StakeStone's DeFi 3.0 play: "UnionPay + Alipay" in the crypto world makes the industry say goodbye to "internal friction"

Author: Ice FrogIn

the crypto world, liquidity determines everything, without sufficient liquidity, no matter how good DeFi is, it is only a "backwater" and cannot really play its value, and with the continuous expansion of the public chain ecology, the separation of capital liquidity between chains has become the biggest obstacle to the development of the industry.

StakeStone has accurately hit the pain point of this industry, trying to become the "UnionPay + Alipay" of the crypto world, building a full-chain liquidity infrastructure, allowing funds to flow freely between different public chains, and bidding farewell to the liquidity dilemma of fragmentation, inefficiency, and involution.

It can be said that StakeStone is trying to build a financial infrastructure in the DeFi 3.0 era, so that the entire blockchain industry can bid farewell to the meaningless battle for liquidity and truly enter a new era of free flow of funds.

Below, I try my best to use the most popular language to give an analysis of this project:

1. StakeStone's positioning: the game-breaker of the full-chain liquidity infrastructure

1.1 Pain points and solution

industry pain points:

liquidity segmentation, single income, and different benefits of the new old chainThe

current blockchain cross-chain transfer requires complex operations and high fees. The full-chain technology is a bridge to open up these islands, so that money can flow freely, and you can use whichever chain you want;

From the perspective of cross-chain liquidity, there are currently cross-chain liquidity fragmentation (for example, it is difficult for BTC to participate in DeFi), a single income strategy (token incentives are not practical and unsustainable), and it is difficult for emerging chains to start cold. More popularly, the main thing is that the following three points

1⃣ of money are "carded" on a chain and cannot be moved. For example, Bitcoin can only lie on the Bitcoin chain, and ETH can only be used in DeFi on the Ethereum chain.

2⃣ The new chain is not used, and the old chain is too crowded. For example, when the new public chain was first launched, no one saved money, and the old chain (such as Ethereum) overflowed funds but had low returns.

3⃣ Earnings are unsustainable. Many projects attract users with high token rewards, and once the tokens are stopped, the funds are immediately withdrawn.

StakeStone's solution: three core products to solve the full-chain liquidity allocation

1⃣STONE (interest-bearing ETH): aggregate multi-chain ETH liquidity and dynamically optimise the yield strategy.

2⃣SBTC/STONEBTC (Full-Chain BTC and Interest-Bearing BTC): Unify the BTC liquidity pool and activate the DeFi value of BTC.

3⃣LiquidityPad: Connects the flow of funds between Ethereum and emerging chains to achieve two-way value capture.

1.2 The uniqueness of the StakeStone solutionIf

the uniqueness of the StakeStone solution is clarified, it can be compared with the "Alipay + UnionPay" complex in the crypto world.

1⃣ Alipay-level experience

STONE: Like the Yue Bao in Alipay, you can automatically earn interest when you deposit ETH, and you can also spend cross-chain at any time.

SBTC: Like a "digital gold credit card", BTC can also earn income and can also be swiped everywhere.

LiquidityPad,a UnionPay-level network, can open up the capital pools of all chains, so that new chains can quickly "attract investment" and old chains can "go to the countryside for poverty alleviation". 2⃣

With the addition of the above products and experiences, for users, it is basically possible to manage the money of all chains in one account and earn income while lying down; It can also make Bitcoin an interest-bearing asset.

For the industry, on the one hand, it helps the new chain to accelerate the cold start, and attracts funds with real income; On the other hand, end the liquidity civil war and internal friction, so that money can flow freely in the whole chain, which chain is easy to use.

For the current currency circle, liquidity is the lifeblood of all products, and money is dead if it doesn't move. StakeStone's full-chain liquidity protocol essentially does nothing more than three things:

repair liquidity pipelines so that asset pools of all chains can be seamlessly linked; Build a liquidity pump, so that the money is automatically pumped to the chain with high returns (such as the new chain); Unify the standard and let the assets of different chains flow under one standard. Let the money flow smoothly between the blockchains. Ordinary users can earn income without brains, and the industry can completely bid farewell to fragmented internal friction, which is the real value of the full-chain liquidity narrative.

2. Analysis of the dual-token model: one work, one

dividendsStakeStone recently released a whitepaper on its protocol, and also pioneered the use of two Token models (sto and vesto).

This dual-token model is worth analysing, as it epitomises the project's intention to use this model to solve the current DeFi casino model and transform it into a partnership model, which may indicate the project's long-term strategic ambitions.

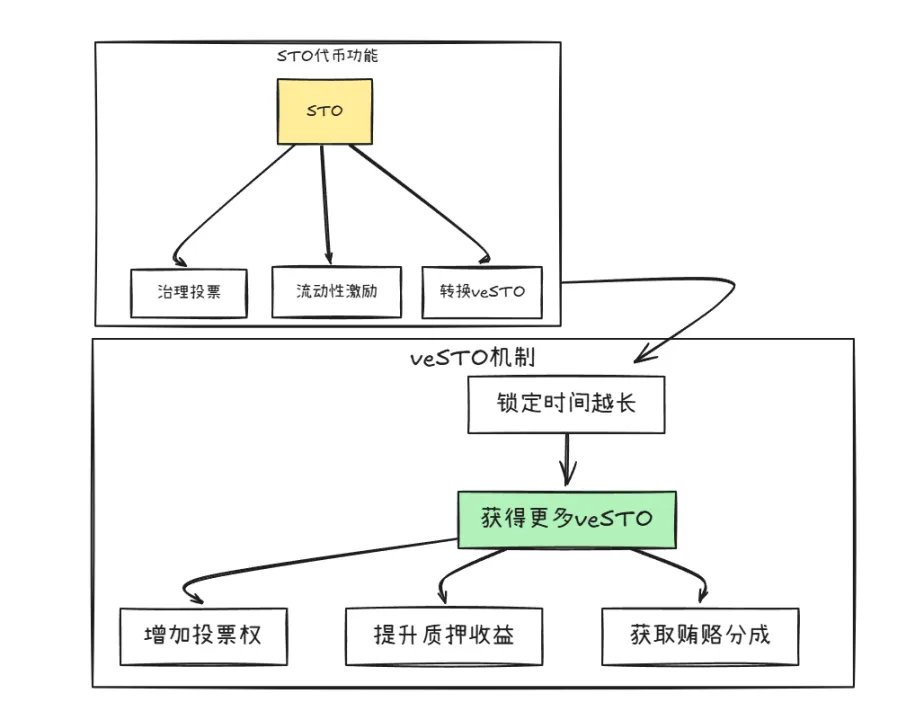

dual tokens as shown above, STO and veSTO, there is a conversion mechanism between the two, but the functions are different:

1⃣STO: The main function of the working token

is: governance voting, and holding STO can vote on the direction of project development (such as which chain to support first). Rewards, the project uses STOs to reward users who provide liquidity (such as those who deposit ETH to earn interest). Fees are charged, and the platform takes a cut of each transaction and distributes it to the holders with STO.

In addition, it is particularly worth mentioning that although STO is a working governance token, it has its own deflationary mechanism, and other projects must buy STO and burn it if they want to use the liquidity of StakeStone.

2⃣veSTO: Dividend tokenThis

token is mainly exchanged for veSTO by locking STO (similar to a deposit period). With veSTO, you automatically have three privileges, more voting power, and you can decide which pool the STO reward will be sent to; More holding income, when saving money to earn interest, veSTO holders' income doubles; There are more opportunities to receive red envelopes, and other projects will send "bribes" to veSTO holders (such as directly dividing ETH) in order to attract funds.

In addition, in order to prevent running away immediately after holding, veSTO is set to 30 days to unlock to prevent large investors from smashing the market.

This dual-token model does not seem to be complicated, but the entire design is basically aimed at the current industry pain points.

1⃣ In the past, users basically ran with one shot, and sold tokens after earning them, and the price of the currency fell endlessly; Now it is through veSTO lock-up, which indirectly prompts users to change from speculation to long-term floating, and the more they earn, they have to lock in and reduce speculation.

2⃣ In the past, the project team threw money crazy in order to start quickly, but no one used the pool; Now it's the veSTO holders who decide where the money goes, in other words, the community where the money flows has the final say.

3⃣ In the past, there was an unlimited issuance of project tokens, and some evil project parties were added at will; Now other projects want to use StakeStone's liquidity? Buy STO first and burn it! The more people use it, the more scarce STOs become.

From the above token design, the intent of the project can be clearly seen, and through the clever design of the token model, users and project parties can become a community of interests - the longer you participate, the more you earn, and you can still be the master.

3. Valuation and Earnings Potential: Points, Airdrops, and Ecological

Dividends3.1 Project Valuation Analysis

From the perspective of track valuation benchmarking, the current top projects of liquidity pledge protocols, such as EtherFi (FDV $820 million) and Puffer (FDV $250 million), generally fall in the range of $200 million to $800 million. StakeStone's valuation expectation (FDV 5-$1 billion) is higher than similar projects overall. This premium logic stems from three core supports:

1⃣ the scarcity premium of full-chain

positioningStakeStone is not a traditional single-chain staking protocol, but the first protocol to propose the positioning of full-chain liquidity infrastructure. Compared with Renzo and Puffer, which are vertically subdivided, their business logic covers three major scenarios: ETH staking, BTC interest-bearing assets, and cross-chain liquidity aggregation, which is equivalent to benchmarking LRT, BTC-Fi, and cross-chain bridges at the same time.

Horizontally comparing LayerZero (a full-chain interoperability protocol with a valuation of $3 billion), StakeStone focuses on the differentiated path of capital efficiency optimisation, further strengthening its valuation imagination.

2⃣TVL-driven fundamental hard powerAs

of now, the total pledged assets (TVL) on the StakeStone chain have exceeded 700 million US dollars, and high liquidity means high market recognition, sufficient liquidity, and can often give higher valuations.

In particular, due to its dual-token model, it can bring a significant revenue multiplier effect: the protocol fee and bribery income are directly linked to TVL, forming a flywheel of "revenue growth-ecological expansion-TVL rise".

3⃣

Through the LiquidityPad product, StakeStone has reached in-depth cooperation with top ecosystems such as Plume (financing 10 million) and Story Protocol to provide them with initial on-chain liquidity.

This role of "liquidity infrastructure provider" brings triple gains: the fees and bribes paid by cooperative projects directly increase the agreement revenue; Each time a new chain is connected, StakeStone captures incremental users and assets for that chain.

To sum up, StakeStone's valuation logic should go beyond a single track benchmark, and its positioning as a full-chain liquidity hub, high TVL liquidity, and the snowball effect of ecological expansion together constitute a strong support for FDV of $5-1 billion.

3.2 The project participation income analysis

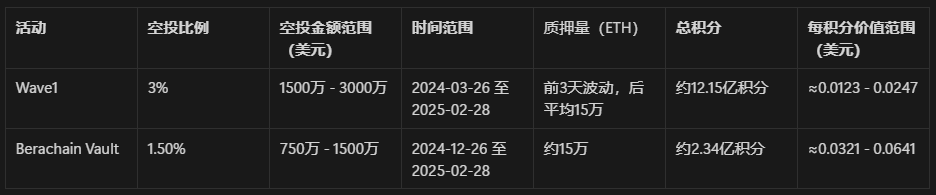

project has clarified the airdrop ratio, 3% of the total supply of the Wave1 reward pool in the first phase of the full-chain carnival event, and 1.5% airdrop of the Berachain Vault event reward, due to the small proportion of BTC, the following is only based on the average of the ETH staking amount to calculate the potential income.

1) Wave1

activity launch time: March 26, 2024 - February 28, 2025 (about 340 days)

Staking: 3 days ago: 342,000, 275,000, 259,000 ETH; After: ≈ 150,000 ETH

points calculation: the first 3 days of points: about 2,102,400 points; There are 337 days of points remaining, and the average is about 150,000 × per day: 24 = 3,600,000,3,600,000 × 337 = 1,213,200,000

Total points for the first stage: 1,215,302,400

Value per point:

Minimum: $15 million ÷ 1,215,302,400 ≈ 0.0123 USD/credit

maximum: $30 million ÷ 1,215,302,400 ≈ 0.0247 USD/credit2

) Berachain Vault

activity time: December 26, 2024 - February 28, 2025 (about 65 days) Average staking amount in all phases: ≈ 150,000 ETH

points calculation: 150,000 × points per day 24 = 3,600,000, total points: 3,600,000 × 65= 234,000,000

Value per Points:

Minimum: $7.5 million ÷ $0.032 ≈ $234,000,000 / Points

Maximum: $15,000,000 ÷ $234,000,000 ≈ $0.064

/Credit The above calculation is about 0.0123-0.064 US dollars / points in different stages, excluding the points markup coefficient, you can refer to the comparison query according to the number of points you have, and other points also have referral points and some boosts, these small heads are not calculated for the time being.

Due to the average calculation and high uncertainty of the data, the price is for reference only, combined with the feedback of the official team, it may be considered to increase the share of wave1, which is subject to the announced results.

4.

ConclusionStakeStone recently announced two major updates: the snapshot and the dual-token model were launched at the same time, further consolidating its positioning as a full-chain funding hub, and optimising the token economic model to enhance sustainability.

In the DeFi 3.0 era, full-chain liquidity is the core narrative, and StakeStone's layout is very forward-looking:

free flow of funds: allowing BTC, ETH and various public chain assets to break ecological barriers and achieve efficient cross-chain flow.

Revenue model upgrade: Through the veSTO mechanism, users are bound to the long-term income of the protocol to reduce short-term speculation.

Improving the overall efficiency of the industry: ending the "digging and selling" model, guiding liquidity from competition to synergy, and improving capital utilisation.

For the industry, the project provides a viable path from liquidity friction to value creation. In the world of DeFi, where liquidity is king, StakeStone is building the core financial infrastructure of the crypto industry.

If it can be successfully implemented, this will not only be a victory for the agreement, but also an important step for the entire industry to mature.

Special note: The various calculations in the article are based on public information and reasonable assumptions, and are not intended as investment advice, please make your own decisions and participate as appropriate!