USDe plans to have 25 billion in circulation, will Ethena become a new financial hub?

Written by: Ponyo : : FP, FourPillarsFP Researcher

Compilation: Groove Little Deep

Editor's note: Ethena maintains USDe, a $5 billion stablecoin with a market capitalisation team, with a team of 26 people, hedging the volatility of assets such as ETH and BTC through a delta-neutral strategy, keeping the $1 peg while providing double-digit annualised returns. Its automated risk management and multi-platform hedging built a moat to successfully deal with market shocks and the Bybit hack. Ethena plans to drive 25 billion USDe in circulation through iUSDe, the Converge Chain, and the Telegram app, becoming a financial hub connecting DeFi, CeFi, and TradFi.

The following is the original content (the original content has been edited for ease of reading and comprehension):

Have you ever tried to ride a roller coaster while eating hot noodles? It sounds outrageous, but that's exactly what @ethena_labs does every day is the best metaphor for: it maintains a $5 billion stablecoin (USDe) that has always been pegged to $1, despite the volatility of the crypto market. And all this is made possible by a team of 26 people led by founder @gdog97_. In this article, we'll take a deep dive into Ethena's unique secrets, reveal why it's so hard to replicate, and explain how Ethena plans to push USDe into circulation to $25 billion.

Hedging billions of volatile

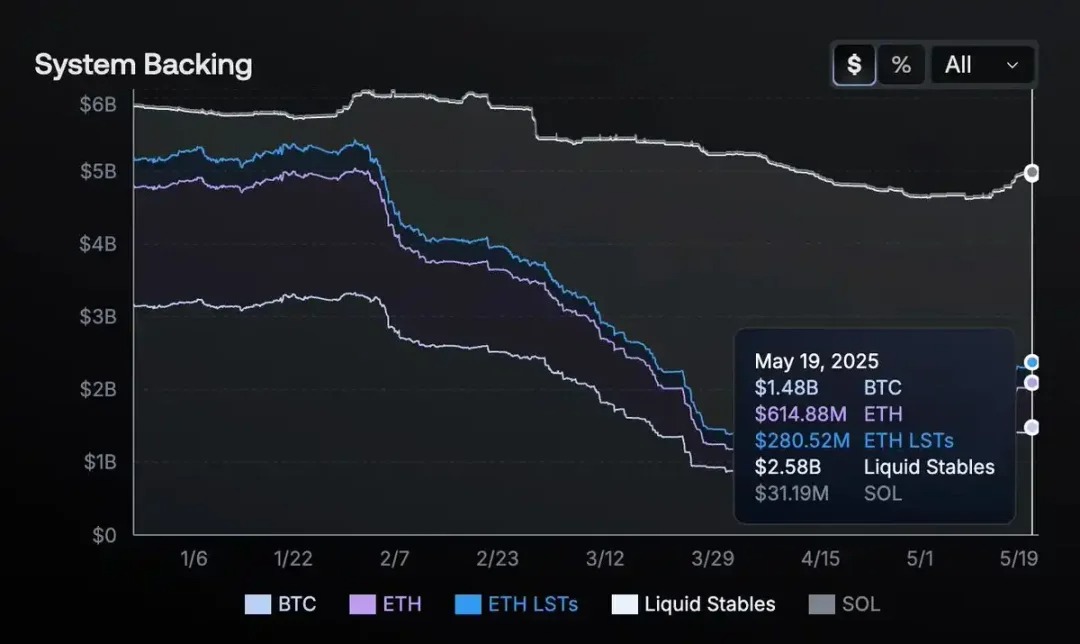

stablecoins looks boring on the surface: $1 is $1, right? But dig deeper into the inner workings of Ethena and you'll see that it's not that simple at all. Instead of backing stablecoins with U.S. dollars in the bank, Ethena has adopted a robust portfolio of assets, including ETH, BTC, SOL, ETH LSTs (liquid staking tokens), and $1.44 billion worth of USDtb (a stable asset backed by U.S. Treasuries). These assets are continuously shorted in the major derivatives markets to ensure that any fluctuations in the price of the collateral are offset by the corresponding profit and loss of the short position.

: Ethena Transparency Dashboard

If ETH rises by 5% and your hedge ratio is skewed, it could lead to tens of millions of dollars in exposure. If the market crashes at 3 a.m., the risk engine must immediately rebalance the collateral or close the position. Minimal margin for error. However, Ethena manages billions of daily hedges in the 2023-2024 roller coaster market without a single crash (no decoupling, no margin liquidation, no shortage of funds).

During the Bybit hack, Ethena remained solvent and did not lose any collateral. While a traditional hedge fund might require an entire floor of analysts and traders to handle this volatility, Ethena has managed to do so with a lean team and zero mistakes.

Within months of its launch, Ethena became the largest counterparty to a number of centralised exchanges. Its hedging transactions even affected liquidity and order book depth, but few noticed that stablecoins "just work".

About High Yields: Ethena offers double-digit annualised yields when the market is bullish. At first, this was reminiscent of Terra/LUNA and its 20% Anchor tragedy. But the difference is that Ethena's yield comes from real market inefficiencies (staking rewards plus positive perpetual contract funding rates, etc.), rather than minting tokens or unsustainable subsidies.

How Ethena's Delta Neutral Magic Works

When users deposit $1,000 in ETH, they can mint about $1,000 in USDe. The protocol automatically opens a short futures position. If the price of ETH falls, the short position makes a profit, offsetting the collateral loss; If ETH rises, the short loses money, but the collateral appreciates. The end result is that the net dollar value remains stable. At the same time, when the perpetual contract market is over-leveraged in the long direction, Ethena (holding short) can charge a funding fee, thus providing USDe with a double-digit APY under bullish conditions without the need for financial subsidies.

Ethena spreads these hedges across Binance, Bybit, OKX, and even some decentralised perpetual contract protocols to circumvent the risks and margin limits of a single exchange. A recent governance proposal revealed that Ethena plans to include Hyperliquid in its hedging portfolio, taking short positions in the most liquid markets. By diversifying short positions, Ethena reduces its reliance on a single platform, further enhancing stability.

: Ethena Transparency DashboardIn

response to the ongoing adjustments, Ethena deployed automated bots to work in tandem with the trading team (similar to a high-frequency trading system) to continuously rebalance the entire multi-platform ledger. That's why USDe stays anchored no matter how volatile the market is.

Finally, the protocol employs overcollateralization to deal with extreme declines and can suspend minting under unsafe conditions. Custodial integrations (Copper, Fireblocks) allow Ethena to control assets in real-time, rather than leaving them in hot wallets on the exchange. If the exchange goes bankrupt, Ethena can quickly withdraw collateral, protecting users from the catastrophe of a single point of failure.

Themethod of the sturdy moat

Ethena seems to be replicable on paper (hedging some crypto assets, charging funding fees, making profits), but in reality, the protocol builds a strong moat that deters copycats.

A key obstacle is trust and credit lines: Ethena hedges billions of dollars through institutional transactions with custodians and major trading platforms (Binance Ceffu, OKX). Most small projects do not have easy access to these institutions to negotiate minimum intra-exchange collateralization requirements for multimillion-dollar short positions, which requires legal, compliance, and operational institutional-grade rigor.

Equally important is multi-platform risk management. Splitting large hedges across multiple exchanges requires real-time analytics that rivals Wall Street's quantitative trading teams. Yes, anyone can replicate delta hedging on a small scale, but scaling up to $5 billion (and rebalancing huge collateral around the clock across multiple platforms) is another level. The required analytics, automation, and complexity of credit relationships grow exponentially with scale, and new entrants will hardly be able to catch up with Ethena's scale overnight.

At the same time, Ethena does not rely on perpetual free earnings. If the perpetual contract funding rate turns negative, it will reduce its short position and rely on staking or stablecoin yields. Reserve funds cushion periods of long-term negative funding rates, while many high-yield DeFi protocols collapse when music stops.

By not holding all collateral directly on a single exchange, Ethena further reduces counterparty risk; Instead, assets are stored in a custodian. If a trading platform is unstable, Ethena can quickly close the position and transfer the collateral off-exchange, ensuring minimal risk of catastrophic failure.

Finally, Ethena's performance in the face of extreme volatility cemented its moat. USDe has not seen a single decoupling or crash during months of intense market volatility. This reliability drives new user adoption, listings, and top-tier brokerage deals (from Securitize to BlackRock and Franklin Templeton), creating a snowball effect of trust that cannot be replicated. Talking about the gap between delta hedging and round-the-clock delivery on billions scale is what makes Ethena stand out.

TheRoad to 25 Billion

Ethena's growth strategy relies on a self-reinforcing ecosystem where the currency (USDe), the network (the "Converge" chain), and the exchange/liquidity aggregation evolve simultaneously. USDe was the first to launch, driven by crypto-native demand from DeFi (Aave, Pendle, Morpho) and CeFi (Bybit, OKX). The next phase involves iUSDe, a compliant version suitable for banks, funds, and corporate treasury. Even a small fraction of the vast bond market of traditional finance (TradFi) flows into USDe, potentially pushing stablecoins in circulation to 25 billion or more.

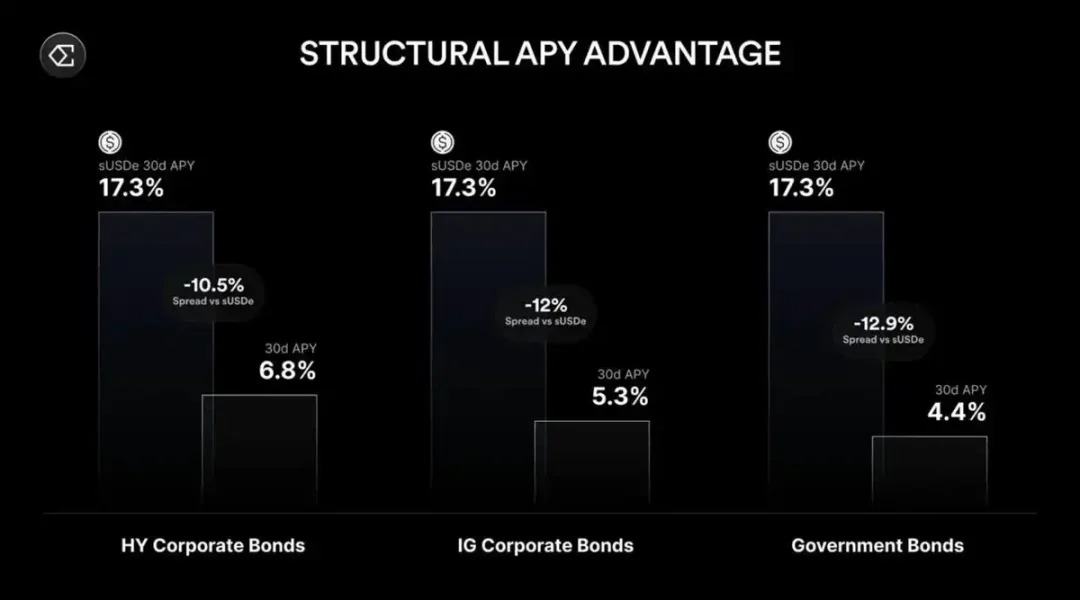

Driving this growth is the arbitrage between on-chain funding rates and traditional interest rates. As long as there is a significant yield gap, money will flow from the low-interest rate market to the high-interest rate market until it reaches equilibrium. As a result, USDe becomes a hub that connects crypto yields with macro benchmarks.

: Ethena 2025: Convergence

At the same time, Ethena is developing a Telegram-based app that will bring high-yield USD savings to regular users and hundreds of millions of users to sUSDe through a user-friendly interface. On the infrastructure side, the Converge Chain weaves together DeFi and CeFi tracks, and each new integration will bring cyclical growth to USDe's liquidity and utility.

Notably, sUSDe's returns are negatively correlated with real interest rates, with funding yields jumping from around 8% to over 20% when the Fed cut rates by 75bps in Q4 2024, highlighting how lower macro rates are fuelling Ethena's earning potential.

This is not a slow, phased progression, but a circular expansion: broader adoption enhances USDe's liquidity and earning potential, which in turn attracts larger institutions, driving further supply growth and a more solid anchor.

Looking ahead

,Ethena is not the first stablecoin to promise high yields or position itself as an innovative approach. The difference is that it has delivered on its promises, and USDe has remained firmly anchored at $1 despite the most violent shocks to the market. Behind the scenes, it operates like a high-level institution, shorting perpetual futures and managing pledged collateral. However, what ordinary holders experience is a stable, income-bearing dollar, which is simple and easy to use.

Scaling from 5 billion to 25 billion is not an easy task. Heightened scrutiny by regulators, greater counterparty exposure, and a potential liquidity crunch could introduce new risks. However, Ethena's multi-asset collateral (including $1.44 billion USDtb), robust automation, and robust risk management show that it is better equipped to cope than most projects.

Ultimately, Ethena demonstrated a way to navigate the volatility of the crypto market at a staggering scale using a delta-neutral strategy. It outlines a vision for the future: USDe will be at the heart of every financial sector, from DeFi's permissionless frontier, CeFi's trading desk, to TradFi's massive bond market.