The first time coins are sold and delisted, currency stocks are no longer cryptocurrencies

Written by: KKK, Rhythm

If the last cycle was a micro-strategy that ignited Bitcoin's bull market, then the engine of this round of market is undoubtedly the "altcoin micro-strategy". Ethereum treasury companies such as SBET and BMNR continued to buy, not only pushing the price of ETH all the way from $1,800 in early May to $4,700, an increase of more than 160%, but also playing a new leading role in market sentiment. At the same time, mainstream altcoins such as SOL, BNB, HYPE and other mainstream altcoins have followed suit, and a number of companies with treasury holdings as the core narrative have emerged, further amplifying the market's upward expectations.

– >

– >

However, as this pattern spreads, risk signals are emerging. Recently, BNB treasury company Wint is facing the risk of delisting, and Hype treasury company LGHL has reported a coin sale turmoil, raising questions about the sustainability of the "treasury strategy". What are the potential risks hidden in this centralized buying game? What hidden concerns do investors need to pay attention to while chasing high returns? This article will provide an in-depth analysis of this.

Company game: Capital will only choose a few winners

This competition of "treasury companies" can be called a market knockout match between you and me.

Windtree Therapeutics (WINT) announced the establishment of a strategic BNB reserve in July, but due to weak fundamentals and continued sluggish stock prices, it finally received a Nasdaq delisting notice on August 19. After the announcement, WINT's stock price plummeted continuously, plummeting 77.21% in a single day, and the current price is only $0.13, a cumulative drop of 91.7% from $1.58 after the announcement. For a small biopharmaceutical company that is already in the clinical stage, has not yet achieved commercialization, and has widening quarterly losses, delisting almost means being completely marginalized by the market.

– >

– >

in stark contrast is another new player – BNB Network Company (BNC, formerly CEA Industries). With the support of YZi Labs, BNC completed a $500 million private placement round from late July to early August, with CZ personally leading the case, with as many as 140 participating institutions and a luxurious lineup, including Pantera Capital, Arrington Capital, GSR and other first-tier capital. The company also invited David Namdar, former co-founder of Galaxy Digital, as CEO, and Russell Read, former chief investment officer of CalPERS (California Public Employees' Pension Fund), took the helm of investment decisions, completing the leap from traditional small-cap stocks to "BNB orthodox treasury companies" almost overnight.

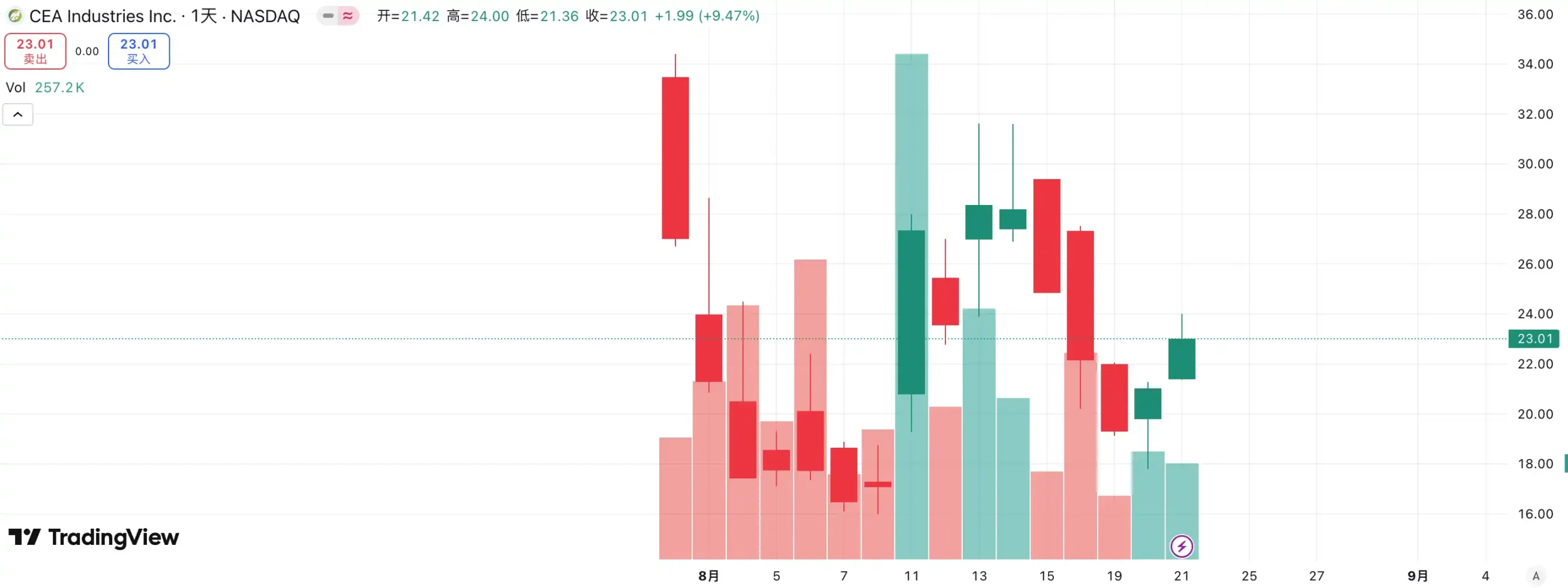

The choice of capital has already given the answer: WINT has become an "outcast", while BNC has become the new market standard-bearer. According to the data, BNC's stock price rose 9.47% yesterday and is now priced at $23.01, further strengthening its leading position in the "BNB Treasury Company" track. It can be said that this competition is not only a showdown of the company's fundamentals, but also a vote of the market on the ability of narrative and resource integration.

in the ETH treasury company track, the competition is also fierce. As the first listed company to shout the concept of "ETH microstrategy", SBET led by Joseph Lubin quickly triggered strong FOMO in the early stages of the market with its first-mover advantage and ETH spokesperson narrative, soaring from $3 to over $120, becoming a benchmark case for the altcoin treasury model.

– >

– >

However, the rise of BMNR quickly rewrote the landscape. As a latecomer, it not only overwhelmed SBET in terms of buying input and capital scale, but also shouted the slogan "hold 5% ETH" in a high-profile manner, instantly raising the market's imagination. More importantly, BMNR is backed by the public support of Wall Street veteran capital such as Tom Lee and Sister Wood, which has quickly dominated the institutional and media levels. In contrast, although SBET has the endorsement of Web3 upstarts like Joseph Lubin, it is significantly inferior in terms of voice and influence compared to BMNR, which is allied with Wall Street's "old money".

The stock price trend of the two also confirms this differentiation. In the August market, SBET's stock price rose from $17 to $25, an overall increase of about 50%; BMNR rose from $30 to $70, an increase of more than 130%, significantly outperforming the former. As BMNR gradually gains recognition from mainstream capital and opinion leaders, the competitive situation of ETH treasury companies has clearly escaped.

inspiration behind this competition is that the "treasury company" track has entered the stage of the strong and the strong. With the participation of institutional investors and head capital, market resources are accelerating the concentration of market resources to a small number of enterprises with capital integration, narrative driving force and governance capabilities. It is difficult for small companies to survive in this model, and even if the concept of "treasury" is played, it is difficult to resist the market's test of performance and financial strength. In the end, only a few winners will be left on the track who can really undertake the funds and narrative, while the bubble and followers will be quickly eliminated.

Hidden Worries about Selling Coins: Strategic Reserves Don't Mean Holding Forever

If Bitcoin's bull market is supported by Michael Saylor's faith, then the "treasury bull" of altcoins seems more realistic. Saylor has been making high-profile claims that MicroStrategy "will never sell" its Bitcoin and continues to buy through continuous financing, bringing a steady stream of buying and confidence to BTC. Nevertheless, "whether micro strategies will sell coins" has always been the focus of market discussion. Although altcoin treasury companies have followed this model, they have never given a promise of "not selling", which has always made the market have greater concerns about its stability.

Recently, Lion Group Holding Ltd., a HYPE treasury company, was monitored selling $500,000 worth of HYPE tokens. Just a month ago, the company announced the launch of the HYPE treasury strategy after completing a $600 million financing, with the goal of positioning $HYPE as a core reserve asset and building a next-generation Layer-1 treasury portfolio by allocating tokens such as $SOL and $SUI, and made it clear that it would continue to increase its holdings of these tokens in the future. Although the sale scale was only $500,000, which was insignificant in the face of 600 million financing, it was still worth the market to wake up the alarm.

Similar examples are not uncommon. Meitu spent about $100 million to buy BTC and ETH, and then cashed out when BTC exceeded $100,000 in late 2024, selling at a price close to $180 million, making a profit of about $79.63 million. Although Meitu is not a treasury strategy company, this operation has shown that when the price rises to a certain level, the so-called "strategic reserves" can be converted into profit-taking tools.

At present, there has been no large-scale collective sell-off by treasury companies in the market, but the potential risks cannot be ignored. Whether it is profit motives or fear of future markets, treasury companies can become a source of selling pressure. Lion Group's reduction is the epitome of this concern: as one of the first HYPE treasury strategy institutions to enter the market, its sell-off is undoubtedly a wake-up call - once the "treasury army" chooses to sell intensively, the stampede effect may detonate instantly, and the bull market may come to an abrupt end under its own engine pressure.

mNAV Flywheel: Infinite Bullets or Double-edged Sword?

The treasury company's financing flywheel is built on the mNAV mechanism, which is essentially a reflexive flywheel logic that gives the treasury company the ability to have seemingly "infinite bullets" in a bull market. mNAV refers to the Market Net Asset Value ratio, which is calculated as a multiple of a company's market capitalization (P) relative to its net assets per share (NAV). In the context of treasury strategy companies, NAV refers to the value of digital assets it holds.

When the stock price P is higher than the NAV of net assets per share (i.e., mNAV > 1), the company can continue to raise funds and reinvest the raised funds into digital assets. Each additional purchase pushes up the position and book value per share, further strengthening the market's confidence in the company's narrative and driving the stock price higher. As a result, a closed-loop positive feedback flywheel began to turn: mNAV rose → additional financing → bought digital assets → increased position per share→ market confidence increased→ stock price rose again. It is thanks to this mechanism that MicroStrategy has been able to continuously raise funds to buy Bitcoin over the past few years without significantly diluting its shares.

However, mNAV is a double-edged sword. The premium can represent a high level of trust in the market, or it may just be speculative speculation. Once the mNAV converges to 1 or falls below 1, the market switches from a "thickening logic" to a "dilution logic". If the price of the token itself falls at this time, the flywheel will turn from a positive direction to a negative feedback loop, resulting in a double kill of market capitalization and confidence. In addition, the financing of treasury strategy companies is also built on the premium flywheel of mNAV, when mNAV is discounted for a long time, the additional issuance space will be blocked, and the business of small and medium-sized shell companies that are already in business stagnation or on the verge of delisting will be completely overturned, and the established flywheel effect will collapse in an instant. In theory, when the mNAV < 1, a more reasonable option for a company would be to sell its position to buy back shares to restore balance, but it should not be generalized, and the discounted company may also represent undervalue.

During the 2022 bear market, even if MicroStrategy's mNAV fell below 1 at one point, the company did not choose to sell coins to buy back, but insisted on retaining all Bitcoin through debt restructuring. This logic of "sticking to it" comes from Saylor's faith-based vision of BTC as a core collateral asset that "will never sell." But this path is not replicated by all treasury companies. Most altcoin treasury stocks themselves lack a stable main business, and the transformation into a "coin buying company" is only a means of survival, without the blessing of faith. Once market conditions deteriorate, they are more likely to sell to stop losses or cash out profits, triggering a stampede.

How to avoid the potential risks of the DAT treasury model?

Most of the current treasury models ofcompanies that prefer "BTC"

are imitations of MicroStrategy, and Bitcoin has always played the role of "industry cornerstone" in it. As the only widely accepted decentralized digital gold in the world, Bitcoin's value consensus is almost irreplaceable. Whether it is a traditional financial institution or a crypto-native giant, the allocation and expectations of Bitcoin have not yet reached their long-term goals. For investors, choosing those "BTC treasury companies" is often more stable and has a long-term confidence premium than companies that simply imitate the logic of altcoin treasury.

Pay attention to the competitive relationship and prefer the ecological

niche competition in the capital market of the leading target is extremely cruel. Especially in the narrative-driven model of treasury strategy, the market often "only knows the first and does not know the second". As can be seen from the competition between WINT and BNC, once the support of capital and orthodox institutions is concentrated in one side, the other side will be almost quickly marginalized. In this context, investors should focus on the "leading effect": the first place tends to get more institutional funding, media narrative and market trust, while the second and third places are easily overlooked.

For retail investors, if they do not have enough grasp of individual stock judgments, it is simpler and more effective to choose to directly allocate coins themselves. In fact, even with fierce competition at the company level, ETH and BNB have both hit record highs and have not been affected.

One of the core problemsof the DAT model, which focuses on company fundamentals

, is that many treasury companies themselves are "shell companies", their main business has long been stagnant, their profitability is weak, and they rely almost entirely on "currency speculation" to continue their lives. Such a pattern may seem reasonable in a bull market, but once the market reverses, it will lose blood in an instant due to lack of cash flow support. Therefore, when choosing a target, investors must pay attention to:

The company's cash flow: Does it have the ability to self-hematopoietic?

Buying costs: Is the average position price enough to stay healthy in the pullback?

Position ratio: Is the proportion of digital assets in the company's net assets too high?

Financing purpose: Is the raised funds mainly used to buy coins, or is there actual business development?

Solvency: Can it remain stable when the convertible bond matures or the stock price is under pressure?

Companies that lack hematopoietic ability may be prosperous in a bull market, but when liquidity ebbs, their ability to resist risks is extremely weak and they are likely to become the first victims of the stampede.

Summary

Treasury strategy has undoubtedly injected the strongest fuel into this bull market, and a steady stream of over-the-counter funds has made altcoins led by ETH sing all the way. But the more it seems to be an "infinite bullet" model, the more we must be wary of the bubbles and hidden worries behind it. History has proven that liquidity and narrative can ignite the market, but they cannot replace real value support. For investors, the current market is certainly optimistic, but they must also remain calm and prudent. Only by remaining rational in the hustle and bustle can we stand tall when the bubble recedes.