"Disenchantment Theory 4: VC is not superior"

VC, the full name is Venture Capital, also known as venture capital in Chinese. That is, investing on the basis of taking a certain degree of risk

There are two main types of VCs in the market: those that do well are called top investment institutions, and those that do not do well are called large retail investors

At the same time, the main work content of VC is divided into four aspects: fundraising, investment, management and withdrawal, of which fundraising and investment are pre-investment work, and management and withdrawal are post-investment work

The former is mainly to raise funds required by the institution, and spread all the funds into different projects (with KPIs) within a certain period of time; The latter is mainly to provide a series of services for the projects invested by the institution, and provide appropriate help and guidance, so that the follow-up projects can earn income when they exit after TGE

So what exactly is the situation and yield of the VC market?

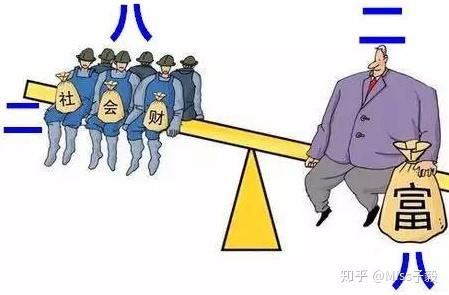

It's still the classic rule of 28, with 20% of the top institutions earning 80% of the gains in the primary market

The reason for this is that the top organizations are extremely competitive in all four areas mentioned above, while most VCs are usually only capable in one or two areas

Although VCs that only raise funds can obtain sufficient investment funds for investment, they have huge shortcomings in follow-up project tracking and various problem handling. This often results in institutions being very rich, but it is difficult to recover what they have invested in

It is generally difficult to see VCs who will only manage and retreat, and in most cases their funds are small, so even if they do a good job of retreating, their income is also capped

In addition, this round of the cycle does not have too much technological innovation in a substantive sense, but mainly revolves around asset issuance and distribution channels. This makes it difficult for the primary market to maintain a relatively normal investment environment in the past, prompting a large number of VCs to frantically huddle together and put themselves in the inner circle

In the end, the VCs in the core inner circle make money, and at worst, they don't make money or lose money; VCs who are not in the inner circle disappear into the continuous update and iteration of the market

Is this very similar to the current on-chain market?

Therefore, when researching a project, don't trust VC endorsements too much, unless you can distinguish which VCs are really powerful and which VCs are really large retail investors

Otherwise, it will be used as a low-priority reference, and it will depend more on whether the project itself has PMF, the prospect of the ecological track it is in, the background of team resources, and so on

Trust that you're doing better than most VCs for what you've put in your research, and the market will reward people for their insights

Let's disenchant VC together

"Disenchantment Theory 3: Be wary of the founder of the first startup"

Why does capital prefer to invest in serial entrepreneurs rather than first-time entrepreneurs?

The answer is simple, the probability of choosing a first-time entrepreneur is much greater

Let's start by talking about some of the advantages of serial entrepreneurs:

First, I have experience in the whole process of the project and know when to do something

The second is to know how to deal with investors

Third, if you have successful project experience, personal credit and endorsement will be very good

Therefore, Babylon, a leading bitcoin staking company, was very easy to raise funds in the early stage, relying on the personal experience and charm of the project founders

On the other hand, first-time entrepreneurs are most taboo to meet the following people:

➣ I don't know how to pretend to understand

➣ Don't take the lessons of those who came before you seriously

The former is especially evident in people who have switched careers in some traditional industries, who always rely on their own past experience and never want to be flexible to respond to market trends

So much so that whenever they want to do a big job, they end up being

The latter is similar to the novice who is new to trading, because investors have been exposed to a large number of projects and participated in many project processes, so they are more useful for solving some problems in the process of project development

But first-time entrepreneurs will have an obsession in their hearts, and they will default to their own way of dealing with it is the best solution. So much so that it took a lot of time and effort to try, and in the end, the solution provided by the investor was the simplest and most efficient

Many first-time projects are in the process of trying, because the money is burned out, and there is not enough cash flow to sustain the project

Based on this, when we are researching a first-time start-up project, we need to focus on the following two points:

➣ Whether the founding team has sufficient awareness and understanding of the market. It's great if there's some irreplaceable past project experience, like Huma

➣ Whether the founders are "obedient" or not. One is to listen to the suggestions of investors, and the other is to listen to the feedback of community members

If I don't have both, all I can say is "Good luck with it!" ”

100.65K

37

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.