WLFI and Binance promote ecological binding, which "Trump Yangmou" concept coins are worth paying attention to?

Original author: Zhouzhou

On May 22, 2025, the market wind continued to rise, Bitcoin Bitcoin broke through a record high of $110,000 in one fell swoop, and in the context of the passage of the "GENIUS Act", an "unexpected" stablecoin USD 1 quietly became the focus of the market.

According to official information, Binance will officially launch the USD 1/USDT trading pair at 20 o'clock today, becoming the third mainstream exchange to support USD 1 after HTX and MEXC. With the strong exit of USD 1, the market has also ushered in a wave of "dollar hot money + Trump label" linkage.

On the list of gainers, the performance of the tokens with the dual blessing of "WLFI concept + USD1 concept" is particularly eye-catching. HAEDAL soared 69.45%, LISTA rose 60%, COOKIE soared 33.37%, STO quickly rose more than 20% after the official announcement of WLFI's integration, and B (BUILDonBsc_AI) on the Binance Alpha platform soared 192% in a single day.

WLFI officially announced that it supports USD 1 and buys token B, and some people in the community believe that USD 1 may become the "new king of the stablecoin war", or even replace FDUSD as Binance's main stablecoin. USD 1 is not only backed by the strong backing of the Trump family, but also through a deep bond with Binance.

Under the dual aura of politics and business, USD 1 seems destined to be ordinary.

This wave of "USD 1 fever" has made investors smell the alpha opportunity, how can USD 1 break through with "political capital + exchange binding"? How will WLFI take advantage of the opportunity to build a new ecological highland with Binance? What other "Trump Conspiracy" concept coins are worth paying attention to?

USD 1

is a USD-anchored stablecoin issued by World Liberty Financial (WLFI) in March 2025, with a target of 1:1 exchange for US dollars, and the assets behind it are 100% backed by short-term US bonds, US dollar deposits, etc., and the custodian is BitGo Trust Company. With the strong endorsement of the Trump family, co-founders include Eric Trump, USD 1 has brought its own traffic since its launch.

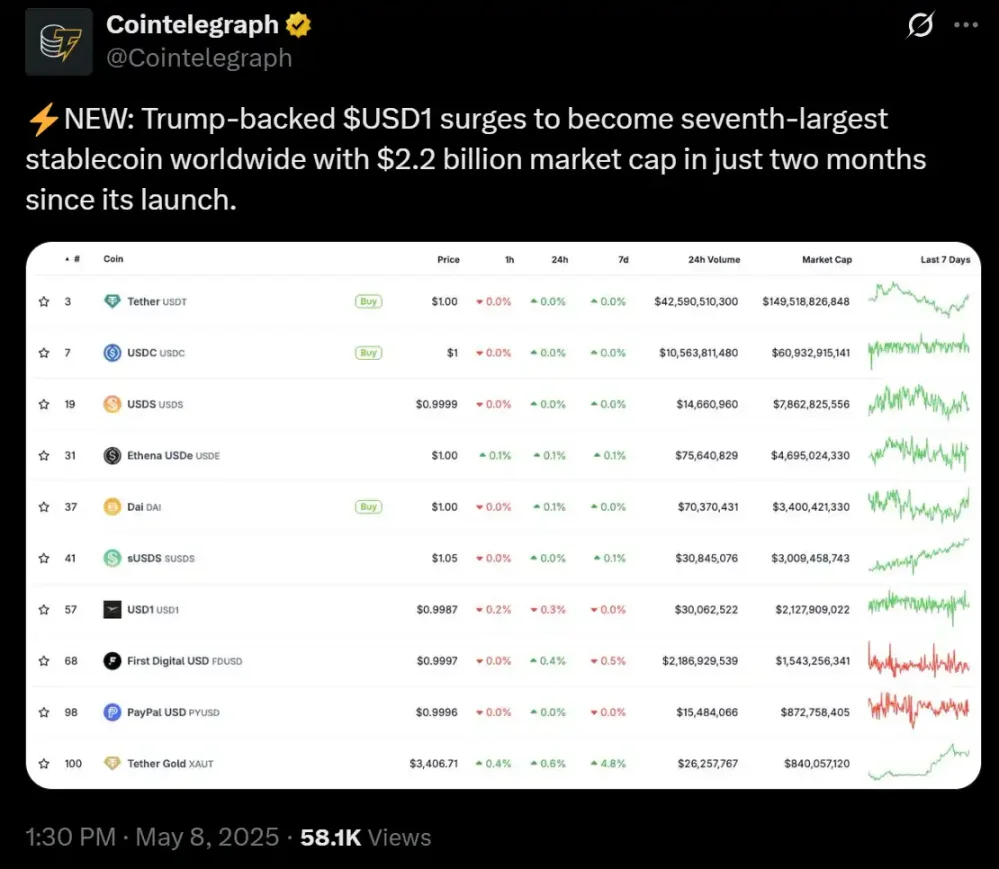

In just two months, the USD 1 market cap soared from $128 million to $2.1 billion, making it one of the top seven stablecoins in the world. It accounts for up to 90% of the circulation on the BNB Chain and was first listed on mainstream exchanges such as HTX.

It also completes multi-chain deployments through Chainlink's CCIP protocol, which currently supports Ethereum and BNB Chain.

The USD 1 buzz continued to heat up in May, prompting MGX Abu Dhabi to inject $2 billion into Binance through USD 1, as well as introducing a zero-fee policy on BNB Chain.

Some users have even speculated that Binance is "testing the waters" of USD 1 through the Alpha platform, intending to make it the core stablecoin of BNB Chain.

Behind this wave of USD 1 detonation, the most eye-catching is a series of potential projects branded "Trump".

Under thehottest targets of the "Trump Scheme" concept

, let's take a look at a few of the "Trump Concept" targets that are currently the hottest in the market.

Binance Alpha Ecological Token

B (BUILDonBsc_AI)

B Token was listed on Binance Alpha on May 21, soaring 192% in a single day, with a trading volume of $80 million.

The project focuses on the combination of AI and blockchain, and will launch a prediction market function in the future. Binance has officially promoted B on the X platform many times, and Eric Trump mentioned the combination of USD 1 and emerging tokens in Consensus 2025, which also indirectly increased the popularity and trust endorsement for B.

HAEDAL HAEDAL

, THEWLFI ECO-TOKEN

, ROSE 69.45% ON MAY 22, HAEDAL IS CONSIDERED AN EARLY PROJECT OF THE WLFI ECO-GEN, AND THE COMMUNITY CALLED HAEDAL A "DARK HORSE OF THE WLFI CONCEPT", AND THE DISCUSSION WAS HOT.

LISTA

LISTA rose 46.62% on May 22nd, WLFI reached a strategic partnership with Lista DAO, and USD 1 is now live on the ListaDAO vault, benefiting from the multi-chain deployment of USD 1. LISTA focuses on decentralised lending, and if the WLFI ecosystem expands, its liquidity will be significantly improved, and the community considers LISTA to be "the long-term target of the WLFI concept". Lista Lending, a Lista DAO lending product, has launched USD 1 Vault, which is the first

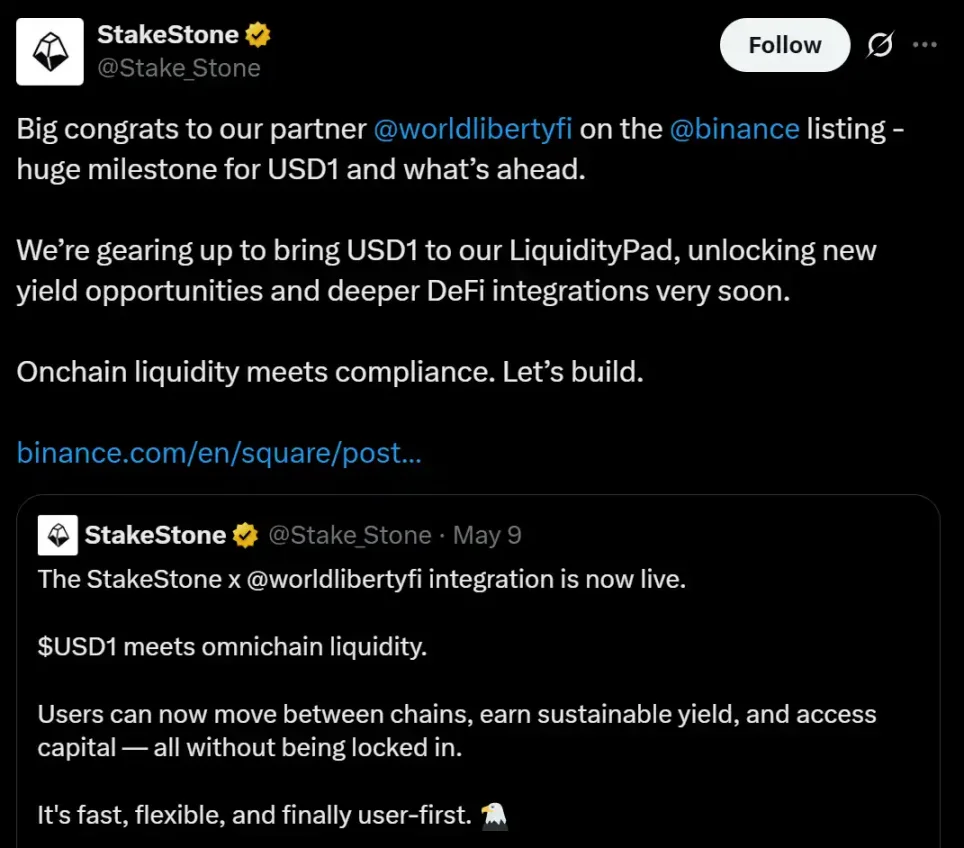

STO (StakeStone)

application of USD 1 on BNB ChainStakeStone saw a 20% increase on May 22 after announcing the completion of its integration with WLFI. The official release plan is based on STONE and USD 1 to create a more flexible cross-chain revenue experience. As an infrastructure focused on full-chain liquidity, StakeStone has integrated 20+ chains and 100+ protocols, and its yield token STONE can improve asset utilisation for USD 1 users while retaining liquidity. At present, although only the official announcement of cooperation, there has not been a large-scale purchase.

COOKIE

AS AN ENTERTAINMENT TOKEN IN THE WLFI ECOSYSTEM, ON MAY 22, 2025, THE COOKIE INCREASED BY 33.37% IN A SINGLE DAY. THE PROJECT TEAM PLANS TO LAUNCH COOKIE-BASED NFT GAMES IN THE FUTURE TO ENHANCE USER INTERACTION AND TOKEN UTILITY, AND FURTHER ENRICH THE ENTERTAINMENT AND METAVERSE LAYOUT OF THE WLFI ECOSYSTEM.

The USD 1 related meme coins

USD 1 DOGE and WLFIDOGE

USD 1 DOGE skyrocketed 10x on May 21, 2025, with their market cap soaring from $130,000 to $6 million. In just 10 days, it has risen nearly 5 times. Due to the direct use of USD 1 in the name, the market generally regards USD 1 doge as one of the representatives of the concept of "Trump's impotent".

In addition, community netizens believe that USD 1 doge is one of the first tokens on the BSC chain to support the USD 1 trading pair, which is earlier than the B token on Binance Alpha. USD 1 DOGE and another token, WLFIDOGE, also saw a sharp rise on the news of the USD 1 launch.

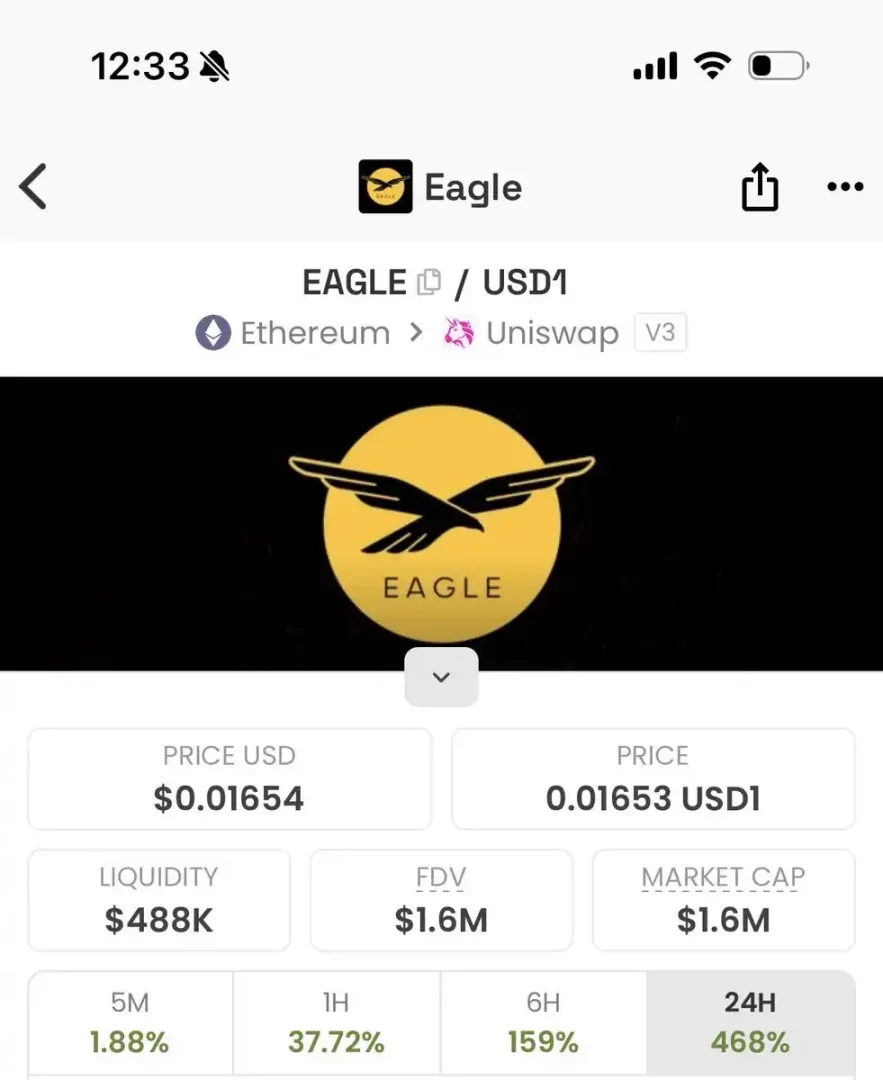

EAGLE

EAGLE is the first USD 1 token on the Ethereum chain, and has recently performed well in the USD 1 trading pair, with short-term gains of 50% to 70%. However, because it runs on the Ethereum chain rather than the more active BSC chain, the speed of capital follow-up is relatively slow, and it is difficult to quickly attract a large amount of speculative funds in the short term.

from Binance Alpha's B (up 192%), to WLFI's HAEDAL (69.45%), LISTA (46.62%), and then to the 10x take-off of the meme coin usd 1 doge, the market boom shows the strong driving effect of USD 1.

However, regulatory uncertainty and market volatility in USD 1 remain a source of vigilance. Investors should pay attention to Binance Alpha dynamics and X community discussions, seize the alpha opportunities in the "Trump Scheme" craze, and do a good job of risk management.