DeFi today is fragmented and starved of deep liquidity.

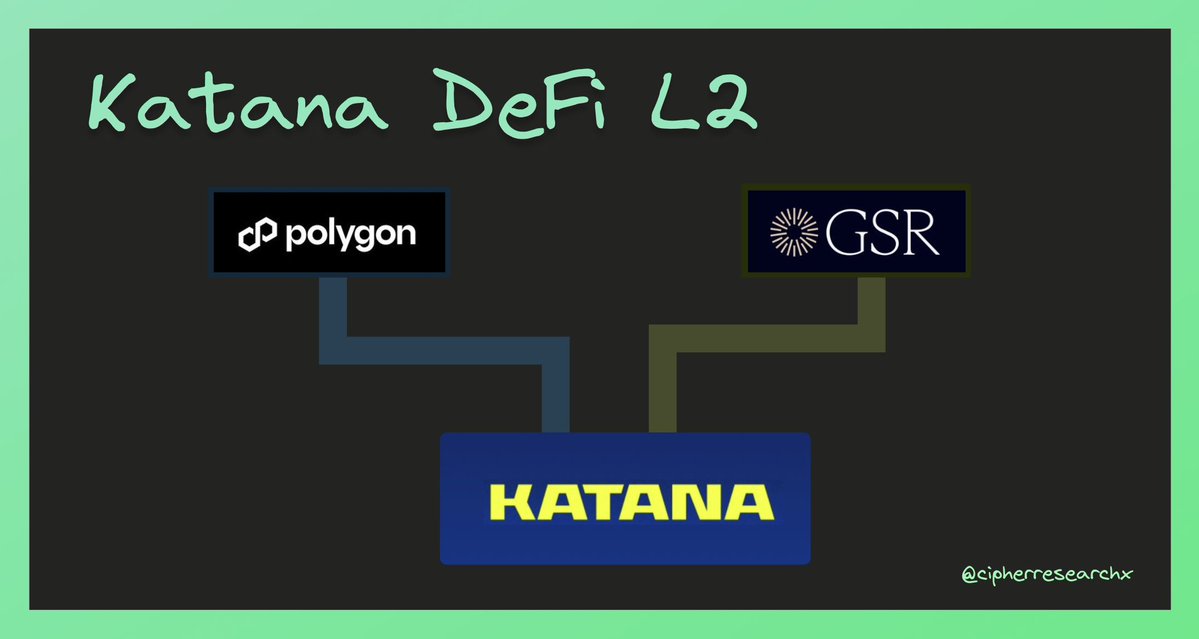

Katana is changing that by building a high-yield, highly liquid L2 purpose-built for DeFi.

Everyone's talking about it. Here's your crash course ⚔️

Problem with DeFi today

Capital in DeFi is extremely fragmented.

A chain might have 6 billion in TVL but in reality,

its spread across 30+ Dexs, lending and yield apps.

The Result?

Shallow pools and thin liquidity.

Large trades? Forget it.

Here’s how it works:

Instead of 30+ scattered DEXs and DeFi apps, Katana uses Core Apps (one app per primitive):

Lending → @MorphoLabs

Swap → @SushiSwap

Perps → @vertex_protocol

Stablecoin → @withAUSD

Liquidity is concentrated → deeper, more usable pools.

Katana’s design ensures:

- Best yield (onchain + offchain)

- Deep, unfragmented liquidity

- No scattered, competing apps

As the network grows, yield & liquidity grows!

There’s 1B in $KAT incentives live right now to supercharge adoption

Start here →

11.16K

87

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.