$IREN = Dilution

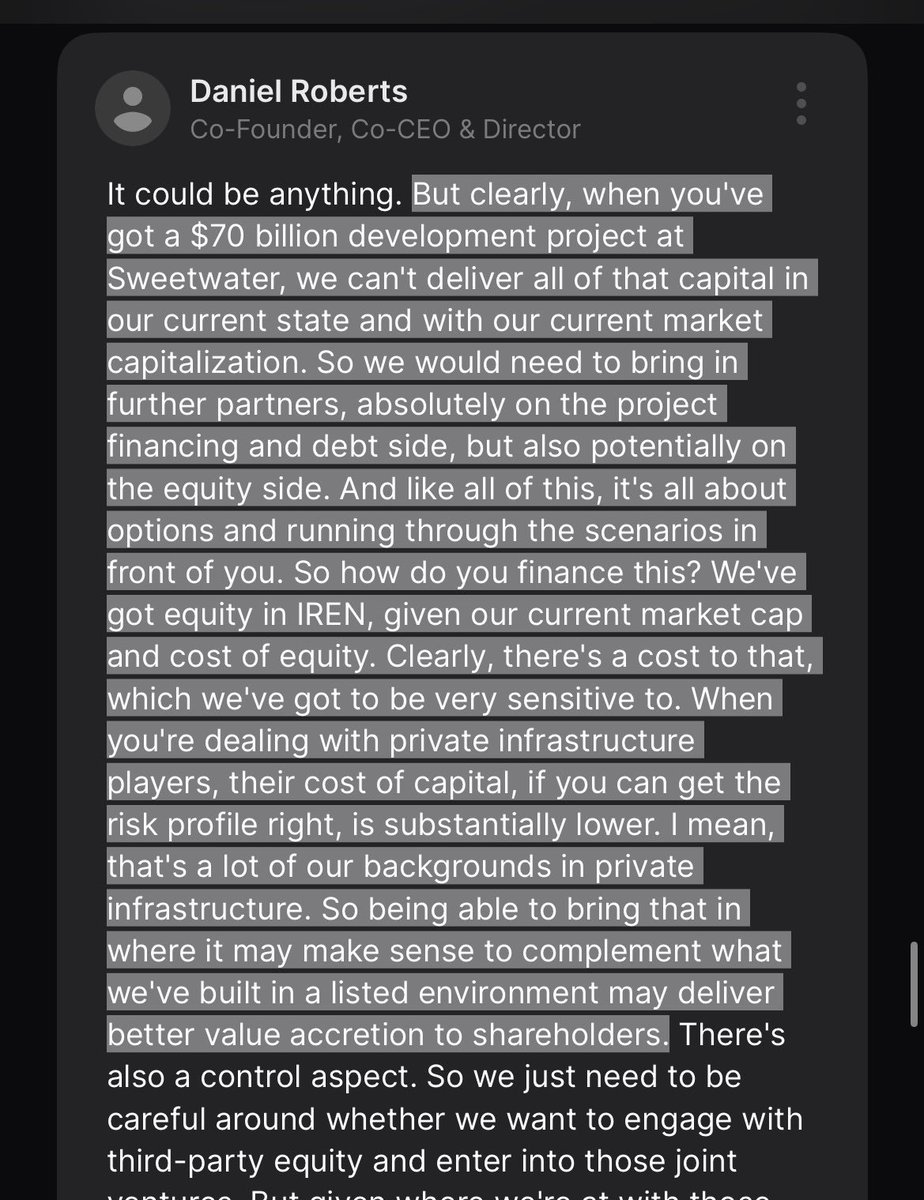

$IREN needs several billions to develop the Sweetwater data center

They hold $200M in cash

Anyone valuing this company based on this data center capacity is valuing something that doesn’t exist

OCF + proceeds from Bitcoin – depreciation comes out to $46M

That’d be the net cash generated per quarter at a maintenance level

Long way to reach the funding needed

Horizon 1 still requires lots of CapEx and will be only 50 MW

This company realistically has enough money to complete Horizon 1 and that’s it

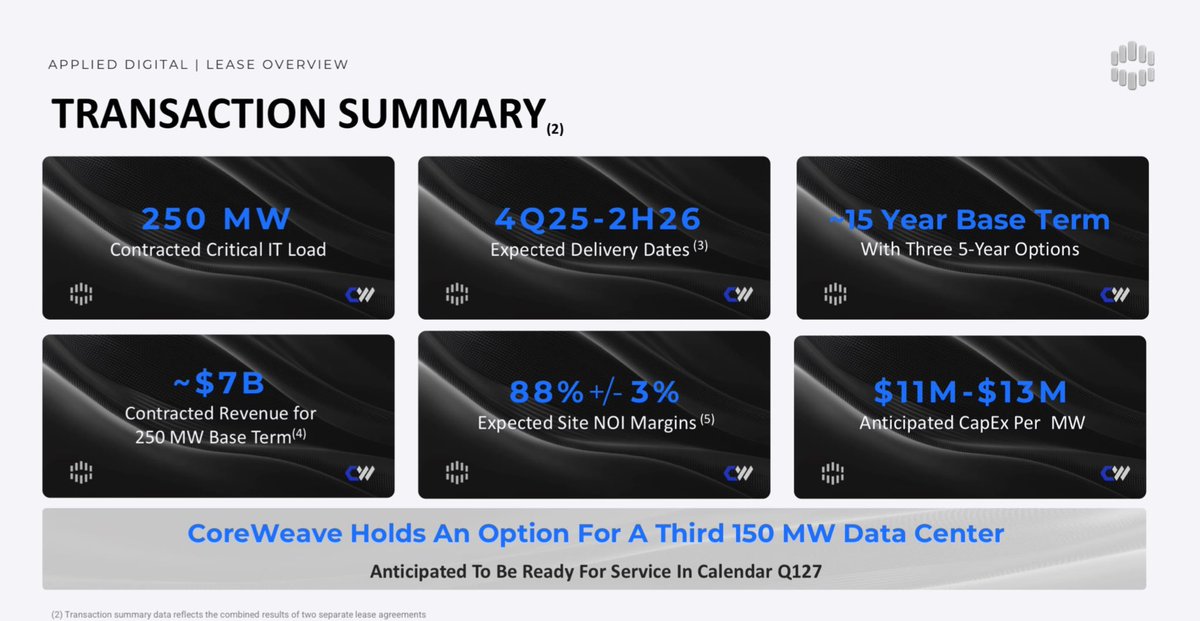

$APLD is going to make $466M in revenue yearly for 250 MW of capacity contracted by $CRWV

If $BTC stays at this range, $IREN could be making ~$120M in adjusted operational maintenance free cash flow by next year

Now trades at 26x that

Fair value if you’re neutral or bullish on $BTC

Apart from that, it’s dilution or debt. And at a $3.1B valuation, it wouldn’t be pretty

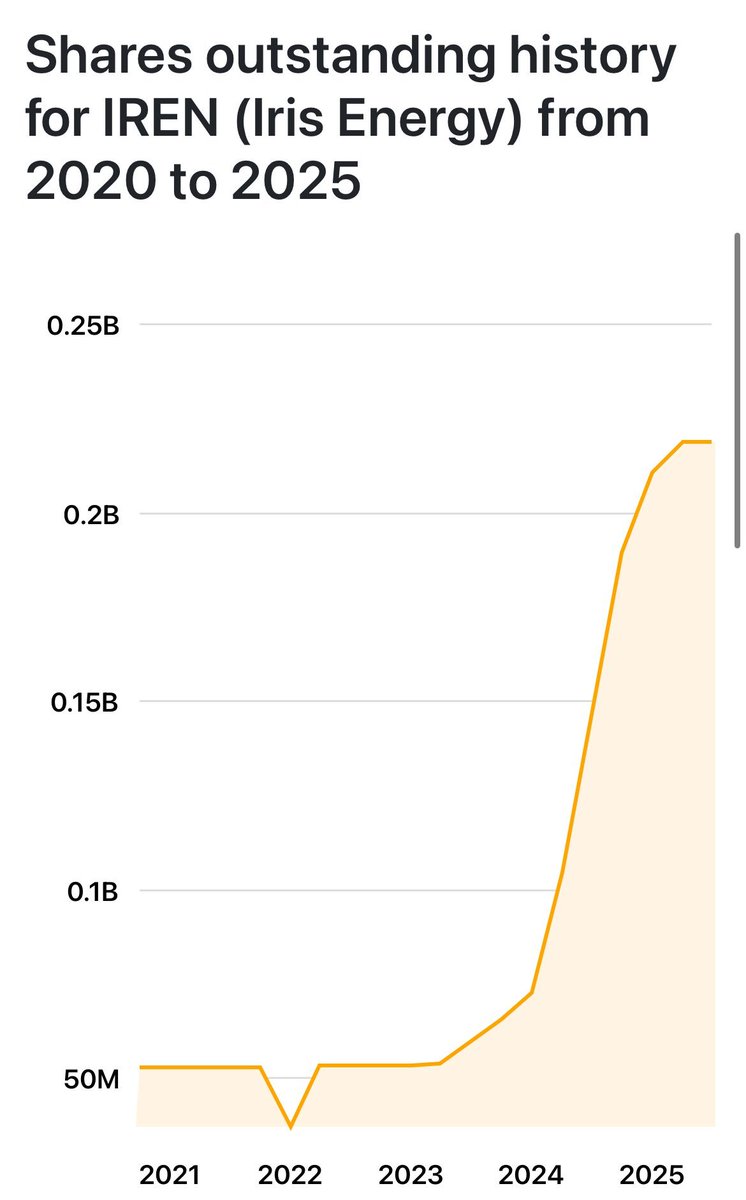

This company is already issuing shares like there’s no tomorrow

That’s why it’s underperforming $BTC by 49 percentage points in the last year

70.97K

302

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.