Slippage Abyss: Survival Rules and Technical Breakthroughs in the Era of High Leverage Contracts

According to BitMart data, BTC once again broke through a new all-time high, and the spot price once touched $123, 215, marking a new investment boom in the crypto market as it continues to heat up. In recent years, with the globalization of cryptocurrency trading and the influx of institutional funds, the contract trading market has ushered in unprecedented explosive growth. As a highly leveraged and volatile market, contract trading offers investors the potential for higher returns, but it also comes with huge risks. In particular, the problem of slippage has become a pain point that many crypto traders cannot ignore. Therefore, how to effectively solve the problem of slippage has become the focus of attention in the industry.

The current situation and challenges of contract trading in the crypto market

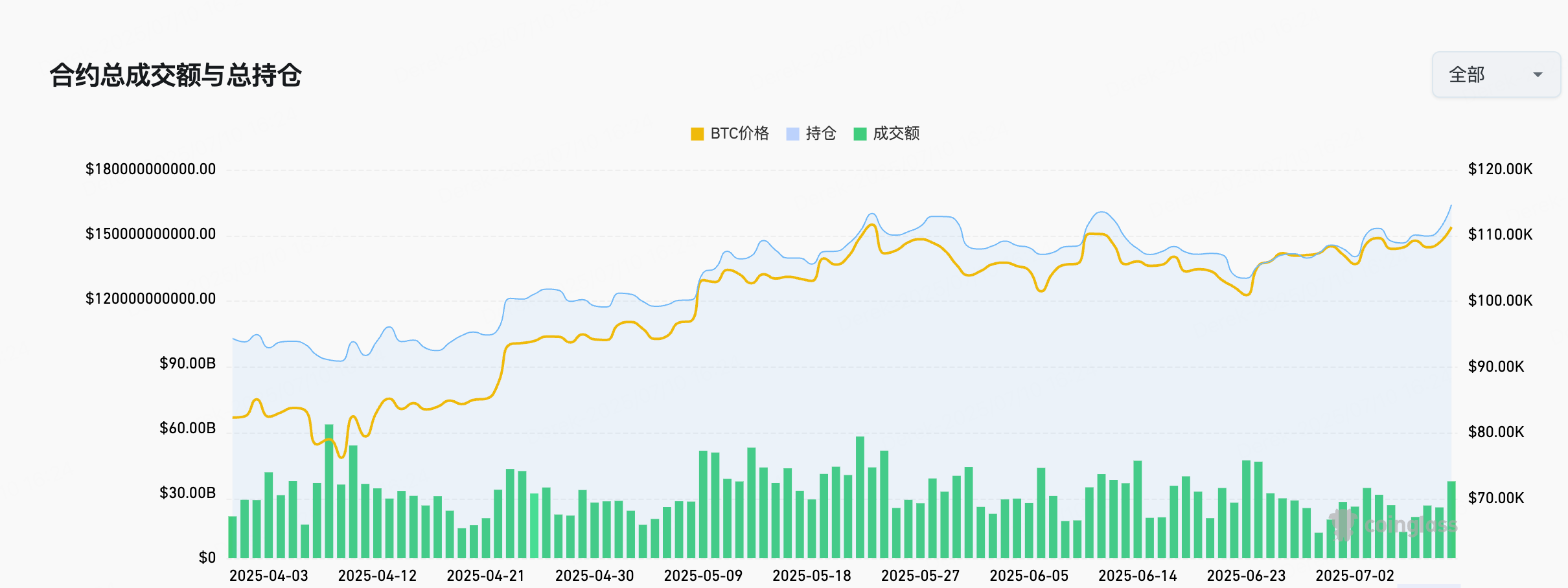

According to the latest data from Coinglass, in the second quarter of 2025, the contract open interest in the global crypto market has risen steadily, with the average daily contract trading volume exceeding $300 billion in a row, and reaching a peak of nearly $500 billion. This growing trend reflects the continued enthusiasm of market participants for futures trading. However, high volatility and leverage make futures trading not only a tool for investors to pursue high returns, but also a complex game of technology, risk and psychology. For traders, how to accurately grasp the market dynamics and avoid potential risks has become the key to success in this uncertain market.

At the same time, the futures market has attracted a large number of new users and has become a "hot spot" in the eyes of many people. However, with the expansion of the market, the high risk and complexity of contract trading have gradually exposed hidden costs, especially slippage. Slippage not only reduces the execution efficiency of transactions, but also magnifies potential losses in a volatile environment, which has become a fatal problem that new traders cannot ignore.

Slippage Problem: The Invisible Killer of the Crypto Market

Slippage refers to the difference between the actual transaction price and the expected price during the order execution process. In the crypto market, slippage is often caused by factors such as market volatility, lack of liquidity, and technical bottlenecks. Especially when the market fluctuates violently, traders' orders often fail to fill at the expected price, resulting in additional costs, which is undoubtedly a loss for users. Taking a daily trading volume of $300 billion as an example, if the slippage is 0.001%, the user loss due to slippage is $3 million per day.

Specifically, the causes of slippage can be boiled down to the following:

-

Market volatility: The crypto market is known for its high volatility. When prices fluctuate rapidly, especially in the case of large-scale buy and sell orders in a short period of time, the market is unable to digest the orders in time, resulting in a gap between the expected price and the actual transaction price.

-

Illiquidity: Some trading pairs, especially niche coins or low-volume markets, have poor liquidity, resulting in slippage for large orders. This is especially true in the crypto market, which is generally less liquid and deep than traditional financial markets.

-

Technical limitations: Slippage may also occur due to factors such as the technical architecture of the platform and system latency. Especially in high-frequency trading and extreme market conditions, the platform may not be able to respond quickly to keep up with market fluctuations.

For many traders, slippage is not only an increase in transaction costs, but also an increase in uncertainty in trading decisions and strategies. When a trader makes a large trade with leverage, slippage may even increase the risk of forced liquidation.

BitMart Slippage Guardian Program Phase II: From Risk Compensation to Extreme Protection

BitMart understands the importance of slippage to traders, so the second phase of the "Slippage Guardian Program" has been significantly upgraded. This upgrade not only lowers the threshold for payouts, but also further improves the control and transparency of slippage through innovative technical solutions.

1. The payout threshold has been significantly reduced

One of the biggest highlights of the second phase of the Slippage Guardian Program is the adjustment of the compensation threshold, which requires the slippage to be reduced from the original 0.05% to 0.02%. This improvement allows even small slippage to be caught and payout rules triggered in a timely manner. In the case of Bitcoin (BTC), for example, if the expected price is $100, 000 and the actual price is $100, 020 (a difference of $20), this small difference can trigger a payout. This adjustment demonstrates BitMart's confidence in the platform's liquidity and engine stability, as well as its innovative advancements at the technical level.

2. Comprehensive payouts and tiered incentives

The second phase of the Slippage Guardian Plan not only greatly expands the scope of compensation, from a single "margin slippage loss" to "compensation for cross position slippage loss", to ensure that users can be fully protected even in large-value transactions. At the same time, new users can also enjoy the "200% Difference Rebate" discount on abnormal slippage when they register and trade for the first time (up to 2, 000 USDT per transaction). In addition, BitMart also provides users who hold BMX tokens with an additional 10% payout and priority review channels, which further enhances the platform's user stickiness and increases the holding value of BMX.

3. Currency expansion and fast payout

In order to better meet the needs of users, the second phase of the Slippage Guardian Program will expand the range of supported currencies from the initial BTC and ETH to 8 mainstream currencies including SOL, XRP, BNB, TRX, DOGE and ADA, covering a wider range of market needs. At the same time, BitMart promises that after the review is passed, the user's compensation will be "quickly received", ensuring that users can receive compensation in a timely manner in any market environment, and enhancing the user's trust and security in trading.

The second phase of BitMart's Slippage Guardian Program undoubtedly provides traders with some protection, especially in terms of improving trading transparency and control. By lowering the payout threshold, expanding the payout range, and introducing more efficient liquidity matching, the platform not only strengthens the trust of users, but also attracts more high-frequency traders and high-capital users. However, despite technological breakthroughs, extreme market conditions and illiquid trading pairs may still lead to slippage, which undoubtedly puts forward higher requirements for the platform's compensation mechanism.

In the future, BitMart seems to be intent on continuing to optimize this mechanism to adapt to changes in market demand. By combining cutting-edge technologies such as quantitative trading and artificial intelligence, the platform is expected to make further progress in improving the accuracy of slippage prevention and personalized services. If this trend continues, BitMart could further strengthen its market position in the highly competitive crypto trading market.

summary

In fact, slippage has always been an unavoidable challenge in crypto market contract trading, especially in an environment of high volatility and illiquidity, which not only increases transaction costs, but can also directly affect the success of trading strategies. With the continuous expansion of the market scale and the injection of institutional funds, how to effectively control slippage and improve transaction efficiency has become the core problem that crypto trading platforms must face.

Currently, the crypto market is once again buoyant as BTC breaks new highs, which also means that trading volumes and market volatility will increase further. In this environment, the platform's technical architecture and risk management capabilities will directly determine whether it can provide users with a more stable and secure trading experience. In addition to slippage control, the focus of the industry in the future will focus on how to use technologies such as quantitative trading and artificial intelligence to improve trading accuracy, ensure stable execution under extreme market conditions, and promote the entire crypto industry to a more mature and standardized future.