From Growth Illusion to Cash Flow Reality: When Buybacks Become the Collective Narrative of Altcoins

Original | Odaily Planet Daily (@OdailyChina).

Author | Dingdong (@XiaMiPP).

On June 19, CEO and founder Humayun Sheikh announced the launch of a massive buyback program: the Fetch Foundation will unite multiple exchanges and market makers to drive a $50 million total FET token buyback. Behind this is the underlying support brought about by the continuous growth of demand for its proxy platform and ASI-1 applications. "FETs are currently undervalued by the market." He said bluntly.

This buyback program is not an isolated case, but a trend that has become increasingly evident in the altcoin track over the past few months. Funds are flowing to BTC, and ETH has recently regained the favor of whales and institutions, but the trading volume of the altcoin market has plummeted, investor sentiment has weakened, and the project parties seem to have entered a collective "survival difficult mode": in the context of difficult financing and shrinking valuations, how to survive and how to tell a story that can be believed have become a common topic in front of every project.

Token buybacks are becoming a common answer for more and more projects.

The logic of repurchase under the survival narrative

If the main theme of the bull market is the "growth story", then the bear market is about the "cash flow strength". Token repurchase is a natural extension of this logic: use the project's own funds to repurchase tokens in circulation, on the one hand, reduce market selling pressure and stabilize the currency price; On the other hand, it is also a kind of external declaration, "We are still capable and confident." ”

In this process, repurchase is not only a market operation, but also a "self-certification" mechanism at the financial level. Only when a project has enough income and reserves can it dare to take out real money to "gamble" on its future. For investors, this behavior itself is an endorsement of the value of the project.

But because of this, only a small number of projects can really continue to be repurchased. Most projects can only hang "buybacks" in governance proposals or roadmaps, and end up with no more. How the buyback mechanism is designed, whether it is burned, and whether it is locked is important, but the core is always whether you have a real, stable and sustainable income.

Fetch.ai's buyback program stems from the surge in the use of its ASI-1 and proxy platforms. The value of the platform is rising, but the price of the token is stagnant. The $50 million in funding from the Foundation's reserves may not be enough to rewrite the FET price curve, but importantly, if the plan takes hold, it will shatter the market's stereotype of a project's "lack of cash flow."

Who's buying back?

After 2024, a number of established projects have been launched and even have implemented buyback programs. Although the approach to buybacks varies, the motivation behind them is highly consistent: to leverage confidence with cash flow.

On April 9, 2025, the Aave buyback proposal passed with 99.63% support. The full plan for the proposal is to repurchase $1 million per week over the next six months, with the first buyback commencing on April 10. Since the launch of the protocol fee buyback mechanism, Aave DAO has been continuously executing a weekly buyback program of $1 million. The latest data shows that the agreement has spent a cumulative $10 million to buy back 50,000 AAVE, with an average cost price of $199.74. At the current market price of $264, this portion of the Treasury reserve has generated approximately $3 million in unrealized gains. This is not only a capital operation, but also a reflection of the execution and cash flow health of Aave DAO's governance structure. (Additional reading: "Aave Economic Model Overhaul: Anti-GHO Mechanism + Token Buyback, Helping AAVE Soar by 20%").

On the other hand, the 2 million USDS that Sky (formerly known as MakerDAO) co-created Rune has transferred to the repurchase address has been used to repurchase SKY. Since June 4, Rune has used a total of 2.33 million USDS to repurchase 30.227 million SKY, accounting for about 1.4% of its circulating supply, with an average repurchase price of about $0.077.

On February 14, Jupiter announced that 50% of all agreement fees would be used to buy back JUPs with a three-year lock-up, with the buyback officially beginning on February 17. As of now, JUP buybacks are worth about $25 million.

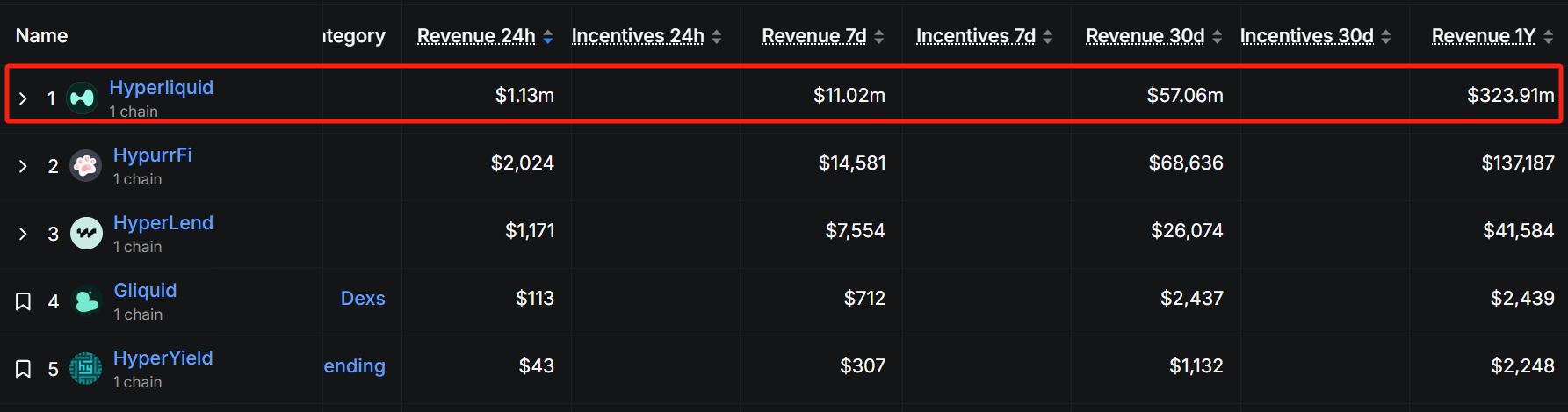

Hyperliquid has been initiating a buyback since March 20, using 50%-100% of its platform revenue to buy back HYPE tokens, with most of the repurchased tokens being burned to reduce circulation. According to the repurchase data, in the past 30 days, its repurchase amount reached about $55 million, and the average daily repurchase amount can reach $1.83 million, based on this data, the quarterly repurchase can reach $165 million, and the repurchase volume is about 4.46 million according to the current price of HYPE at $37, accounting for about 1.3% of its circulating supply (333 million).

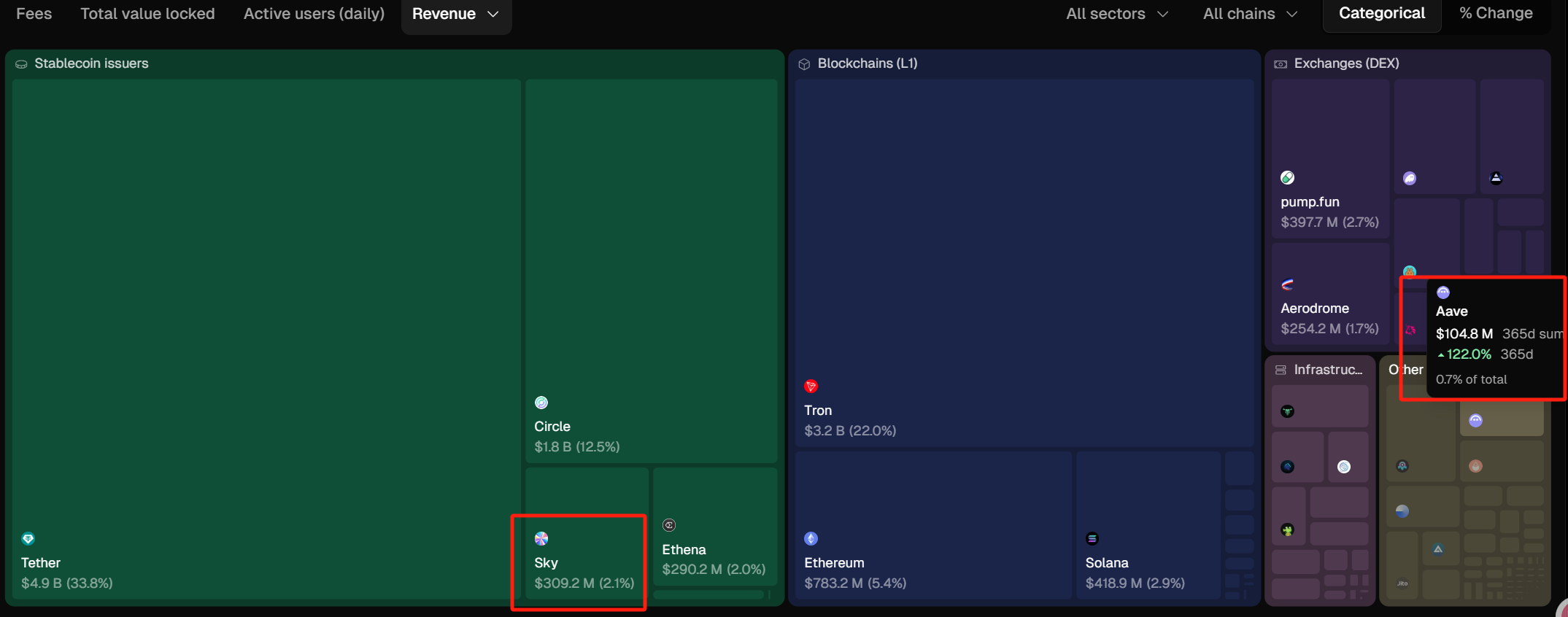

Judging from TokenTerminal data, Sky's annual revenue has reached about $310 million, and in the stablecoin track, the annual revenue is only lower than Tether and Circle. Of course, in terms of revenue scale, there is still an unbridgeable gap between centralized and decentralized stablecoins. Aave's revenue in the past year was around $100 million, ranking first in the lending track.

Judging from defillama.com data, Jupiter's annualized revenue is around $30 million. It's worth noting that Hyperliquid, despite being an emerging DeFi project, has already generated $320 million in revenue over the past year. For more information, please read "With a total trading volume of $1.5 trillion topping the on-chain contract throne, Hyperliquid (HYPE) is the next SOL?" 》

epilogue

Token buybacks are not a panacea, but they are an effective narrative entry point in a cycle of scarce confidence. Instead of continuing to rely on empty "vision" and "roadmap" to "empower", it is better to regain the market's attention with a solid revenue structure and clear financial actions.

The real competition is no longer how big the story you tell, but whether you can live to tell the day it is realized.