How much did you miss out on June 24 market key intelligence?

Featured news

1. Xiao Feng: The Hong Kong stablecoin license will not be limited to the Hong Kong dollar stablecoin, and the deployment of the network can be determined by the issuer

2. Nano Labs raises $500 million in private placement of convertible bonds for a BNB reserve strategy

3. Circle (CRCL) has risen by more than 740% since its listing, and its market capitalization has reached 103.6% of USDC.

4. Upbit will list NEWT

5. At 22 o'clock tonight, Powell will have a "tongue war" on Capitol Hill, and Trump had hoped that "Congress" would knock Powell

Trending topics

Source: Overheard on CT (tg:@overheardonct), Kaito

VANECK: Today's participation in the NASDAQ opening bell ringing ceremony with Pudgy Penguins symbolizes the deep intersection of traditional finance and the digital asset world. VanEck's unwavering commitment to integrating Web3 and cryptoassets into the mainstream financial system has sparked a lot of social media discussion and celebration, with many expecting the partnership to accelerate institutional adoption of cryptoassets.

BNB: Much of the discussion around BNB today has focused on a symbolic dynamic – a former Coral Capital executive is planning to raise $100 million through a NASDAQ-listed company to build a BNB reserve, similar to MicroStrategy's Bitcoin strategy. The news sparked widespread speculation and heated discussions in the market about BNB as an institutional asset allocation target. At the same time, Binance also announced that it will issue Newton Protocol (NEWT) airdrop rewards to BNB holders, further enhancing market attention. The BNB Chain ecosystem has continued to expand recently, and new projects and collaborations have been implemented one after another, which has also helped its overall popularity to rise.

TURTLECLUB: Today it was notable for its integration with Kaito and the launch of a new "Yapper Engagement Leaderboard," which encourages users to participate and contribute through a reward system. The project has been recognized for its key role in launching liquidity across multiple ecosystems, especially in the Katana project, and has also been praised for its egalitarian DeFi philosophy. THE COMMUNITY IS HOTLY DISCUSSING TURTLECLUB'S POTENTIAL TO REINVENT THE LOGIC OF CRYPTO LIQUIDITY DISTRIBUTION, AND MANY USERS ARE EXCITED ABOUT THE WHOLE NEW OPPORTUNITY TO EARN REWARDS THROUGH ACTIVE PARTICIPATION.

HYPE: Today's topic focuses on its strong market performance and strategic development. The community buzzed about how it compares to other high-growth assets on a number of key financial metrics, noting that its potential should not be underestimated if its valuation level is close to that of similar projects. Its ecosystem continues to expand, including new integrations and SDK releases such as Ferrofluid and Enso Shortcuts, which enhance its appeal to developers. HYPERLIQUID currently ranks third on the Web3 revenue list and has launched a strategic buyback program for $HYPE tokens. In addition, many have likened its potential to Solana's explosive growth, which has the dual benefits of attracting both retail and institutional investors. While there are still some voices expressing concerns about centralization and transparency, the overall sentiment remains positive, and the community is generally optimistic about its future growth prospects.

Featured Articles

1. "Interest rate cuts, ceasefires, is there a rebound or a reversal behind the good news?" Trader's Observation》

The Fed's dovish voice returned, and Fed Governor Bowman spoke out in support of a rate cut as early as July. The lack of significant inflationary pressures since Trump imposed tariffs on April 2 could allow the Fed to cut rates again. On the positive news of an official ceasefire in Iran and Israel, the crypto market ushered in a sharp rebound, with a 6% recovery in market capitalization at its low point. The Fed's expectation of an interest rate cut has also boosted market sentiment, and the "water release" brought about by the rate cut is expected to start a new round of market sentiment. What is the next trend of BTC, see what traders in the market think.

2. "Downcast 92%, Celestia's new proposal to change the life of "POS""

Now no one cares about the "pledge shovel" TIA is once again ushering in a crisis of community public opinion. Co-founder John Adler threw out a disruptive governance proposal during a period of long-term price declines and a marginal narrative, as well as low online revenues and challenges to the viability of the DA track.

On-chain data

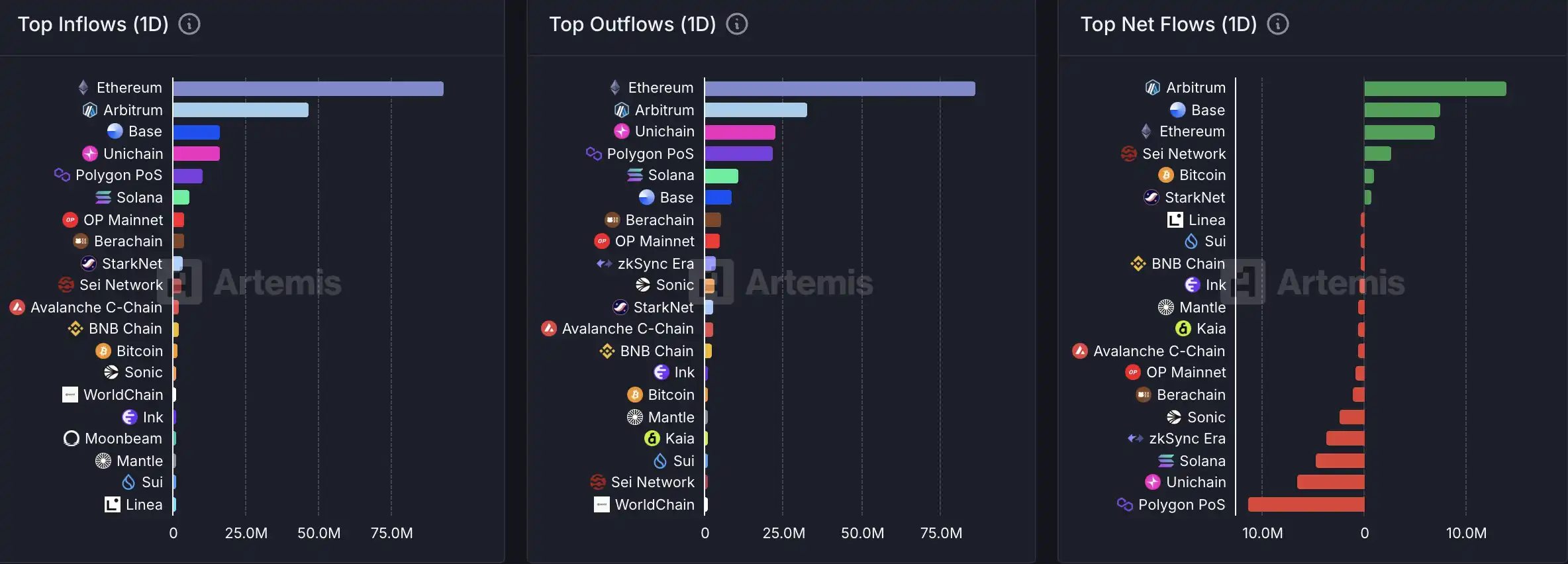

On-chain fund flows on June 24