"Sei's fundamentals have officially changed since the listing of Circle. 》

(The full text is not extensive, only from the stress response of an alpha research team)

1. Sui and Sei are public chains laid out by Coinbase and Circle as early as 2022, if you think they are inexplicable before this, it is right.

According to the public information of CryptoRank or RootData, you can check:

August 31, 2022: Multicoin Capital and Coinbase Venture invested in Sei in seed round, which raised a total of 5M

December 15, 2023: Circle has an undisclosed investment round

September 18, 2022: Coinbase Venture and Circle Venture (and A16Z) invested in Sui in Series B, raising a total of 300M in this round

(To briefly add that in 2022, Coinbase, Circle and A16Z also invested in Aptos, and Optimism has always been invested by A16Z and Paradigm)

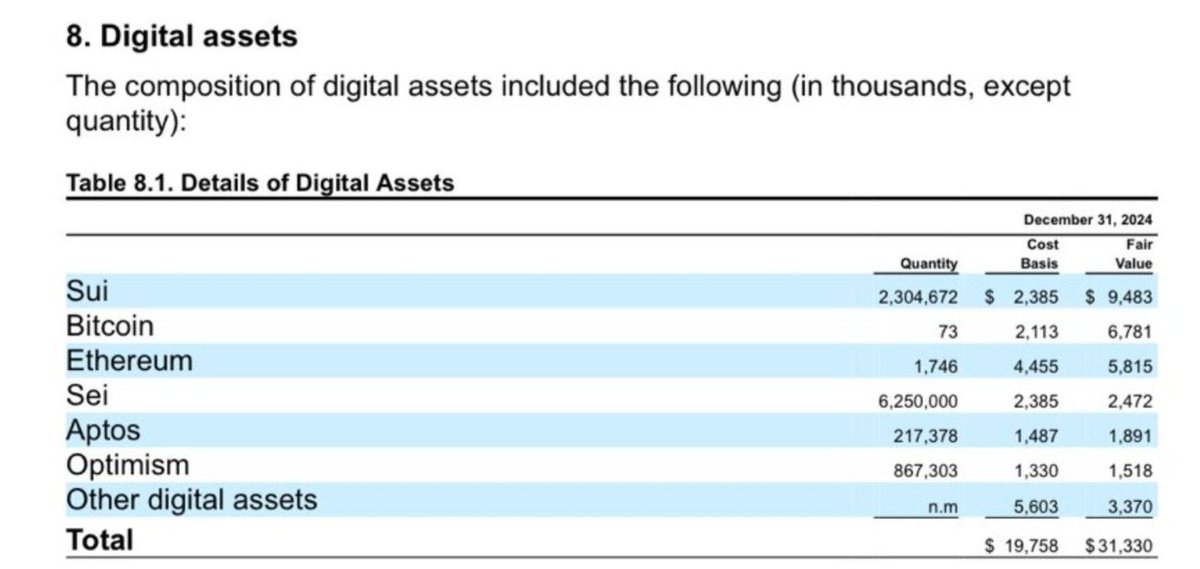

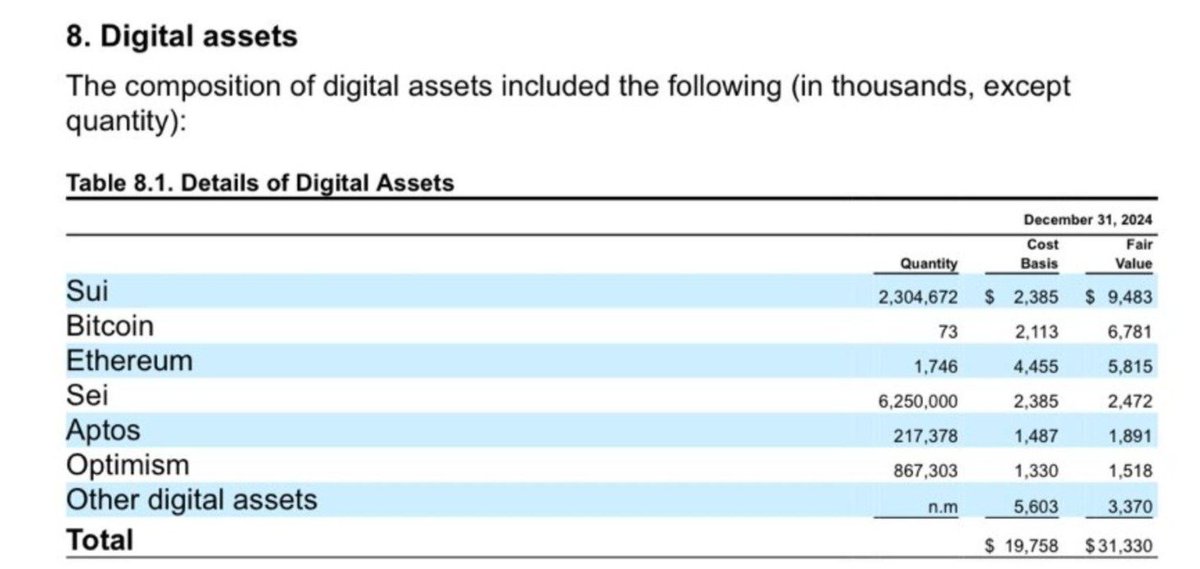

The four chains mentioned above are all in the asset table of the Circle IPO, except for BTC and ETH, just the four of them.

There is a high degree of certainty speculation that from 2022, Coinbase and Circle have been laying out public chains. What for? None of this seemed very clear until then.

In the list of candidate blockchains in Wyoming, the first state of the United States to legislate stablecoins, all four chains were selected.

Aptos and Solana are tied for first place with 32 points, followed by Sei with 30 points.

So teachers, I think, this is Coinbase and Circle doing.

I don't particularly understand, but I always feel that there is capital in the game! Is this going through the channels of state government in the United States?

Sei should be one of the top three paradoxical projects in my VC career:

Before the team went online, Runway was no more than 3 months, and it has been shipping OTC since it was launched. So far, there are more than 1B, and it has never been broken, and investors have already begun to unlock it, only the problem of earning more and earning less.

The last time I saw such a magical project, it was probably INJ...

No buying, non-shouting, NFA

2.$sei It should be just at the beginning of the effort, and there is no interest relationship. I haven't gotten on the bus yet, I should wait for the opportunity, it does not constitute any investment advice, it is recommended that I am interested in researching it.

According to the flaws in the Circle asset table, I calculated the cost price of their sui and sei, the sui is 2.385M/2.304672=1.034, and the sei is 2.385M/6.25M=0.3816.

First of all, you can see that when they allocate assets, the cost basis given to SUI and SEI is the same. At the end of 24 years, the fair value of SUI is much higher than that of SEI. So far, too, the value of SEI has not been explored and discovered.

SUI Let's not talk about it for now, let's take a look at SEI. According to the Circle's asset table, if it is true, they themselves are still underwater now, from the end of 24 to the present.

Let me highlight again, Mala Cake does not give any investment advice and does not have any stakes!!

3. I'll add one more Hua point

Canary's application for the SEI ETF is a groundbreaking step in bringing SEI to institutions

Who is Canary, this company only invested in a product called Hashdex with Coinbase on May 12, 2021, which is an institutional-grade digital asset investment platform that does ETFs or something.

3. I'll add one more Hua point

Canary's application for the SEI ETF is a groundbreaking step in bringing SEI to institutions

Who is Canary, this company only invested in a product called Hashdex with Coinbase on May 12, 2021, which is an institutional-grade digital asset investment platform that does ETFs or something.

If you say it's not a Coinbase game, am I doing it? 🤣🤣

The above content is pure conjecture and fiction, and children are ignorant and say it casually!

Tag a teacher who might be interested

@charlotte_zqh @0x_KevinZ @Normanrockon @EttoroSummer @yi_juanmao @0xDave852 @IvyLeanIn

@charlotte_zqh @0x_KevinZ @Normanrockon @EttoroSummer @yi_juanmao @0xDave852 @IvyLeanIn ser Can you renew on Kaito? good yapper's always ready to work for you! @tezukaTez lol

4. Add one more

Multicoin Capital and Coinbase invested in Aptos and SEI together

Aptos has DragonFly in it, and Dragonfly invested in Codex (Circle's stablecoin chain) two months ago

Teachers Capital is cooking

25.02K

69

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.