Indeed. "Stablecoin" is a way to consolidate and increase the network effect of the US dollar.( aka Dollarization) , while most nations will then want to follow and then launch their own stablecoin, they will realise that it will not have the same effect VS usd(t/c). (Blindly copying will not yield the same effect)

This onchain USD stablecoin blurs the geo-economic borders, and could result in the weakening of their own local currency, as payments for good & services starts to move onchain without global physical borders.

In the end, they might then realise perhaps all of them moving to a single global neutral currency like Bitcoin might have been a better option, rather than being shifted across to "USD" which US will always have the seigniorage advantage and would print their way out of problems.

The only issue now is. When will all these nation states realise this ?

in singapore last year i gave a talk called "cryptodollarization". the idea is dollarization via stablecoins. now with the GENIUS act about to pass and bessent's comments about stables reaching $3.7T (!!) (13% of M3), i believe stablecoins are being unleashed as an economic weapon to dollarize the rest of the world and help reset the US fiscal position.

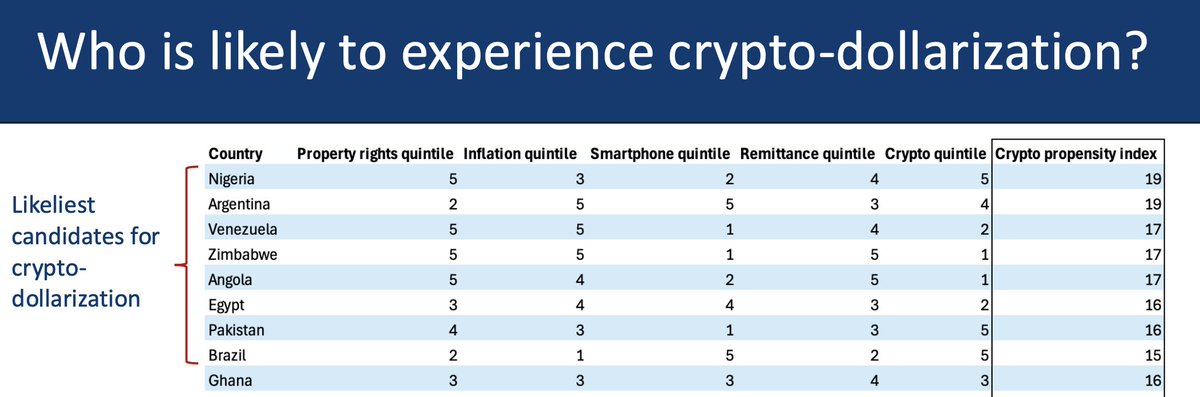

cryptodollarization has happened already, arguably in venezuela, argentina (partial), and nigeria (partial). i believe it's much more aggressive than conventional dollarization, which is often limited by availability of physical banknotes.

I believe that in a decade there will be many fewer sovereign currencies and most weak nations will be dollarized – not through USG intervention but by a spontaneous "bottom up" process (this happened in Ecuador in 99/20 as described by larry white). in effect consumers engage in currency substitution and force the government's hand.

stablecoins eliminate the power of borders in currency choice and allow network effects to actually take hold. this is why we see the dollar representing >99% of stablecoins but only 40-60% of international reserves and financial flows. stablecoins make currency substitution must faster and more aggressive, and they are also ~impossible to stop. in almost all cases where nation states have attempted to prohibit flows out of local FX into USD stablecoins, they have eventually relented.

in my talk I built a simple model to try and guess where these spontaneous crypto-dollarizations might occur (see the last couple slides).

i wanted to revisit this talk because these predictions have become much closer to reality in the last 12 months. the government is saying the quiet part out loud: stablecoins are an economic weapon to passively dollarize the entire planet.

slides:

video:

5

1.97K

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.