SIMD 96 was effectively a transfer of wealth from SOL tokenholders to Solana validators.

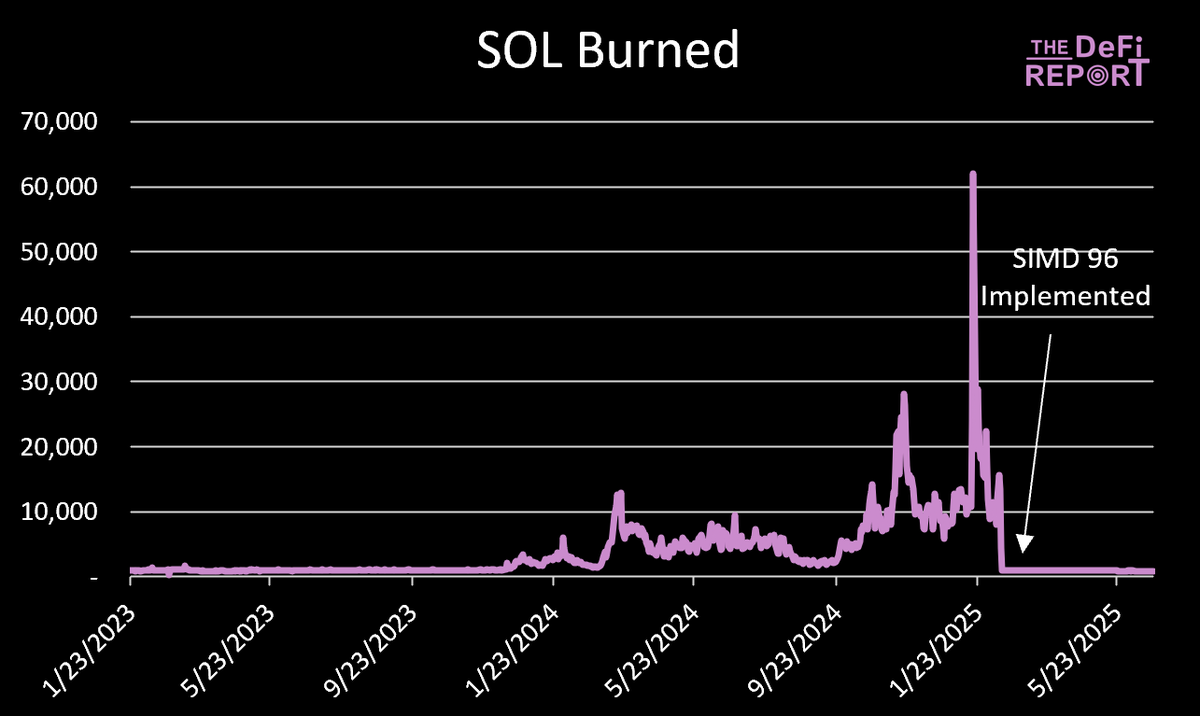

We can observe this in the SOL Burned chart.

It shows SOL Burned falling off a cliff after 2/12/25, when SIMD 96 was activated.

Prior to implementation, 50% of Solana's priority fees were burned (accruing value to tokenholders)

After implementation, 100% of the priority fees are paid to validators.

That's where we stand today.

With that said, Jito is now planning to implement JIP 16, which will allow validators to share priority fees with stakers.

Yet another transfer of wealth, albeit market-driven, this time with valiators voluntarily opting into priority fee sharing.

This time, the value moves back to tokenholders (and to Jito via their 1.5% cut).

----

Takeaways:

1. Jito governance is effectively making decisions that can impact value accrual to *all SOL holders.*

(this is actually a good thing if you're a SOL holder)

2. Solana's YTD Net Dilution Rate is -5.04% (negative = dilutive to passive holders, positive = accretive to all holders via deflation).

*the transfer of wealth primarily impacts non-stakers, who are seeing more dilution due to less burned SOL

3. Ethereum's net dilution is a much more reasonable -.68% YTD.

It's my opinion that tokenholders care more about real yield (user value paid directly to them via staking) than burned tokens.

Therefore, if Solana effectively implements JIP 16, the real onchain yield for SOL holders should rise while burned SOL will likely continue on its current path (a win for stakers and a loss for non-stakers).

----

P.S. We're sharing a valuation framework for L1s through the lens of nation states, currencies, and FX on Friday with readers of @the_defi_report

If you'd like to have the latest research hit your inbox when it's published, you can sign up below 👇

h/t to @0xEekeyguy who's been COOKIN' on @Dune

If you'd like to have the latest research hit your inbox when it's published, you can sign up here:

5.87K

12

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.