Ethereum's battle for revival: Lubin navigates the 425 million treasury strategy

Words: Prathik Desai

Compilation: Block unicorn

Foreword

Two weeks ago, Joe Lubin, co-founder of Ethereum and founder and CEO of ConsenSys, announced that he would be serving as SharpLink Chairman of Gaming's Board of Directors and led its $425 million Ethereum vault strategy.

The move adds a new chapter to the revival of Ethereum, the world's second-largest cryptocurrency, after more than four months of hovering below $3,000.

The move is in line with the strategy promoted by Michael Saylor, whose Bitcoin-focused financial strategy inspired a large number of publicly traded companies to participate in the construction of Bitcoin vaults.

In this article, we analyse whether this is one of the best opportunities for an Ethereum revival.

Ethereum

Vaults When SharpLink Gaming announced funding to build an Ethereum vault, the market reacted quickly and clearly.

Its stock price skyrocketed by more than 450% in a single day, soaring from $6.63 per share to more than $35. In five trading days, the stock price skyrocketed more than 17 times from $6.63. Even after the pullback, it is still trading at a price more than 3 times higher than it was at the beginning of the rally.

–

–

What is > driving this rally?

Lubin is trusted to help SharpLink replicate the success of Saylor at Strategy, formerly MicroStrategy.

Ethereum has allowed Lubin to do a better job than Bitcoin vaults in at least one way: build an active ETH vault that not only stores value like Bitcoin, but creates more value.

How?

Active Treasury Theory

: Thedifference between Bitcoin and Ethereum vault strategies is significant. The logic of a Bitcoin vault is simple: buy Bitcoin, hold Bitcoin, and enjoy price appreciation. It's elegant and simple, but it's passive in nature.

Ethereum's vault strategy is different from Bitcoin's: the majority of ETH tokens will be used for staking, creating what Ethereum core developer Eric Conner describes as "high-beta, yield-generating ETH leverage."

A staking strategy will transform corporate vaults from static vaults to active participants in cybersecurity.

Strategy's Bitcoin holdings do not generate any native yield, but SharpLink's staked ETH will earn at least 2% per annum while enhancing Ethereum's consensus mechanism.

Conner also mentions the "flywheel effect" as a key advantage of ETH vaults.

Businesses can raise cash for less than their net asset value, buy and stake ETH, and then raise more cash if the stock is trading above the value of ETH per share and repeat the process. It's a classic Strategy cycle, but it's super profitable in a way that Bitcoin vaults can't replicate.

The advantages go far beyond basic staking.

Decentralized finance (DeFi) protocols provide additional yield strategies through lending, liquidity provision, and complex financial instruments that don't exist in the Bitcoin ecosystem. SharpLink is backed by DeFi-savvy companies like ParaFi Capital and Galaxy Digital, showing that they understand this potential.

ETH vs. BTC Vault

– >

– >

Ethereum's Initial Coin Offering (ICO) in 2014 raised $18 million. ETH was priced between $0.30 and $0.40 at the time, laying the foundation for the Ethereum ecosystem that is now worth more than $320 billion.

The $425 million pledged by SharpLink is more than 20 times the amount raised in the ICO, enough to acquire more than 150,000 ETH at the current price. But this still represents only 0.25% of the ETH sold during the ICO (60 million).

The ICO in 2014 laid the groundwork for Ethereum. The current treasury strategy is likely to validate its maturity as an institutional asset and contribute to the construction of financial infrastructure over the next decade.

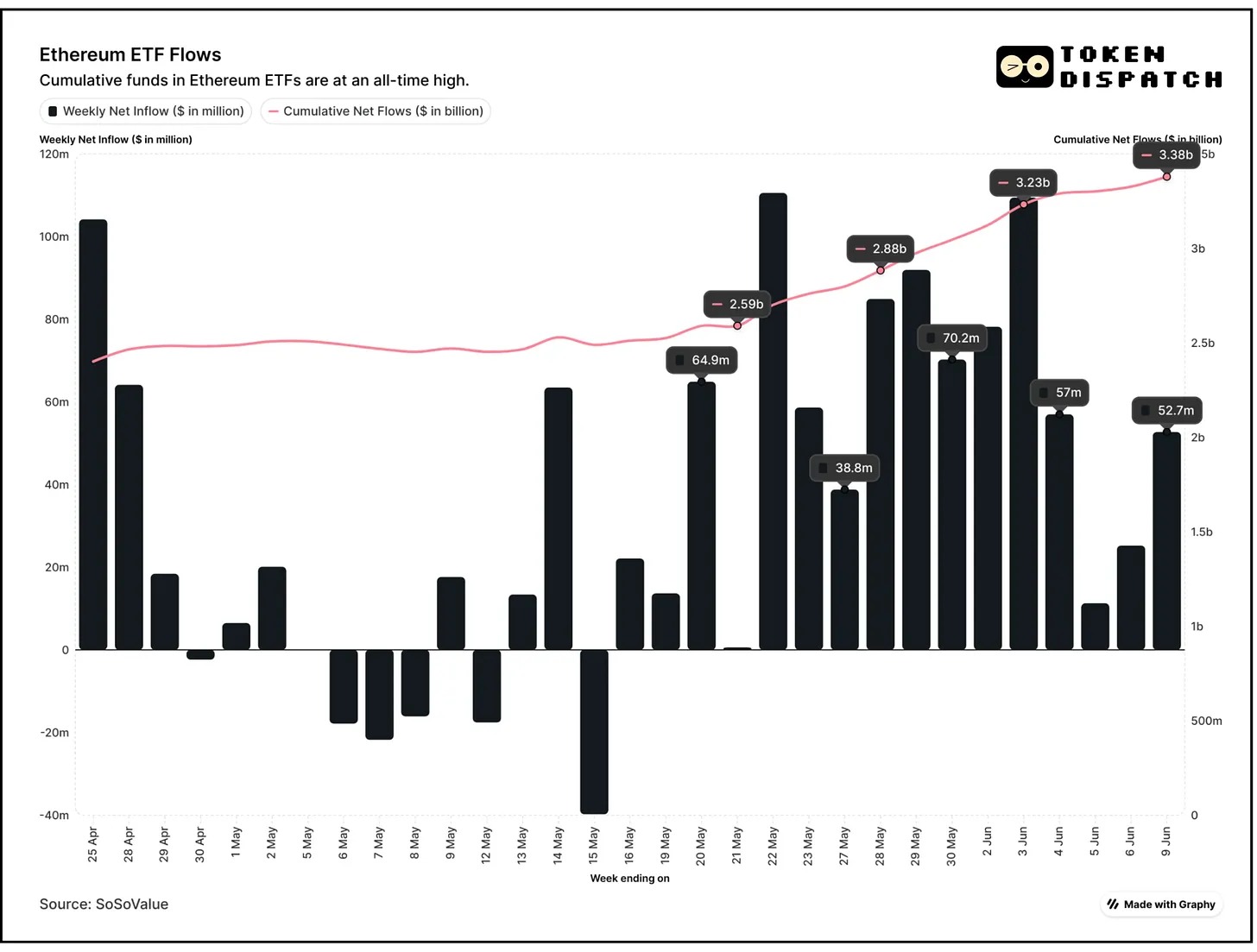

In addition to the vault strategy, Ethereum ETFs have also continued to record inflows in the institutional channel in the past two weeks.

As of June 9, Ethereum ETFs recorded net inflows for 16 consecutive trading days, the second-longest winning streak since it was approved in July 2024.

– >

– >

recorded inflows of $281 million and $285 million, respectively, in the past two weeks, the best two weeks for Ethereum ETFs in four months.

BlackRock, the world's largest asset manager, has amassed more than $500 million worth of ETH in 11 trading days. Its ETHA ETF now has nearly $4 billion in assets under management.

"Over the past 20 days, ETH ETF inflows have reached $815 million, with annual net inflows turning positive to $658 million," Bernstein analysts noted in recent research.

CoinShares said seven consecutive weeks of ETF inflows totalling $1.5 billion marked a "significant recovery in investor sentiment."

Ethereum-based products now account for 10.5% of total assets under management in crypto ETPs.

"The narrative around the accumulation of value in public blockchain networks is at a critical inflection point," and this is "starting to be reflected in investor interest in ETH ETF inflows," Bernstein said.

Our Opinion

: Lubin's move at SharpLink not only has an immediate financial impact, but also marks Ethereum's evolution from a speculative technology to a critical financial infrastructure.

When payments giants like Visa and Mastercard develop stablecoin strategies, when Coinbase builds merchant payment systems, and when Robinhood plans to launch tokenised assets – they're all essentially betting on Ethereum's orbit.

This may be what Bernstein calls a "critical turning point," the moment when the blockchain network is transformed.

The timing seems to be deliberate.

With stablecoin legislation moving forward in Congress and regulatory clarity emerging, institutional investors finally have the framework they need to distribute with confidence. Circle's successful IPO this week, closing 160% above its listing price, shows Wall Street's enthusiasm for crypto infrastructure investments.

For Ethereum, the convergence of corporate vault adoption, institutional ETF inflows, and regulatory clarity has created conditions that didn't exist in previous cycles.

If SharpLink's experiment is successful, it could trigger a "domino effect" of corporate adoption, as Saylor's Strategy did with Bitcoin. Considering that Bitcoin's similar risk model has proven manageable, Ethereum's adoption is likely to be faster and larger.

In addition to corporate adoption, if BlackRock continues to increase its holdings and regulatory clarity solidifies as expected, then Lubin's move could be remembered as Ethereum's first step into the institutional chapter.