From Polygon and Morpho to WLFI: Aave has repeatedly become a "stepping stone", and DeFi gentleman's protocol is like papyrus?

Original author: Lao Lu (@Luyaoyuan1), encryption OG

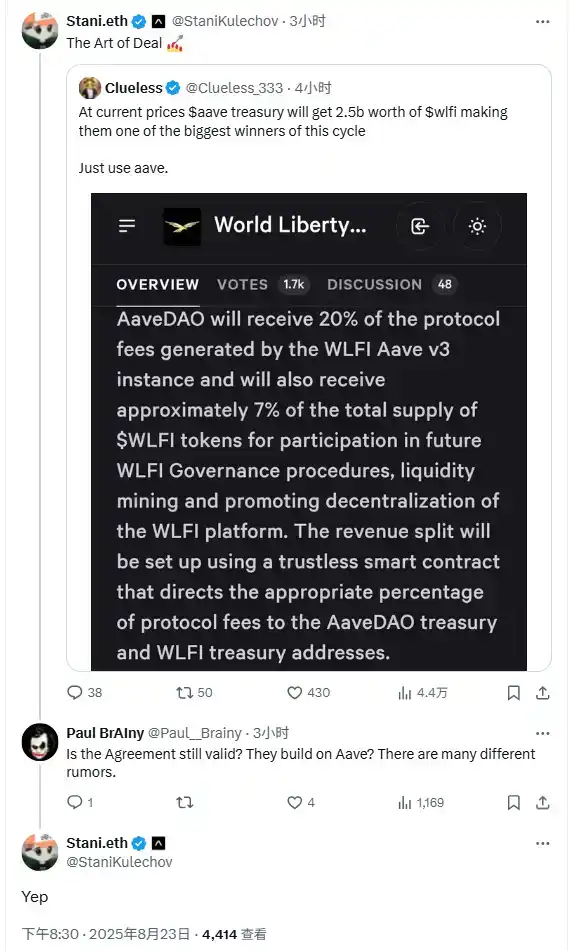

Editor's note:Last weekend (August 24), Aave and the WLFI team had a disagreement over the issue that Aave should receive 7% of the total supply of WLFI tokens, triggering significant fluctuations in the price of AAVE tokens. The debate stemmed from the WLFI team's proposal to launch Aave V3 instances on the Ethereum mainnet in December 2024, which was approved. The proposal shows that Aave will serve as a lending ecosystem partner for WLFI, which will adopt a reserve factor parameter design consistent with the Aave mainnet in its Aave v3 instances. As a consideration for the partnership, AaveDAO will enjoy 20% of the protocol fees generated by this instance and will be allocated approximately 7% of the total supply of WLFI tokens, which are intended to be used to participate in WLFI subsequent governance, provide liquidity incentives, and promote the decentralization of its platform.

However, events have taken a dramatic turn recently. Yesterday evening, a suspected WLFI Wallet team member and Twitter user @0xDylan_ tweeted that "Aave will receive 7% of WLFI tokens" was related to the proposal. In response, Aave founder Stani.eth quickly responded, pointing out that the proposal was written and submitted by the WLFI team and voted through the Aave DAO in accordance with the law.

– >

– >

It's worth noting that this isn't the first time Aave has been embroiled in such controversies. There have been several cases where project parties have obtained reputational endorsements in the name of "cooperation" or "proposal" with Aave, but ultimately failed to fulfill their promises. Such incidents reveal deeper questions: although DAO governance proposals have a certain degree of binding significance, can on-chain governance be effectively implemented when the cooperating party is highly centralized and refuses to fulfill the proposal? In the absence of clear support from traditional legal frameworks, how can DeFi projects break through the "gentleman's agreement" trust dilemma and establish a more reliable cooperative execution mechanism? This has become a real challenge for Aave and the DeFi space as a whole.

Crypto OG @Luyaoyuan1 also wrote a related tweet, detailing Aave's experience of being "deceived" in previous years, and the following is the content of the tweet:

In April 2021, Polygon (with a market capitalization of about 4 billion) offered $40 million worth of 1% MATIC to incentivize Aave (with a market capitalization of about 6.5 billion at the time), which was just the icing on the cake for AAVE at that time.

In the Swap space: Uniswap was not officially deployed to Polygon until December 2021, and until then, QuickSwap had been dominant.

In the lending field: Many protocols for fork mainnet lending products have also emerged on Polygon, but security is a concern, and countless attacks such as EZLend have occurred.

The 40M incentive stacked more than 1 billion TVL, and Matic ran all the way from 0.4 to 2.6 in December 21, which is not entirely due to Aave, although it is not entirely due to Aave, but the impact is undoubtedly far-reaching. Unlike the current TVL of $1 billion, the cooperation between Polygon and Aave has long been regarded as a classic example of a win-win situation between public chains and applications, and has also become a template for later generations to follow.

Fast forward to December 2024, sparking a heated debate over whether the $1.3 billion in assets in Polygon's cross-chain bridge should be placed on Morpho or Aave. Polygon hesitated for a while, but Aave expressed the risk of doing so and responded strongly, Aave adjusted the parameters of the Polygon lending platform, and the LTV was set to 0, which meant that no matter how many deposits were made, it could not borrow, liquidity was frozen, and even considered withdrawing from Polygon.

As for Morpho, its story is quite dramatic. Initially just an interest rate optimization layer for Aave/Compound, it later launched Morpho Blue independently, rapidly expanding and competing for market share with its powerful BD capabilities, becoming Aave's most threatening opponent. Their strategy is to lobby all types of on-chain funders to migrate liquidity to Morpho as much as possible, thereby competing head-on with Aave.

The above story inevitably raises several questions:

Did Polygon have to choose Aave to cooperate in the first place? Without AAVE, could Polygon's ecosystem launch so quickly? Or will security incidents occur frequently and no one cares?

What exactly is Morpho's behavior? Is this a market innovation or "eating other people's milk and growing up and biting back"?

In the face of interests, does Polygon still remember the charcoal in the snow back then, or has it long since put that kindness behind?

Aave's story continues, and a similar scene is repeated between WLFI and Aave. I dug it up again two years later.

you afraid of products from Dough Finance? This is the case between projects, but what about people?

(The above content is only written based on public information and does not involve any position or interest relationship, please judge and assess the risk by yourself.) Original

link