Why Traders Are Turning to dYdX for BTC and ETH Perpetuals: Report

Key Insights:

- dYdX Chain reaches 267 perpetual futures markets with instant listing capabilities.

- Bitcoin and Ethereum account for 80% of $200 million open interest total.

- Platform combines order book performance with on-chain transparency benefits.

Cryptocurrency traders increasingly turn to dYdX for perpetual futures trading as the platform expands market offerings and improves infrastructure.

The decentralized exchange combines centralized venue performance with blockchain transparency while maintaining dominant positions in Bitcoin and Ethereum derivatives markets.

dYdX Expands to 267 Markets Through Instant Listing

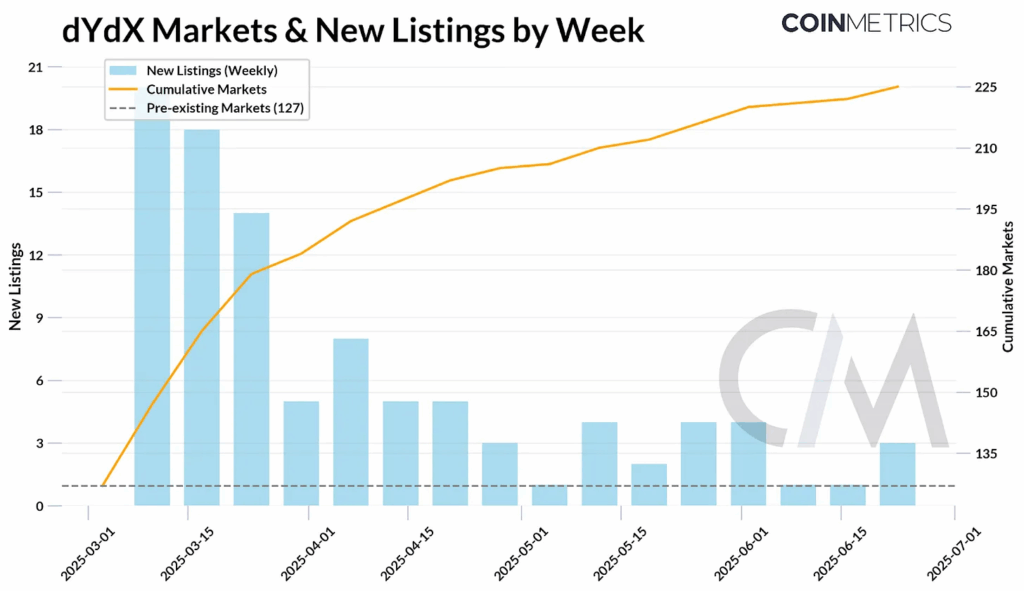

As of the latest report by analyst Tanay Ved, dYdX has expanded its perpetual futures market services from 127 markets to 267 markets. With the introduction of quick market listings in late 2024, dYdX Unlimited made it possible for anybody to produce and trade perpetual futures on any asset without the need for governance approval procedures. This expansion comes after that launch.

The instant listing capability addresses a core advantage of perpetual futures DEXs by providing breadth and accessibility across diverse cryptocurrency assets. Traders gain exposure to large-cap tokens and long-tail assets through streamlined market creation processes that bypass traditional listing requirements.

dYdX launched MegaVault, a master USDC liquidity pool where users lock USDC to provide day-one liquidity for new listings. This infrastructure provides instant trading volume for new listings prior to organic liquidity build-up stages.

The new listings in markets are SRYUP-USD, FLR-USD, and DAI-USD. The exchange caters to various categories such as Layer-1 protocols, DeFi tokens, memecoins, and artificial intelligence projects.

Market diversity enables investors to articulate investment opinions in different stories and sectors. As well, on a timely basis as opposed to conventional centralized exchanges with slower approval procedures. The wider market offers access to blue-chip assets and new coins in the same trading platform and interface.

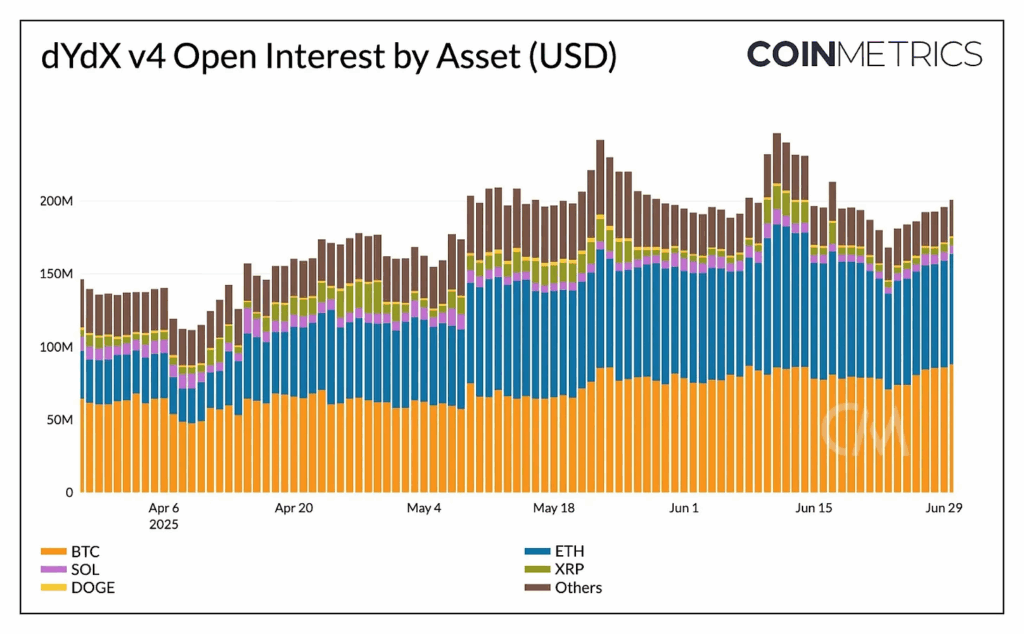

Bitcoin And Ethereum Rule $200 Million OI Concentration

Bitcoin and Ethereum markets maintain the dYdX exchange’s trading volumes in check. With the biggest chunk of perpetual futures daily volume across Q2 2025. The two assets account for 80% of the overall open interest of $163 million on dYdX. Up from 66% valued at $93 million at the end of Q1 when other assets captured market share.

Open interest hit $200 million in Q2, with BTC perpetual futures alone seeing over $65 billion in weekly trade in the overall cryptocurrency derivatives market. Such volume overwhelms options and spot trading and demonstrates perpetual futures as the vehicle of choice.

While the number of long-tail markets available on dYdX is still growing, most have little trading volume and are only available to provide short-term or cyclical volume boosts and not long-term liquidity.

The trend is that dYdX usage remains focused in its most liquid markets, which are Bitcoin and Ethereum derivatives. Although the platform offers trading on 267 different perpetual futures markets, trading is centered on assets with existing market demand and institutional participation.

Market breadth provides options for participants willing to gain exposure to various cryptocurrency sectors. Concentration of volume in BTC and ETH markets, however, indicates that they remain leading drivers of platform activity and revenue streams.

DYDX Token Secures Network While Incentivizing

The DYDX token is the natively released token of the Cosmos-based dYdX Chain, initially developed as an Ethereum-based utility token to execute a range of foundational activities in the ecosystem.

Token holders who stake DYDX with validators are: granted governance voting rights on software updates, fee changes, market additions, and treasury spending with voting power based on staked size.

DYDX stabilizes the dYdX Chain with delegated proof of stake consensus in which validators and delegators stake tokens as an incentive to receive rewards in the form of protocol fees in USDC trading fees. The staking functionality offers returns to token holders taking part in consensus activities to secure the network.

Trading incentives create surplus utility via DYDX-denominated rewards that are returned to users for profitable trades. Up to 90% of trading costs may be reimbursed to traders based on volume as DYDX incentives, and the awards are distributed proportionately based on net USDC-paid trading fees.

The post Why Traders Are Turning to dYdX for BTC and ETH Perpetuals: Report appeared first on The Coin Republic.