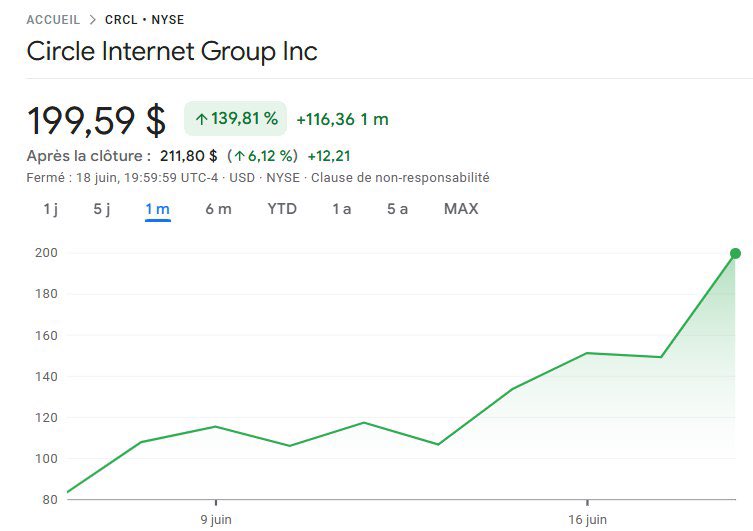

.@Circle (the USDC issuer) is ripping everything up on the stock market 💵. Its entry was sensational: with an IPO price of $31, the stock closed at $83 on the 1st day... and is now trading at more than $200

What for?

Because the planets align:

The support of solid institutions (BlackRock, Ark Invest), a regulatory framework that is becoming clearer at the right time in the USA 🇺🇸 (GENIUS Act) and above all still high key interest rates that boost profits from dollar reserves (which are the very basis of stablecoins)

The bet is simple: Circle is a regulated and publicly traded USDT. When you see Tether's revenues, you understand why investors are rushing to buy it

But this stock is more than just following the crypto market: it is creating a new class of securities in my opinion. Unlike techs, Circle is almost counter-cyclical

When the Fed raises rates → its revenues rise

When the Fed lowers them → they will automatically fall

In short, it's the opposite of most growth or tech assets: a crypto asset, but one that reacts differently to changes in rates.

An anomaly that attracts and balances a portfolio

Show original

106.74K

769

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.