Many say @Polkadot is dead.

I disagree.

Proof attached.

Polkadot ecosystem is clearly heating up:

- @hydration_net (DeFi appchain) taking off with >$290m in TVL

- @EnterTheMythos (gaming chain) wallets skyrocketing with @FIFARivals (Pudgy Party is up next)

- 2M user & 3M machine accounts on @peaq (DePIN)

- Smart contracts mainnet (RISC-V based PolkaVM) expected in October

@Uniswap will launch on said PolkaVM (PVM), which has an EVM compatibility layer to enable simple migration of Solidity apps

- PVM already deployed on Kusama innovation network

- $DOT as a gas token will improve token utility (ongoing)

- Polkadot-native rollups (via @PolkadotDeploy), which are also supported by @alt_layer's RaaS framework

- Unified addresses format to improve UX (some chains and wallets already implemented)

- Elastic scaling coming to Polkadot later this year (which will for example allow @peaq to scale up to 100k TPS)

- 500ms blocks (BASTI blocks) PoC ahead, could go live in 2026

- JAM will turn Polkadot into a trustless supercomputer (basis of a "Web3 cloud").

- JAM CoreChains are coming (currently in private testnet) and official JAM Testnet expected in 2026

- $DOT ETFs (Grayscale & 21Shares) decision in Nov 2025, which could drive demand from investors & institutionals (especially if "Web3 Cloud" narrative hits)

Are you watching anon?

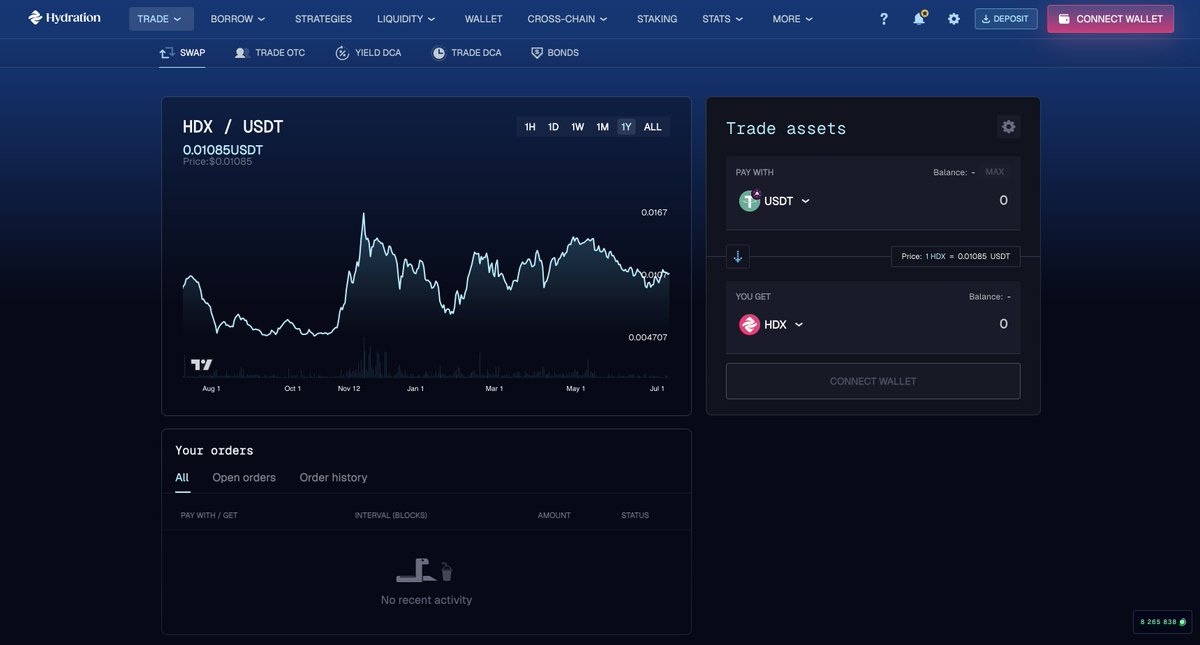

Also check out @hydration_net

DeFi Summer is hitting @Polkadot and @hydration_net is leading it.

Hydration combines swaps (286 tradeable assets), lending, a decentralized stablecoin & more under the roof of one scalable, Polkadot-based appchain, and has surpassed $291M in TVL, driven by:

- >$133m in supply assets on its lending market

- >$87M assets deposited in Stablepool deposits

- >$66M deposited in Omnipool

- >$30M in protocol treasury

- >$20M in staked assets

Activity metrics are also improving with:

- $344M in trading volume in past 30d

- $182M in cross-chain volume in past 30d

- Almost $10M in volume in the past 24h

- >$37M in outstanding loans

- >42k active accounts

Some interesting features of Hydration's DeFi hub are:

- Pay gas in any supported asset

- Multi-million DOT liquidity incentives live

- Simple UX that allows for simple trade splitting

- Automation features for trading

- Allows for single-sided LPing

- Built-in OTC desk: place order & let others fill

- Supports LBPs for token launches

- GIGADOT and GIGAETH for yield maximization

- HOLLAR: over-collateralized stablecoin (coming soon)

- Protocol owned liquidity (treasury)

- In-app cross-chain functionality

- Onchain governance mechanism

- +++

Highly recommended to check out if you're looking to get into Polkadot. Plays a very crucial role as the central liquidity hub in this multi-chain ecosystem.

4.74K

15

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.