Education Megathread

> all high value write ups and videos that I've put out publicly over the years; in one place

> new pieces will be added as they release

12) Fear vs. Euphoria is a stupid view on sentiment

Fear vs. Euphoria is a redacted measure of sentiment.

People are fearful in downtrends.

People are euphoric in uptrends.

Fading sentiment in this fashion is the biggest of midcurve traps and will have you offsides for months at a time.

If you want to try and action the tea leaves, then:

Uncertainty vs. Confidence is much more useful.

1) You want to join early when the charts are trending and people are uncertain and unwilling to accept this new information. Many participants will be hesitant to step in, often looking for deeper pullbacks.

Run with the trend and fade the uncertainty.

2) In the middle of a trending environment, many people have finally accepted the new information and jumped on board. There comes a moment when it seems like everyone is euphoric, yet price continues higher.

Never fade the momentum or sentiment in this environment.

3) You want to fade the crowd only when their confidence continues to grow as momentum begins to wane. Each expansion is weaker than the last. Markets have begun to chop harder than before. Pumps are sold. The TL is pitching you on tech and targets continue getting further. The divergence is actionable.

TL;DR

Momentum + Uncertainty = Bet with trend

Momentum + Confidence = Bet with trend

Momentum + Overconfidence = Bet with trend

Momentum Loss + Overconfidence = Fade trend

13) The 10 Biggest Keys for me to turn a consistent profit for the first time in 2022

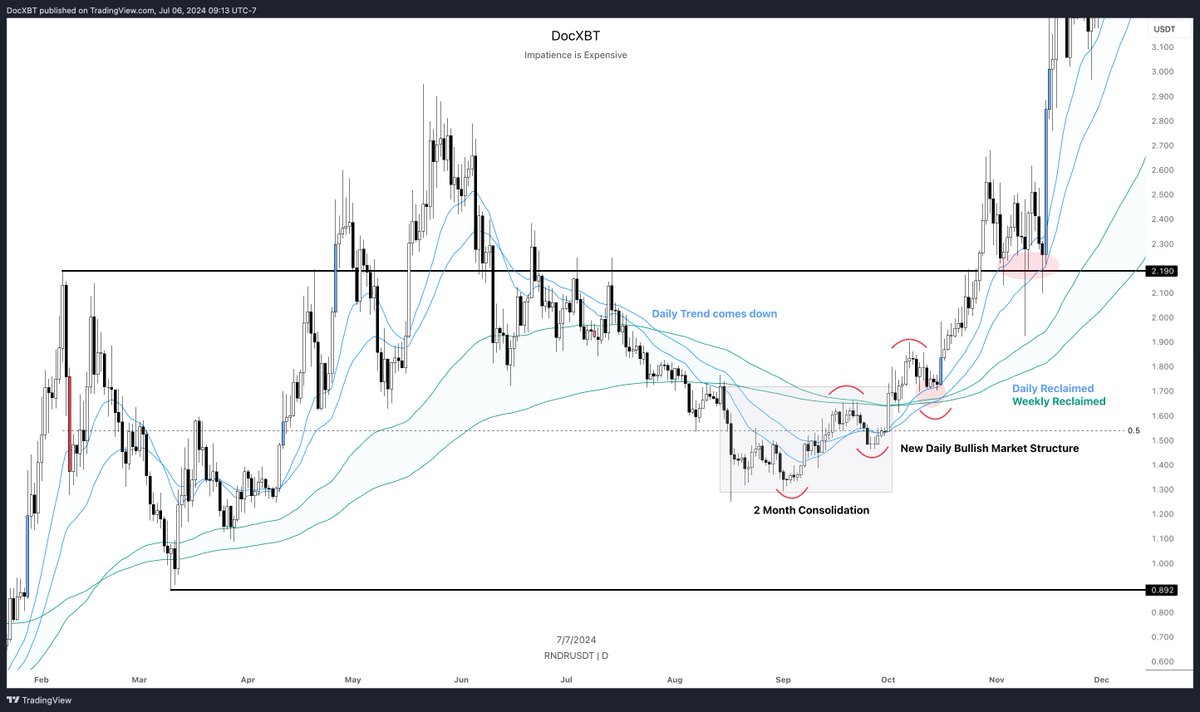

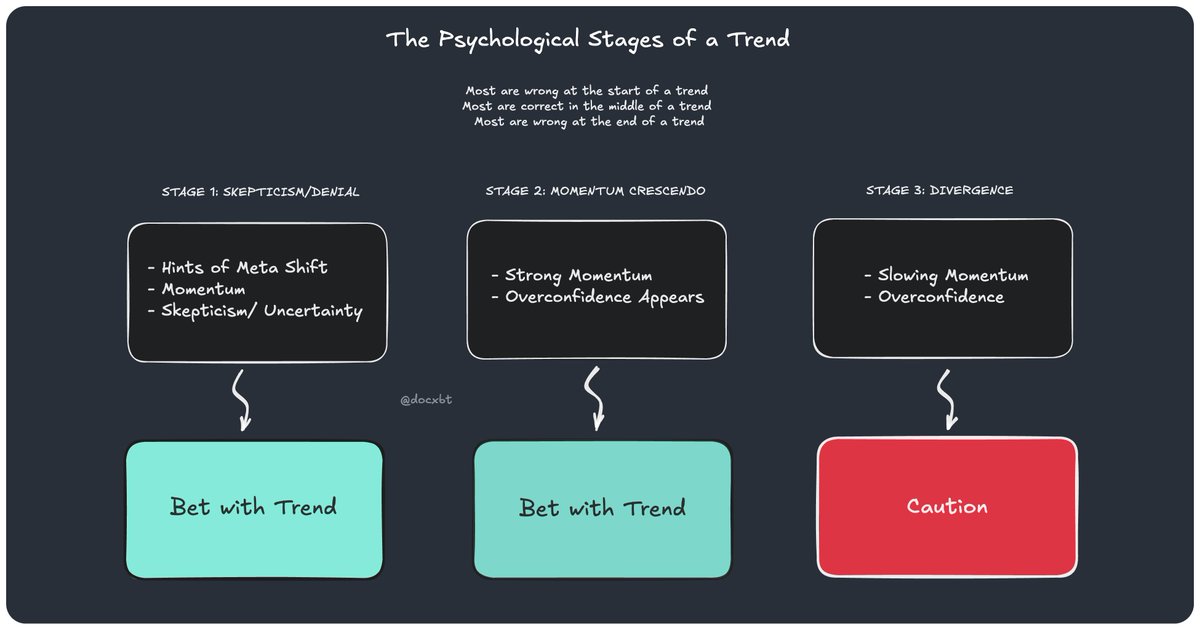

15) Psychological Trend Shifts (Actually Valuable Sentiment Analysis)

The Psychological Stages of a Trend

STAGE 1: Skepticism

> Early meta shifts are met with extreme skepticism

> The majority would rather bet on the more recent, strongly conditioned meta than adapt to the new information being presented.

> A minority of early meta adopters set out to vocalize the shifting tides to the masses and are met with mixed reception.

STAGE 2: The Momentum Crescendo

> With time, the new meta (trend) will lead to a trickle-in effect of participation as they begin to acknowledge and get comfortable with the new information.

> Many participants increase exposure to the trend as it accelerates and as their confidence in the trend grows. i.e small bets early and bigger bets later

> A new feedback loop begins to form. This is when the conditioning effects of the new meta take place.

> A trend will continue for a while even after the overwhelming majority of participants agree on the direction.

> Contrarian traders begin to appear, i.e. "Everyone is bearish therefor I am bullish"

note: fading confident sentiment works best in slowing momentum and poorly in strong momentum.

STAGE 3: Divergence

> Over time, conditioning effects will breed increasingly overconfident market participants willing to bet bigger and bigger on the current meta.

> The momentum of the trend begins to wane and produce less intense results.

> Late trends are met with a divergence between confidence and momentum.

> Rising confidence; waning momentum

> The decrescendo begins.

Lessons:

In risk markets it's wise to bet heaviest early in trend development when there is most skepticism. Maintain that position as other begin to flow in, then wane risk over time as the meta breeds a plethora of now overconfident betters.

Fading sentiment works well when participants get seemingly get louder the more momentum slows. The divergence is actionable.

The majority will be loudest and bet biggest after they become certain; a lethal game.

"It's what you know that kills you"

19) Indicators

INDICATORS

Thread/Thoughts/Ramble/What I Use:

I find it interesting that the most repeatedly asked questions in my replies are about indicators on my charts.

If needed, I'll be the first to tell you- indicators won't be the thing to get you over the hill.

They are just a guide/tool to be used alongside your discretion/experience. Some help with invalidations/risk management, some give you data you wouldn't otherwise have. They will help, but without understanding how/when to use them, they will just end up as unnecessary complexity for people that just throw them on their charts expecting to find gold from shit.

I went from trading price action/ranges to emas to adding vwaps, volume and some flow tools. They all have their use and time in the spotlight, but without the knowledge and experience to know when and what to apply, it will all be noise.

Start simple. Use simple tools and framework. Build a foundation. Add a tool. Tinker with it. Gather data. Remove if not helping. Repeat.

You can be a killer without a single indicator on your chart. You can just trade price action/liquidity concepts/ranges.

Think of it this way- If Roger Federer played with Babolat or Head racquets instead of Wilson he would still be Roger Federer.

At the end of the day it's the wizard, not the wand.

It's the trader, not the system.

--

Now with all that being said, here's everything I use:

--

EMAs:

- Intra-week: 13, 21, 34 EMA

- Daily Trend: H4 100, 200 EMA

- Weekly Trend: D1 100, 200 EMA

VWAPs:

- Standard Timeframes: Daily, Weekly, Monthly etc.

- Anchored VWAP

Volume/Flow:

- Market Order Bubbles

- Buy/Sell Volume

- Open Interest

- Delta Candles

- VRVP

- PVP

- FRVP

20) Introduction to Psychological Defense Mechanisms and their relationship to trading

Better full thread coming soon

Study human psychological defense mechanisms:

Denial- Unwillingness to accept that you’ve lost more than you were willing to. Brushing it off till it gets severe. “It’s not a loss till I sell”

Rationalization - “It’s not my fault, it’s the war/fomc/manipulation”

Undoing - Trying to fix or undo a mistake i.e. revenge trading

Regression - Reverting to common childlike behaviors or in market terms- reverting to bad habits you had when you were learning how to trade

Suppression - Avoiding the reality that you’re in drawdown and you put yourself there

Repression - Not accepting and acknowledging mistakes and working on them so they reappear when under immense stress; like when you’re in drawdown

All of these snowball on you and cause you to trade worse when you avoid the reality that YOU caused the initial error.

Accept your loss and accept your role in it.

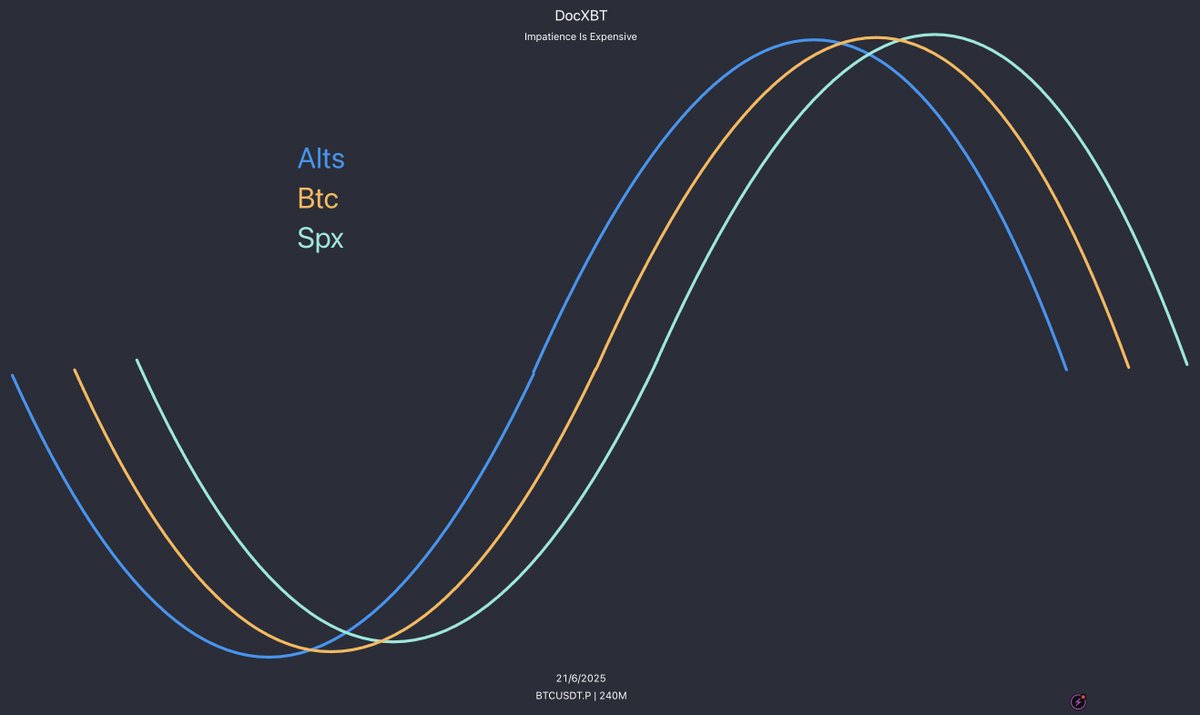

21) Risk Asset Relationships in broad market bottoming

Market Selloff Dynamics + Bottoming

The goal of this write up is to give you a bit of insight on how I spot HTF pivot points in markets. We want to understand the psychology behind risk unwinding and use that to our advantage to potentially spot bottoms.

1. Low Conviction Sells First

- When uncertainty hits, sellers dump what they least desire i.e., lower conviction coins will top first and bleed early.

- Think about it logically. If you're in a pinch and needed cash irl, you're not going to sell your prized possessions, you're gunna sell the crap you never use.

- Likewise, traders will sell what they’re least emotionally invested in to build cash when uncertain or want to decrease risk.

- It’s not a coincidence that this has happened every HTF top this cycle. Alts don't rally after, they rally during. They also top weeks before BTC even shows an ounce of weakness.

- It’s an early warning. Smart traders de-risk before the crowd even knows what's happening.

2. Risk vs. Quality

- Let's go back to the earlier metaphor. People will hold onto their quality prized possessions for as long as they possibly can. It's not until they're desperate that they will part with them.

- The most desirable coins, more often than not, will attempt to hold their gains for as long as possible. This is why BTC always looks fine and you see dozens of "Why is everyone panicking, BTC looks great" tweets weeks before sell offs.

In selloffs:

a) Junk sells early

b) Quality sells late

c) Everything sells eventually

Watch the order of events. It’s a map of stress flow.

3. Reflexivity Kicks In

- Early weakness causes more weakness.

- Once a whale starts to unload into exhausted demand they begin to induce weakness. Classic signs of distribution, absorption, exhaustion, trend loss etc.

- A character shift in a risk asset will make the first order of experienced traders reassess.

- "I didn't sell top, but the character of the trend has shifted. Time to reduce exposure/close"

- “If this is nuking, what else am I exposed to?”

Suddenly:

Rebalancing triggers more selling

This is reflexivity.

A feedback loop of diminishing risk appetite.

4. Volatility: The Dance

Before many big selloffs in BTC, markets go quiet. Volatility drops. Trends become ranges. Complacency peaks.

Then, boom.

Let's talk a bit about balance and imbalance.

- Balance is achieved once the market begins to agree on what's expensive and what's cheap. It's a dance. Equilibrium.

- Equilibrium is calm. What's known is known. Speculation diminishes. Volatility compresses.

- The dance continues until one party gets bored, tired or wants to go to the bar to get another drink. i.e. buyers or sellers get exhausted; changes to supply/demand.

- Equilibrium is damaged- and once it breaks: Imbalance.

- Price displaces violently. Value becomes unclear; volatility explodes. The market craves balance and will actively seek it.

- Price often returns to areas where recent balance was formed- hvn, orderblock, composite value etc.

- This is where you get the sharpest bounces.

"First test, best test"

- Subsequent tests will provide diminishing reactions. Things become structural. Price accepts its new home. Volatility compresses. Balance is found once again.

5. The Flow of a Selloff & Spotting Bottoms

Capitulation isn’t the beginning of the end; it’s the end of the middle.

a) Alts vs. Bitcoin

- This cycle alts often do the bulk of their selling before BTC capitulates.

- Recent example: Fartcoin sold off 88% from its top before the late February BTC capitulation. Since this is true, we can begin to use it as an edge when looking for exhaustion (bottoming)

- The strongest alts will begin to show relative strength (exhaustion) earlier as BTC is still being hyper-volatile and looking for new balance.

- In order words, look for good alts to begin to achieve balance as BTC is in the later stages of imbalance.

As participants, our goal is to spot these divergences:

“Has momentum shifted?”

“Is volatility compressing?”

"Is the velocity of selling diminishing?"

“Is it holding while BTC makes new lows?”

Signs of bottoming in Q2:

- Momentum loss (Fartcoin)

- SFP/Deviation (Hype/Sui)

- Higher lows vs BTC’s lower lows (Pepe)

In short: alts front-load their pain, then decrease in velocity as BTC bottoms.

Remember this how we spot "good" alts.

The weak stay weak.

The strong start whispering before the market speaks.

b) Bitcoin vs. SPX

Now a little exercise for you all

Combine all the concepts in this thread and maybe the following begins to make sense:

Summer '23: BTC topped before SPX, bottomed earlier

Summer '24: BTC topped before SPX, absorbed the macro related SPX crash at range low

So far in '25: BTC topped before SPX, absorbed a 20% SPX crash at range low

TL;DR

Bottoms are a process, not a moment.

Alts First

Bitcoin Next

SPX Last

Watch for the structure, not just the sentiment.

23) Trend -> Range

When the trend that carries an expansive rally breaks- my baseline bias becomes (in order of expectation):

1) a consolidation (range)

2) a reversal/downtrend

3) a reclaim into continuation

Nuance obviously needed based on environment.

Ex. Order of expectancy shifts in risk-on environments where reclaim/cont. moves to most likely scenario.

When in doubt. Default to the above. It's saved me a lot of money (and stress).

24) Systemization vs. Discretion

Systemization vs. Discretion

This gets framed as a debate.

It's not.

It's part of the same toolkit.

Trading is war.

Systemization is your army.

It's your preparation, routine, map of the battlefield, foot soldiers, weaponry and vehicles.

But what happens the map tears, the fog rolls in, the ground gets muddy and vehicles get stuck?

In comes your Field General i.e., your Discretion.

Experienced, calculating, adaptive, able to call an audible.

The best traders don’t choose one; they weaponize both.

Let's learn how:

1. Definitions

> Systemization:

Rule based, repeatable, backtested, positive expected win rate over time, high expected value entries/exits.

This is the mechanical side of trading.

> Discretion:

Allows for nuance, adapts to regime shifts, accounts for context, uses experience and intuition that machines cannot replicate.

This is the human side of trading.

2. Strengths

> Systemization

- You can test it.

- You can scale it.

- You can outsource decision making.

- You can protect yourself, from yourself.

- You get repeatability under stress and over time.

But don’t confuse automation with edge.

Garbage in = garbage out.

> Discretion

- You see what machines miss.

- You recognize the meta shift early.

- You use your experience to override mechanical errors in systemization.

- You understand the context of the market (you can avoid trend trading in a rangebound asset)

- You can adapt mid-trade and apply probabilistic outcomes like evolving R.

- You can sniff out the bullshit like when a trigger appears but during a lower EV session.

- You avoid hard price stops and begin to use invalidations- "is static price telling me I'm wrong or is the flow?"

3. The Hybrid Approach

Systems lay the foundation for your success.

They teach you the discipline to execute on your high EV triggers when they appear.

They teach you the patience to do nothing the rest of the time.

They show you that your fear/emotion at entry is often an edge. You execute while they overthink.

Systems inherently prevent you from overthinking.

They protect you, from you.

Discretion is your evolution.

Why gain the experience if you're never going to use it?

Why find an unsystematic edge if you won't try to exploit it?

Discretion is the sum of your experiences in markets.

Some things don't come around often- like trading around an actual real life war. I've been around for 5 years and traded war headlines 3 distinct times. I've journaled those moments. I've traded them. I've become able to find edges around those times that systems can't solve for.

Example: Discretion will lead you to comparing severity of news against headline impact on price over time i.e. News absorption.

Experience is an edge. Don't ignore it.

4. My Takeaway

Don’t ask, “Should I be systematic or discretionary?”

Ask:

a) Where can I reduce decision fatigue?

b) Where must I stay human and adaptive?

c) Where does my judgment add value and where does it destroy it?

Don't know yet? Journal. Gather data.

Your answer = your advantage.

Final Thought

In war, strategy wins battles- but instincts save lives.

In trading, systems build consistency- but discretion makes the difference.

Know your tools.

Know yourself.

And never confuse impulse for intuition.

34.96K

377

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.