USD1 ignites Binance summer: a Trump-backed crypto feast

By Oliver, Mars Finance

May 22, 2025, Bitcoin broke through an all-time high of $110,000 in one fell swoop, and the crypto market was boiling. However, Bitcoin's brilliance was only the beginning of this craze, and a stablecoin called USD1 quietly took center stage. USD1, a dollar-pegged stablecoin launched by the Trump family-backed DeFi project World Liberty Financial (WLFI), has sparked an eco-token after Binance announced its support for its trading pair. In just one day, the USD1-related token BUILDon skyrocketed by 480%, and USD1DOGE soared 10x, and the market sentiment was completely ignited.

Binance's "ignition": USD1 trading pair detonates the market

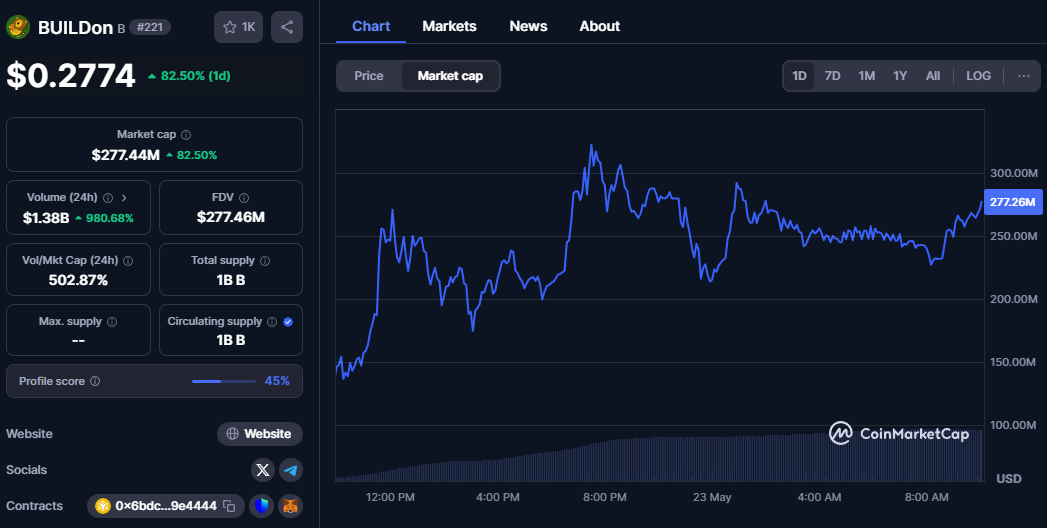

At8 p.m. on May 22, Binance officially launched the USD1 trading pair, becoming the third mainstream exchange to support USD1 after HTX and MEXC. This news was like a bombshell to the market, quickly detonating the price of USD1-related tokens. BUILDon (Token B) on Binance's Alpha platform bore the brunt, soaring 480% in six hours, a 192% increase in a single day, and a record market capitalization of more than $220 million. In the community, investors are excitedly discussing: "USD1 is going to take over FDUSD and become Binance's new favorite!"

BUILDon is not alone. USD1DOGE, a USD1-pegged meme coin, achieved a staggering 10x increase in 24 hours, soaring from $130,000 to $2 million in market capitalization, and although it has since fallen back to $730,000, its performance is still jaw-dropping. Another token, EAGLE, is not to be outdone, as the first USD1-related project on the Ethereum chain, it rose by 1067% in a day, and its market value once touched $3.74 million. Tokens such as LISTA and STO also performed well, rising 46.62% and 20% respectively, and the market's confidence in the "WLFI concept" and "Binance system" projects was quickly pushed to a high point.

The immediate trigger for this craze was Binance's support for USD1. Launched by WLFI in March 2025, USD1 is positioned as a 1:1 USD-pegged stablecoin, with reserve assets 100% backed by short-term U.S. Treasury bonds and U.S. dollar deposits, and custodians by BitGo Trust Company. With the strong endorsement of the Trump family, co-founder Eric Trump's involvement allows USD1 to bring its own traffic. In two months, its market capitalization soared from $128 million to $2.1 billion, making it one of the top seven stablecoins in the world. What's more, USD1 accounts for up to 90% of the circulation on the BNB Chain, and Binance's launch of the trading pair has undoubtedly injected new vitality into this ecosystem.

Hot Money Rush: The Catalytic Effect of the Trump Label

The rise of USD1 is not accidental, it is behind the double blessing of "dollar hot money + Trump label". In early May, Abu Dhabi investor MGX injected $2 billion into Binance through USD1, an event that not only boosted USD1's market capitalization, but also showed the market its strong resource integration capabilities. Binance founder Changpeng Zhao publicly stated on May 16 that the investment was made entirely through USD1 and had nothing to do with the TRUMP meme coin that was hyped in the market. This statement further justified USD1 and made investors look forward to the deep binding of Binance to USD1.

What's even more striking is that there is a deeper geopolitical layout behind USD1. On May 23, the Wall Street Journal, citing people familiar with the matter, reported that Trump's Middle East envoy, Steve Witkoff, had flown to the UAE a month before Trump's inauguration to discuss geographical issues and participate in a crypto-themed conference. His son, WLFI founder Zach Witkoff, compared Trump to the "godfather" when pitching to crypto companies and declared that WLFI would take full advantage of the increasingly lax crypto regulations in the United States. Not only that, but Zach Witkoff also visited Pakistan to meet with top government officials and floated the idea of using blockchain technology to "tokenize" the country's rare earth minerals — just weeks before the officials began negotiations with the Trump administration on a ceasefire between India and Pakistan. It was Binance founder Changpeng Zhao (CZ) who helped WLFI connect some of its overseas trips, even though a WLFI spokesperson clarified that CZ was only a friend of Zach, not a "middleman". In addition, the WLFI team is also in discussions with companies in the Gulf region about token purchases, suggesting that such deals could help them expand in the United States, but this claim was denied by a company spokesperson. This series of actions shows that USD1's ambitions go far beyond the stablecoin market, but try to open up new horizons through the deep integration of crypto technology with geopolitics.

In the community, there is speculation that Binance is "testing the waters" of USD1 through the Alpha platform, with the intention of making it the core stablecoin of BNB Chain. After all, USD1 has already been deployed on multiple chains through Chainlink's CCIP protocol, spanning Ethereum, BNB Chain, and Tron Chains, and its ecosystem is expanding at an astonishing rate. WLFI co-founder Zack Witkoff revealed on May 1 that USD1 will be natively deployed on the Tron chain, a decision that is closely related to the investment of Tron founder Justin Sun. As the largest individual investor in WLFI, Justin Sun invested $75 million, and his influence has undoubtedly contributed to USD1's multi-chain layout.

The carnival of ecological tokens: the

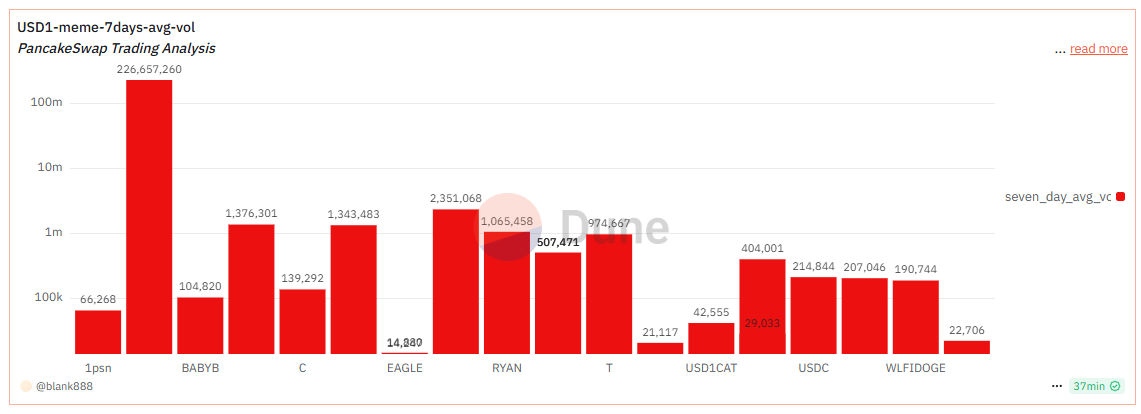

coexistence of opportunities and bubbles The launch of the USD1 trading pair not only ushered in a skyrocketing price of tokens in the Binance ecosystem, but also allowed investors to smell alpha opportunities. Take BUILDon as an example, the token that was fairly launched through the Four.meme platform, which was originally just a mascot to promote BSC's building culture, but became the focus of the market due to the support of WLFI and the USD1 boom. PancakeSwap data shows that BUILDon has a 7-day trading volume of $220 million, far exceeding other tokens, and its 7-day average number of transactions has reached 27,487.9, showing that the market is highly concerned about it. WLFI officially announced the purchase of B tokens and the start of the USD1 construction plan, which was seen as an important signal of the USD1 ecosystem and quickly ignited the enthusiasm of investors.

At the same time, protocol tokens partnering with WLFI are also being chased by the market. Lista DAO's token, LISTA, rose 46.62% on May 22 with the listing of USD1Vault on its lending product, Lista Lending, providing the first use case for USD1 on BNB Chain. StakeStone's token, STO, is up 20% due to its planned integration with USD1, and its cross-chain yield product provides USD1 users with higher asset utilization. These collaborations not only enhance the usefulness of USD1, but also bring flow and funding to related projects.

However, under the boom, the shadow of the bubble also looms. The prices of usd1doge and EAGLE have fallen sharply in a short period of time, showing the intensity of speculation in the market. In the community, some people excitedly discussed "the next 10x coin", and some people calmly reminded that "this kind of surge is often short-term, and chasing high risks is not small." Indeed, while the token boom within the USD1 ecosystem presents opportunities, its sustainability remains to be seen.

USD1's ambition: From a payment tool to the core of the ecosystem,

USD1's success lies not only in the boom of trading pairs, but also in the full flowering of its ecological construction. It has integrated with more than 10 DeFi protocols, including Venus Protocol, Meson Finance, and Pyth Network, among others, covering multiple areas such as lending, cross-chain transactions, and oracle services. In terms of consumption scenarios, USD1 also shows strong expansion capabilities. TokenPocket, HOT Wallet, and Umy, a decentralized wallet, and Umy, a Web3 travel platform, all support USD1, allowing users to book more than one million hotels around the world. Pundi X, a payment ecosystem, is also fully connected to USD1, laying the foundation for its application in retail scenarios.

According to WLFI co-founder Zach Witkoff, USD1's goal is to provide institutional customers with a secure and efficient cross-border payment tool, and will also integrate with traditional retail POS systems in the future. Such a vision is reminiscent of USDT and USDC's path to success. However, USD1 still has a long way to go to challenge the "Big Two" of the stablecoin market. The transparency of its reserve assets and the stability of its anchoring mechanism need to withstand market tests, and the political risks posed by the Trump label cannot be ignored.

Summary

:The rise of USD1 has injected a shot in the arm into the Binance ecosystem and brought a new narrative to the crypto market. From the skyrocketing price of BUILDon to the linkage of LISTA and STO, the market's pursuit of the "Trump concept" is setting off a wave of enthusiasm. For investors, alpha opportunities in the USD1 ecosystem may be lurking, but high returns often come with high risks. In this crypto feast, it is especially important to stay calm and rational. Can USD1 gain a foothold in the stablecoin market and even challenge the position of USDT and USDC? The craze sparked by the Trump family's endorsement may be just the beginning of the story.