How do you invest with everything going on between Israel and Iran? The simplest answer is usually the right one – energy, Gold, and Bitcoin. Check out my recent CNBC appearance discussing that alongside deregulation, and why The Free Markets ETF (Ticker: $FMKT), the first ETF specifically designed to capture value from deregulation—is allocated to all three. 🧵 (1/10)

Why $FMKT? Well, what if we told you regulation costs American businesses $2.1 TRILLION annually? That’s ~$15,000 per household. As these burdens lift, companies can unlock unprecedented value. $FMKT is your vehicle to capture this transformation. (2/10)

Manufacturing companies spend over $50,000 PER EMPLOYEE annually on regulatory compliance. Financial services, healthcare, and energy face similar burdens. When these costs decrease, margins expand dramatically. $FMKT targets these opportunities. (3/10)

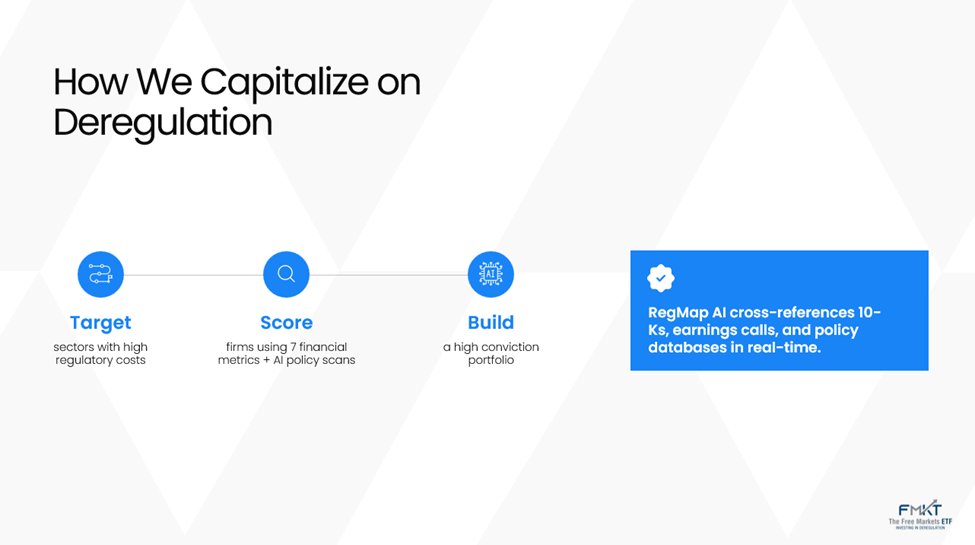

$FMKT employs our proprietary AI system that cross-references 10-Ks, earnings calls, and policy databases in real-time to identify companies specifically discussing regulatory relief opportunities—before the market fully prices them in. (4/10)

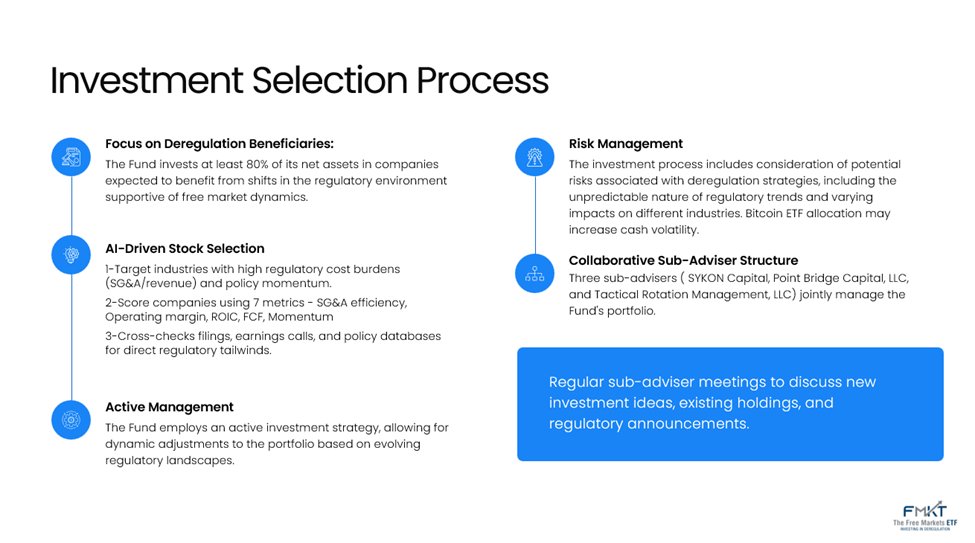

Our investment process is simple yet powerful:

1️⃣ TARGET sectors with high regulatory costs

2️⃣ SCORE firms using 7 financial metrics + AI policy scans

3️⃣ BUILD a high-conviction portfolio of 25-50 companies positioned to outperform (5/10)

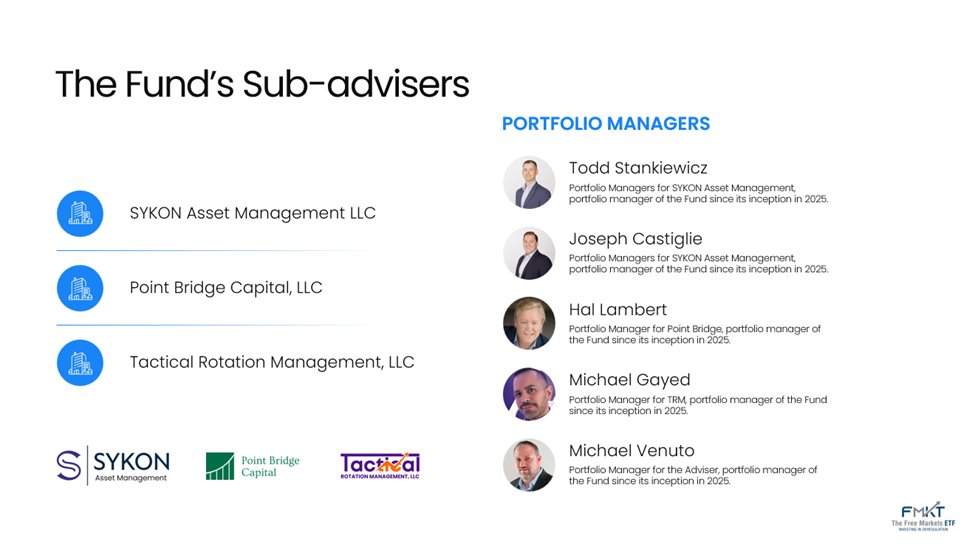

$FMKT brings together an elite team of specialized investment managers:

• SYKON Capital

• Point Bridge Capital

• Tactical Rotation Management

• Tidal Investments

Expertise in regulatory impact analysis across all market sectors. (6/10)

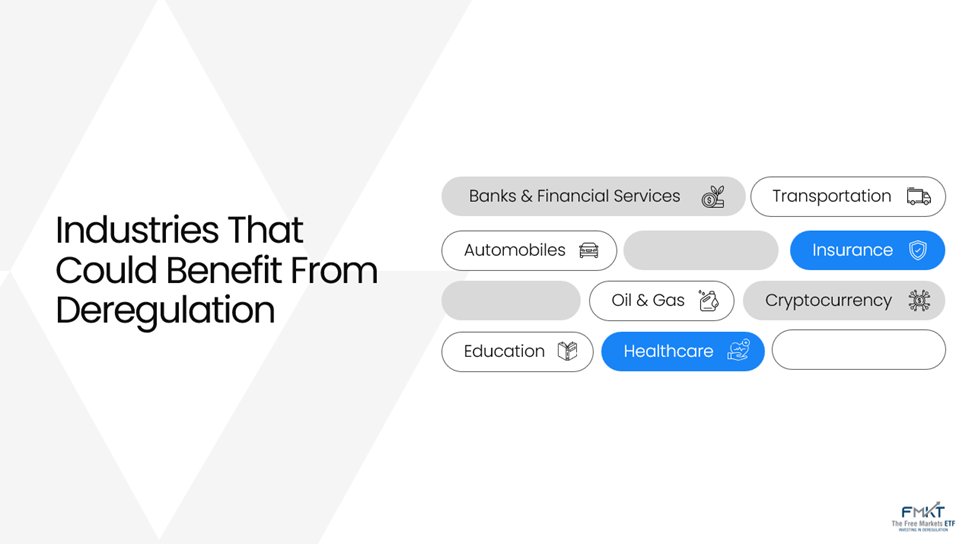

Key sectors $FMKT targets:

• Healthcare (CMS billing flexibility → higher facility utilization)

• Transportation (labor classification preserved → lower costs)

• Energy (streamlined permits → accelerated development)

• Financial services (reduced capital requirements) (7/10)

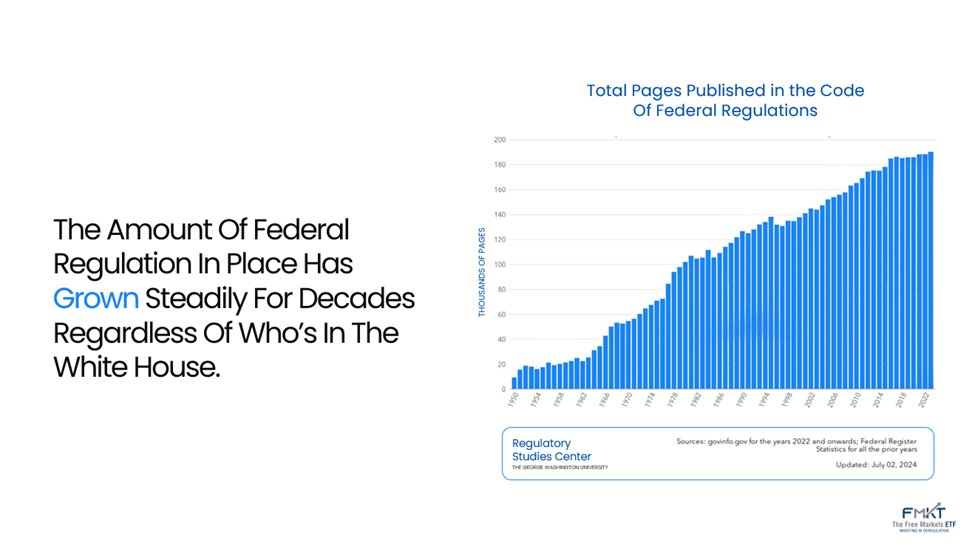

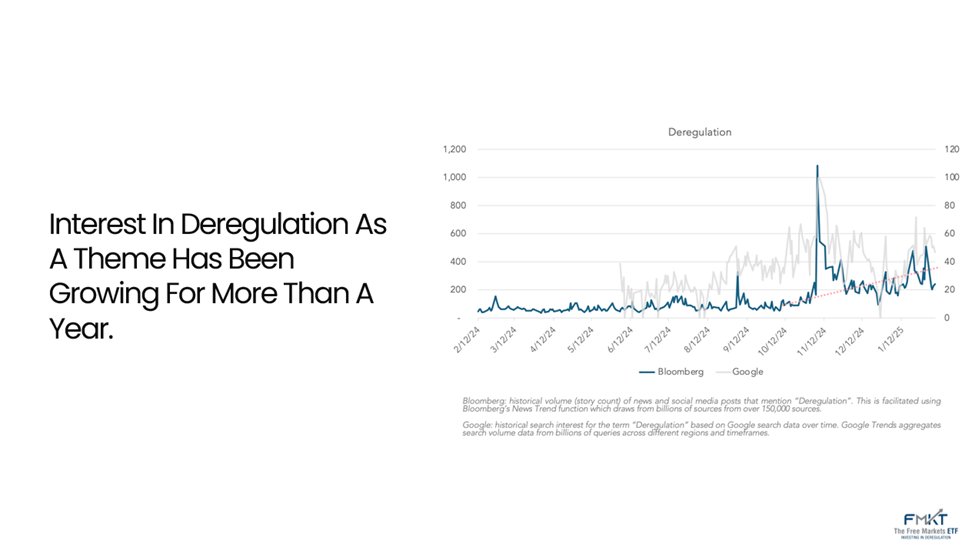

The regulatory landscape has expanded regardless of which party controls Washington. $FMKT is designed to potentially benefit from both existing deregulation initiatives and anticipated policy shifts across administrations. (8/10)

$FMKT can serve as:

• A strategic complement to broad market exposure

• Part of your thematic allocation targeting secular growth

• A differentiated approach to sectors like financials, energy, and healthcare

Available through all major brokerages. (9/10)

Learn more about $FMKT at .

$FMKT does not invest directly in crypto currencies or gold.

Link to current holdings: .

Lead-Lag Publishing, LLC is not an affiliate of Tidal/Toroso, Tactical Rotation Management, LLC, SYKON Capital, Point Bridge Capital, LLC or ACA/Foreside.

83.46K

91

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.