; holders who’ve been underwater for six months are finally breakeven—many will sell, so watch that level like a hawk.

6/ TL;DR: Plot anchored VWAP from key highs/lows to understand crowd psychology.

3.9K

3

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.