DeFi Lego Games: Demystifying Ethena, Pendle, and Aave's Tens of Billions of Growth Flywheels

Written by Shaunda Devens, Analyst at Blockworks Research

Compiled by: Yuliya, PANews

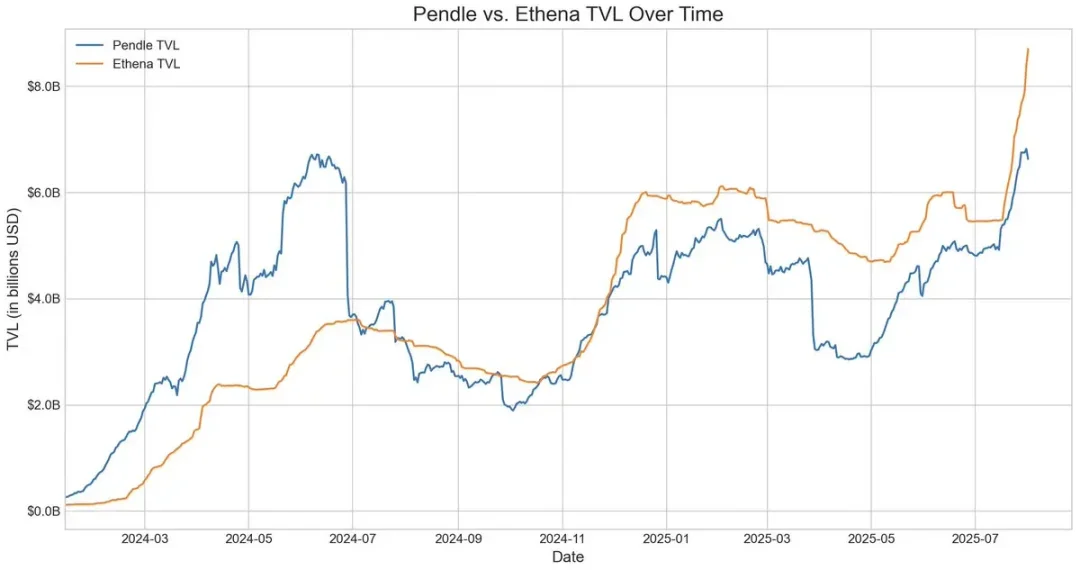

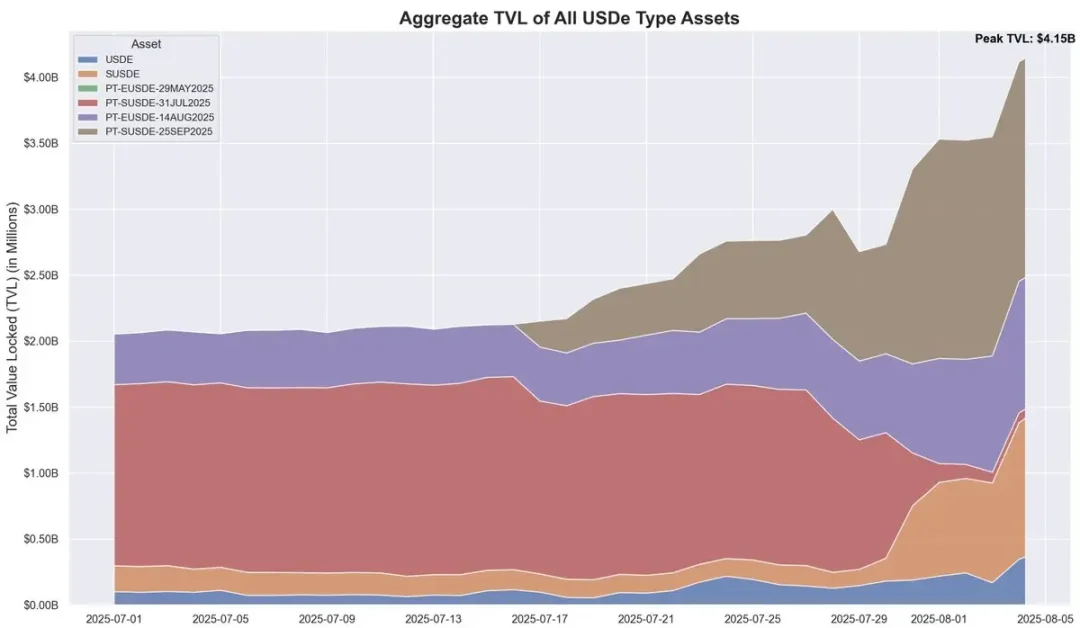

Over the past 20 days, Ethena's decentralized stablecoin USDe supply has increased by approximately $3.7 billion, primarily driven by the Pendle-Aave PT-USDe circular strategy. Currently, Pendle has about $4.3 billion locked (60% of USDe), and Aave has deposited about $3 billion. This article will break down the PT cycle mechanism, growth drivers, and potential risks.

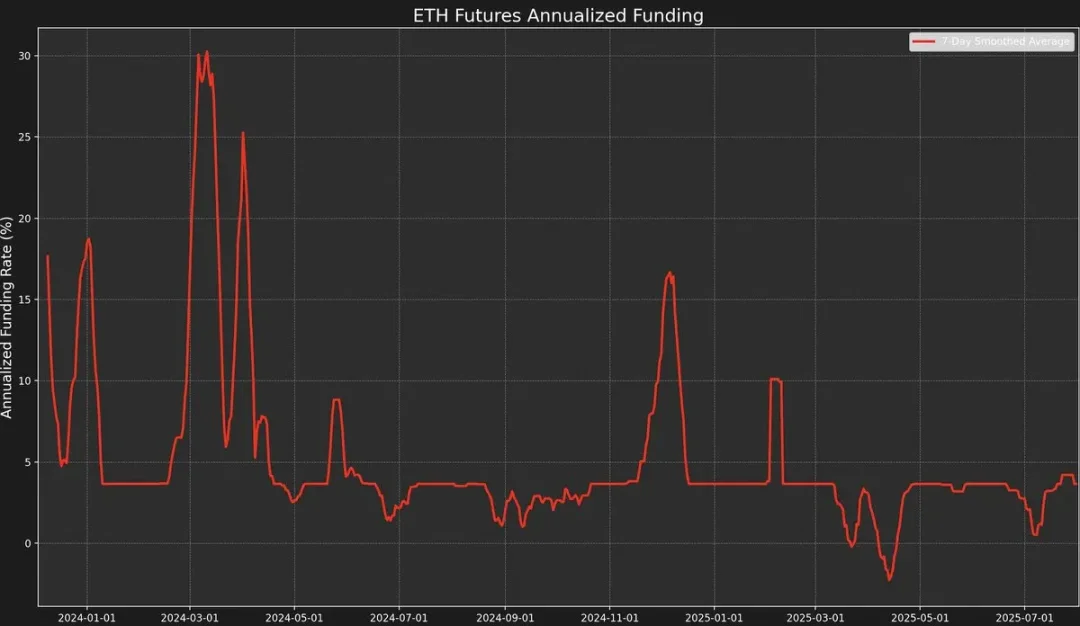

USDe's core mechanics and yield volatility

USDe is a decentralized stablecoin pegged to the US dollar whose price is not anchored by traditional fiat currencies or crypto assets, but by delta-neutral hedging in the perpetual contract market. In short, the protocol hedges against ETH price volatility by holding long spot ETH while shorting the same amount of ETH perpetual contracts. This mechanism allows USDe to algorithmically stabilize its price and capture yield from two sources: staking yield on spot ETH and funding rates on the futures market.

However, the strategy has high yield volatility because the yield depends on the funding rate. The funding rate is determined by the premium or discount between the price of the perpetual contract and the spot price of the underlying ETH (the "Mark Price").

When market sentiment is bullish, traders will focus on opening high-leverage long orders, pushing the price of the perpetual contract above the mark price, resulting in a positive funding rate. This will attract market makers to hedge by shorting perpetual contracts and going long on spot.

However, funding rates are not always positive.

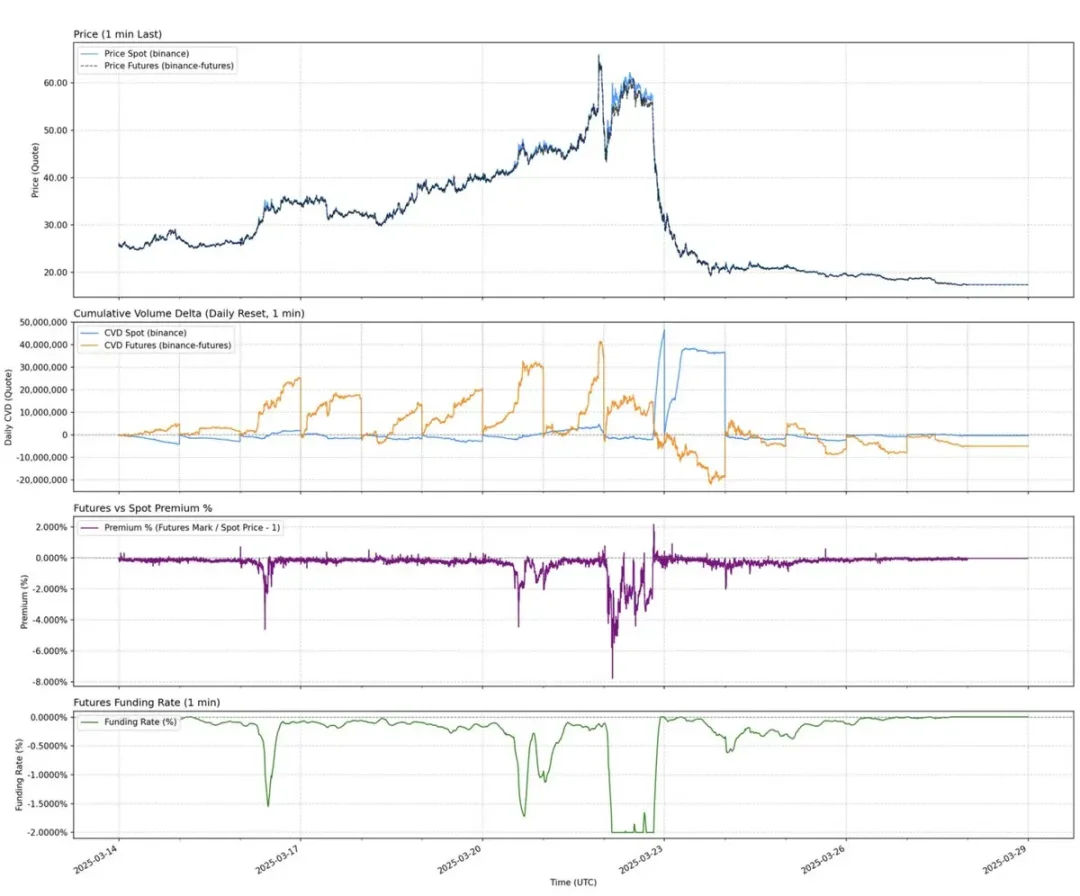

When market sentiment is bearish, an increase in short positions can push the price of ETH perpetual contracts below the mark price, causing the funding rate to turn negative.

For example, the recent AUCTION-USDT spot premium formed by spot buying and selling perpetual contracts has resulted in an 8-hour funding rate of -2% (approximately 2195% annualized).

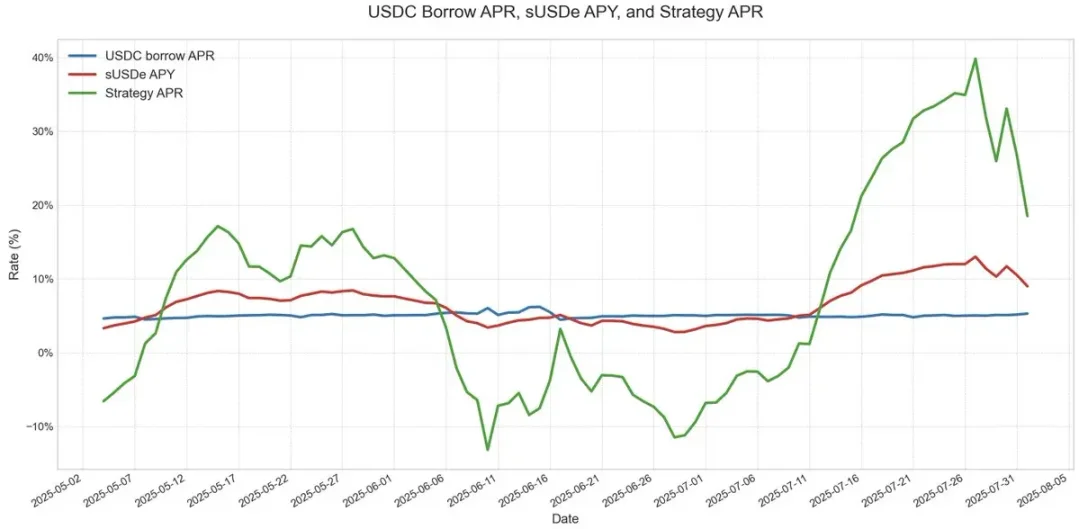

Data shows that USDe has an annualized return of about 9.4% so far in 2025, but the standard deviation has also reached 4.4 percentage points. It is this sharp fluctuation in earnings that has given rise to an urgent need for a product with more predictable and stable returns.

Pendle's fixed income conversion and limitations

Pendle is an AMM (automated market maker) protocol that splits yield-bearing assets into two tokens:

-

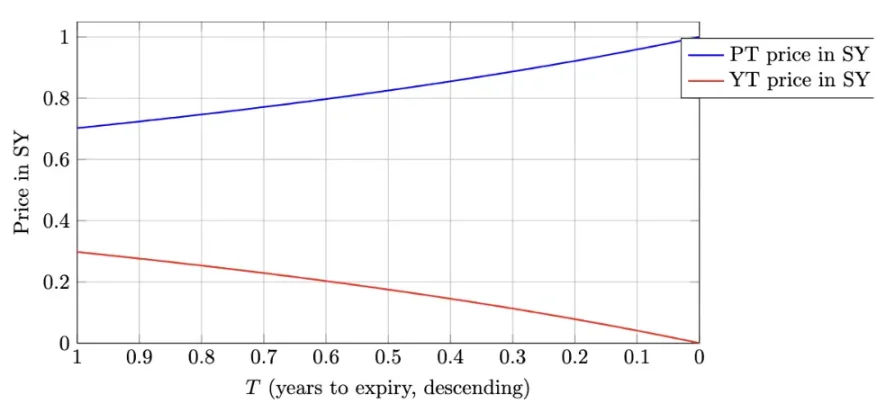

Principal Token (PT - Principal Token): Represents the principal amount that can be redeemed at a certain date in the future. It trades at a discount, similar to zero-coupon bonds, and its price gradually reverts to its face value (like 1 USDe) over time.

-

Yield Token (YT - Yield Token): Represents all future yields generated by the underlying asset before the maturity date.

In the case of PT-USDe expiring on September 16, 2025, PT tokens typically trade below their face value at maturity (1 USDe), similar to zero-coupon bonds. The difference between the current price of PT and its face value to maturity, adjusted for the remaining maturity time, reflects the implied annualized percentage yield (i.e., YT APY).

This structure provides USDe holders with the opportunity to hedge against earnings fluctuations while locking in a fixed APY. During periods of high historical funding rates, the APY of this method can exceed 20%; The current yield is around 10.4%. In addition, PT tokens can also receive up to 25x the SAT bonus of Pendle.

Pendle and Ethena thus form a highly complementary relationship. Pendle currently has a total TVL of $6.6 billion, of which about $4.01 billion (about 60%) comes from Ethena's USDe market. Pendle solves USDe's earnings volatility but still has limited capital efficiency.

YT buyers can efficiently access yield exposure, while PT holders must lock up $1 in collateral for each PT token when shorting floating yield, limiting gains to tight spreads.

Aave Architecture Adjustments: Clearing the way for USDe circular strategies

Aave's two recent structural changes have enabled the rapid development of the USDe circular strategy.

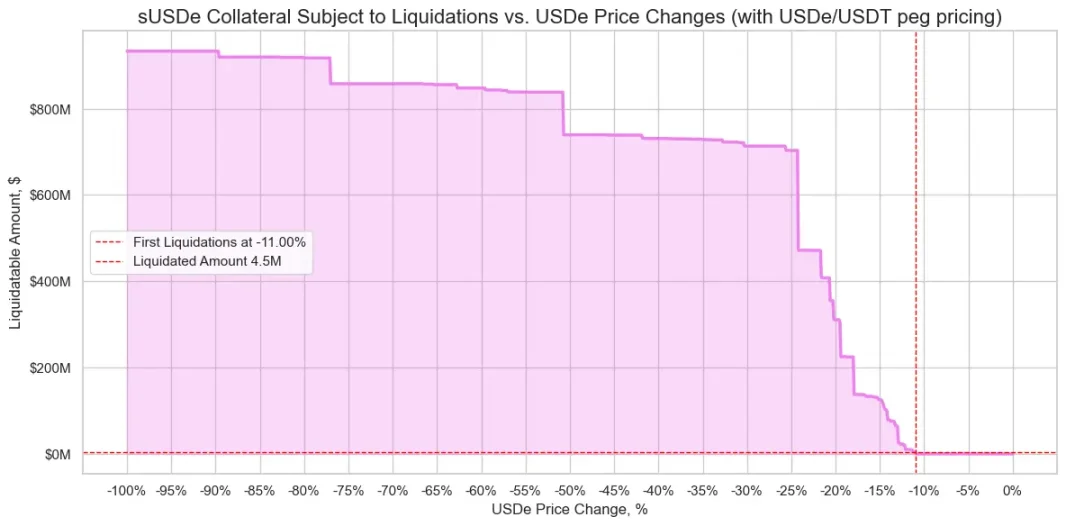

First, after the risk assessment team pointed out that sUSDe lending poses a significant risk of large-scale liquidations due to price de-peg, Aave DAO decided to peg the price of USDe directly to the USDT exchange rate. This decision almost eliminated the previous most important liquidation risk, retaining only the interest rate risk inherent in carry trades.

Second, Aave began accepting Pendle's PT-USDe directly as collateral. This change is even more profound, as it simultaneously addresses two previous limitations: insufficient capital efficiency and volatile returns. Users can leverage PT tokens to establish fixed-rate leveraged positions, significantly enhancing the viability and stability of revolving strategies.

Strategy Shaping: High-leverage PT circular arbitrage

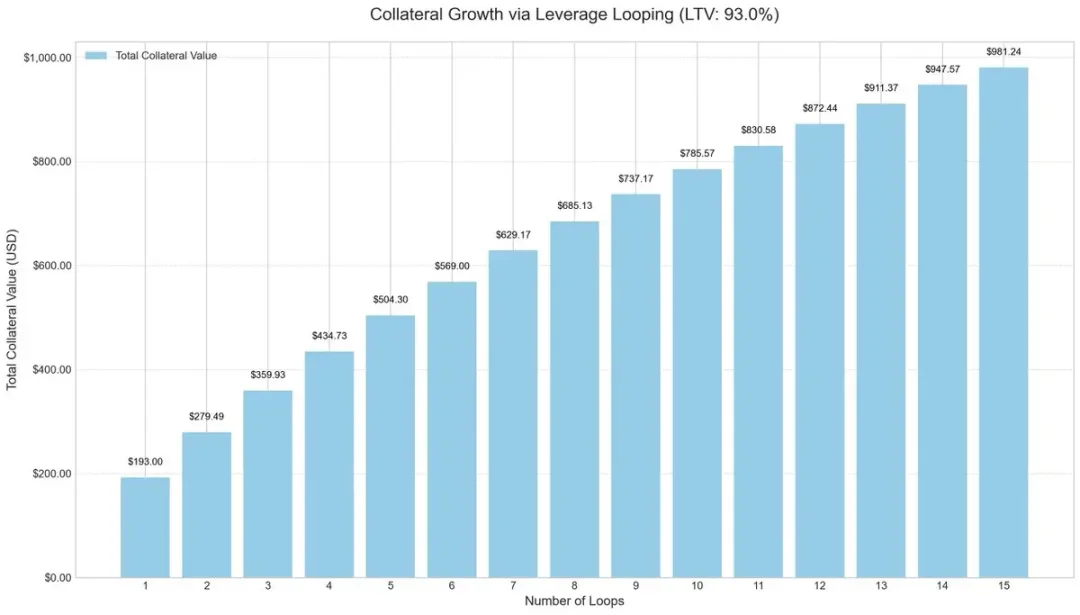

To improve capital efficiency, market participants have begun to adopt leveraged cycle strategies, a common carry trade method that increases returns through repeated borrowing and depositing.

The operation process is usually as follows:

-

Deposit sUSDe.

-

Borrow USDC at a loan-to-value ratio (LTV) of 93%.

-

Exchange borrowed USDC back to sUSDe.

-

Repeat the above steps to obtain approximately 10x effective leverage.

This leveraged loop strategy has become popular across several lending protocols, especially the USDe market on Ethereum. As long as USDe's annualized yield is higher than the cost of borrowing USDC, the trade remains highly profitable. But once earnings plummet or borrowing rates soar, profits will be quickly eroded.

The key risk was the oracle design. Billion-dollar positions often rely on AMM-based oracles, making them vulnerable in the face of temporary price decoupling. Such events, such as those seen in the ezETH/ETH circular strategy, can trigger chain liquidations, forcing lenders to sell collateral at huge discounts, even if the collateral itself is fully backed.

PT collateral pricing and arbitrage space

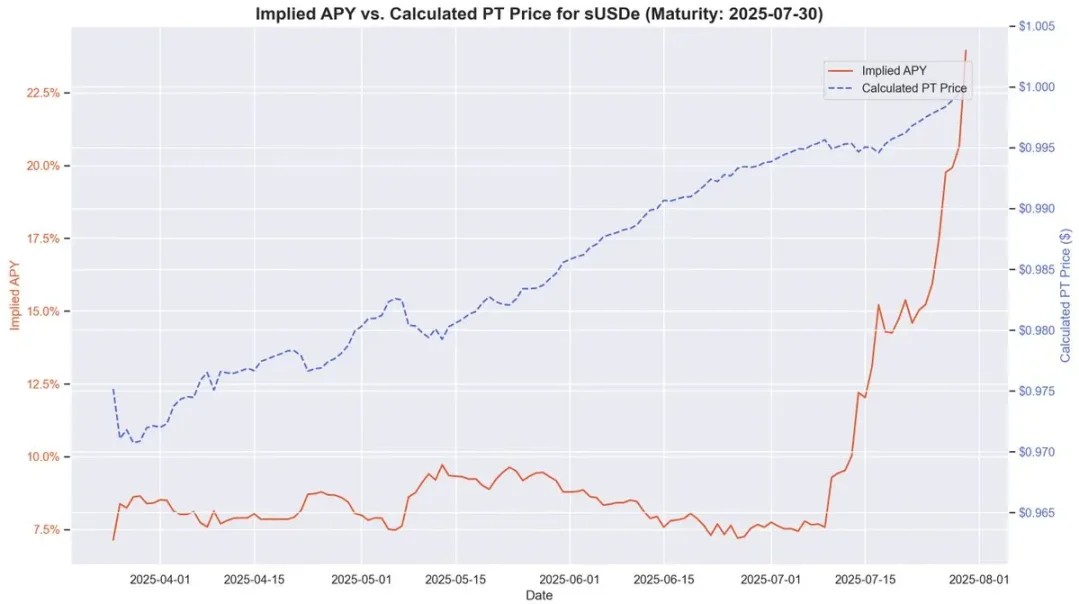

When pricing PT collateral, Aave employs a linear discount based on PT implied APY and is based on USDT anchored pricing. Similar to traditional zero-coupon bonds, Pendle's PT token gradually approaches its face value as its maturity date approaches. For example, in the PT token expiring on July 30, this pricing model clearly reflects its price approaching 1 USDe over time.

While PT prices don't exactly correspond to face value 1:1, and market discount fluctuations can still affect pricing, their returns become increasingly predictable as maturity approaches. This is highly similar to the stable value appreciation model of zero-coupon bonds before maturity.

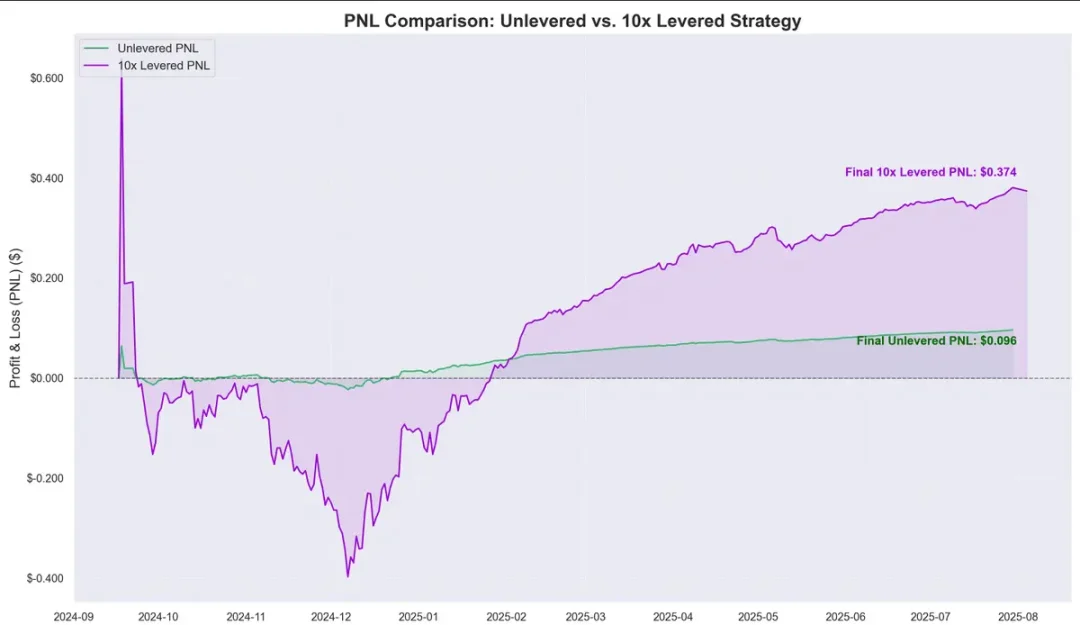

Historical data shows that the appreciation of the PT token price relative to the cost of borrowing USDC creates a clear arbitrage space. The introduction of leveraged cycles has further amplified this profit margin, yielding approximately $0.374 per $1 deposited since September last year, with an annualized yield of approximately 40%.

This begs a critical question: does this circular strategy equate to risk-free returns?

Risks, linkages and future prospects

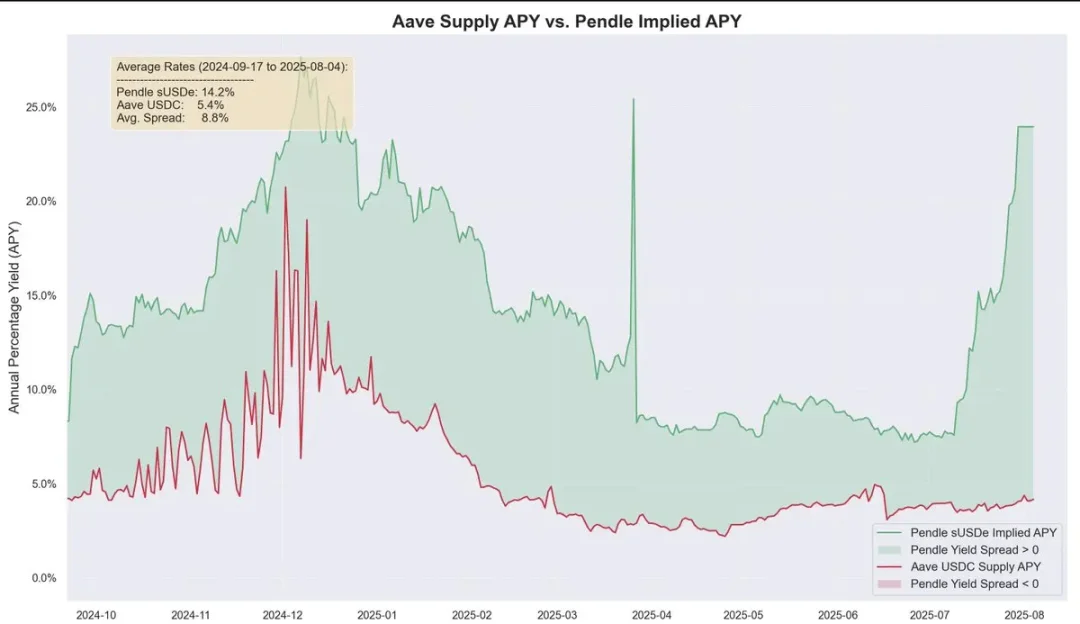

Historically, Pendle's returns have been significantly higher than borrowing costs over time, with an average unleveraged spread of about 8.8%. Under Aave's PT oracle mechanism, the risk of liquidation is further reduced. The mechanism has a floor price and a kill switch. Once triggered, the LTV (loan-to-value ratio) will immediately drop to 0 and freeze the market to prevent bad debts from accumulating.

In the case of Pendle's PT-USDe September expiration symbol, the risk team sets an initial discount rate of 7.6% per year for its oracle and allows a maximum discount of 31.1% (circuit breaker threshold) under extreme market pressure.

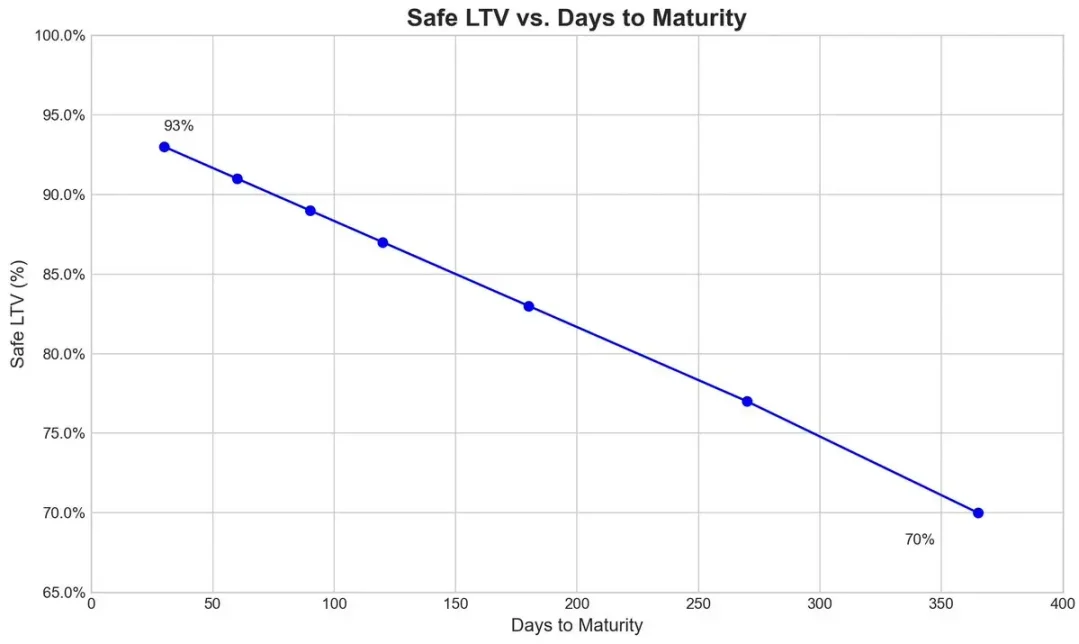

The graph below shows the LTV of various safes (calculated by the fact that liquidation is virtually impossible once the discount reaches the lower limit of the kill switch, so the PT collateral remains above the liquidation threshold at all times).

The interconnectedness of ecosystems

Since Aave underwrites USDe and its derivatives at the same value as USDT, market participants can execute circular strategies on a large scale, but it also makes Aave more closely linked to the risks of Pendle and Ethena. Whenever the collateral supply limit is increased, the pool is quickly filled up by circular strategy users.

Currently, Aave's USDC supply is increasingly backed by PT-USDe collateral, and circular strategy users borrow USDC and then stake PT tokens, making USDC structurally similar to senior tranche: its holders receive higher APRs due to high utilization and are protected from bad debt risk in most cases, except in the event of extreme bad debt events.

Scalability and ecological revenue distribution

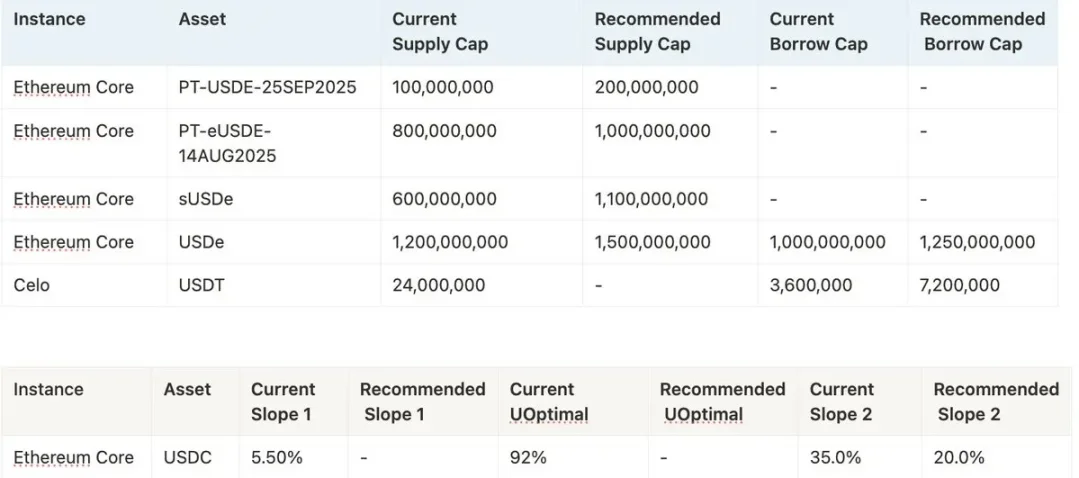

Whether the strategy can continue to expand in the future depends on Aave's willingness to continue to increase the collateral limit of PT-USDe. Risk teams currently tend to raise the cap frequently, such as proposing an additional $1.1 billion, but due to policy regulations, each increase in the cap must not exceed twice the previous cap and must be more than three days apart.

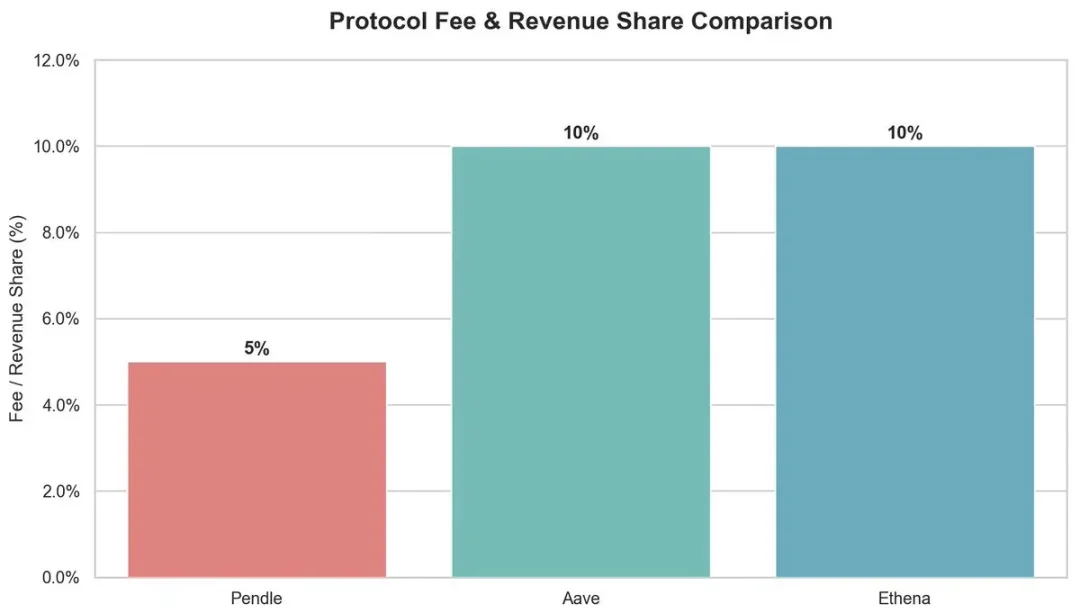

From an ecological perspective, this circular strategy brings benefits to multiple participants:

-

Pendle: 5% fee from the YT side.

-

Aave: Takes 10% of the reserve from USDC borrowing interest.

-

Ethena: Plans to take about 10% of the share after the fee switch is launched in the future.

Overall, Aave provides underwriting support for Pendle PT-USDe by using USDT as an anchor and setting a discount cap, allowing the circulation strategy to operate efficiently and maintain high profits. However, this high-leverage structure also brings systemic risks, and problems on either side may have a linkage impact between Aave, Pendle, and Ethena.