EOS frustrated "exit": renamed Vaulta to transform into a "Web3 bank" and make a wedding dress for the ecological project exSat

Author: Frank, PANewsEOS,

once known as the "Ethereum killer", officially announced the brand upgrade to Vaulta, starting a strategic transformation with Web3 banking as the core. Shifting from public chain infrastructure to institutional-grade banking narratives, the EOS Foundation found inspiration in reconstructing the Bitcoin ecosystem through exSat, and also took the opportunity of this rebranding to completely cut the historical baggage.

Behind this transformation, is it the helplessness of losing the competition on the public chain track, or the ambition of betting on Web3 financial compliance? When the Vaulta token replaces EOS, the scarcity of RAM surpasses that of the native token, and the exSat independent ecological anti-customer is dominant, a backdoor ecological transformation has quietly begun.

Can Canadian asset custodians complete the transformation of Web3 banks with the entry of Canadian asset custodians?

EOS has several key points in its latest rebranding initiative. One is about the next Web3 banking brand narrative, and the other is about how to realise this narrative. The third is about some potential changes in tokenomics.

First of all, the reason why Web3 banking business is to be done in the direction of brand upgrading is highlighted in the announcement, one is that the adoption rate of cryptocurrencies around the world continues to increase. Second, the market value of stablecoins continues to rise. The third is the market potential of RWA. From these points, it seems that the next new goal of EOS is to become another XRP, and this transformation seems to be related to the external environment of the crypto market.

In addition to this, Vaulta also announced the launch of a banking advisory board, which is currently in the position and role of ecological governance is not mentioned.

From the background of these BIC members, these institutions are not actually traditional banks, but are mainly asset custodians. And it has a strong territoriality, all from Alberta, Canada. ATB Financial is the largest financial institution in Alberta, founded in 1938, with assets of $65.5 billion and serving more than 830,000 customers. Others are digital asset custodians created within a few years, and the exact size of assets under management is not yet disclosed.

However, in general, although the cooperative financial institution holds a Canadian compliance license, there is still a question mark over whether its regional attributes match Vaulta's vision of a global Web3 bank.

In the new announcement, Vaulta mentions four major business directions as core pillars. They are wealth management, consumer payment, securities investment, and insurance. Among these four businesses, the focus can be on the exSat business launched to institutions in wealth management.

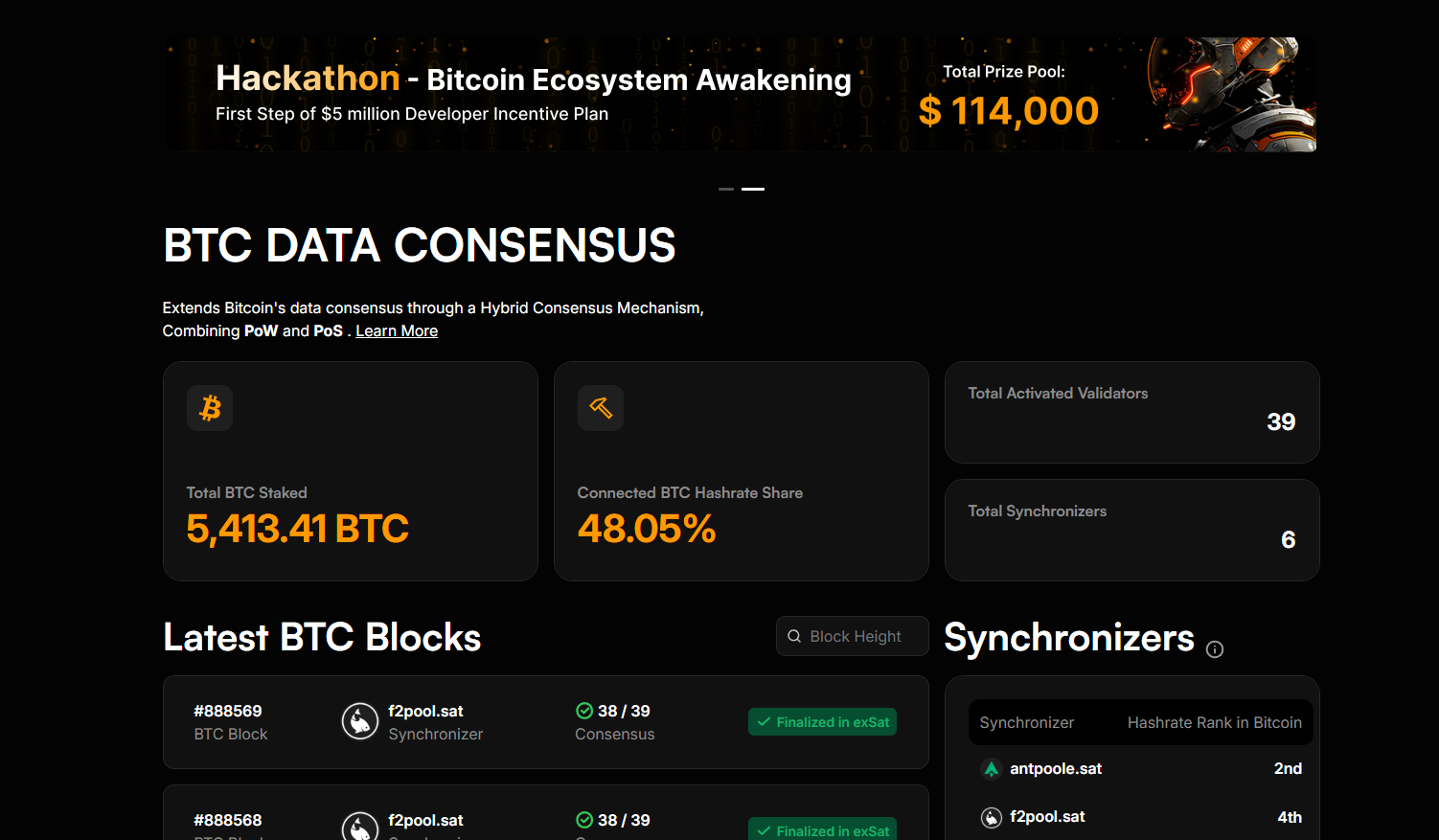

exSat is a Bitcoin scalability project launched by the EOS ecosystem in 2024 as a "Docking Layer" to connect the Bitcoin main chain with Layer 2 scaling solutions, using EOS RAM to store and process Bitcoin data, enhancing Bitcoin's performance and interoperability. Its main role is to enable faster and low-cost Bitcoin transactions and provide space for the Bitcoin ecosystem to carry out DeFi business.

The project appears to have achieved more influence than EOS itself, with 5,413 BTC staked on exSat as of March 20, and TVL has reached $587 million, far exceeding the $174 million on the EOS mainnet.

Therefore, it is not difficult to see why the focus is basically around exSat rather than EOS in the brand upgrade plan. In fact, exSat has an independent consensus mechanism (POS+POW+DPOS three consensus combinations), and there are currently 39 validators, among which we can see some well-known cryptographic institutions involved, such as Certik, Hashkey, Bitget, F2pool, OKX, Matrixpt, Tron, etc. Judging from various characteristics, exSat seems to have become another independent public chain that has grown from EOS, but it still uses the RAM and block space of EOS.

The Vaulta token will be launched, the token will be weakened, and the RAM scarcity

willbe strongerIn terms of tokenomics, Vaulta will also replace the EOS token with the Vaulta token. But it is clear that the new Vaulta token will be significantly weakened in terms of governance functions. Just as this rebranding proposal was not launched by voting on a proposal, but by being released directly by the EOS Foundation. The governance of the EOS network seems to have died in name only.

According to the announcement, "Vaulta token holders stake tokens and earn rewards, actively participate in governance, and vote for block producers who are responsible for managing the network's consensus and security." With the development of Vaulta, token holders of all sizes can participate in discussions and proposals", in this description, it can be seen that the main benefit of token holders is that they can stake rewards, and regarding governance, it seems that only voting for the block leader, which is the consensus mechanism design of DPOS, and does not belong to the category of governance. As for when token holders will be able to participate in substantive governance, the right to interpret is still in the hands of the foundation.

However, judging from the current EOS token price and TVL, it seems that this block reward only satisfies the normal operation of the infrastructure, and it seems that no one is actively promoting the expansion of the EOS ecosystem, but only doing a good job of infrastructure work for exSat. In addition, it was proposed in this announcement that EOS tokens could be exchanged for Vaulta tokens 1:1, but it was not stated whether Vaulta tokens would be issued on top of EOS's current issuance.

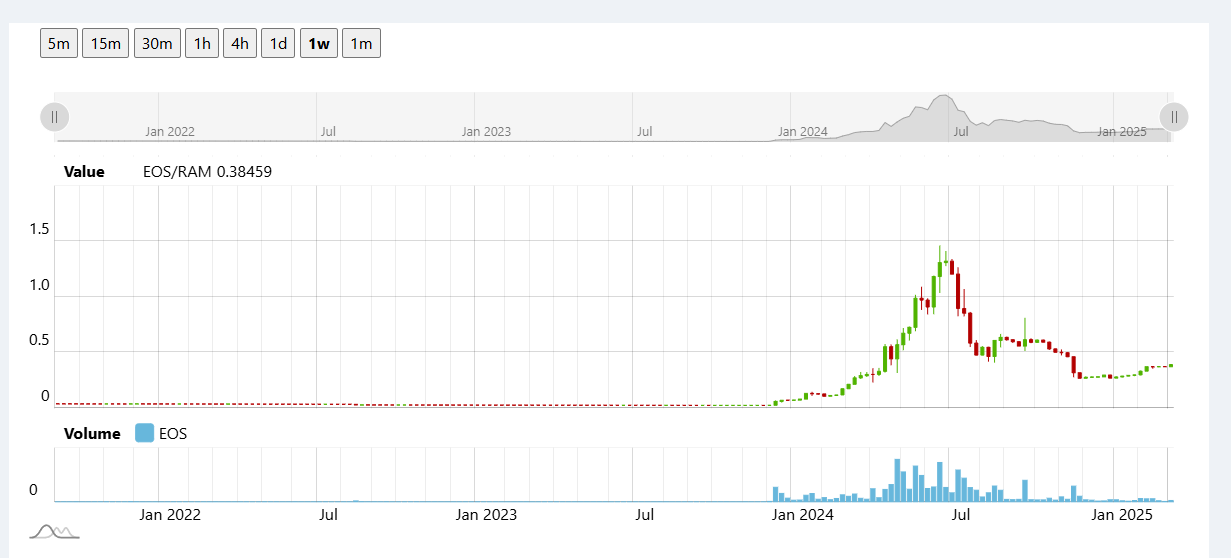

And with this brand upgrade, the importance of RAM seems to be more scarce than EOS tokens. "As Vaulta expands its role in decentralised finance and Web3 banking, the inherent scarcity and growing demand for RAM puts holders in a unique position."

RAM is the running memory within the EOS network, and all products running on the EOS network require leased memory. exSat is no exception, as the total amount of RAM is currently designed so that inflation has stopped. Therefore, as a strategic resource in the network, RAM seems to have more utility and value potential than the token itself.

From the perspective of price action, the price movement of RAM is also much more stable than that of EOS tokens.

4 billion ICO financing monster, frustrated out of the historical stage

In essence, the biggest change in this brand upgrade seems to be that the original route of EOS has been completely abandoned, due to the failure of ecological construction in recent years, EOS has failed in the public chain competition. Fortunately, EOS has never had any problems with performance, and the new Vaulta brand seems to be using EOS's existing infrastructure and the exSat network, which was launched last year. It remains to be seen whether Vaulta's Web3 banking will be successful. But what will happen is that EOS will be completely out of the historical stage.

In fact, for early adopters of crypto, the end of EOS seems embarrassing. In 2017, EOS raised $4 billion through an ICO, a record in crypto history. At that time, the Solana founders were still struggling to raise money, and in the end, they only received $3.17 million in seed support.

In 2018, the influence of EOS on the mainnet was in full swing, just like Solana's suppression of Ethereum today, and there was a lot of noise in the market about EOS being the new king of public chains. Its price also rose to $15.6, and its market value was once close to $18 billion, ranking third in the market. At present, the market capitalisation of EOS token is only $870 million, and the ranking has also fallen to 97th.