Pump/Bonk/$M three-point meme, two paths for asset issuance

Author: Saye Crooked Neck Mountain

The Secret to Getting Rich = Innovative Asset Class + Capital Efficiency

$PUMP the whole process of coin issuance, hustle and bustle to silence, the biggest beneficiary has emerged, MemeCore, whose token $M not only grabbed the CT hot list, but also successfully won Binance Alpha, followed by Bonk, which is eyeing users in the Chinese area.

The English project side speaks Chinese, which reminds me of the era of SBF, when the world was still very homogeneous.

Caption: Bonkfun speaks Chinese

Image source: @SolportTom

But don't be nervous, today is not to analyze the price trend of PUMPS, but to talk about why the Meme platform issued coins, and after the end of the Meme cycle, the coins can still make waves.

Earn the last copper plate

PumpFun is issuing coins to maximize the value of itself as a meme platform.

The normal meme platform should die when CZ and FourMeme enter the market, please note that I am talking about the end of the meme platform as an industry-wide consensus and as a mainstream asset issuance platform, if it is the meme itself, it will be back to the release of $TRUMP in January.

Review: Meme comes from the sea and goes from the sea

The subsequent breakup of PumpFun and Raydium, the AMM pool you build, and the meme launch pad I build, are all clear evidence of the split consensus.

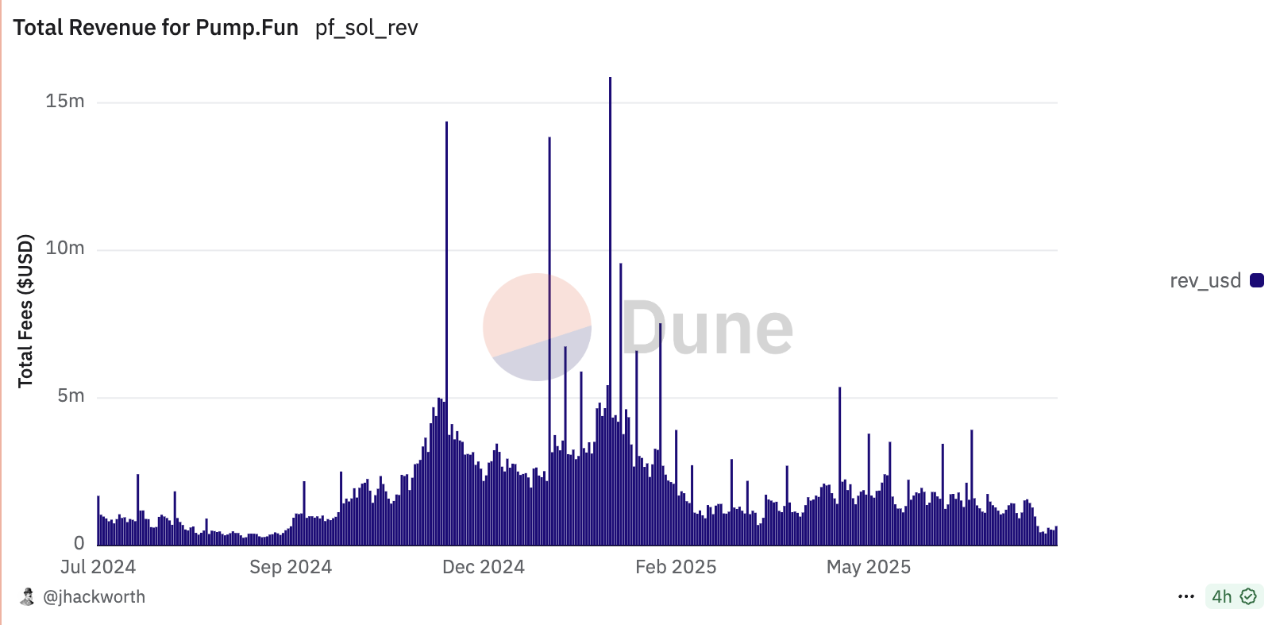

Caption: PumpFun Profit Movement

Image source: @jphackworth42

It is becoming more and more strange how after nearly half a year, not only the Pump Fun platform coin has become the focus of the audience, but also attracts many similar sharing liquidities such as Bonk and $M, referring to the DePIN, NFT, BTCFi and L2 tracks, basically will not be able to maintain the splashing traffic at the time of coin issuance after the end of the main narrative.

A more normal rhythm is to directly issue coins to squeeze out market liquidity when the industry consensus is most focused

-

• For example, the "positive case" of NFT Blur, and the negative case is OpenSea;

-

• Filecoin, Helium (Mobile) for DePIN, and Starpower on the reverse side;

-

• BTCFi's Babylon, the opposite of BTC L2

However, the normal liquidity of Meme has been sucked away by $TRUMP, and theoretically the emergence of FourMeme should be the death period of PumpFun, but the PUMP token can still stir up the storm.

PumpFun gives the perfect way to exit the dying track and earn the last copper plate that the market has accumulated.

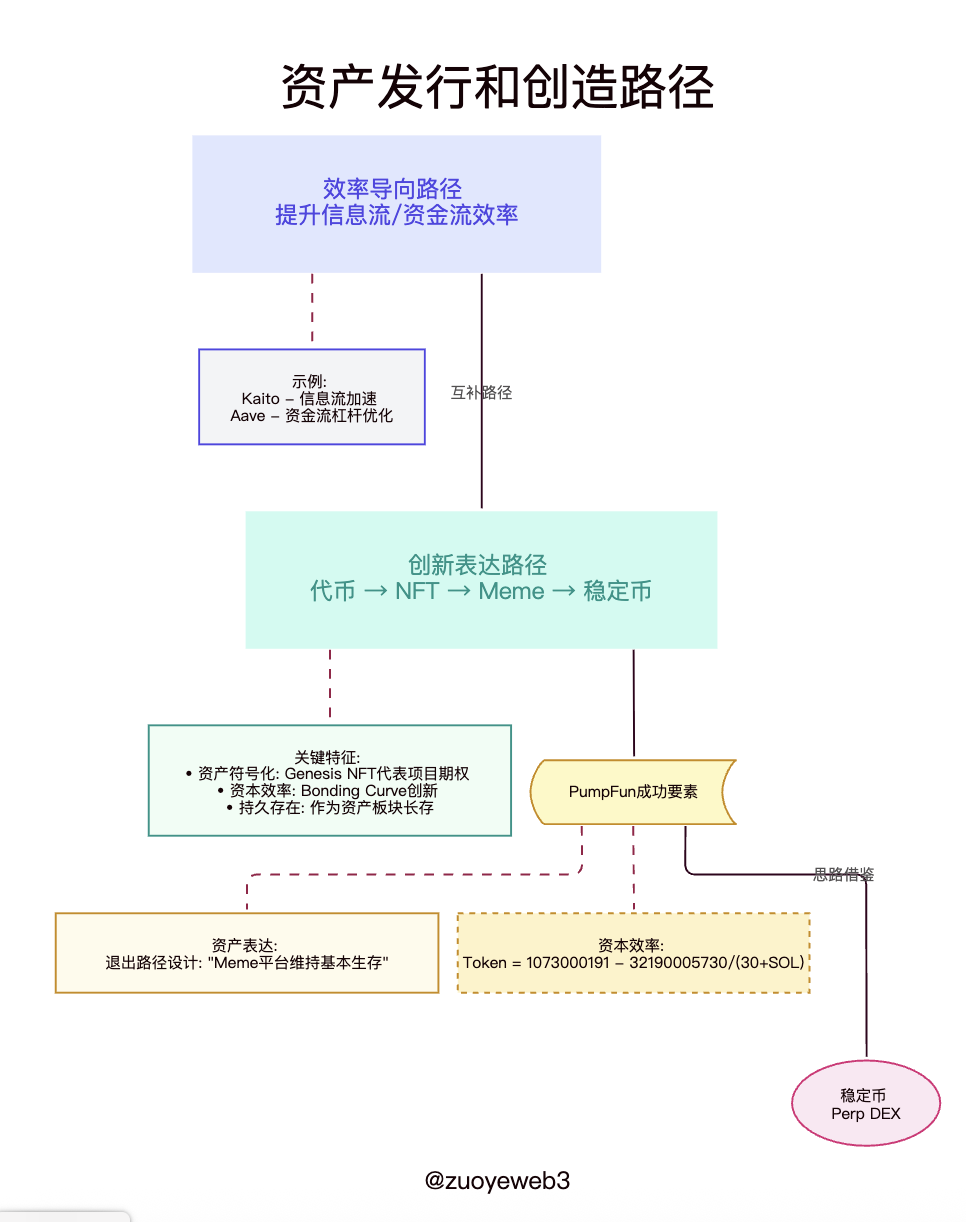

The creation and expression of crypto assets, one is efficiency-oriented, which makes the flow of information (Kaito) or capital flow (Aave) faster and more leveraged, and the other is innovative expression, which develops along the token-NFT-Meme-stablecoin.

If you want to answer how PumpFun did it, first review the successes and failures of NFT, unlike the inscription and BTCFi, which were finally falsified, NFT has found its place in the field of project parties.

Genesis NFTs represent options for the project, or even some kind of analogue of Coinlist, depending on how the project party designs, and the NFT as a fashion symbol and ticket fails in exchange for the success of the asset symbol.

The NFT trend is definitely not coming back, and my understanding is that memes as an asset sector are here to stay.

It's like the copycat season will not come back, and it won't affect everyone to continue to send copycats and do alpha points.

It's the same with memes, people's valuation systems will change, PumpFun won't be Binance, it won't be Hyperliquid, but isn't Uniswap alive too.

Between complete failure and success, there is also the choice of landing safely, right and wrong, leaving the world to comment.

The next scene that can be landed

Previously, the crypto industry thought that landing was a move towards Mass Adaption;

Now, the crypto industry believes that landing is the final action of issuing coins;

Caption: Asset issuance and creation paths

Image source: @zuoyeweb3

Not everyone will be obsessed with memes, but as long as someone is willing to participate, then as an asset class and launch platform, it will be possible to maintain basic survival, and there will always be a place for people to buy Moutai and virtual $LABUBU on the chain.

From blue-chip NFTs to Genesis NFTs, from $TRUMP to $PUMP, an era has come to an end, and in the crypto mini-cycle, memes have been running for 6 months, which is longer than many 2-3 month tech narratives.

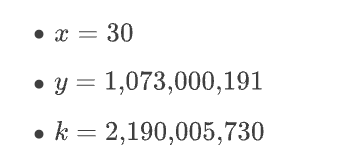

The only thing left is the unsolved mystery of the Bonding Curve, we know the x*y=k of the AMM DEX, but we still don't know how the specific parameters of the Bonding Curve are derived.

A piece of trivia, FriendTech also uses Bonding Curve, the earlier 2020 DeFi Summer, which is actually a three-kingdom kill of AMM, order book and Bonding Curve, but Uniswap takes AMM, dYdX takes the order book, and Bonding Curve doesn't shine until it meets PumpFun.

Another secret to PumpFun's legacy is that Bonding Curve has improved capital efficiency, memes have never been a pure new asset type, and PumpFun's capital efficiency orientation as a platform is also a winning formula in product design.

Referring to @CuntouErjiu's algorithm, the Pump Fun algorithm is a super magic modification of x*y=k, and the Bonding Curve equation:

Quantity, quantity

The value of the parameter is:

Other meme launch platforms can reverse and refer to the specific parameters of PumpFun, but how this formula itself is derived has almost become an unsolved mystery in the currency circle, just like AI large models, open source code makes no sense, only open source training methods and datasets are really open source.

Unfortunately, no one has really decompiled PumpFun's original formula, so based on this, PumpFun's moat to improve the efficiency of capital (meme) is still strong, even if the meme is no longer hot, the remaining traffic can still be used as the value base of $PUMP.

At this point, PumpFun is much more reliable than many ghost chains, and USDT's withdrawal from Algorand/EOS shows that it's not memes that have been forgotten.

However, it must be admitted that Meme as a representative of the era is completely over, and it is not easy to be glorious in the past, and only BTC AND ETH can become popular, and SOL still needs to go through many tests if it wants to enter the game.

At least SOL is not recognized by PumpFun, and all the SOL earned is exchanged for U-margined capital, but EOS has held the raised BTC until now, what kind of ETH should the Ethereum Foundation sell ETH belong to?

epilogue

At present, the hot spots are RWA and stablecoins, and it makes no sense to keep an eye on PumpFun, but PumpFun is better than FriendTech and Blur, and Meme is better than NFT and BTCFi, and PumpFun's idea is worth learning.

Starting with the end in mind, the Founder must design an exit path at the beginning, not simply issuing coins on the exchange, but answering whether he can find a suitable position behind the scenes after the explosion in the crypto stage.

As a foresee, the same will be true for Perp DEXs, as we struggle to spot off-chain matching algorithms for order books.

Similarly, there are

1. The routing algorithm of the DEX aggregator

2. Transaction matching algorithm for dark pool DEXs

3. The liquidity "detonation" algorithm of on-chain option products

In particular, on-chain options are now in the same predicament as the pre-PumpFun era when meme trading was difficult to maintain, and the liquidity was too low, and the LP Token subsidy model commonly used by DEXs did not seem to work.

In addition, the on-chain options product model also needs to be reinvented, either an original crypto product like Meme, or a currency circle transformation similar to a perpetual contract, maybe VIX is a good idea?